Co-produced by Austin Rogers.

If you’ve been investing for a while, you are almost certainly aware of the “snowball effect” of reinvesting dividends.

For those in the accumulation phase of their investment journey (or those in retirement with excess income to invest), bear markets can be far more of a blessing than a curse. That is because bear markets give dividend investors access to the most powerful tool for supercharging their dividend income:

- Investing (and reinvesting) at higher yields.

It sounds so simple, but the power of plowing cash into dividend stocks at higher-than-average yields cannot be underestimated.

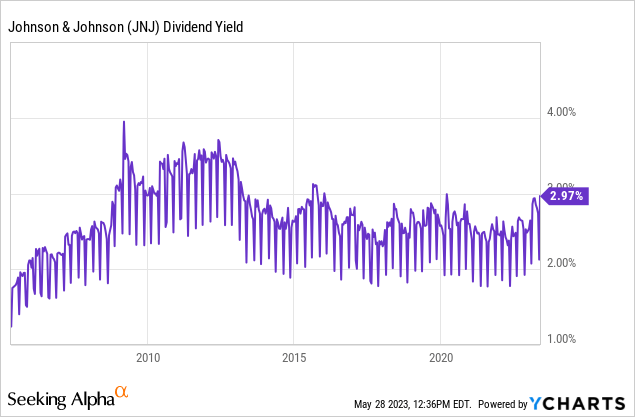

Take the example of one of the most popular dividend growth stocks, Johnson & Johnson (JNJ). Normally, JNJ trades at a dividend yield of around 2.5%, but today it offers a near 3% yield. (The chart below shows yield based on TTM dividends.) During the Great Recession, that yield reached around 3.5%.

If you invest $1,000 into JNJ at a 2.5% yield, it renders $25 a year in dividends. At a 3% yield? $30 a year.

On the surface, this doesn’t sound like much of a difference but consider the long-term effects. JNJ has increased its dividend for 60 consecutive years. It has a solid record of raising it at about 6% per year.

- At a 2.5% starting yield and 6% annual dividend growth, your yield-on-cost turns into 3.3% in 5 years, 4.5% in 10 years, and 6.0% in 15 years.

- At a 3.0% starting yield and 6% annual dividend growth, your yield-on-cost turns into 4.0% in 5 years, 5.4% in 10 years, and 7.2% in 15 years.

Half a percentage point makes a difference!

Okay, okay. The difference half a percent makes may not be that impressive. But this is for JNJ, one of the most boring (but also safest) dividend growth stocks on the market.

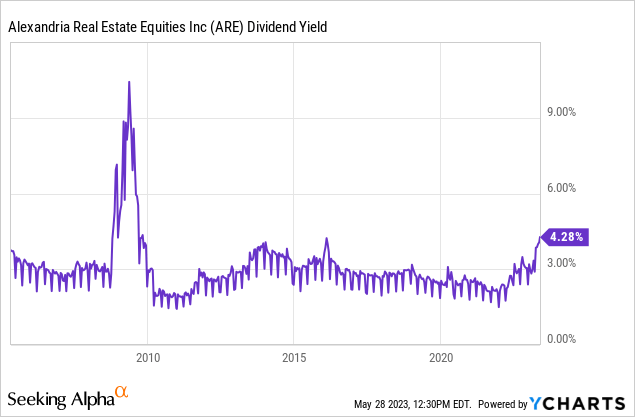

Let’s look at another example: Alexandria Real Estate Equities (ARE), an owner/developer of Class A life science (laboratory and medical research & development) properties located in the most highly productive and sought-after research clusters in the nation.

Because it is often misclassified as an “office REIT” (life science doesn’t have its own sub-sector of commercial real estate), ARE has sold off this year right alongside the REITs like Boston Properties (BXP) and Vornado Realty (VNO) that actually own traditional office buildings.

ARE’s average dividend yield is 2.7%. Right now, because of the “office bear market,” it offers a dividend yield of 4.3%. What is the difference in opportunity right now for dividend investors?

Well, considering that ARE has established a strong track record of roughly 6% annual dividend growth, let’s consider the long-term effect that this starting yield differential has.

- At a 2.7% starting yield and 6% annual dividend growth, your yield-on-cost would turn into 3.6% in 5 years, 4.8% in 10 years, and 6.5% in 15 years.

- At a 4.3% starting yield and 6% annual dividend growth, your yield-on-cost would turn into 5.75% in 5 years, 7.7% in 10 years, and 10.3% in 15 years.

That’s a big difference!

To illustrate, a $1,000 investment in ARE at a 2.7% starting yield would theoretically produce $48/year in 10 years and $65/year in 15 years. But at a 4.3% starting yield, the same amount of invested dollars would produce $77 in 10 years and $103 in 15 years.

That’s an 18.5% income differential in 10 years and a 58.5% differential in 15 years.

And this doesn’t even include dividend reinvestment. Reinvesting dividends right back into dividend stocks after receiving them is a powerful accelerator of compounding. That’s because your dividends become more invested capital, which generates more dividends, which can then be reinvested into more shares.

Hence the snowball illustration. As the snowball rolls downhill, it gathers more snow. And as the snowball gets bigger, its growing circumference gathers even more snow.

The real unicorn in dividend growth investing is a stock offering a high yield, safe dividend, and sustainable dividend growth. The opportunities to buy such unicorns are few and far between, but they are a lot more common to find during bear markets.

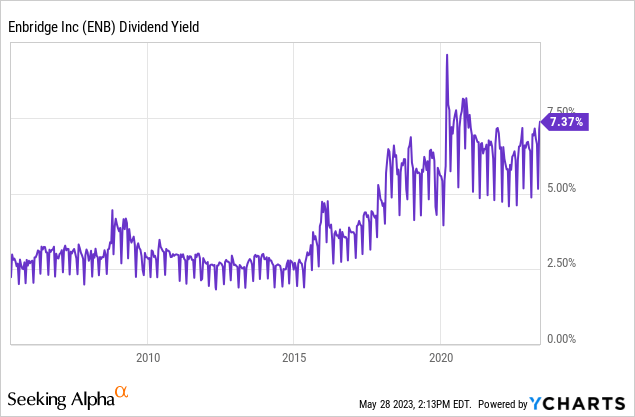

A perfect example of this is the Canadian midstream energy giant, Enbridge (ENB).

Compared to ENB’s average dividend yield over the last five years of about 6.5%, the current 7.3% yield looks quite enticing.

ENB has a strong track record of 27 consecutive years of dividend increases as well as 70 years of dividend payments without a reduction. In the last five years, dividend growth has averaged around 7% (in Canadian dollars), but in recent years, dividend hikes have slowed to 3-4%.

To be conservative, let’s assume a forward dividend growth rate of 4%.

- At a 6.5% starting yield and a 4% dividend growth rate, your yield-on-cost would turn into 7.9% in 5 years, 9.6% in 10 years, and 11.7% in 15 years.

- At a 7.3% starting yield and a 4% dividend growth rate, your yield-on-cost would turn into 8.9% in 5 years, 10.8% in 10 years, and 13.1% in 15 years.

You can see how it’s stocks like ENB that the best blends of current yield and future income!

Bottom Line

You’re far more likely to find deals like this during bear markets than bull markets, which is why dividend investors who are still accumulating shares should be overjoyed rather than fearful right now.

Seek out and buy the safest, highest-yielding, and most sustainably growing dividend stocks, and you will master the market rather than letting it master you.

We’ve highlighted the power of continuously investing new capital and reinvesting dividends during bear markets, when yields are higher, giving a larger base dividend income stream from which to grow.

But perhaps the most powerful aspect of being a dividend investor during a bear market is the fact that it can keep you engaged, motivated, and excited about investing the incremental dollar rather than scared out of the market “until things calm down” (in other words, once the best deals are no longer available).

At High Yield Investor, we love finding “dividend growth unicorns” with generous and sustainable dividends. And today’s market is a target-rich environment for such opportunities.

Read the full article here