September has held up its reputation as one of the worst months for equities, as it was the worst month in 2023 so far. To me, that sounds like the perfect opportunity was created to add to several positions in my portfolio at an even better price.

Over time, I look for this portfolio to grow my monthly cash flow. This works through putting new capital to work and reinvesting the steady cash that comes in monthly as well. This has a compounding snowball effect over time. The more capital that is put to work, the larger the ball of monthly cash becomes.

This is another month where I was avoiding adding any leveraged names, as has been consistent with my theme most of this year. The idea is that I’m reducing overall leverage being utilized in my portfolio due to higher interest rates, making leverage less appealing. This is also having the natural effect of de-risking my portfolio in general so that can be seen as a bit of a bonus.

BlackRock Health Sciences Trust (BME)

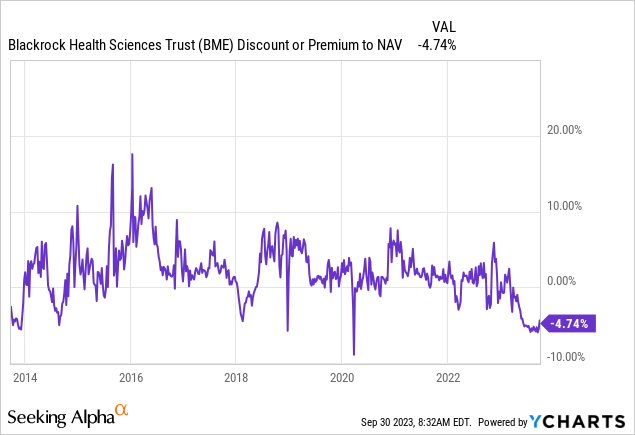

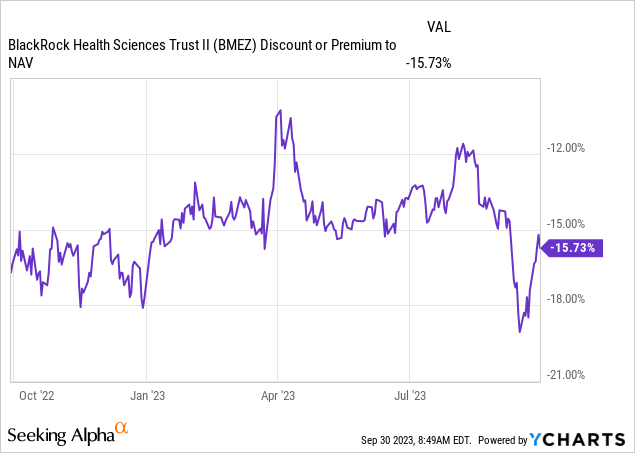

Historically, it’s fairly rare for BME to be trading at a discount unless you go back to the global financial crisis. Since then, the fund has often traded at a premium. So, with a discount widening out on this fund, I thought it was a decent time to add to my position in my portfolio. In fact, with natural market movements and adding to this position, it has now been pushed to the largest position in my closed-end fund portfolio.

YCharts

It also doesn’t hurt that healthcare is often a defensive sector, and the fund also employs a covered call strategy, which also adds a slightly more defensive tilt to the fund. This can make it a more conservative investment, relatively speaking, though the discount/premium mechanic of a closed-end fund will be something that adds volatility back in.

Healthcare hasn’t been acting great this year, as it is one of the down sectors on a YTD basis. However, with a recession anticipated to kick up sometime next year, 2024 could look like a potentially better year.

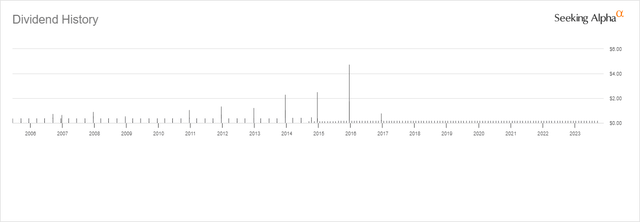

The fund’s distribution rate won’t set the world on fire, but it still comes in at a respectable 6.53% rate on the market price. This is one of the few funds that hasn’t cut their regular distribution but also has an inception prior to the GFC. With year-end special payouts, there would have been some varied years in terms of total payouts. While that is subject to change at any time, and a cut is always possible, it’s a testament to the general steady nature of the sector.

BME Distribution History (Seeking Alpha)

BlackRock Enhanced Equity Dividend Fund (BDJ)

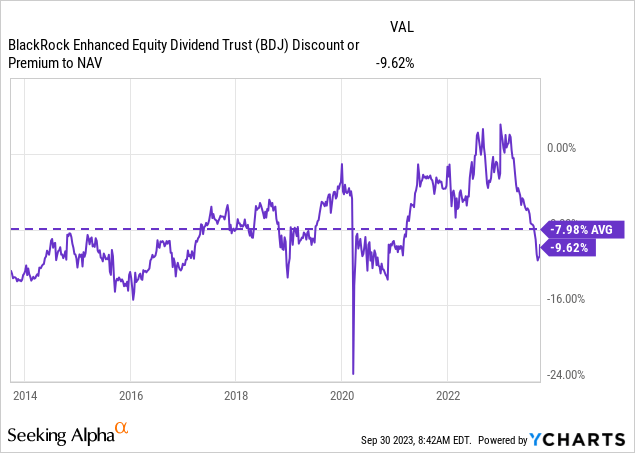

BDJ is another fund that was running pricey for a while but has now traded down to a deep discount. However, the history of trading at a premium isn’t nearly as long as its cousin fund BME. In fact, this fund has generally traded at a 10% discount for most of its life.

YCharts

So, the current discount is merely consistent with where it generally trades. However, where it generally trades is fine by me as it also means a larger discount than this is often rare, creating the opportunity to add to my position. Ultimately, I’m not getting a steal, but I also feel that I’m not paying up, either.

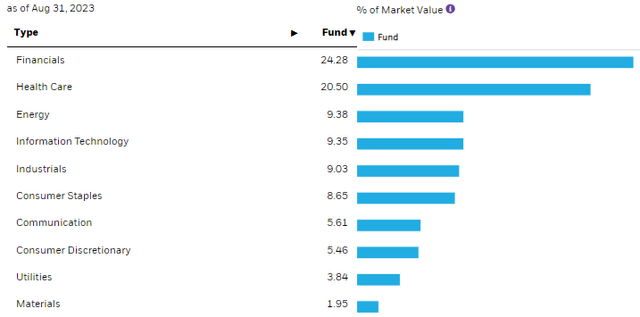

BDJ has also become a larger position in my CEF portfolio over time. This is a general equities portfolio that also implements a covered call writing strategy on individual positions. The fund actually tracks the Russell 1000 Value Index, which gives the portfolio a tilt toward more value sectors such as financials and healthcare. Those are, in fact, the largest sectors, which is then followed by energy before the tech sector shows us.

BDJ Sector Exposure (BlackRock)

BlackRock Health Sciences Term Trust (BMEZ)

Just because I’m sticking with unleveraged funds doesn’t mean that they can’t be exciting enough. BMEZ is going to be an aggressive healthcare fund that invests a sizeable sleeve of its portfolio in private and more biotech-oriented investments. The fund’s discount has widened considerably on the back of the news that the fund would be implementing a 6% NAV-managed distribution plan.

This will make it essentially a variable payer from month to month. This also saw a significant reduction in the first month. The fund was carrying around a 10.22% NAV rate based on its $0.145 monthly distribution. The first month under the new policy has been declared at $0.09318.

Despite the already deep discount the fund was carrying, it did seem like investors didn’t like hearing this news as the discount widened out further. However, it made up for some of that drop as the price recovered and the NAV fell through a weak September performance.

YCharts

Personally, I think this policy makes more sense for this type of fund. When times are tough, as they are now, it’ll mean less erosion to the fund’s assets. Alternatively, when the fund is performing well, it means shareholders will also be rewarded with a higher distribution.

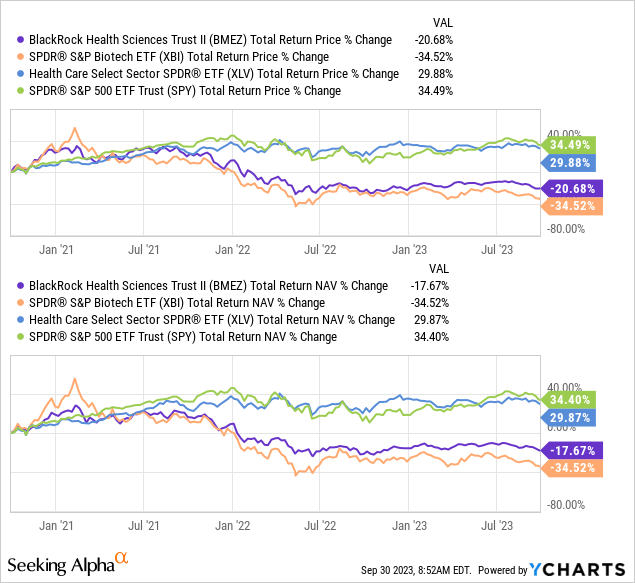

To give some context of how tough the biotech space has been, we can run a comparison of BMEZ to the SPDR S&P Biotech ETF (XBI) over the last three years. To provide some more color, I’ve also added the Health Care Select Sector SPDR Fund ETF (XLV) for a sense of the broader healthcare sector performance outside of this subsector. I’ve also included the broader market measurement, the SPDR S&P 500 ETF Trust (SPY).

YCharts

Western Asset Investment Grade Income Fund (PAI)

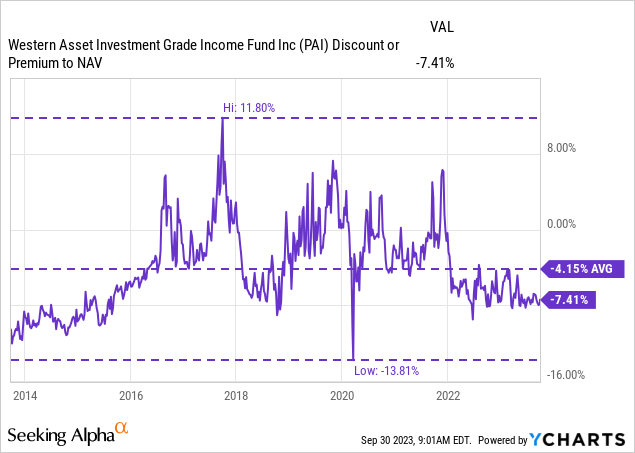

Finally, to end the month, I picked up more PAI. This is part of my rate pivot play along with Nuveen AMT-Free Municipal Value Fund (NUW), which I’ve been alternating each month and adding. The distribution yield currently works out to just over 5%, which means it’s only a bit above the Fidelity (SPAXX) money-market fund currently.

Given that fact, the play isn’t necessarily the yield today but looking toward when the Fed eventually cuts. When that happens, the fund’s yield should look more appealing relative to the risk-free short-term rates that will drop quickly. On top of that, even getting some discount contraction could potentially boost the results going forward over the coming few years.

YCharts

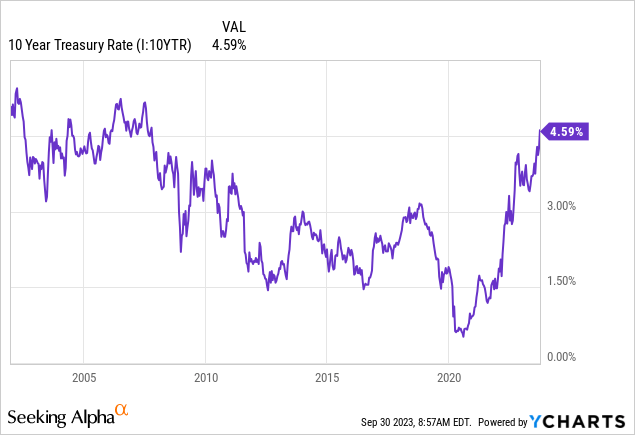

With yields on Treasuries blasting off higher for the month, they certainly felt some damage, and this play was under pressure, though creating more opportunity to add lower. The 10-Year Treasury rate hit its highest level not seen since prior to the GFC.

YCharts

On the good news front, the fund raised its monthly distribution to $0.0475. A small raise from the $0.0465, but it is supported by the income generation of the underlying portfolio. In fact, if yields stay higher for longer, the distribution could continue to rise slowly moving forward.

Read the full article here