I am a gold bug. My reasons for being one are numerous least of all where across time and geography gold has remained valuable (As a timeless store of value, a medium of exchange, a hedge against economic turmoil, and a transcendent cultural symbol). Comparisons of gold against emerging technologies such as Bitcoin as “digital gold” is a moot point (These simply haven’t stood the test of time, have higher volatility, and are yet to prove themselves as a safe haven, but I digress)

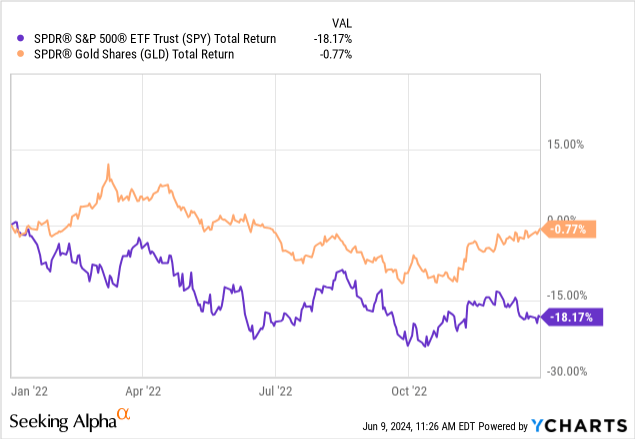

But within the context of one’s investment portfolio, how can one view gold? It plays an important role as a portfolio diversifier and has demonstrated a low/ negative correlation with stocks (The most recent example is 2022 where Gold held steady for the year compared with SPY).

The current geopolitical, monetary, and fiscal risks are not reflected in the stock market which I believe makes a great reason for Gold to be in an investor’s portfolio should we encounter another down year in the stock market. While I do hold Gold in my portfolio, its low volatility also means its returns can be slow at times. Investors do try to “spice things up” by diversifying into miners as gold miners provide leveraged exposure to gold prices and have shown explosive moves during gold bull runs.

But the hard truth is outside of short to medium term, miners have significantly underperformed the yellow metal. I have seen long-term charts of many well-established mining companies exhibit this pattern. Multiple reasons for this –

1. Miners are not just a big hole in the ground; they can also be a money pit. As the value of the yellow metal climbs, miners drastically increase their capital expenditures to capitalize on the higher prices. However, if the prices drop, these companies are left with substantial operational costs and react more to the downside.

2. Inflationary pressures can hit a miner’s bottom line due to increased costs from labor, energy, equipment, and supplies. When this is combined with declining ore grades it can be a double whammy for a miner.

3. Interest rates also have an effect as higher borrowing costs affect financing new projects and expansions.

4. Geopolitical risks can become a huge factor in a miner’s fate and can change the company’s fortunes overnight.

To overcome this, one can look into royalty companies but these are not completely immune from miner-type risks as one is led to believe. A recent example of Franco-Nevada where its mine in Panama was affected comes to mind (Overall, royalty companies are still exposed to operational risks of a miner)

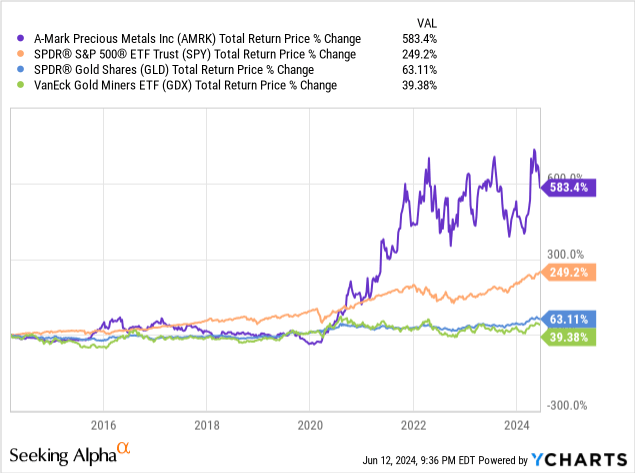

But what if there was a company that provides magnified exposure to Gold’s returns and is not a miner or a royalty company? Can we have the cake and eat it too?

Enter A-Mark Precious Metals (NASDAQ:AMRK)

A-Mark Precious Metals is a precious metals trading company

A-Mark Precious Metals company wears many hats within the precious metals commodity space especially since they have grown through acquisitions in the last several years. Operationally, they have a history of 50 years with a global footprint and they have established themselves as a major player in the precious metals trading industry.

A-Mark’s evolution through expansions and acquisitions (Investor Presentation)

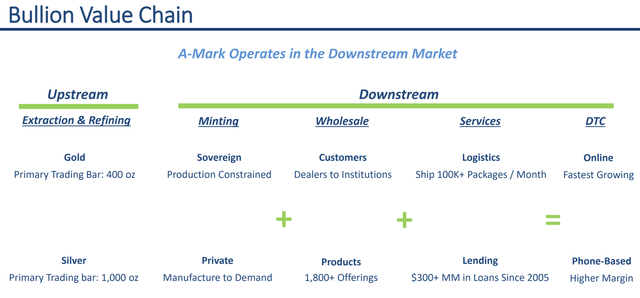

Their core business model revolves around trading physical precious metals and earning a spread between the commodity spot prices and the prices at which they sell coins, bars, and bullion to customers and dealers. Their profitability is driven by trading volumes and the premiums they can command over spot prices. I will make an attempt to list their operations here (acquired and organically grown) with their business spanning multiple segments.

Direct to Consumer (DTC) This segment involves selling precious metal products like coins, bars, and rounds directly to consumers through e-commerce channels. A-Mark’s subsidiaries JM Bullion and Goldline are the primary drivers of this direct-to-consumer business. They have prioritized expanding their retail presence and digitizing precious metal sales through acquisitions like CyberMetals.com. Presently, CyberMetals has only $6.8M AUM but it is an interesting and emerging concept where customers can digitally manage Precious Metals portfolio tied to actual inventory stored in A-Mark’s secure vaults (can also be redeemed). This subsegment has the advantage of attracting a much younger generation to invest in precious metals.

Wholesale Trading Under this segment, A-Mark buys and distributes precious metals sourced from sovereign and private mints across multiple countries including the U.S., Australia, Austria, Canada, China, Mexico, South Africa, and the U.K. The company acts as a wholesale trader and supplier of these precious metals.

Lending A-Mark has two subsidiaries, Collateral Finance Corporation (CFC) and Goldline, that provide loans secured by bullion, numismatic coins, and other precious metal collateral. This lending business generates revenue primarily through interest income on the loans.

A-Mark’s operational focus (Investor Presentation)

Overall, the company has vertically integrated operations downstream from minting and production to distribution, e-commerce sales, lending, and storage services. This comprehensive precious metals ecosystem allows A-Mark to capture value across the supply chain.

Diversifying risks from the market and Gold miners

Before we dive into the company’s financials/fundamentals, I want to explain quantitatively how this stock has behaved and why I think it helps diversify risks while providing superior returns. By analyzing its correlation (or lack thereof) and examining its performance, I believe an argument can be made that an investor can sufficiently diversify/decouple risks while pursuing gold-related investments and also have a shot at achieving returns superior to that of gold.

A-Mark stock’s returns have a zero Beta to the market (It has a 5Y Beta of 0) which is surprising considering the sector in which the company operates (Financials) but not surprising considering its actual business. Its complete lack of connection to the overall market is already a good sign!

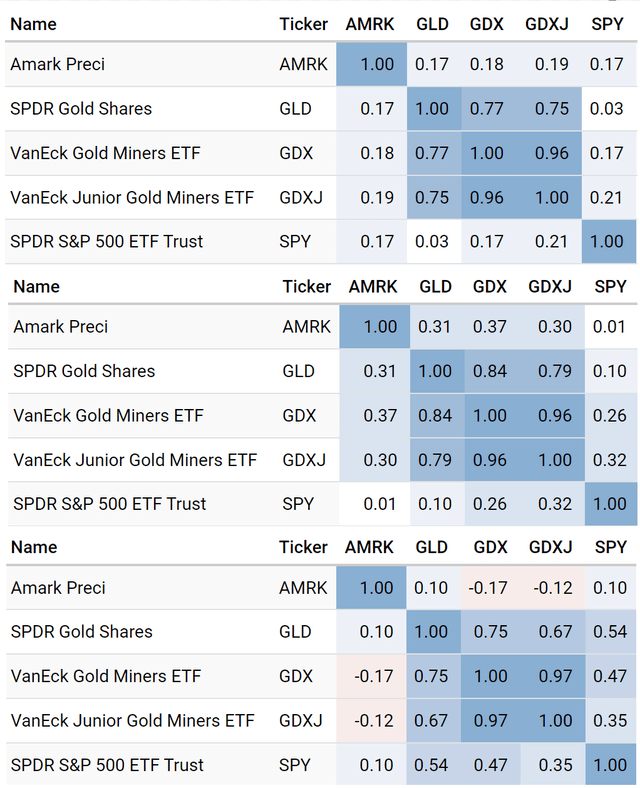

Next, we will examine its correlation and it is quite clear that the stock’s returns are quite uncorrelated to Gold and the miners. In this exercise, I ran correlations for this stock under 3 different basis (Daily, Monthly, and Annual) and used the returns from 2015 when all my comparables started trading.

Daily. Monthly and Annual Correlation (PortfolioVisualizer)

From the snapshot above following things are clear –

- Gold exhibits a low correlation to the S&P index (This is already widely known)

- Gold miners show a high correlation with Gold (This makes sense and we have said before that gold bull runs provide an opportunity for explosive returns in the miners)

- A-Mark shows a low correlation to the market index (SPY)

- A-Mark shows a much lower correlation to Gold when compared to miners.

- Low correlation says nothing about performance. Since its inception, the stock has outperformed the S&P index, Gold (GLD), and Gold miner indices GDX and GDXJ by a wide margin (A-Mark saw the highest outperformance during the Gold bull run of 2020 – 2022)

Commentary on A-Mark Precious Metals Q3 2024 Earnings

Investor Presentation

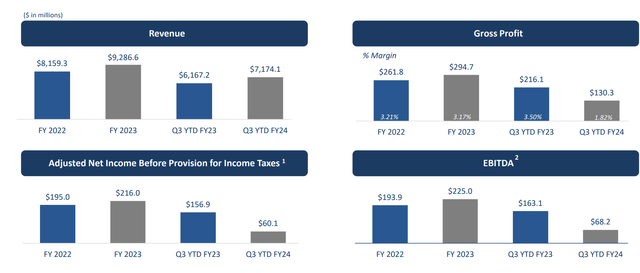

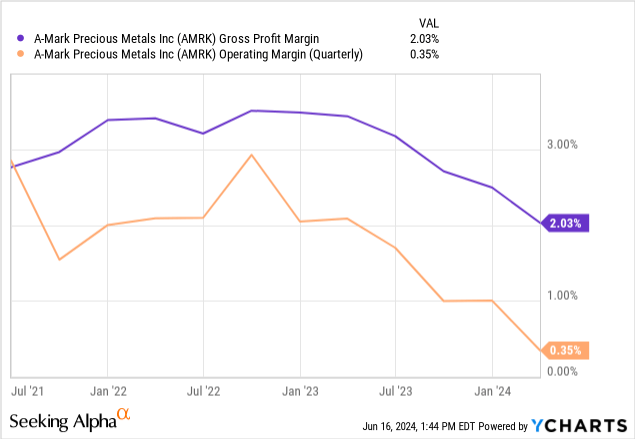

Revenues have sequentially grown in the last several years and this trend continued into the latest quarter as well. For the quarter ending March 31, 2024, A-Mark reported total revenues of $2.6B, representing a growth of 12.7% compared to the previous quarter. However, margins have fallen which has resulted in impacting the bottom line (EPS for the quarter was $0.22, a significant decline of 85% compared to the same quarter last year. The EPS for the twelve months ending March 31, 2024, was $3.43, reflecting a decrease of 47%) . A-Mark’s Q3 2024 Earnings call makes the reasons for this very clear.

A-Mark faced several challenges in Q3 2024, including softened demand, premium compression, and elevated gold and silver prices (Lower gross margins during the quarter were primarily due to the compression in premiums and the necessity to sell some inventory repurchased from wholesale customers at lower margins compared to the direct-to-consumer channel). The quarter saw a record number of days with all-time high gold prices, which led many of A-Mark’s customers to become sellers rather than buyers. This shift in customer behavior required A-Mark to balance its inventory purchases and sales.

But overall, A-Mark remains optimistic about the current quarter and believes that Q3 2024 represented a low point. The company generated strong results in April and sees opportunities for mergers and acquisitions in the current market environment across their key segments. They continue to focus on growing their direct-to-consumer business, including new product offerings.

From a balance sheet perspective, its current assets of $1.3B alone cover all of its liabilities ($1.1B). It has a long-term debt that stands at $300M and the interest payments on its debt are well covered by EBIT. The company also returns value to shareholders through dividends (2.35% yield) and share buybacks. With a low payout ratio, its dividend payments are well covered by its earnings.

Overall, after reviewing their latest quarterly results, I believe the company’s financials exhibit strength and its balance sheet does not pose a concern.

A-Mark Precious Metals is undervalued considering its potential

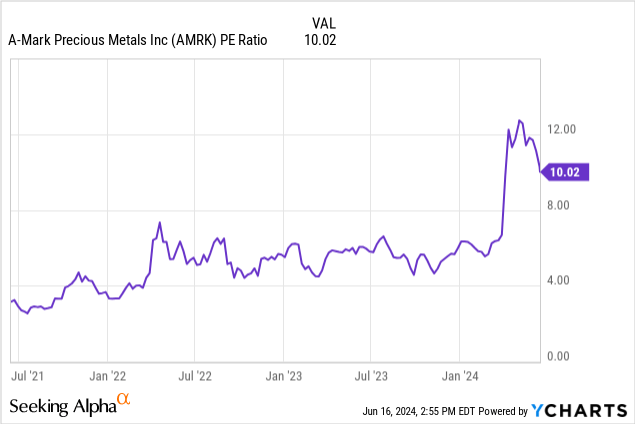

A-Mark stock’s P/E ratio of 10x is relatively low, indicating that the stock might be undervalued compared to the broader market (SPY is trading approximately at 25x). A closer comparison would be how it looks versus the miners (since that is another focus point for this article). The gold miner ETF (GDX) currently trades at 27 times earnings, therefore the company’s valuation is coming out on top in this instance as well. The P/B ratio of 1.3x suggests that the stock is trading close to its book value, reflecting a conservative valuation. The recent dip in earnings has relatively inflated its earnings multiple which highlights the challenging nature of its business (The razor-thin margins the business depends on add to this variability in earnings). But the CEO has already mentioned in the last earnings call, that this is about as worse as it can get. On the upside, there was a lot of optimism that was expressed.

… I made comments that I thought the January, February, March period of calendar 2024 was what we would view as a kind of a low watermark. I feel like we are very optimistic and enthusiastic about what we’ve seen in the last four or five weeks. We’ll see if that plays out in May and June.

But we know how much the company can generate. The company can generate huge amounts of money in a good market. The company continues to grow and grow through M&A and grow new customers and grow our credit facilities and our liquidity so that the company — if given the opportunity, the company could do 50% more in top line sales if we were given the opportunities.

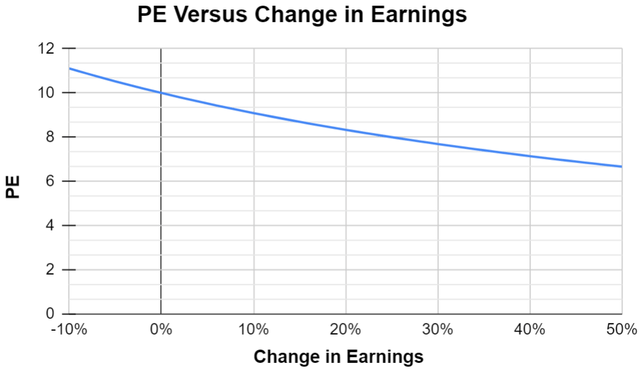

So if we look at the future, the downside seems limited but on the upside, there is a lot of unpredictability. In such situations, I would like to evaluate forward valuation on a range of scenarios.

Author generated

In a situation, where the company’s optimistic top-line growth expectations translate into an equivalent (if not greater) move in the bottom line, we see PE dropping to 6.5x making it even more attractive than it is now (overall market forward PE 27x- 22x). If the market starts recognizing the opportunity and we see a multiple expansion, we may potentially see the stock move 3 – 4x from the current price.

A-Mark Precious Metals is a Strong Buy

Rounding up, I think this investment falls under two lenses. One you can choose to look at its merit on a standalone basis. A-Mark Precious Metals is a strong buy and has shown a history of growth through expansions and acquisitions, its niche business model will benefit an underserved part of the market, and its dividends and buybacks will unlock shareholder value. These characteristics may allow it to outperform Gold.

The other is to look at it through the lens of broad market risks.

- Market or economic breakdowns that cause the population to rush into buying precious metals (Geopolitical risks, pandemic, loss of confidence in the dollar, etc.) which will benefit the stock.

- Investors who would like to diversify their exposure from the broad market

- Investors who have heavy Gold miner exposure and would like to diversify the risks while keeping open the exposure to Gold

Read the full article here