Listen here or on the go via Apple Podcasts and Spotify

Transcript

Grayscale Investments’ (NYSEARCA:GBTC) (OTCQX:ETHE) (OTC:ETCG) Managing Director of Distribution & Partnerships, John Hoffman; Coinbase’s (NASDAQ:COIN) Head of Strategy for Coinbase Institutional, John D’Agostino; and Director of Research at Fidelity Digital Assets (FBTC), Chris Kuiper joined Rena Sherbill to discuss the importance of investors getting more educated in the crypto sector on June 18 at Seeking Alpha’s first Investing Summit. Is now the time to get in (0:46)? Bitcoin vs the rest (5:30). ‘Volatility is not risk’: Spot Bitcoin ETFs (11:00). Retail crypto investing, evolution of brokerages (21:00). Originally published with video here.

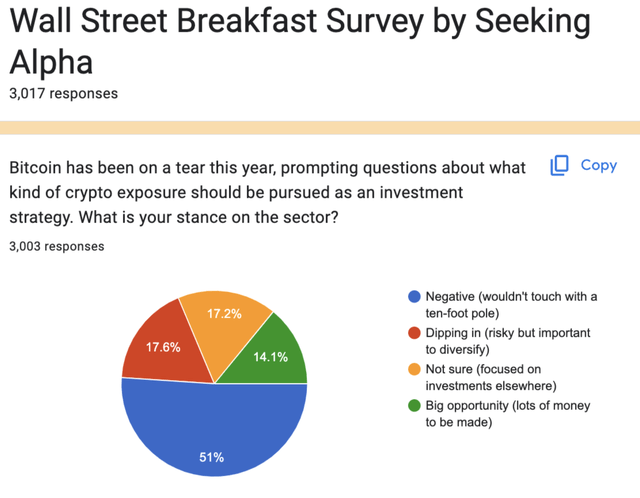

Rena Sherbill: Towards the beginning of the year, at the beginning of March, we have a flagship Wall Street Breakfast newsletter and podcast, and we asked our audience how they feel about investing in the crypto space. I bet you can guess, or maybe not, but it was over 50% said they wouldn’t touch it with a 10-foot pole. We asked them again less than a week ago, it was up to 44.5% — or down to 44.5% that wouldn’t invest in crypto.

Wall Street Breakfast crypto survey (Seeking Alpha)

So, John and John, I ask you, is now the time to get into the crypto space or should we be heckling ourselves?

John Hoffman: So, I love the audience participation and hearing a few comments and jeers right out of the start here. So, this is going to be exciting. It tremendously excites me that not everybody is a bull on crypto today. I think crypto, in many ways, represents the most significant technological or financial technological innovation of our generation. There’s 52 million Americans today that hold crypto in portfolios, so that’s nearly one in every six Americans owns crypto today.

The technology is 15-years-old. So, Bitcoin started in 2009, January of 2009. So, we’re 15 years into this technology, but when you think about the adoption rates, on a global basis, it’s 2%, maybe 3% of the globe has exposure to crypto today. So, 15 years is a long time on a timescale, but when you think about adoption of a technology, technology is not adopted in a linear way. It’s very much exponential.

Think about the Internet in the early days. There was this huge promise that the Internet was going to change the world. And I remember in the ’90s, you looked around, this hasn’t really changed the world yet. It took 20, 30, 40, 50 years to rewire the world, build the infrastructure. These computers that we all carry around needed to speed up. All of that needed to happen for us to recognize the opportunity of that promise. And today, you can click a button, when I leave here, an Uber will arrive outside the hotel. I’ll click a button, a package will arrive at my doorstep. 30 years ago, that couldn’t happen.

So, my point here is, we are in the very, very early stages of this crypto revolution. I think more is going to happen in the next three years than has happened in the past 15 years, and you’re going to continue to see that that speed up.

The last thing I’d say is, this is just a technology. It’s a piece of code, it’s software, however you want to think about it. It’s just technology. Technologies go through curves of adoption. They start-off promising the world. It doesn’t happen. You have this disillusionment, and then that’s when all the building happens and the infrastructure gets built, and then you start to see the promise come to fruition. I think that’s where we are right now. We’re starting to see these promises come to fruition. So, is it a good time to be looking at crypto, investing in crypto? It’s certainly a good time to be getting educated on crypto, and making your decision if this fits in a portfolio.

John D’Agostino: Yeah, I couldn’t agree more. I mean, I also love the naysayers, because they make me feel young again. And what I mean by that is, I used to be Head of Strategy for the New York Mercantile Exchange, which was the largest commodities derivative exchange in the world. And we’re not talking about the 1960s.

This was 2004, 2005. There was a very active discussion in government and in finance, do we need derivatives? Why do we need this stuff? We got the spot crude. We got the spot natural gas. Who needs all these futures and options? And I remember having to — my first job was I had to write text for the President when he — when we go down. Every time the price of crude oil would spike, we’d get angry letters from Congress. We don’t need these derivatives. And we’d have to explain, look, we’re just the exchange. We don’t care about price direction. And by the way, you never yell when the prices spike down. You only yell when they spike up. And what we’re doing is providing price discovery.

And so, when I hear virtually every argument against crypto — by the way, let me be clear, not everyone will invest in every asset. I don’t believe any asset class is for everyone, but when I hear these sort of arguments — and I hear them less and less as people realize the arguments are just wrong. Like it’s foundational, it’s embedded in the economy, it’s not going away, but when I hear those arguments, it brings you back to those, like, wonderful days when people actually thought that a call on crude oil was going to destroy the U.S. economy and was useless, when in reality, it helps refineries hedge out their production. It helps build infrastructure and energy.

These markets are, I get it, they’re complex, they’re difficult to understand, they’re not for everyone, but they become essential parts of modern finance, and they don’t go away.

So, in terms of whether it’s a good time to invest, I agree with John. Again, my — I’m an exchange guy. So, I don’t give — if I could give price direction, I love all of you, but I would be on an island somewhere if I knew the price. I do think that if your view is, this isn’t important for me, just like, for example, with artificial intelligence, if you’re going to — if you’re not planning on being in finance in the next five years, you might be able to ride it out. If you plan on being interested or active in finance longer than that, you should take the time to learn, because as much as you might wish it’s going to go away, it is not going to go away.

Rena Sherbill: So, in terms of categorizing all of the different cryptos that people can invest in, how do you talk about Bitcoin in general? And then, in relation to the other cryptos in the space, how do you judge and analyze Bitcoin?

John Hoffman: So maybe I’ll take a stab at this. John could probably do a better job breaking down the ecosystem. I mean, I think one of the challenges with this space is that there’s a lot of noise. There’s thousands and thousands of tokens. The majority of them are not adding utility or have value in solving problems.

Having said that, we’re in a new sector here in a lot of ways. And so, if you think about, again, if you went back 40 years and showed up at this hotel and said, what’s the Wi-Fi password or the Wi-Fi network name, they’d say, what’s Wi Fi? There’s this whole vernacular that has developed to support the Internet, terms like Wi-Fi. When we talk about crypto, that’s a whole new terminology. There’s a whole new vernacular that’s being developed to describe these things so that we can actually converse in a way around the taxonomy.

So, if you think of equities as an example, there’s sectors. There’s energy and consumer staples and information technology. And these are sectors in terms of how stocks are organized. Grayscale is the world’s largest crypto investment management focused firm, and we have built what we’re calling the crypto sectors, which is taking these tokens, looking at the commonality between them, and then grouping them into sectors in a common way to how you’d see equities grouped.

And so, that didn’t even exist two, three, four years ago. So, again, we’re in the early stages of education. We’re in the early stages of actually organizing these things into different buckets, in different categories. There’s currencies as a category.

And John could certainly add to how they look at this from a Coinbase perspective, but my point is organizing this is actually just one of the next steps of really driving the understanding of the space. Each of these perform a different utility.

Bitcoin and Ethereum make up the majority of the market, the two largest cryptocurrencies. When you look at the size of the market, it’s nearing $2 trillion. So, I think, to John’s point, I don’t think it’s going away. The network has been — Bitcoin specifically has been operating for 15 years every minute, every day, every hour, every week, every month, every year for 15 years with no downtime.

And that network is getting bigger and bigger every single day. And so, I think we’re past the point of, is this going to be here in a couple years, to now, what’s it going to look like, and how do we organize it, and how do we talk about this so that the next generation can understand this space.

John D’Agostino: Yeah. So, the way I would think about it, and I think of it very simply, blockchains and the associated tokens that come with blockchains are like a business. They’re trying to solve a problem. And if they’re really good at solving that problem, more people want to use them. And the way you use that business is through the affiliated token.

So, for example, Bitcoin, the problem it was trying to solve, if you read the original white paper, is a unit of — a better unit of currency that doesn’t have inflationary component and a store of value. And people argue about what it’s better for. I don’t have a strong opinion. I think, like, you can use gold to buy stuff. It’s not that easy, but you can buy stuff with gold.

And it’s been — again, if you go back at a time machine 10 years and I gave you two or three things to invest in, you’d be insane if you didn’t invest in Bitcoin, Nvidia (NVDA), and maybe one other thing. So, we know it’s been a good storm out. We know that because we have 10 years of it being the best-performing asset, large liquid asset in the world. I think eight out of those 10, right, Nvidia took over last year.

And so, it’s been a pretty good store value. We know that if you add a certain component of it to a portfolio, it increases the Sharpe and reduces volatility. So, we know these things for fact, just absolute fact. What’s going to happen in the future? Who knows?

But if you’re looking at — say, that’s my problem. I believe — and so, I was on the Board of a very large, very large, very well-known commodities hedge fund. And it’s public information, but I won’t say the name, just as a decorum. And they very publicly said, we think there’s no good inflation hedge. That’s a single asset. So, we think we ran thousands of assets through a screen, and we think the best inflation hedge is this amalgam of assets of which Bitcoin represented about 2.5% to 4%.

So, we think that, that was commodity derivatives, it was gold, it was real estate. We think this is a better inflation hedge than anything else, and Bitcoin plays a role in that. So that’s the business problem or the problem Bitcoin tried to solve. And if you want to engage in it, you buy the associated token.

As John correctly pointed out, you can create a token in 30 seconds. And there’ll be billions of them, because AI can create them automatically. Just like there’s tons of junk bonds, just like there’s tons of penny stocks, just like there’s tons of horrible private investments like your brother’s cousin’s restaurant, all asset classes have stuff, bad stuff associated with them.

Coinbase (COIN) only lists and operates in the ones that have value, that we perceive to have value and that don’t meet the definition of security. So, that’s how we think about it. It should be very discriminating. And yeah, that’s it. I’ll stop there.

Rena Sherbill: I think a lot of what we’re discussing here is this burgeoning industry and how to understand it as investors, as consumers, but especially obviously as investors sitting here with Seeking Alpha. And I think one of the things that Seeking Alpha does really well is gets through the noise and gets more to the signal of what we should be looking at and what we should be focused on.

And something that John said in our prep call was volatility is not risk. And I’ve been thinking about that a lot because I think there’s a lot of nuance and thoughtfulness behind that phrase.

And I think something that we’ve seen as investors at the beginning of the year, the SEC approved spot Bitcoin ETFs and what that’s done to the market and what that has done for investors to be able to invest in the market. How are you both thinking about the ETF space as it relates to Bitcoin, and how do you see it perhaps developing or evolving in real time?

John Hoffman: Do you want me to start, John?

John D’Agostino: Yeah, please. You’re the King. You’re the King.

John Hoffman: I’m the King?

John D’Agostino: Yeah.

John Hoffman: Hey. You write the code. I think it was you. So, I started in ETFs in 2005 here in the U.S., and it was $100 billion market. There was a couple of hundred listings. It was a nascent technology. Nobody really understood them. They weren’t mainstream.

And I looked at it and said, this is a way better way to get exposure to assets. It’s a more efficient packaging of assets. And I looked at the existing structure and said, in a couple weeks, this is going to be bigger than mutual funds. Here we are 30 years later. Mutual funds are still bigger than ETFs, but ETFs now are $9 trillion here in the U.S., $12 trillion globally.

And so, one of my points there is, this stuff takes time to fully develop, but ETFs have proven to be an incredibly efficient way to gain exposure to markets. Couple that with this disruptive technology that we were just talking about, perhaps the most disruptive innovation of our generation. Put those two things together, and you’re going to have a transformative exposure in many ways.

And so, it’s not surprising that these have been the most successful ETF launches in the history. And to be specific, in January of this year, the SEC approved 10 spot Bitcoin ETFs, so ETFs that hold Bitcoin in them. They have $60 billion in assets now six months later. So, nearly any metric that you could look at, volume, daily traded volume, spreads, liquidity, number of investors, AUM, it has been the most successful launch in the history of ETFs.

What fascinates me about this too is that the investor base is individual self-directed. It is some of the largest pension funds in the world. The state of Wisconsin announced that they hold $170 million in these spot Bitcoin ETFs.

So, you have all of these investors coming together in this single wrapper. And again, having spent 20 years in ETFs and having run one of the largest ETF businesses in the world, what I saw through that is, it’s a technology. And what technology does is it brings all of these different things together, people with different views, different expressions, and it opens up markets.

And so, when we would build an ETF in my prior life, we we’d say, we know exactly who’s going to use this and what they’re going to use it for. And then we go out and we talk with clients, and every — not every, but nearly every use case was different. And what was powerful was all of those different use cases, somebody buying it long, somebody selling it short, somebody using options on it, somebody lending it, investors from LatAm coming to the U.S. markets, investors in Asia, tying it to swaps, tying it to derivatives creates this incredible efficiency.

And so, I made the switch out of ETFs to crypto, and joined Grayscale about eight months ago because they said, this is the same path that’s going to happen with crypto. We have now connected the pipes to $100 trillion of capital here in the U.S., $750 trillion globally can now access this scarce asset. And there’s always this debate, like, well, how does it have value, right? It has value because somebody else is willing to pay that much for it at this point in time. And so, the ETF in a lot of ways has opened these markets, opened the use cases, and really created the path now for this next generation of adoption in this technology.

John D’Agostino: Yeah. I mean, John has forgotten more about ETFs than I know, but I do remember from my NYMEX days that, if we — oh, wow. He made it. Excellent.

Rena Sherbill: Oh, wow.

John D’Agostino: All right.

Rena Sherbill: Welcome, Chris.

Chris Kuiper: Train trouble.

John D’Agostino: So, one thing I do know is that, from my NYMEX days, is that if you believe that — let’s give you Bitcoin example. If you believe Bitcoin is a commodity or view it as a commodity like gold, there has never been, to my knowledge, an ETF, a single asset ETF, where the underlying reference was a commodity, where the value of that commodity has not gone up and the volatility has not gone down.

So, I used double negatives there to be clear, it’s always better for the underlying commodity. So, again, no idea where price is going to go, but it’s a positive thing that Bitcoin is now in the hands of 52 million Americans.

And just out of curiosity, how many people think they know how many Americans have bought stock? Not through a pension, not — have directly bought a share of stock, have gone on to a broker and directed a share of buying. So, how many Americans roughly? Who thinks they know? Okay. 52 million. So, about the same number of Americans have directly, willingly purchased share of stock that have purchased crypto. And I was going to say one more thing, but I want to give Chris some time. So, the question was, how ETFs are impacting Bitcoin and retail holding of Bitcoin.

Chris Kuiper: Yeah, absolutely. I mean, obviously, a huge deal. And what’s interesting to me is, I thought — I was actually in the camp that I thought it wouldn’t be as big as it was. And sorry if you already covered this, but I really thought it would be kind of a nothing burger. And I’m glad to say, obviously, that I’m wrong.

John D’Agostino: Yeah.

Chris Kuiper: But I just thought if anyone wants to get exposure, what you’re just talking about here, they could open up an account. It’s just as easy as opening a brokerage account. They could have gotten exposure already, but obviously this unlocked a lot of new channels. And so, you could think of one investing persona as someone who maybe did open an account, they already have direct exposure, but then they said, okay, now I can hold it in tax advantage accounts, IRAs, 401(k)s, that sort of thing. And so that could be a new channel.

And then, of course, it brings in a lot of other people too, some speculators, traders, which is good. It makes a market. They’re not the long-term holders. And more recently, we’re seeing the financialization of this.

I mean, I don’t want to get too technical, but you’re seeing the futures explode. CME Futures on Bitcoin are now larger than the offshore stuff, which is great to have that here in the U.S. And then, now hedge funds and others can go long the ETFs for their spot exposure and short the futures. So, there’s an arbitrage strategy there. So, you’re just seeing this whole infrastructure get built out. It’s one of the big things we’ve noticed.

John Hoffman: Okay. I’ll just add that point quickly. All of those things we’re talking about here accrete value to the end investor. So, it has become less friction in the system to access Bitcoin. It’s never been cheaper, more efficient to access this underlying asset, and that’s what ETFs do in a lot of ways.

They make it simple, easy, convenient, flexible to do this. And I think there’s a point there as you hear about these different strategies coming online, you’re going to see spreads compress. You’re ultimately going to see efficiency drive to the consumer. The consumer is the benefiter of all of this in terms of being able to access the asset class.

Rena Sherbill: So, speaking to that, where do we go now in terms of brokerages and ETFs? How do you think it continues to develop? And what does it look like — what will it look like for investors?

John D’Agostino: Look, I mean, I don’t think the apparent imminent approval of the Ethereum ETF and this very wildly successful launch of Bitcoin, the ETF means that every single crypto underlying asset will have an ETF, just like every single other asset doesn’t have an ETF. I think…

Rena Sherbill: Or even — sorry. But even just for Bitcoin ETFs, how do you see it, like, in terms of brokerages versus ETFs?

John D’Agostino: Well, I mean, look, it’s — correct me if I’m wrong, John, but, like, it’s still – I believe, still for most of the money center banks, it is not sellable. Like, meaning they have to answer to you — requested by. So that big unlock — there is going to be a big unlock at some point when the Morgan Stanleys and Merrill Lynchs allow their brokers to actually recommend it. I would imagine over time it’s going to taper off, the growth will taper off.

It can’t keep continuing at this idiosyncratic rate. It would be larger than the U.S. economy given how massively it’s growing. But I think that next big unlock is when the brokerages get comfortable enough to allow their army of RIAs to recommend it to clients. Again, think of it, it’s been the best opening ever of an ETF, and brokers aren’t allowed to recommend it. I mean, that’s extraordinary.

Rena Sherbill: Do you have a sense of the timing on that, when that will…

John D’Agostino: No idea.

Chris Kuiper: I’ll just add to that, though. I think that’s one thing that a lot of people know. It’s very simple to understand, but we don’t actually internalize it. And what I mean by that is, it’s the most underrated trend that I see over the next, to give you a timeframe, 12, maybe even it takes 24 months.

But this is going to be a slow burn that is going to get a consistent bid demand for Bitcoin, because as soon as it’s introduced on these platforms and then it starts getting into model portfolios and it starts getting recommended at x percent and people realize it’s the best-performing assets, it’s uncorrelated to everything else, it’s got a highest Sharpe ratio of anything out there, why don’t you own it?

They’re going to start figuring that out, and you’re just going to see this play out over time, but it’s going to take a while, but I think people are really underestimating how much demand and bid that will be there.

Rena Sherbill: John, you talked about coming on recently to Grayscale, but Grayscale has been in the business for a long time. How do you think about the development and the evolution? And what role do you see for brokerages within that for, especially retail investors?

John Hoffman: Yeah. So, I left the ETF space to go to focus full time on crypto thinking the next 20 years, it’s not a function of, if you’re going to own crypto, it’s purely a function of when. And that sounds a bit aggressive, but the reality is, again, the state of Wisconsin incorporated this in their portfolio. Now 700,000 state workers in Wisconsin have exposure to crypto in some capacity.

So, I would draw a parallel here. Again, this is a technology, and the ETF is a technology. I read a story years ago about Instagram, and that was obviously started, and I’m going off here. I’ll connect it in a moment. It was started as a picture sharing application, but the use case that they were talking about was a Taiwanese shopkeeper was posting their inventory on Instagram so people could see it.

And so, my point is, Instagram is just a platform. It’s a technology that creates all these different use cases. Where I think we’re going with ETFs now, taking this underlying asset of Bitcoin in the first instance and putting it in an ETF, all of a sudden democratizes access to all investor types.

The point I made a moment ago, the $60 billion that’s flooded in has predominantly been from kind of two spectrums. One is the self-directed individual retail segment that has the ability to transact in these through their legacy brokerages, Fidelity, Schwabs, TDs of the world.

And then, the other end of the spectrum is really the very sophisticated pools of capital that can ultimately allocate to whatever they want to. And those two areas have been the predominant drivers. So, call it hedge funds, state pensions, foundations, endowments, I kind of look at it as a barbell.

A lot of the wealth in this country is managed in the intermediary channel, which is financial advisors. They manage about $35 trillion of capital here in the U.S. Most of those platforms are calling us today and doing the diligence on these products. They have processes to approve them. They have committees that need to evaluate each of the different components before they put them on the platform.

That wave is coming. And that’s why I made the transition is, over the next 20 years, this is going to be in every portfolio, whether it’s in an index of some sort, a broader fund, a macro asset allocation fund, it’s going to make its way into portfolios. And so, we really haven’t seen that, that full-scale adoption. And again, we’re only at 2%, 3% of the globe has exposure to this today.

So again, these things don’t grow in a linear fashion. They grow exponential. The next three years, you’re going to see those adoption rates jump again and jump again and jump again. They’ll plateau at some point, but we’re in the early stages of the adoption, and I think that the ETF was really the flippening here, where — I spent a lot of time in the wealth channel, and I would say to advisors, your job is to see around corners, make probabilistic decisions about an uncertain future, and you don’t have exposure to Bitcoin? How did you miss the best-performing asset in the world over the last decade?

The reality is there was high career risk, high reputation risk, high regulatory risk. That is flipping now. I think if you can’t talk about this, if you have clients that come in and say, what do you think about Bitcoin? And you say, it’s vaporware, or it’s used for tax evasion, you now have career risk and reputation risk, because I’ll tell you what, your clients are going to call somebody else, and ask them what they think about it. And we’re starting to see that risk invert, and I think it’s going to just continue to accelerate.

Last point, $85 trillion is going to move from baby boomers to Gen X, Gen Y, Gen Z. Those people grew up on this technology. It’s native. As that wealth transfers, they’re going to want exposure to this asset class.

Rena Sherbill: And expense ratios, do you see that just continuing to go down?

John Hoffman: I’ll let…

Chris Kuiper: I mean, I think so, just based on everything else we’ve seen in the ETF world. This is not my specialty, but, I think you’ll see a lot of competition. We’re already seeing it. But at some point, you are going to hit, I think, a level where it’s not going to be just about the fee because what’s unique about Bitcoin and other digital assets is, you have to custody them very carefully. They’re unlike anything else, right? Whoever holds the keys has ownership and control of those assets, and it’s immutable, right?

So, if someone gets hacked or if they get lost or compromised, whether inside or outside the firm, they’re gone. That’s it. And so, at some point, people are going to wake up and say, I would rather pay maybe a little bit more to go with someone who I have a little more trust in, who has put a little more work, who has a bigger team of cybersecurity experts. So, that’s the only thing I think would add.

John D’Agostino: Which is exactly why Coinbase won 10 of the 11 custody mandates. You guys being the only one who didn’t choose us. No. I…

Chris Kuiper: We have our own.

John D’Agostino: Fair enough. No. I get it. I get it. And so, you should trust a firm like Fidelity or Coinbase to hold your Bitcoin. I agree with that. I think, these guys are exactly right. Look, there’s going to be fee pressure. There always is. But I do think it’s — just like for gold ETFs and other kind of things where it’s a little bit hard to store the physical or tricky to store, you need like higher trust. I don’t see it getting down to like the Vanguard and Onebip thing, but yeah, there’ll be pricing pressure as more players enter, because it’s an expanding market.

More and more — adoption of crypto is growing faster than early adoption of the Internet. Again, I don’t think people really understand. I think if you — especially if you leave the U.S. for a bit and see how aggressively it’s being embraced, not just by people, by governments, by companies, some of the big banks that their CEOs get on TV and say they don’t believe in blockchain are using blockchain to transact billions of dollars of Treasury securities and other similar instruments. It’s just a better tech.

So, a very, very quick story. When I first joined the NYMEX, again, this is not the 1960s. This is 2004. It was open outcry. So, everyone seen the movie Trading Places? That was filmed on the floor of the NYMEX. So, the most powerful and important commodity in the world. The price was set by 816 people screaming and yelling at each other and making hand signals like this. And I joined a freshly-minted MBA, and I’m like, this is insane. This is 2004, 2005, how are we still doing it this way?

And I remember some grizzled trader who saw the beginning of the end because they love the floor, pulled me aside one day, and he’s like, listen, kid, he goes, “There’s a reason the design of the spoon has stayed the same since the caveman era. It works.” And that’s crazy, but he’s not wrong, right? It’s a great argument because not entirely wrong, but, of course, we switch to electronic trading, and, of course, the markets septupled in size.

And tokenization, using blockchain to trade these assets, is that next jump. I hope I’m around to see it, but it’s so obvious that to go from open outcry to electronic trading to electronic trading with an instrument that’s codable, that you can put code into it, so it could automatically file your reports when you cross over 4.9% of ownership, of course my daughter, my 10-year-old daughter, will live in a world like that when she’s my age, obviously.

I don’t know the timing because, unlike John, I’m a little bit pessimistic. My mother just switched to online banking, 91-years-old. She held out for 20 years. And so, I think people can be — can grip to the past more tenuously than we give them credit for, but it’s clearly the future.

I’ll let you have a last word, because you jumped in late.

Chris Kuiper: No. Go ahead.

John D’Agostino: No. I’m done.

Rena Sherbill: Well, I wanted to talk about Ethereum, but I want to leave time for Q&A also. Chris, if you want to — you got here late. If you want to have some words before we get to Q&A, I’m happy to…

Chris Kuiper: No. I love Q&A. Get right to it. This is why we’re here.

Male Speaker: Could you explain in the simplest language possible for somebody who’s not experienced with crypto, why Bitcoin is preferable to any randomly chosen newly invented cryptocurrency? And, especially, could you touch on whether it has any future proofing against potentially a better cryptocurrency being invented?

John D’Agostino: Yeah. I’ll jump there. So, a couple of things. One is, why is gold a better store value than others? Because it’s been — the predominant use case for thousands of years, right, or hundreds of years. So, Bitcoin is preferred because more people have chosen it. That’s first and foremost, right? And that’s practical applications in terms of the security of the blockchain. So, the more people that participate in it, the more secure the blockchain is. So, the first reason I would say is that it’s just — it’s the one that that won, if you will. And there’s first-mover advantage in that.

I’ll jump to your last question, which is, can I ensure you that a — that all of those people will not decide they’d prefer a different blockchain? No, I can’t assure you that. That’s a beautiful thing about Bitcoin, is people can vote with their feet. They can choose not to operate a node. They can choose not to participate in mining. So — but then the question is, like, what is the probability of that occurring in mass? And I think it’s fairly low.

So, it’s a longer conversation about, like, my theory as to why Bitcoin has value, but I think those are the two predominantly — the reason I would trust Bitcoin now is because more people have trusted it and that makes it a more secure network. And to answer your question, yeah, everyone could spontaneously decide to shift to a different blockchain and use that. I just think it’s a very low probability at this point.

Chris Kuiper: Yeah. I’ll just add one little thing there, a shameless plug. We wrote a report exactly on this. It’s called Bitcoin First. So, just Google “Fidelity Digital Assets Bitcoin First: why investors need to consider it separately?”

It’s the most secure, most decentralized network out there. So, as an emerging monetary good, where do you want to store trillions of dollars? You want to store it in the most secure, the most decentralized one out there. It’s not to say these other things don’t have other use cases, but that’s why we think you have to consider it very differently from everything else.

Become a Premium subscriber to access more exclusive events and content like this.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here