Introduction

Activision Blizzard (NASDAQ:ATVI) has been at the forefront of gaming for quite some time. Being home to some of the world’s largest names in video games Activision Managed to power through the pandemic without any downturn. And although revenues have not been the most stable due to evolving consumer preferences and strong competition, Activision has managed to expand into different genres of interactive entertainment to hedge against the losses. Catalysts such as the growing video game community and recent support from Microsoft leave the opportunity for Activision to remain at the front lines of the video game world.

Company Overview

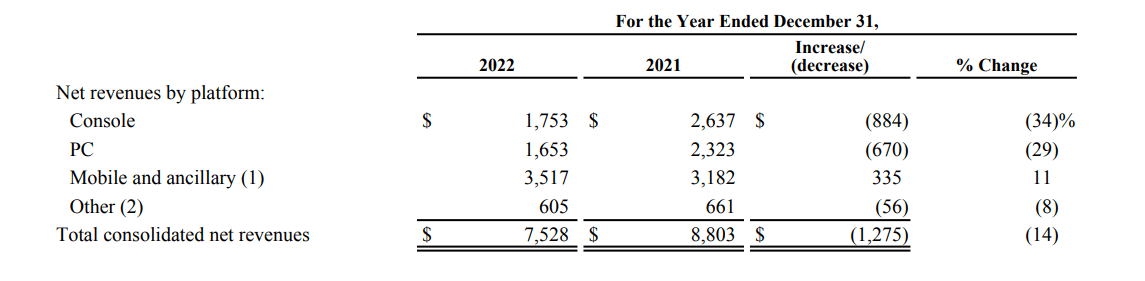

Activision Blizzard is a leading entertainment company that specializes in the development, publishing, and distribution of video games. The company is renowned for some of the gaming industry’s biggest names such as Call of Duty, World of Warcraft, Diablo, Candy Crush, and Overwatch. Their revenue comes from the multiple platforms they distribute to such as Console, PC, Mobile, and Leagues. Reported financials from 2022 reveal that 46.7% of their total revenue that year came from mobile products. 23.3% from console, and 22% from PC. The remaining 8% can be sourced back to esports leagues and other miscellaneous distribution methods.

Industry Overview

The global online gaming market has proven to be dynamic with each year bringing something new to the gaming community. People have widely accepted video games as a popular form of entertainment, means of socialization, and even as a competitive sport. The gaming market was estimated to be worth $204.63 billion USD and is expected to grow to $440.89 billion USD by 2032 with a CAGR of 7.97%. Activision Blizzard currently holds a 3.32% market share in Q1 of 2023. As more people embrace gaming as a part of everyday life, the Interactive Entertainment industry shows no signs of slowing down.

Competitive analysis

If there is one thing that Activision does right its diversification. Their strong portfolio of franchises brings a loyal fan base and provides consistent revenue streams across various genres of video games. On top of that Activision Blizzard generates revenue from multiple sources within each franchise including sales, in-game purchases, subscriptions, licensing, and esports events. This diversification increases the stability of Activision’s revenues by not making them too reliant on any one revenue stream. One great opportunity that comes along with owning a franchise is the ability to expand intellectual properties and build on already successful titles.

Financials

Activision Blizzard released its 2021 and 2022 segmented revenues. The average revenues from each platform across these two years come out to 41% mobile sales, 26.9% console, 24.3% PC, and 7.8% from other distribution methods.

Activision Blizzard 2022 Annual Report

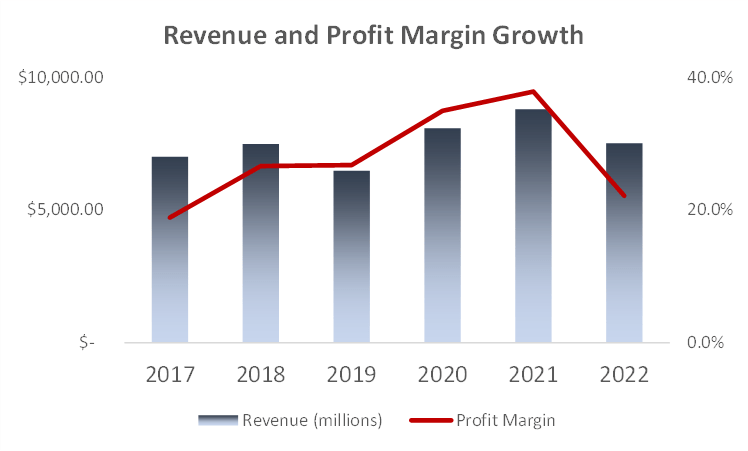

Over the past five years, Activision Blizzard has seen a couple of years where revenue growth was negative but has managed to maintain a five-year average growth rate of 2.5%. The 14% decrease in revenues from 2021 to 2022 can mainly be attributed to lower revenues from Call of Duty: Vanguard compared to the previous year’s release Call of Duty: Black Ops Cold War. This decrease was slightly offset by the success of Call of Duty: Modern Warfare ll, compared to Call of Duty: Vanguard.

Author’s Material

Key Catalyst: Imminent Acquisition

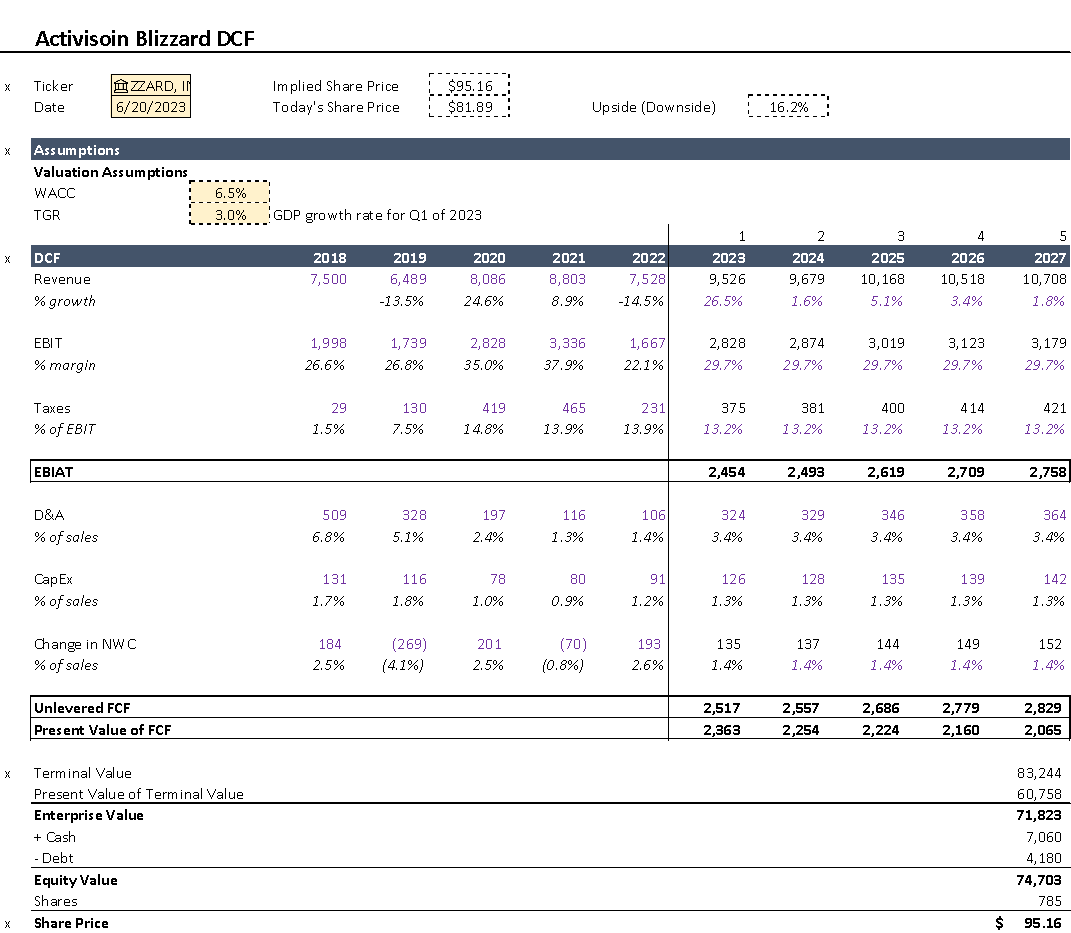

One significant catalyst that’s going to drive Activision’s growth even further is the acquisition of the company by Microsoft which finalized the terms of the deal in May of 2023. This all-cash transaction was valued at $68.7 billion USD and comes out to around $95 per share of Activision Stock. This is just over $20 more than what the stock was trading at when the terms of the deal were finalized. This can bring a considerable advantage to both Microsoft and Activision Blizzard by partnering Activision with Microsoft’s Xbox. Microsoft plans to include Activision Blizzard games in its game pass subscription which has over 25 million subscribers. This will expose Activision Blizzard to Microsoft’s almost 85% market share of the Software and Programming industry. Revenues for 2023 are expected to hit $9,526.02 million USD, an 11.9% increase from 2022. As good as this seems for the company, this deal doesn’t come without risks. Although the deal is finalized, the acquisition has been put on hold by the Federal Trade Commission [FTC]. On Thursday June 22, 2023 the FTC was granted a preliminary injunction to temporarily block the acquisition due to speculation by Sony and the FTC that Microsoft had plans to make Call-of-Duty Xbox exclusive. Microsoft has agreed to sign a contract that states Call-of-Duty will be available to other platforms for 10 years. Even though the block is temporary, the duration of this trial could push the deal past its termination date of July 18 causing a re-negotiation or Microsoft will pay Activision Blizzard a termination fee. Luckily both Microsoft and Activision Blizzard are large enough companies to where they can afford to wait out the trial without suffering too drastically. nonetheless, it is something to consider as a possible risk.

Valuation

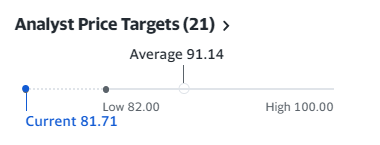

After performing a discounted cash flow [DCF] using a 6.5% discount rate and a 3.0% terminal growth rate, Activision Blizzard holds an implied value of $95.16 USD per share. Along with the expected market size growth of 7.97%, It is reasonable to assume that Activision Blizzard has the potential to reach this price. Other Analysts from yahoo finance are estimating the value of the stock to be between $82 and $100 USD per share.

Author’s Material Yahoo Finance

ESG

Although Activision Blizzard has been on the radar of the SEC for failure to adequately track and report workplace complaints, they have been making efforts to improve their impact on their employees and the community around them. In February of 2023, the company agreed to a $35 million settlement to resolve the claims for workforce complaints. Throughout the course of 2022, Activision was recognized with many awards including the LA Times CFO Leadership Award, Variety 500 Award, and the Profiles in Diversity Journal Award. Looking forward to 2023, Activision Blizzard states that they plan on increasing their global coverage of employee relations support, increasing opportunity for innovation and recognition of DEI work in their teams, and continuing their goal to achieve net zero carbon emissions by 2050.

Risks

Though Activision Blizzard has a good foundation for growth and is capitalizing on its opportunities, there are a few potential risks to consider. Activision Blizzard has had negative publicity in the past related to workplace culture and a hostile work environment. While the company has taken measures to improve these things, negative attention can harm the company’s reputation even after the issues have been resolved. Another risk comes from the evolving preferences of consumers. The gaming industry has begun to see a shift in what consumers like. The massive boom of battle royale style games has brought companies like Epic Games into the competition that provide games such as Fortnite and Fall Guys. Regardless of how diverse Activision Blizzard is, the video game market is an extremely competitive market with online influencers who massively control what their viewers are playing.

Conclusion

Regardless of the competition Activision Blizzard faces, the growing acceptance of video games in everyday life is paving the way for the growth of companies like Activision. The company has shown the ability to stay strong through market downturns while making forward-thinking decisions that support its expansion. With the company’s acquisition by Microsoft finalized earlier this year, Activision’s value has not captured the growth it is going to receive from Microsoft’s influence. Video games are only growing and the companies that can capitalize properly are bound to see a generous return.

Analyst Recommendation By: Kevin Caballero

Read the full article here