Investment Thesis

22nd Century Group (NASDAQ:XXII) shares have been punished unjustifiably during the past month with a 60% drawdown, despite the recently commenced aggressive multi-state launch of VLN (very low nicotine) branded cigarettes, which are minimally- or non-addictive. XXII is on the brink of successfully transforming from its cash burning research and development phase to cash generating commercialization stage. While the recent dilutive equity raise, deletions from the Russell 3000 Index and Russell Microcap Index, and a 1-for-15 reverse stock split have depressed investor sentiment, the stock is now washed out with several short, medium, and long-term catalysts. Moreover, we think if XXII proves itself with a successful VLN launch (i.e. 1% to 2% market share), then the 22nd Century Group will instantly become an acquisition candidate for a major global tobacco company. Even absent being acquired, we expect XXII to re-rate higher over the next 12 to 18 months as catalysts play out, particularly when investors are confident that XXII no longer needs to seek additional equity capital and/or generates operating cash flow. Our base case represents more than 300% upside to $16 (marginally higher than $1 prior to the reverse stock split), while our bear case represents 20% downside to $3.

Company Overview

22nd Century Group, an agricultural biotechnology company focused on improving health and wellness through plant science, commercializes disruptive products in the tobacco and hemp / cannabis markets, utilizing advanced alkaloid and flavonoid plant technologies.

Management

James Mish is the chief executive officer, having joined 22nd Century Group in 2020. Mish has a strong track record of pharmaceutical and consumer product commercialization. John Miller is president of the tobacco business. Miller was hired in September 2022 and is leading the VLN product launch. Previously, Miller was the president and chief executive officer of Swisher International, one of the largest manufacturers and exporters of cigars and smokeless tobacco products in the United States. R. Hugh Kinsman joined as chief financial officer after 22nd Century Group acquired GVB Biopharma, where he held the same position.

VLN

VLN brand cigarettes are the first and only combustible cigarettes authorized by the U.S. Food and Drug Administration (the “FDA”) as modified risk tobacco products. VLN King and VLN Menthol King contain 95% less nicotine than traditional addictive cigarettes, representing a level considered to be minimally or non-addictive. Every package of VLN is required by the FDA to include the statement “Helps You Smoke Less” to explicitly communicate to adult smokers the primary mission of the brand.

VLN Package Design (22nd Century Group Investor Presentation – June 2023)

GVB

GVB Biopharma (“GVB”), acquired in May 2022, is the other business unit that is expected to scale for 22nd Century Group’s long-term profitable growth trajectory. GVB manufactures and distributes hemp-derived active ingredients and finished goods in the consumer products, nutraceuticals, and pharmaceutical industries. XXII has already signed agreements worth more than $140 million in cumulative sales during their initial three year terms, according to its investor presentation.

In April 2023, 22nd Century Group announced a fully-integrated, single-source strategic license, manufacturing, and distribution agreement with Cookies. This deal encapsulates XXII’s contract development and manufacturing plus distribution business model. Cookies is among the most recognized hemp / cannabis companies in the world. This deal was followed by a similar agreement with Old Pal in May 2023.

There are many synergies to be extracted by XXII’s rapidly evolving mass-market retail distribution power for VLN and GVB business units, as the same wholesalers and retailers are targeted for both tobacco and cannabinoid products.

The Science

In the press release issued by the FDA announcing its authorization for 22nd Century Group to market “VLN King” and “VLN King Menthol” combustible, filtered cigarettes as modified risk tobacco products, Mitch Zeller, director of the FDA’s Center for Tobacco Products stated: “Having options like these products authorized today, which contain less nicotine and are reasonably likely to reduce nicotine dependence, may help adult smokers. If adult smokers were less addicted to combusted cigarettes, they would likely smoke less and may be exposed to fewer harmful chemicals that cause tobacco-related disease and death.”

This same press release referenced studies evaluated as part of the FDA’s behavioral and clinical pharmacology review and summarized this primary conclusion: “Public studies have shown that significantly reducing the number of cigarettes smoked per day is associated with lower risk of lung cancer and death, with greater reductions in cigarettes per day resulting in less risk.”

For example, a study published by The New England Journal of Medicine in 2018 titled Potential Public Health Effects of Reducing Nicotine Levels in Cigarettes in the United States concluded that a “nicotine product standard for cigarettes in the United States could save millions of lives and tens of millions of life-years over the next several decades.”

We note the FDA only authorized the marketing of VLN cigarettes as modified risk tobacco products. The FDA does not endorse, approve, or consider VLN cigarettes to be safe. To be clear, there are no safe tobacco products.

VLN Growth Strategy

The growth strategy for VLN is based on two key pillars: (1) commercial expansion (distributors and retail partners) and (2) consumer marketing. We expect these dynamics to create expanded availability and compelling brand / product awareness, leading to trial and repeat purchase. Therefore, we anticipate VLN to gain market share and realize profitable growth (i.e. operating cash flow) over the next 12 months.

Commercial Expansion

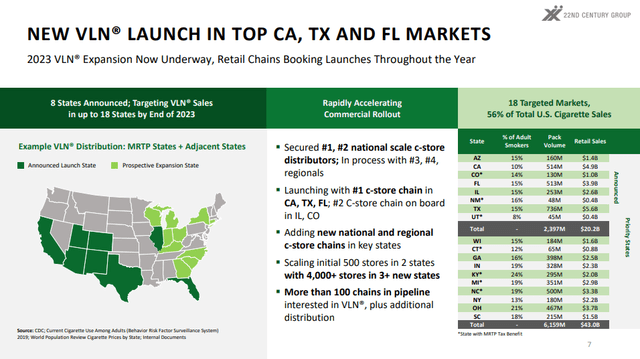

This year, 22nd Century Group has embarked on an aggressive multi-state commercial launch program for VLN, with more than 100 retail chains in its sales funnel. Underpinning this commercial expansion are agreements with top convenience store distributors and retail chains. This plan follows the successful initial launch (i.e. pilot program) in Chicago last year.

VLN Product Launch (22nd Century Group Investor Presentation – June 2023)

In early June, 22nd Century Group announced VLN will be sold at the “#1 convenience store chain in the U.S. at more than 1,450 corporate locations in Texas, California and Florida.” Moreover, an additional 3,100 franchised-owned stores in those states are incentivized to add VLN. 7-Eleven was confirmed to be the convenience store chain referenced in the press release, according to a C-Store Dive news story. As the slide from its investor presentation indicates, these states represent the largest pack volumes in the country, while the core 18 states account for 56% of total U.S. cigarette sales.

In late June, 22nd Century Group announced VLN launched in Nevada marking the 14th state where VLN recorded sales or announced a product launch. Moreover, XXII raised its expectations for 2023 in this same press release by stating it now anticipates exceeding its launch goal of 18 states.

The launch strategy includes adding retail chains to increase availability density in key states (i.e. markets). With broad product availability, VLN is poised to capture market share across carefully targeted high-volume markets. In our view, this is a classic business case of a product launch that requires sufficient scale and scope to ensure profitability (i.e. operating cash flow), and we think XXII is executing on the path to achieving this goal.

We also note that 22nd Century Group is concurrently introducing VLN to international markets with new pilot testing in Switzerland and Japan, as well as additional market testing in South Korea.

Consumer Marketing

The second core pillar to its VLN growth strategy is a consumer marketing campaign to drive trial and repeat purchase. According to its investor presentation, 22nd Century Group proprietary research indicates these core marketing advantages for VLN: (1) smokers are addicted to the act of smoking, not merely nicotine; and (2) current cessation messaging are perceived negatively and make smokers feel less confident and competent.

We think the first advantage is compelling for VLN over other products, such as nicotine patches, vaping devices, and e-cigarettes, since VLN offers an authentic smoking experience. In addition, the second advantage is critical, too, since VLN is positioned to help adult smokers reduce smoking rather than quit smoking. Therefore, in our view, this distinction would make these smokers more receptive to the brand’s messaging.

Leveraging these advantages is exactly how 22nd Century Group has built its marketing campaign for VLN. XXII plans to underscore the idea that adult smokers don’t need to quit “cold turkey” and instead have the “freedom to smoke less… one cigarette at a time.” By utilizing this empowering messaging, XXII is optimistically encouraging adult smokers to try VLN by inspiring confidence in them to take control of their addiction. As with any effective marketing message, there is a call to action for those interested to “learn more” by visiting the VLN website. This campaign will be deployed with hyper-targeted paid media blitzes utilizing advanced targeting techniques in key rollout markets with multiple digital touchpoints to generate top-of-mind awareness.

In addition to a redesigned brand website to attract consumers and organic search engine optimization, XXII plans to cultivate continuous consumer engagement with a brand community to help consumers navigate their smoking reduction journeys and enhanced public relations efforts with local market advocates. 22nd Century Group is also engaging with influencers to further educate and establish brand trust.

GVB Growth Strategy

The growth strategy for the GVB business revolves around these core business drivers: (1) scaling contract development and manufacturing plus distribution business model; (2) unlocking pharmaceutical-grade opportunities; and (3) market expansion within food and nutraceuticals. By scaling revenue, increasing margins, and realizing operational efficiencies, we expect this hemp / cannabis business to be operating cash flow positive in early 2024.

According to the investor presentation, GVB is already leveraging its agreements with Cookies and Old Pal with additional white label manufacturing and distribution deals in the pipeline to drive volume growth and realize higher operating margins. In addition, GVB is pursuing opportunities to cater to the pharmaceutical grade market, a currently untapped high-value addressable market, by submitting a drug master file to the FDA with the intention to clearly differentiate GVB distillates and isolates. Moreover, 22nd Century Group anticipates that new FDA guidelines will soon establish enhanced regulatory standards to effectively validate and thereby further extend the market for consumer and nutraceutical products. After these guidelines are set, GVB will be further distinguished from smaller producers based on its certification and standardization capabilities.

Earnings Model

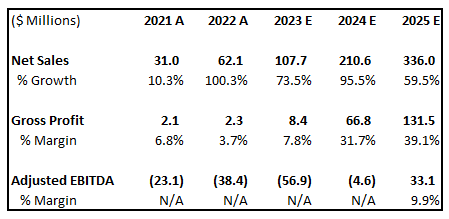

XXII Earnings Model (The Bulls Bay)

Our earnings model is predicated on the aggressive VLN launch underway currently. In 2023, we expect net sales to exceed $100 million, while adjusted EBITDA losses to worsen year over year due to the increased costs associated with the product launch. However, we project dramatically improved results in 2024, as 22nd Century Group finally reaches sufficient scale with the sales volumes in both the VLN and GVB businesses necessary to leverage fixed costs. 2024 will truly be an inflection point for the XXII business model.

In our view, further enabling XXII to reach operating cash flow profitability (adjusted EBITDA in our model is a proxy for operating cash flow) in 2H:2024 are (1) the shifting product mix within its tobacco business to higher margin VLN and away from lower margin filtered cigars and (2) expansion of its in-house growing, extraction, and distillation facilities. Our model assumes a modest $4.6 million adjusted EBITDA loss in 2024, due to the GVB unit reaching operating cash flow generation in the first half of the year, while the VLN unit in the second half of the year. Subsequently, we anticipate a significant acceleration in adjusted EBITDA / operating cash flow in 2025.

Valuation Analysis

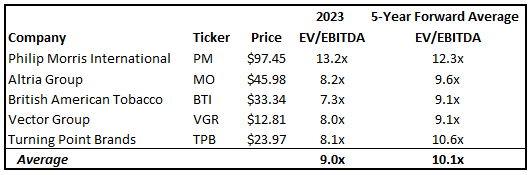

Comparative Group Valuation (The Bulls Bay)

Our investment approach values stocks based on earnings (i.e. net income, EBITDA, or operating cash flow). We think investors should focus on earnings multiples, especially in the current market, more than sales multiples.

The comparative valuation chart in this section illustrates the current year forward EV/EBITDA multiple, as well as 5-year average forward multiple, for major tobacco companies: Philip Morris International (PM), Altria Group (MO), British American Tobacco (BTI), Vector Group (VGR), and Turning Point Brands (TPB). The average current year multiple is 9.0x and five-year multiple is 10.1x.

Since our financial model projects XXII to generate meaningful adjusted EBITDA beginning in 2025, our fair market value estimate is based on the approximate $33 million for that year. Adjusting for the 1-for-15 reverse split and warrants, XXII currently has roughly 17 million diluted shares outstanding. To be conservative, we increase this share count by 25% to account for potential further dilution, resulting in 21 million shares outstanding. Given the significantly higher growth potential for VLN compared to slower growth incumbent competitors, we think XXII deserves at least a 10x EV/EBITDA multiple. Based on these inputs, we derive a base case 12 to 18 month price target of $16, resulting in more than 300% upside. (We note that $16 equates to marginally higher than $1 prior to the reverse stock split.)

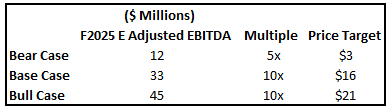

Valuation Sensitivity (The Bulls Bay)

The current share price almost reflects our bear case price target, underscoring our contention that the stock is already at washed out levels with all the negativity already priced-in (i.e. recent dilutive equity raise and 1-for-15 reverse stock split), as well as slower growth in adjusted EBITDA (or operating cash flow). We think the market is currently discounting management’s guidance for operating cash flow breakeven for VLN and GVB in 2024.

However, our bull case (upside scenario) pushes our price target to $21 (more than 400% higher than current price) and is reflective of stronger volume growth (i.e. market share gains) for VLN.

We acknowledge that valuing XXII based on an earnings multiple rather than sales multiple derives a lower price target. However, we think that’s the better valuation methodology, especially with equity markets emphasizing earnings (and cash flow) in a “risk-off” macro-environment. Moreover, the EV/EBITDA multiple for our base and bull cases could prove to be conservative, if XXII generates higher EBITDA growth than expected.

Catalysts

We think there are many potential transformational catalysts in the short- and long-term. Based on expected chronological order, these include: (1) retail store count expansion; (2) receipt of business interruption insurance relating to Grass Valley facility fire; (3) FDA decision to ban menthol cigarettes; (4) internal production recovery for hemp / cannabis business; (5) initial sales for Cookies and Old Pal within the GVB business; (6) FDA decision to mandate reduced nicotine content in all cigarettes; (7) realization of operating cash flow breakeven; (8) New Zealand implements law mandating all cigarettes contain 95% less nicotine.

As earlier detailed, 22nd Century Group is in the midst of an aggressive multi-state launch for VLN, most notably with 7-Eleven in California, Texas, and Florida. By year-end, we expect VLN to be sold in more than 18 states nationwide and reach more than 50% of the domestic market. Therefore, positive progress updates are key catalysts.

Another catalyst in the near-term is the receipt of an additional $8 million in business interruption insurance proceeds relating the Grass Valley facility fire that occurred in Q4-22. During the Q1-23 conference call, management indicated that these additional proceeds would begin to receive in Q2-23, implying that some portion would be received in 2H:23. This follows the initial $5 million received in Q1-23. In our view, these proceeds are a significant source of working capital for the balance of the year. Furthermore, XXII expects to have capacity restored from the fire in 2H:23 resulting in higher margins. We expect the timing to coincide with the initial sale volumes for the Cookies and Old Pal deals.

In Q3-23, we expect the FDA to announce its decision on whether to ban menthol cigarettes. If this occurs, then we expect VLN to receive an exemption, given its modified risk tobacco product designation. This would result in “VLN Menthol King” being the only combustible menthol cigarette on the market, thereby serving as the off-ramp for menthol cigarette smokers and providing XXII with even greater market share potential. By Q4-23, the FDA is likely to announce its decision to limit nicotine content in cigarettes (and other tobacco products). While the timelines for implementation of either of these FDA actions would likely be multi-year processes (potential litigation, required time for retail wind down of existing inventory, etc.), we suggest either or both of these developments would nonetheless be accretive to XXII.

Perhaps the most important catalyst (and consistent with our investment thesis) is the realization of operating cash flow breakeven (and soon thereafter generation), which we expect to occur in 2024. (Our model assumes negative operating cash flow / adjusted EBITDA for full-year 2024, due to the exact timing of when the VLN and GVB businesses reach their respective breakeven points.)

A longer-term catalyst is implementation of the New Zealand mandate for reduced nicotine content in cigarettes by 2025. 22nd Century Group has already announced the acceleration of a seed cultivation project to rapidly scale availability of XXII’s nicotine content tobacco leaf to manufacture cigarettes compliant with the new law.

Risks

There are critical risks for XXII that are very important for investors to understand properly, including: (1) execution; (2) equity dilution; (3) competition; and (4) stock price volatility.

A key risk to our investment thesis is execution missteps, given our expectations for success this year and next in the aggressive multi-state VLN product launch. If these efforts were to fail and significantly miss expectations, then XXII’s ability to reach operating cash flow breakeven in 2024 would be severely impacted.

Moreover, execution mistakes would lead to another core risk: equity dilution. In our view, this is the risk that investors fear the most. Expectations are so low now for XXII that for many investors the base case assumption is significant further dilution. However, most of these investors overestimate the impact and / or extent of potential dilution. For example, we even modeled 25% more dilution into our base case valuation analysis and still derive a share price more than 4x the current price. Our model assumed this level of dilution and a successful product launch. Of course, poor execution would lead to higher equity dilution. For the discussion of equity dilution (and the need for working capital), we remind investors that XXII expects during 2H:23 to receive $8 million in business interruption insurance proceeds and generate higher margins (i.e. burn less cash) due to VLN sales volume growth and resumption of internal production. Moreover, the need for further equity dilution is further mitigated by the potential exercising of outstanding warrants, with the ability to raise approximately $11 million with the exercising of 1.5 million warrants at $7 per share (adjusted from 22.4 million at $0.47 per share before the reverse stock split).

We believe investors are currently overlooking this near $20 million infusion of capital that could occur by year-end and be a key part of the bridge between current negative operating cash flow and breakeven / positive next year.

The tobacco and hemp / cannabis industries are highly competitive. As a result, investors need to consider that VLN cigarettes are not the only product designed to reduce tobacco usage. Many smokers will decide to utilize nicotine patches, e-cigarettes, vaping products, or even smokeless tobacco. In addition, there are personal preferences. Perhaps some smokers simply will not enjoy VLN cigarettes. These are all possibilities, in our view. However, we think these concerns are mitigated by the key competitive advantages that we discussed earlier. For the GVB business, we think deals with well-known brands, such as Cookies and Old Pal, mitigate competitive concerns.

Stock price volatility is another key risk factor. As a thinly-traded micro-cap stock with very limited institutional investor ownership, we think XXII shares are susceptible to increased volatility. For example, given the large retail investor base some of the recent volatility (i.e. downward pressure) is likely due to some stop-loss orders being triggered.

Investor Sentiment

While we acknowledge the frustration of nearly all investors in XXII to date, we urge readers to evaluate this stock based on its potential as of today. Despite shares plummeting approximately 60% during the past month, we think there is potential exponential upside from current price levels for new investors and existing investors who choose to dollar cost average.

As with many micro-cap growth stocks, early investors (us included) placed too much emphasis on the long-term potential while discounting the likelihood of dilutive equity raises and their resulting punitive effects on the stock price. Until now, 22nd Century Group has been a great company (based on its mission and cumulative corporate achievements) but a bad stock (based on stock price performance). Investors now need to consider, based on the numerous upcoming catalysts, whether the stock has reached an inflection point and can be “great” for shareholders.

Unfortunately, the downward spiral in the stock during the past month has likely been driven by a “perfect storm” of negative news: (1) a dilutive equity offering; (2) deletions from both the Russell 3000 Index and Russell Microcap Index; and (3) a 1-for-15 reverse stock split. For a retail-oriented shareholder base, these three events have eroded investor confidence in management and caused many to exit their positions, thereby creating a snowball effect. However, we think, based purely on fundamentals, there likely has never been as many near-term catalysts. Yet, this apparent misperception is the current reality.

In the recent press release about the equity offering, 22nd Century Group announced the elimination of its at-the-market (“ATM”) offering program. Moreover, management reiterated its full-year net sales guidance of $105 million to $110 million and stated the equity infusion was needed due to the opportunistic acceleration of VLN product launch.

While there are obviously no positives from being removed from major stock indexes, we remind investors that the selling pressure over the past few weeks is likely due to forced selling from index funds (i.e. Blackrock and Vanguard Group), which were previously among the largest shareholders.

We also note that in the press release earlier this week announcing the 1-for-15 reverse stock split management again reaffirmed its full-year guidance for net sales of $105 million to $110 million. While we are disappointed with the timing of the reverse stock split and do not understand the board’s rationale that the split now provides investors greater “assurance” for the stock (especially based on the stock’s performance since this announcement), we think ultimately the reverse split will serve to attract new long-term institutional investors. In addition, with a smaller float, there is now a greater likelihood of a short squeeze, too.

Conclusion

Simply put, we think shares of 22nd Century Group offer investors a compelling opportunity with an asymmetric risk-reward profile, after the extreme sell-off during the past month. In our view, investors are overly concerned by the risk of additional near-term dilution and discounting the aggressive multi-state VLN product launch and many short- and medium-term catalysts for both the tobacco and hemp / cannabis business units. In addition, if the VLN product launch is successful, then we think 22nd Century Group would be a solid acquisition candidate for a major tobacco company. Therefore, we suggest that XXII shares are poised to finally generate significant shareholder return from current price levels, with our base case target of $16 (300% upside) compared to our bear case target of $3 (25% downside).

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here