One of my high yield income holdings in my Income Compounder portfolio that currently offers one of the highest annual yields in my Fidelity portfolio next to Oxford Lane Capital (OXLC) and several of the YieldMax ETFs, is a global fixed income fund, abrdn Income Credit Strategies Fund (NYSE:ACP). With its current monthly distribution of $0.10, ACP trades near par (close to its NAV) and offers an annual yield of nearly 18% at the current market price. That very high yield has generated several sell ratings from other SA analysts.

Seeking Alpha

Although I have never specifically covered ACP before in my analyses on SA, I have mentioned it in some articles that I have published on high yield income opportunities to consider. I like ACP and have held it in my Fidelity IRA for nearly a year now and still feel that the fund is a Buy given its steady high yield distribution, stable NAV, and pending mergers with FSD (and potentially FAM assuming they receive shareholder approval) that should help to grow the fund size and future net income once those reorganizations are completed. Furthermore, the outlook for the global credit market is quite positive, and that macroeconomic factor should also benefit ACP shareholders.

2024 Credit Market Outlook

According to this 2024 Credit Market Outlook from Carlyle, bank disintermediation is picking up pace, leading to even greater opportunities in private credit.

As bank balance sheets become more constrained due to regulation and other factors, their lending decisions will become even more sensitized to relationship considerations, especially for large banks who derive a disproportionate share of their operating earnings from noninterest income. While this may constrain the growth (or expected returns) of direct lenders competing directly with banks for larger borrowers, it should create more opportunities virtually everywhere else, as private funds partner with banks to assume more of their assets in some areas and displace them entirely in many others.

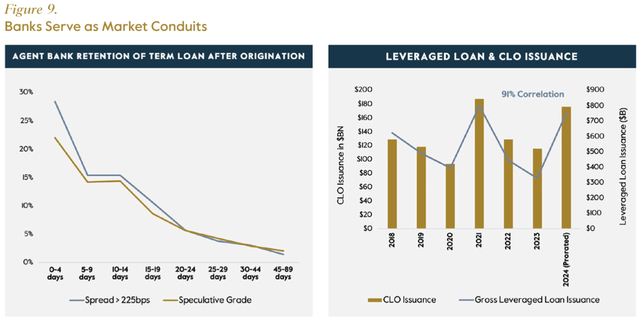

LEVERAGED LENDING AS “METERED” DISINTERMEDIATION

Leverage lending perhaps best clarifies this asset-client distinction. Originally conceived to allow one bank to offload credit risk onto others, syndicated lending became a mechanism for the banking sector as a whole to offload credit risk onto nonbanks. In 2000, banks accounted for about 20% of the primary purchases of leveraged term loans. By the onset of the pandemic, that figure had dropped to 3%. On average, the agent bank responsible for arranging committed credit for its client sells down its share of the term loan balance from 28% at the time of origination to just 1% three months later. Most of the loan ends up in the hands of Collateralized Loan Obligations, which today serve as the ultimate home for about 70% of leveraged loans. The ability to distribute loans is key to their origination; CLO issuance explains over 80% of the variation in leveraged loan origination volumes over the past six years (Figure 9, page 9).

Carlyle

To build on this optimistic view of a healthy global credit market, the fund quarterly commentary for the quarter ending April 30, 2024 also paints an optimistic picture for global HY (high yield) assets, the types of assets in the ACP portfolio.

Despite Treasuries taking a hit in April, HY spreads barely moved. This is a good indication that technicals for the market remain solid. Flows have remained steady, likely due to the appeal of a yield of nearly 8%. As mentioned previously, despite the increase in issuance, most of this volume is for refinancing existing debt so net new issuance is modest. Additionally, most companies reported solid earnings, lending support to fundamentals. While BBs just reached their post-crisis tights, we continue to find some value in lower-quality end credits. While credit negative liability management exercises are occurring or being rumored, we believe this is providing opportunities among the higher yielders that do not require this type of financial engineering to deleverage. There are a limited number of credits that fit this profile and we intend to continue adding to them in a prudent way.

ACP Overview and Key Facts

Before I go too much further into the details of global credit and HY spreads, I would like to review the fund and its key characteristics. There are four portfolio managers, Ben Pakenham, Matthew Kence, Adam Tabor, and Erlend Lochen. Two of them are located in Boston and two in London. They all work together to manage the investments for ACP and other global high yield funds that abrdn sponsors.

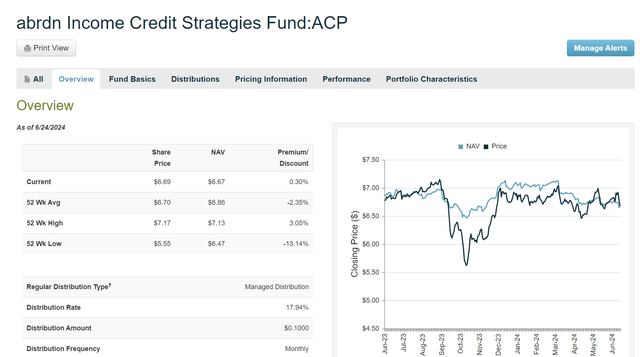

As of 6/24/24, the fund held about $500M in total managed assets, with about $350M in net common assets. The fund uses leverage, which is currently estimated at about 29%, according to CEFConnect. At the closing price of $6.69 as of 6/24/24, the fund trades at a very small premium of about 0.3% and yields 17.94%. After trading at a fairly wide discount for most of 2023 (especially in October, which was a great time to buy), that discount has now vanished for the time being as NAV has remained fairly stable as can be seen in this overview chart from CEFConnect.

CEFConnect

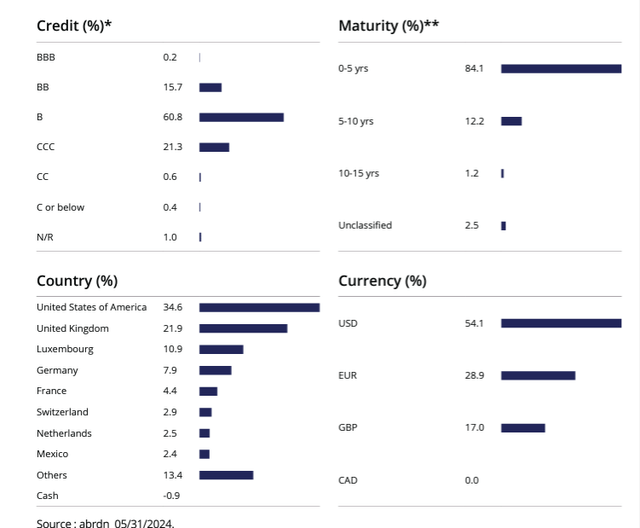

The fund’s primary investment objective is to seek a high level of current income, with a secondary objective of capital appreciation. The fund invests primarily in the debt and loan instruments of issues that operate in a variety of geographic regions and industries. Currently, less than 40% of fund holdings are based in the US and about 50% in Europe with 10% in fixed income in other regions along with a very small equity allocation. Credit ratings include mostly B-rated, with a smaller amount of CCC and BB-rated securities. Most of the fund’s investments are short maturity holdings of 0-5 years as shown on the fund fact sheet, effective 5/31/24.

ACP Fund Fact Sheet

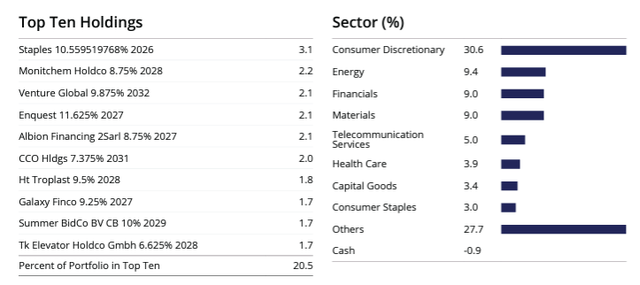

The top 10 holdings are shown on the fund’s fact sheet, along with a breakdown by sector.

ACP Fund Fact Sheet

Past Performance Not Indicative of Future Returns

According to the fund quarterly commentary, total return since fund inception as of April 30, 2024 was only 3.25% at market price and 3.8% at NAV. However, in the past one year (April 2023 to April 2024) the total return was 16.2% at market price (14% at NAV). And April was a challenging month for the market overall and for ACP specifically as explained in the fund commentary.

In February, Treasury yields reacted to rate-cut expectations getting pushed to the right following strong economic data, with the five-year Treasury yield increasing 41 basis points. Rates in Europe trended similarly. Despite this, stocks performed well as did spreads, which tightened and helped the global high-yield market’s return. The HY asset class continued to perform well in March on the back of tightening spreads and marginally lower Treasury yields. Subsequently, HY bonds took a step back in April. Rising Treasury yields drove the weakness after U.S. data pointed to inflation remaining higher than expected. As a result, the market’s expectations of rate cuts were reduced and pushed to the right, and the 10-year Treasury yield rose over 47 basis points during the month. However, spreads for the global HY market, as represented by the Bloomberg Global High Yield Corporate Index, were essentially flat, increasing slightly to 324 from 322. Due to the impact of higher rates on returns, the global HY market lost 0.69% during the month and the yield increased from 7.52% to 7.92%.

One positive aspect of the changing rate expectations is that yields on HY assets remain higher due to higher for longer interest rates that put price pressure on those loans and bonds. One advantage to investing in fixed income is that as prices decline and those loan payments and bond coupons are still being paid, the high yield goes even higher, further supporting the fund’s 18% distribution.

ACP Distribution History and Return of Capital Considerations

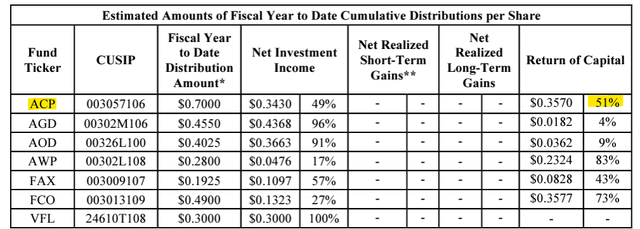

Because ACP uses a managed distribution, which is currently set to $0.10 per share monthly, some distributions are paid using about 50% ROC (return of capital). Many investors see this as a red flag, even though it is common practice for many CEFs that offer a managed distribution, and especially those that use leverage. The latest 19a notice for the month of May shows 51% ROC on a YTD basis (ACP fiscal year ends October 31).

ACP May 19a Notice

Although some may fear that such a high percentage of ROC is a bad thing, it does not always suggest that the fund is returning your invested capital back to you unless the NAV is steadily declining. That has not been the case with ACP as NAV has remained relatively even for the past year with a 52-week average NAV of $6.70 (current NAV = $6.67).

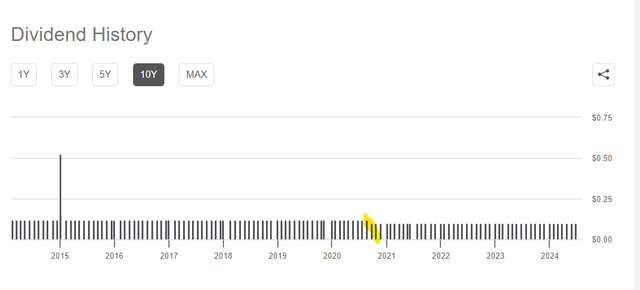

The fund’s distribution history has been very consistent with only one cut to the distribution in 10 years and that occurred in September 2020 (after the Covid market plunge) The monthly distribution was reduced from $0.12 to $0.10 where it has remained since.

Seeking Alpha

The fund also offers a DRIP discount, for those shareholders who wish to reinvest the monthly distribution instead of taking it as cash. When the fund trades at a premium to NAV of at least 5%, the shares are reinvested at 95% of the market price. While the fund mostly traded at a discount over the past year this has not been a consideration, but as the fund begins to trade at a premium, income compounders may want to consider turning DRIP on to get the additional discount on reinvested shares.

Mergers and Reorganizations: Past and Pending

In March 2023, the former Delaware Ivy High Income Opportunities Fund (IVH) was reorganized into ACP, which is essentially a tax-free method to merge or absorb the IVH fund assets into ACP. Former IVH shareholders became ACP shareholders and the ACP net assets grew in size. The end result is growth in the NAV of the ACP fund. Now, two more reorganizations are pending. The First Trust High Income Long/Short Fund (FSD) voted for shareholder approval to reorganize with and into ACP. That news was announced on May 31 (emphasis is mine).

The Board of Trustees of abrdn Income Credit Strategies Fund announces today that shareholders of First Trust High Income Long/Short Fund (“FSD” or the “Acquired Fund”) advised by First Trust Advisors L.P. have approved the proposed reorganization into ACP (“Reorganization”) which is targeted to be completed before the end of July or as soon as practicable thereafter, subject to the satisfaction of customary closing conditions. To facilitate the Reorganization, all shares of FSD will cease trading on the New York Stock Exchange as of date to be announced in the coming weeks and FSD shareholders will be issued new issued shares of ACP.

The Reorganization will occur based on the relative net asset values of the common shares of FSD. As of May 30, 2024, the combined net assets of ACP following the Reorganization will be approximately $765 million. The Reorganization is expected to benefit each fund’s shareholders in a number of important ways, providing greater opportunities to realize economies of scale by combining the funds’ assets resulting in a larger fund. Additionally, the Reorganization is expected to help ensure the viability of the resulting combined fund by increasing scale, liquidity, and marketability of the fund.

In addition, shareholders of ACP approved a resolution in January of this year to issue additional shares in anticipation of a proposed reorganization with another First Trust fund, First Trust/abrdn Global Opportunity Income Fund (FAM). However, FAM shareholders have yet to approve that transaction. The special meeting held on June 18 did not garner enough votes so that meeting was postponed until July 11 to allow enough time to gather more shareholder votes.

I view both of these potential mergers as very positive moves for the future of ACP shareholders. Not only do the reorgs increase the size of the fund, but it also gives the fund managers more diversity of holdings and increased flexibility in pursuing additional high yield opportunities.

With a steady, managed, monthly distribution that offers income investors a nearly 18% yield, a stable NAV, and a positive outlook for the global credit market for the foreseeable future, I remain convinced that ACP is a Buy for income investors who can withstand some market price volatility. If the fund should return to a discount of -5% or more, then I would upgrade my rating to a Strong Buy. The fund also offers some non-US diversification for those fixed-income investors who wish to take advantage of mispricing in global credit markets via a well-managed fund.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here