Investment Thesis

From my point of view, companies with a low Beta Factor are important for any investment portfolio. This is because they can help you to stabilize your portfolio in times of a stock market decline or stock market crash.

In today’s article, I will introduce you to five companies that can provide you with an attractive dividend income and which, at the same time, can help you to decrease the volatility of your investment portfolio.

For each of the selected picks, I will make a projection of the company’s Dividend and Yield on Cost in order to show you how you could benefit from the steadily increasing dividend payments when investing over the long term (and not speculating over the short term).

In order to make a first pre-selection, I have only included companies that at least fulfill the following requirements:

- Market Capitalization > $5B

- Dividend Yield [FWD] > 3%

- Payout Ratio < 60%

- P/E [FWD] Ratio < 30

- Beta Factor < 0.90

From this pre-selection, I have selected the five companies that you will find below.

These are the 5 High Yield Dividend Companies that can help you generate extra income and reduce portfolio volatility:

- Cisco Systems, Inc. (NASDAQ:CSCO)

- CVS Health Corporation (NYSE:CVS)

- Kellogg Company (NYSE:K)

- The Kraft Heinz Company (NASDAQ:KHC)

- The Toronto-Dominion Bank (TSX:TD:CA)

Cisco Systems

Cisco Systems was founded in 1984 and has a current Market Capitalization of $192.91B. The company has a Payout Ratio of 44.19% and has shown a Dividend Growth Rate [CAGR] of 4.98% over the past 5 years.

At this moment of writing, it pays shareholders a Dividend Yield [FWD] of 3.31%. The company’s current Dividend Yield [FWD] stands 101.21% above the Sector Median of 1.65%. At the same time, it lies 9.79% higher than its Average Dividend Yield [FWD] over the past 5 years (3.02%).

Cisco Systems’ 24M Beta stands at 0.79, which supports my thesis that it can contribute to reducing the volatility of your investment portfolio.

In addition to that, the company’s Free Cash Flow Yield [TTM] currently stands at 7.96%, which lies 95.76% above the Sector Median and indicates that it’s an appealing choice for investors when it comes to risk and reward.

In addition to that, I consider Cisco Systems’ Valuation to be attractive: the company has a P/E GAAP [FWD] Ratio of 15.78, which stands 30.31% below the Sector Median (22.64).

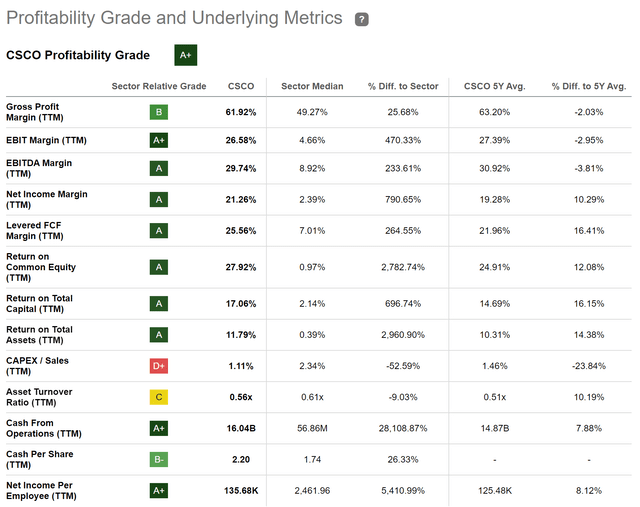

The company disposes of a relatively strong financial health, which is underlined by its EBIT Margin [TTM] of 26.58% (470.33% above the Sector Median). Its financial health is further underlined by its Return on Equity of 27.92%, which stands 2,782.74% above the Sector Median.

Even though it is true that in terms of Profitability, Cisco Systems (with an EBIT Margin [TTM] of 26.58%) is clearly behind other companies from the Information Technology Sector such as Microsoft Corporation (NASDAQ:MSFT) (EBIT Margin [TTM] of 41.42%) or Adobe Inc. (NASDAQ:ADBE) (33.91%), it can be stated that the company has a significantly lower Valuation: while Cisco Systems’ current P/E [FWD] Ratio stands at 15.78, Microsoft’s is 32.79, and Adobe’s is 30.99.

However, it should also be mentioned that Cisco Systems’ Growth Rates are significantly lower: while the company’s Revenue Growth Rate [FWD] is 5.71%, Microsoft’s is 11.82% and Adobe’s is 11.00%.

Below you can find the Seeking Alpha Profitability Grade, which confirms the strength of Cisco Systems in terms of Profitability.

Source: Seeking Alpha

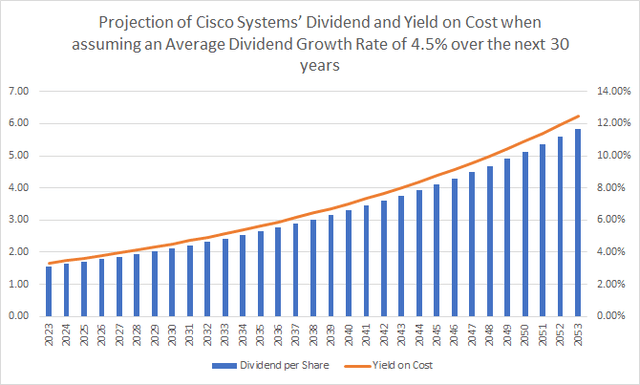

Projection of Cisco Systems‘ Dividend and Yield on Cost

Below you can find a projection of Cisco Systems’ Dividend and Yield on Cost when assuming that the company would be able to raise its Dividend by 4.5% over the following 30 years (which is in line with the company’s Dividend Growth Rate [CAGR] of 4.98% over the past 5 years).

Source: The Author

CVS Health Corporation

CVS Health Corporation provides health services and operates through the following segments:

- Health Care Benefits

- Pharmacy Services

- and Retail/LTC segments.

The company has 295,000 employees and currently a Market Capitalization of $88.27B.

CVS Health Corporation pays a Dividend Yield [FWD] of 3.51% while its Payout Ratio stands at a relatively low level of 25.80%. The company has shown a Dividend Growth Rate [CAGR] of 2.92% over the past 5 years.

These metrics confirm my investment thesis that the company can be an adequate choice for those investors looking to combine dividend income with dividend growth while reducing portfolio volatility. The company’s 24M Beta Factor of 0.55 confirms that the company can contribute to reducing the volatility of your investment portfolio.

I believe that the company is currently undervalued: its current P/E [FWD] Ratio of 9.42 stands 65.16% below the Sector Median and it is 38.21% lower than its Average from over the past 5 years.

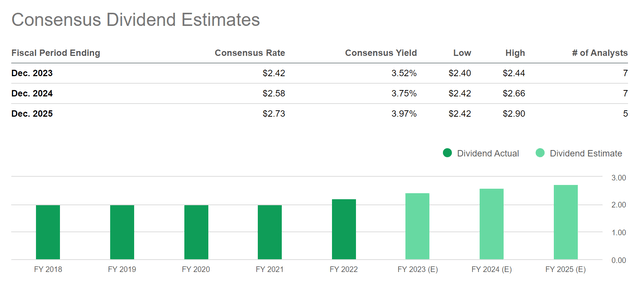

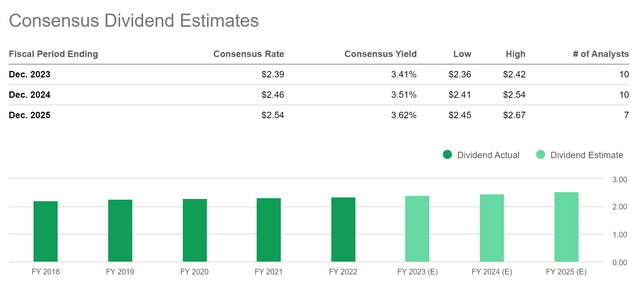

Below you can find the Consensus Dividend Estimates for CVS Health Corporation. The Consensus Yield is at 3.52% for 2023, at 3.75% for 2024 and at 3.97% for 2025.

Source: Seeking Alpha

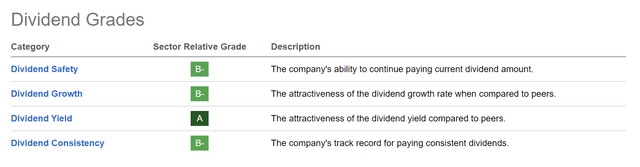

Next you can find the Seeking Alpha Dividend Grades for CVS Health Corporation, which support my theory that the company is appealing for those looking for dividend income and dividend growth at the same time: the company receives an A rating for Dividend Yield, and a B- rating for Dividend Safety, Dividend Growth and Dividend Consistency.

Source: Seeking Alpha

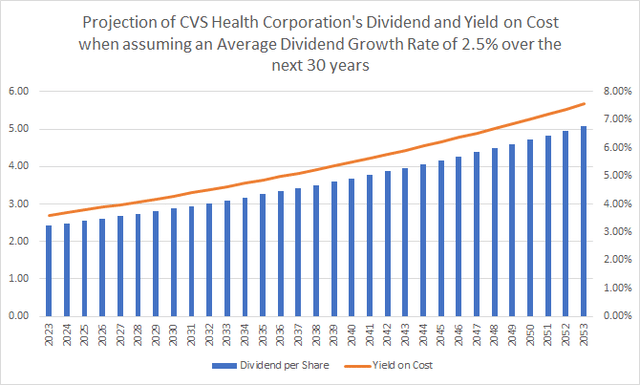

Projection of CVS Health Corporation’s Dividend and Yield on Cost

Below you can find the projection of the company’s Dividend and its Yield on Cost when assuming that the company were able to raise its Dividend 2.5% per year for the following 30 years (which is in line with its Dividend Growth Rate [CAGR] over the past 5 years of 2.92%).

Source: The Author

Kellogg Company

Kellogg Company manufactures and markets snacks and convenience foods. The company was founded in 1906 and has 30,000 employees. Kellogg Company currently has a Market Capitalization of $24.03B.

The company currently pays shareholders a Dividend Yield [FWD] of 3.37%. Its current Dividend Yield [FWD] stands 37.16% above the Sector Median of 2.45%. While Kellogg Company’s current Free Cash Flow Yield [TTM] of 4.36% stands 7.71% above the Sector Median of 4.05%.

The company’s Payout Ratio of 55.56% strengthens my belief that it should be able to provide shareholders with increasing dividends in the years ahead.

Below you can find the Consensus Dividend Estimates for Kellogg Company. The Consensus Yield is 3.41% for 2023, 3.51% for 2024 and 3.62% for 2025. These Dividend Estimates further increase my confidence that the company can be an attractive pick for investors aiming to combine dividend income and dividend growth while, at the same time, reducing the volatility of their investment portfolio.

Source: Seeking Alpha

The company’s 24M Beta of 0.26 strongly indicates that you can reduce portfolio volatility by including it in your investment portfolio.

Kellogg’s current P/E [FWD] Ratio stands at 17.88, which lies 12.21% below the Sector Median of 20.37, thus indicating that the company is undervalued.

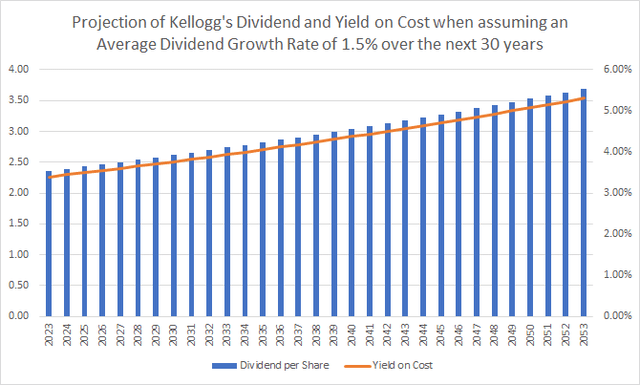

Projection of Kellogg Company’s Dividend and Yield on Cost

Below you can find a projection of Kellogg’s Dividend and Yield on Cost when assuming an Average Dividend Growth Rate of 1.5% over the next 30 years (being in line with the company’s Dividend Growth Rate [CAGR] of 1.89% over the past 5 years).

Source: The Author

Even though the company’s Dividend Growth is relatively low, I believe that it can still be a good choice for your portfolio if you would like to reduce its volatility.

However, if you decided to include it, I would only underweight it due to the company’s limited growth perspective. Kellogg has shown an Average Revenue Growth Rate of 1.63% over the past 5 years.

The Kraft Heinz Company

The Kraft Heinz Company manufactures and markets food and beverage products. The company was founded in 1869 and has 37,000 employees. It currently has a Market Capitalization of $49.30B.

At the company’s current stock price of $39,34, it pays its shareholders a Dividend Yield [FWD] of 3.98%. The company’s current Payout Ratio stands at 55.94%, indicating that there shouldn’t be another dividend cut in the near future, which could result in a negative effect on its stock price.

The Kraft Heinz Company currently pays a significantly higher Dividend Yield [FWD] than companies such as General Mills, Inc. (NYSE:GIS) (2.39%) or PepsiCo, Inc. (NASDAQ:PEP) (2.60%).

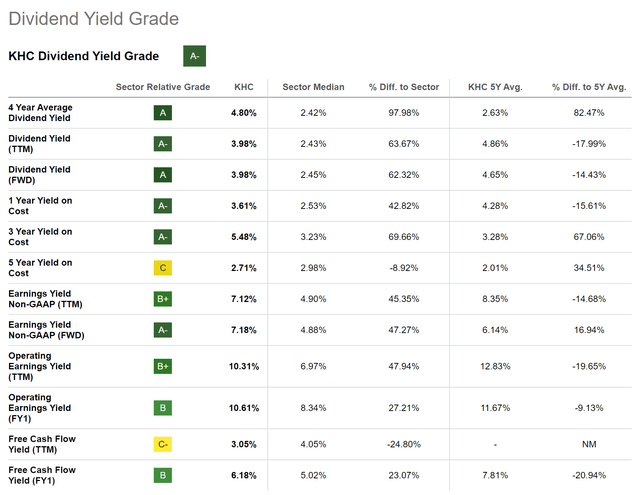

Below you can find the Seeking Alpha Dividend Yield Grade for the Kraft Heinz Company, which underline the company’s attractive Dividend.

Source: Seeking Alpha

The Kraft Heinz Company’s Dividend Yield of 3.98% stands 62.32% above the Sector Median, which is 2.45%.

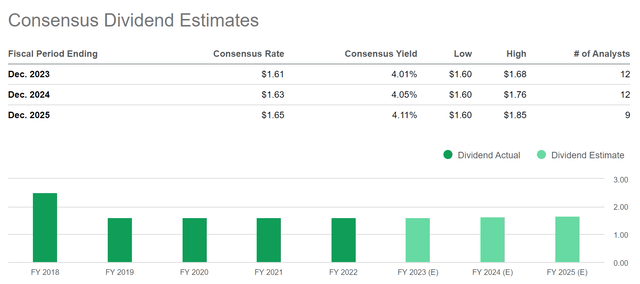

Below you can find Consensus Dividend Estimates for The Kraft Heinz Company. Consensus Dividend Estimates are 4.01% for 2023, 4.05% for 2024 and 4.11% for 2025. The numbers indicate that the company could be an attractive choice for dividend income and dividend growth investors.

Source: Seeking Alpha

The company currently has a P/E [FWD] Ratio of 13.48, which stands 48.17% below its Average over the past 5 years (26.02), indicating that it is undervalued at this moment in time.

In addition to the above, it can be highlighted that the company’s 24M Beta Factor of 0.28 strongly indicates that it will contribute to significantly reducing the volatility of your investment portfolio while helping you to generate extra income in the form of dividends.

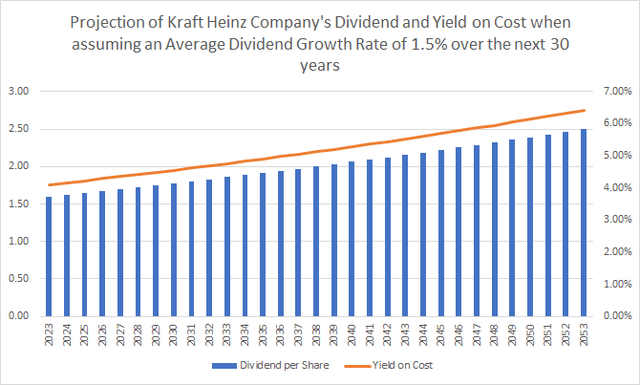

Projection of Kraft Heinz Company’s Dividend and Yield on Cost

The graphic below shows you Kraft Heinz Company’s Dividend and Yield on Cost when assuming a Dividend Growth Rate of 1.5% over the following 30 years.

Source: The Author

Similar to Kellogg, I would recommend to only underweight Kraft Heinz Company in an investment portfolio if you decided to include it. This is due to its limited growth perspectives: the company has shown an Average Revenue Growth Rate [FWD] of -0.63% over the past 5 years.

The Toronto-Dominion Bank

The Toronto-Dominion Bank currently pays a Dividend Yield [TTM] of 4.47% and a Dividend Yield [FWD] of 4.64%. What makes the Canadian bank particularly attractive for investors in my opinion is that, in addition to the attractive Dividend Yield, it has shown significant Dividend Growth in the past years.

I believe that the bank can not only contribute to help you earn a significant amount of extra income, but it could also increase this amount year over year.

The company has shown a Dividend Growth Rate [CAGR] of 7.00% over the past 3 years and a Dividend Growth Rate [CAGR] of 7.13% over the past 5 years.

I further believe that the bank’s Valuation is currently attractive, since its P/E [FWD] Ratio of 10.77 lies 7.19% below its Average from over the past 5 years (11.60). Furthermore, its Price / Book [TTM] Ratio of 1.41 lies 27.17% below its Average over the past 5 years (which is 1.94).

I further believe that the bank has a strong Profitability. This is underlined when looking at its Return on Common Equity of 14.66%, which stands 32.54% above the Sector Median (which is 11.06%). Moreover, the bank has a Net Income Margin [TTM] of 31.78%, which lies 23.21% above the Sector Median of 25.80%.

The Toronto-Dominion Bank’s Net Income Margin [TTM] of 31.78% is even higher than the one of banks such as the Royal Bank of Canada (NYSE:RY) (Net Income Margin [TTM] of 29.77%), Citigroup (NYSE:C) (21.22%), Bank of America (NYSE:BAC) (30.28%) or Wells Fargo (NYSE:WFC) (19.64%).

The Canadian bank has a 24M Beta Factor of 0.72, which supports my investment thesis, that it can further contribute to decreasing the volatility of your investment portfolio while providing you with a significant amount of extra income in the form of dividends.

Projection of The Toronto-Dominion Bank’s Dividend and Yield on Cost

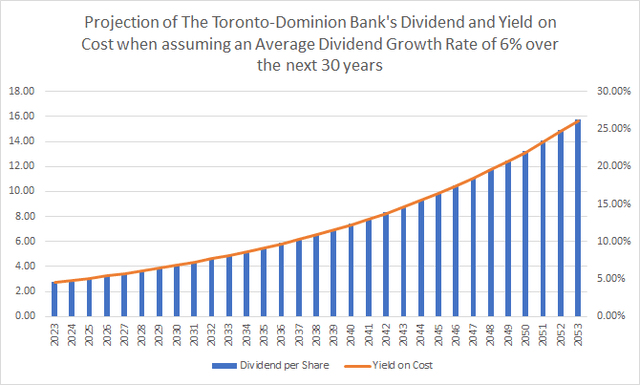

Below you can find a projection of the bank’s Dividend and Yield on Cost when assuming an Average Dividend Growth Rate of 6% over the following 30 years (its Dividend Growth Rate [CAGR] over the past 10 years lies at 6.02%).

Source: The Author

The graphic illustrates that the Canadian bank is an excellent pick for those investors that want to combine dividend income with dividend growth. Furthermore, it shows you the benefits of investing over the long term instead of speculating over the short term.

Conclusion

The five selected companies which I have presented in today’s article could be able to provide your investment portfolio with the following benefits:

- Extra income in the form of Dividends

- Increase this extra income from year to year due to the Dividend Growth they can provide your portfolio with

- Reduce the volatility of your investment portfolio.

I consider it important for any investment portfolio to include these kinds of companies that provide stability by decreasing the portfolio’s volatility. These companies will help you to sleep better during the next stock market crash. In addition to that, they help you to understand that you do not need to sell some of your stocks during the next stock market decline.

Author’s Note: I would appreciate hearing your opinion on my selection of high Dividend Yield companies that can help you to reduce the volatility of your investment portfolio. Do you already own or plan to acquire any of the picks? Which are currently your favorite high dividend yield companies that combine dividend income with dividend growth?

Read the full article here