Shares of Acadia Pharmaceuticals (NASDAQ:ACAD) are barely higher since my previous article despite a significant improvement in fundamentals. Nuplazid is doing largely as expected but the launch of Daybue has far exceeded expectations. I previously argued that peak annual sales of Daybue could be $350 million at the low end of the range and up to $700 million at the high end of the range, and while I admit it is too early to say this with confidence, it is entirely possible that the low end of the range is very conservative, especially now that the company has secured commercial rights outside of North America.

Market expectations around Daybue this year were very modest when I published my previous article in late April. The implied expectations for Daybue’s sales this year were as low as $9 million and, at best, just around $40 million depending on where Nuplazid ended the year. The modest expectations have set the stage for a big reaction when Acadia announced in mid-July that it expects Q2 net sales of Daybue between $21 million and 23 million (sales ended up at $23.2 million) and said it expects Q3 net sales in the $45-55 million range.

The stock surged to just below $34 per share, but the gains were short-lived and Acadia’s share price is now below mid-July levels, implying the situation is slightly worse than it was prior to the Q2 net sales pre-announcement. However, this speaks more to the difficult market conditions and they are especially difficult for biotech stocks, evidenced by XBI sitting near 52-week lows.

With this poor biotech market backdrop in mind, the rest of the article will focus on Acadia’s latest developments and changes.

Daybue launch significantly exceeds expectations, Acadia in-licenses additional territories

As mentioned, the launch of Daybue is off to a very strong start. The company says feedback from prescribers has been positive and that caregivers are reporting improvements in patients such as speech improvements or Rett syndrome patients speaking for the first time in years, having increased alertness, and completing activities they were previously not able to.

Over 400 prescribers have written a prescription and demand is coming from both high-volume institutions and community practices. Depth of prescribing is also good with many physicians writing more than one prescription.

Conversion to a paid prescription also looks very good and was 70% in the second quarter with the company expecting the other 30% from Q2 to convert in Q3. Improvements in insurance coverage should also help the conversion rates going forward.

Acadia has also been proactive in dealing with gastrointestinal problems (primarily diarrhea) that are known issues for patients taking Daybue.

Overall, the launch of Daybue looks quite strong. However, I would be cautious before getting significantly more bullish on the peak sales potential because there is still a high degree of uncertainty regarding Daybue’s uptake. The success of the launch is partly driven by the bolus of patients that were waiting to be put on the drug and we should get a better idea of how the normal uptake will look in a quarter or two after this initial bolus of patients is absorbed. There is also the open question of compliance and treatment discontinuation rates.

The strong launch of Daybue was enough for Acadia to in-license other global territories in July as it only had commercial rights in North America. Under the new terms, Acadia paid $100 million upfront to partner Neuren and has committed to additional potential downstream milestones and royalties on net sales ranging from the mid-teens to the low 20s.

However, I would not expect a material contribution from ex-U.S. territories anytime soon. The company said getting approved in Europe will take at least a few years as Neuren has not done proper regulatory work and Acadia will have to basically start from scratch, although the company says it is unlikely that it will need to conduct another trial. On the other hand, it will need to do some clinical work in Japan before it can submit for approval.

Nuplazid doing as expected

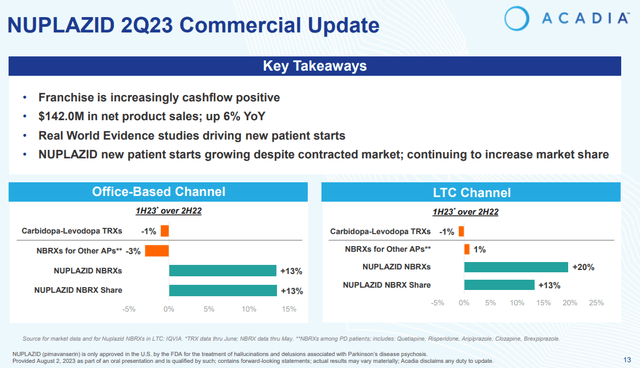

Nuplazid’s net sales grew 6% Y/Y $142 million in Q2 and the franchise is increasingly cash flow positive as Acadia has managed to slightly grow the topline during a period of significant cuts in spending.

New-to-brand prescription growth was in the double-digits in the second quarter in both the office-based and the long-term care channels, and this is happening in a contracting Parkinson’s disease psychosis (‘PDP’) market. And double-digit Y/Y new-to-brand growth is encouraging as it is the leading indicator of demand.

Acadia Pharmaceuticals investor presentation

However, we should not expect miracles from Nuplazid in the current PDP market and we will need to see indication expansion in the following years if the product is ever to become a blockbuster.

Financial outlook improves after Daybue’s better-than-expected launch

Operating leverage is starting to kick in at Acadia, a result of both the cost-cutting initiatives and the strong launch of Daybue.

On a pro-forma basis, the cash position declined from $417 million at the end of 2022 to $275 million at the end of Q2, and $140 million out of the $142 million decline was due to the $40 million milestone payment to Neuren after the first commercial sale of Daybue and the $100 million upfront payment to Neuren in Q3 for worldwide rights to Daybue.

We should expect further improvements in the following quarters and should Daybue continue to perform well, Acadia should exceed even the increased Street expectations and become profitable on a non-GAAP basis as soon as the fourth quarter of this year.

Conclusion

The tough biotech tape is masking the considerable progress Acadia has made this year – managing to maintain Nuplazid in growth mode despite the significant cost cuts, and successfully launching Daybue to treat Rett syndrome. After the Q3 results later this year, the focus will temporarily turn to Nuplazid’s phase 3 trial as an adjunct treatment of schizophrenia. The results are expected in the first quarter of 2024 and, if positive, could substantially expand the addressable market for Nuplazid.

I should also note that a patent litigation event related to Nuplazid is expected within the next month. Acadia previously settled with four of the five ANDA filers seeking to market a generic version of Nuplazid with the expected launch dates ranging from 2036 for the 10mg tablet to 2038 for the 34mg capsule. MSN Pharmaceuticals is the only one left and is seeking a resolution of a single issue related to the Nuplazid composition of matter patent. According to Acadia, MSN Pharmaceuticals is asking the judge to re-write patent law which seems unlikely. If it happens, the negative outcome would be the shortening of the life of the composition of matter patent on Nuplazid from October 2030 to early 2028 (this includes Hatch-Waxman extensions and an additional six-month pediatric extension) and does not affect the other outstanding patents or the settlements with the other generic filers.

Read the full article here