Truth be told, I am about as far away from being an outdoor person as you can get. Having said that, one sport that I have always had a good amount of appreciation for is golf. And for anybody who enjoys both golf and investing, one company that is definitely worth looking into is Acushnet Holdings Corp. (NYSE:GOLF), the owner of the famous Titleist brand of balls, apparel, and other goods. In the past, I have not historically been the best at golf. I am several times more likely to score two or three hits over par than I am to get an eagle. Thankfully, however, I do have a pretty good track record when it comes to this particular firm.

The last article that I published about the company came out in June of this year. Leading up to that point, the company had experienced a few difficult months, with shares underperforming the broader market. This was in spite of continued robust fundamental performance and attractively priced shares. That led me to keep the company rated a “buy” to reflect my view that shares should see further upside from where they were trading. Since then, things have gone quite well. While the S&P 500 (SP500) is up only 0.1%, shares of Acushnet Holdings have jumped 11.6%. But that’s not all. Since the first bullish article that I published about the company back in May of 2022, shares are up 46.8% compared to the 11.3% increase seen by the S&P 500.

The picture continues to impress

Very rarely will you find a company that is an evergreen opportunity. Most firms only warrant so much upside and, once that upside is achieved, it’s better to look elsewhere for opportunities. I do believe that Acushnet Holdings is an example of a more traditional investment as opposed to an evergreen one. But I don’t believe that the upside has been great enough for investors to feel as though shares are fairly valued or overvalued. To see what I mean, we should first touch on financial performance covering the third quarter of the 2023 fiscal year.

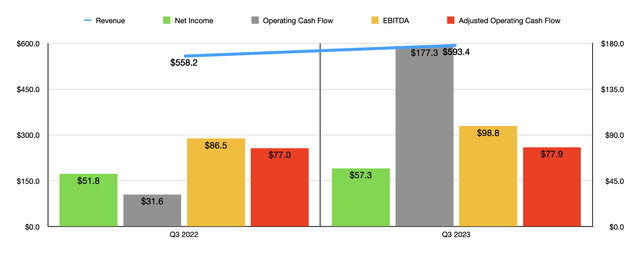

Author – SEC EDGAR Data

During the third quarter, the management team at Acushnet Holdings reported revenue of $593.4 million. That’s 6.3% higher than the $558.2 million reported one year earlier. The greatest portion of this increase actually came from the Titleist golf clubs that the company sells. Revenue spiked 17.6% from $153.9 million to $181 million. Management attributed this to higher sales volumes associated with some new product launches including the T-Series irons, TSR hybrids, and Scotty Cameron Super Select putters.

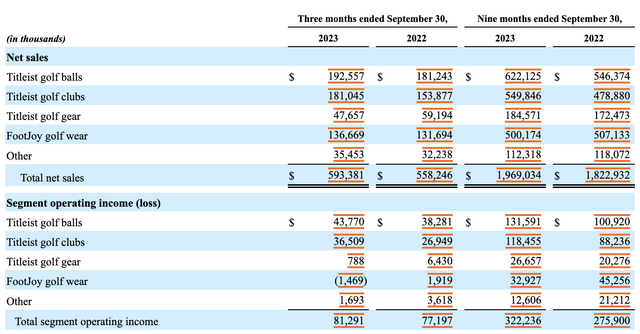

Acushnet Holdings

Titleist branded golf ball revenue, meanwhile, grew a respectable 6.3% while revenue for the FootJoy golf wear products increased by 3.8%. This is not to say that everything was great for the company. Titleist golf gear revenue actually fell from $59.2 million to $47.7 million. That’s a year-over-year drop of 19.4%. Management stated that strong revenue from the prior year that was caused by a recovery of supply chain and fulfillment issues was responsible for the year-over-year decline that we saw this year.

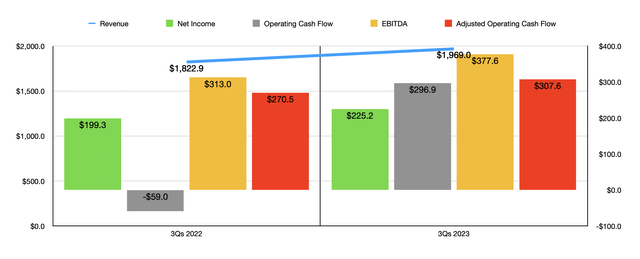

Author – SEC EDGAR Data

The increase in sales for the company brought with it higher profits. Net income, for instance, grew from $51.8 million to $57.3 million. Other profitability metrics followed a very similar trajectory. Operating cash flow, for instance, skyrocketed from $31.6 million to $177.3 million. But if we adjust for changes in working capital, we would get a more modest increase from $77 million to $77.9 million. And finally, EBITDA for the company grew from $86.5 million to $98.8 million. As you can see in the chart above, financial performance for the first nine months as a whole was robust just like it was for the third quarter on its own. This is true of every profitability metric as well as revenue. So it is great to see that this is not a one-time change for the company.

Acushnet Holdings

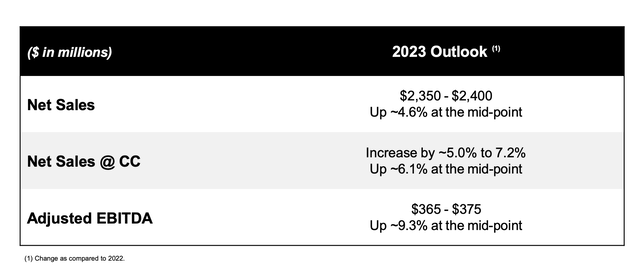

Right now, things are going fairly well for the golf industry. It has been estimated, for instance, that in 2023, the industry is experiencing 441 million rounds of the game being played by 24.3 million people. On top of this, 14 million Millennials are interested in playing a game of golf on the course. And already, around 35% of all golfers who are active are between the ages of 6 and 34. All of this shows that this is an industry that’s experiencing a great deal of excitement at this point in time. Management’s forecast for the year reflects this. Revenue for 2023, for instance, is expected to come in at between $2.35 billion and $2.40 billion. On a constant currency basis, revenue should be between 5% and 7.2% higher than what it was last year. On the bottom line, the only guidance management gave involved EBITDA. This is now expected to be between $365 million and $375 million. That’s an increase for the bottom end of the range of $10 million compared to what management previously forecasted.

Author – SEC EDGAR Data

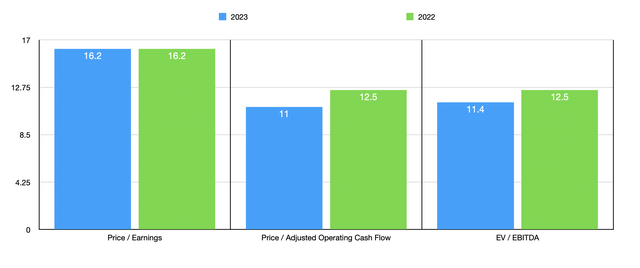

Unfortunately, management has not provided any guidance when it comes to other profitability metrics. But based on the figures we have so far for the year, we should anticipate net profits of around $225.2 million and adjusted operating cash flow of $332.3 million. Using these figures, I was able to create the chart above. In it, you can see how shares of the company are priced on a forward basis and how they are priced using data from last year. Using two of the three metrics, shares do look a bit cheaper on a forward basis. And in general, I would argue that they look fundamentally attractive on an absolute basis. I then compared the company in the table below to five similar firms, only one of which is very close in nature to what Acushnet Holdings does. Using both the price-to-earnings approach and the price-to-operating cash flow approach, two of the five companies ended up being cheaper than our prospect. When it comes to the EV-to-EBITDA approach, three of the five were cheaper.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Acushnet Holdings Corp. | 16.2 | 11.0 | 11.4 |

| Vista Outdoor Inc. (VSTO) | 3.9 | 3.8 | 34.1 |

| Topgolf Callaway Brands Corp. (MODG) | 24.6 | 59.6 | 8.4 |

| YETI Holdings, Inc. (YETI) | 53.9 | 17.5 | 26.0 |

| Latham Group, Inc. (SWIM) | 46.0 | 3.5 | 10.3 |

| Sturm, Ruger & Company, Inc. (RGR) | 13.8 | 17.9 | 7.3 |

Takeaway

At this point in time, I must say that I am rather impressed with Acushnet Holdings and how it’s doing. The stock has frankly outperformed my initial expectations from early last year. But that’s the great thing about a quality company. They do tend to perform quite well over the long haul. This would not necessarily be the case forever. And even compared to similar firms, the stock is looking to be more or less fairly valued. But because of how cheap it still is on an absolute basis and the fact that it continues to grow during these uncertain times, I would argue that Acushnet Holdings Corp. still makes for a decent “buy” candidate.

Read the full article here