I don’t believe anything the government tells me.- George Carlin.

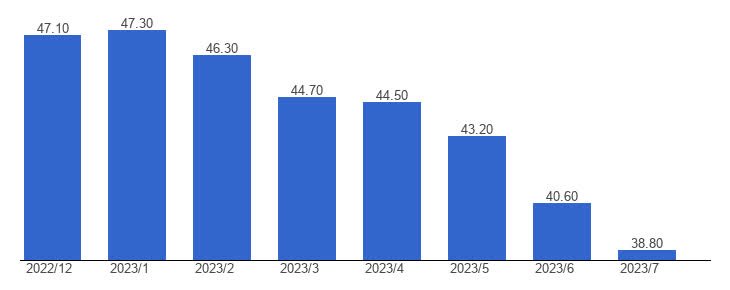

GDP growth has clocked in with some impressive numbers so far in the first half of 2023. The economy grew two percent in the first quarter and 2.4% in the second quarter, both levels nicely above expectations. This expansionary economic activity occurred despite some traditional economic metrics pointing directly to recession ahead. These include the Leading Economic Indicators being in negative territory for 15 straight months now and the Treasury yield curve being more inverted than at any time since the early ’80s, when the economy experienced a brutal “double dip recession.” Specifically, the inversion between the yields of two- and 10-year treasuries reached a four-decade high in July.

U.S. Leading Economic Indicators (The Conference Board)

The staff at the Federal Reserve are no longer predicting a recession on the horizon despite taking the Fed Funds rate up by 525 basis points since March of 2022, implementing the most aggressive monetary policy since the days of Paul Volcker.

My personal view is it is way too early to declare victory on either inflation or avoiding pushing the economy into the ditch. I saw a good analogy the other day relating to the Fed draining liquidity from the economy with much higher interest rates and pushing money supply growth into negative territory. It is akin to draining half the oil from your car engine. The engine will run for a while afterward, but eventually it is destined to freeze up and bring the vehicle to a complete stop at some point.

I have laid out how major economic indicators are still pointing to a likely economic contraction in the quarters ahead in a couple of recent articles (I, II). Today, I highlight three rather obscure economic indicators that are practically screaming that a recession lies dead ahead.

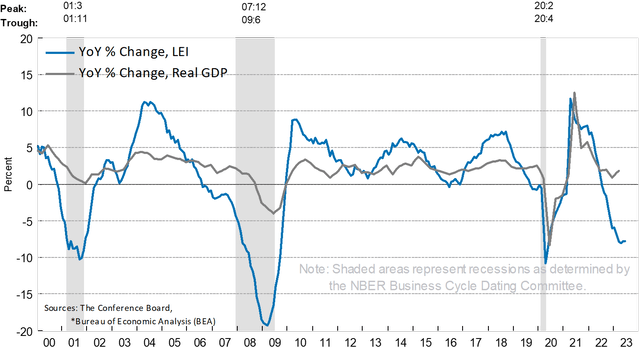

Earlier this week, Packaging Corp. of America (PKG) reported that cardboard box sales fell 9.8% in the second quarter. This comes after a 12.7% drop in the first quarter. This is the biggest six-month decline in cardboard box sales since early 2009, when the country was in the bowels of the Great Recession.

Packaging Corporation of America

As can be seen above, this activity has been correlated strongly with recessions. This makes perfect sense given the rise of Amazon (AMZN) and online retail over the past quarter century, and cardboard plays a key role in the e-commerce ecosystem and the transport of goods. This indicator is clearly flashing red right now.

Investors pay a great deal of attention to the monthly jobs report that comes out the first Friday of every month from the Bureau of Labor Statistics. This despite the fact that the unemployment rate is always a lagging indicator from an economic perspective.

Zero Hedge – JOLTs Report

One thing I have been watching recently in the level of monthly Job Openings, or the JOLTS, report. As you can see above, this has started to turn over in recent months. Job openings fell to 9.6 million in July, their lowest level in two years. “Quits” also unexpectedly fell by 300,000 from June to 3.8 million individuals.

Corporations have been inclined to “hoard” workers, thanks to the huge labor supply shortages that came about after the pandemic lockdowns. However, in recent months, companies are getting much more conservative in posting and filling jobs. This points to slower job growth in the months ahead. While a positive on the inflation front, it is negative for consumer confidence and most likely personal spending as well.

Finally, while investor focus has largely been on Big Tech and the “Magnificent Seven” that have driven most of the gains in the NASDAQ (COMP.IND) and S&P 500 (SP500) in 2023, the U.S. manufacturing sector has quietly been in contractionary territory since last October. The Dallas Fed Manufacturing Survey came in a bit better than expected on Monday but still had a negative print of -20, showing manufacturing is deep in recessionary territory in the region. The July Chicago PMI also posted a reading 42.8, also significantly in contractionary territory.

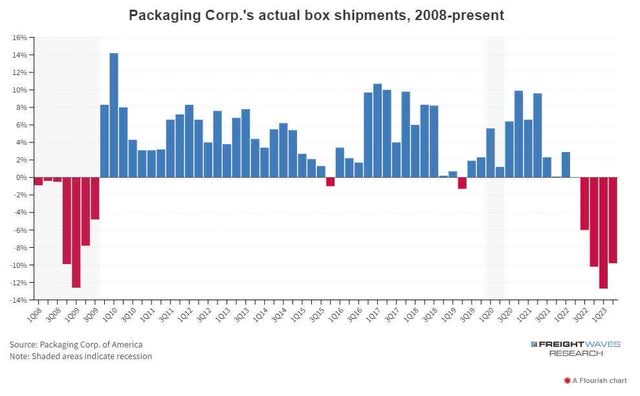

And this manufacturing slump is hardly confined to the United States. Over in Germany, the biggest economic engine of the European Union, just printed a PMI level of 38.8. This is deep in recession territory and the worst level since the Covid lockdowns. German PMI had averaged a reading of 53.3 over the past decade for comparison.

German Monthly PMI (GlobalEconomy.com)

Given these indicators as well as negative readings from more well-known measures of the economy I have highlighted in recent articles, my outlook continues to be quite negative on the economy and markets in the coming quarters.

Fortunately, cash is no longer “trash” and approximately 50% of my current portfolio holdings are in 3-month and 6-month U.S. Treasuries. Both of which yield around 5.5% currently. Around 40% of my portfolio is in covered call holdings around names with great balance sheets and reasonable valuations. 6% to 8% is in the cash and the rest is in out of the money bear put spreads against the Invesco QQQ Trust ETF (QQQ) and SPDR® S&P 500 ETF Trust (SPY), as well as some of the names in the overvalued Magnificent Seven. One of these trades is around Apple (AAPL), which I highlighted in this recent article.

My portfolio is thus more conservatively positioned than it has been in years, awaiting what I believe will be significantly lower entry points in the quarters ahead.

Never underestimate the power of stupid people in large groups.”― George Carlin.

Read the full article here