Volatility is both a blessing and a curse. It’s a blessing in the sense that it brings with it volatility. It’s a curse in that it often causes investors to sell at the exact wrong time. I happen to believe we are entering an age of high volatility broadly. If I’m right, then perhaps at the core of a portfolio should NOT be the S&P 500 (SP500), for example, but a diversified basket of global stocks which tend to exhibit lower volatility dynamics in general. If you agree with that idea, then you may want to consider the iShares MSCI Global Min Vol Factor ETF (BATS:ACWV). It consists of global equities that tend to outperform in broad market downturns, and which in turn makes it more likely that you won’t sell at the wrong time as a result.

A Look At The Holdings

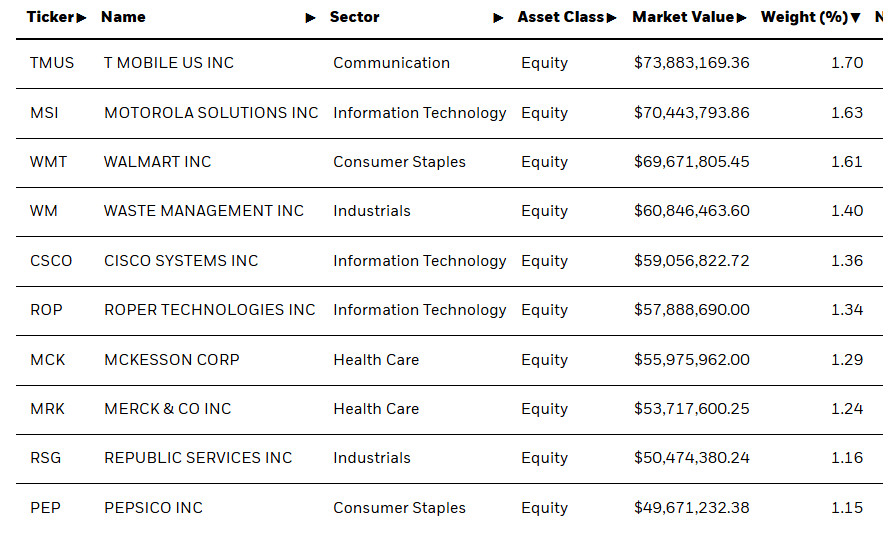

ACWV’s stated investment objective is simple: to track the MSCI All Country World Minimum Volatility Index, which itself is a mixture of equities from the developed world and emerging markets that, as a whole, have lower volatility than a wider index of global equities. Critical to this is the broad diversification aspect of the fund. When we look at the top holdings, we find that no stock makes up more than 1.7% of the portfolio, and the top positions tend to be focused on providing goods and services that are less cyclical in general.

iShares.com

What do some of these companies do? T-Mobile US Inc. is one of the largest general service telecommunications companies in the US. Motorola Solutions is a provider of mission-critical communication solutions and services for enterprise and government customers. Walmart Inc., of course, we all know as the operator of huge retail stores. Waste Management Inc. is a leading provider of comprehensive waste management services in North America. And McKesson Corp is a healthcare company that distributes pharmaceuticals and provides healthcare information technology solutions.

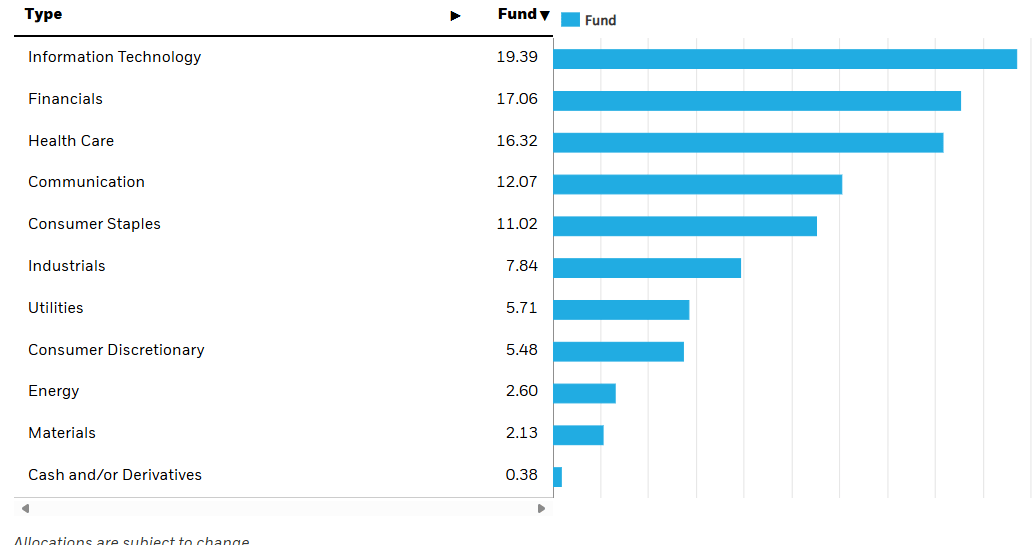

Sector Composition: A Balanced Allocation

Out of the gate, I like the mix here. Tech is a far lower sector allocation than what is currently the case in market-cap weighted averages, at just shy of 20%. Financials and Health Care come in 2nd and 3rd respectively. I like that Consumer Discretionary is relatively low weighted here, as I view that to be a vulnerable sector in general, and Consumer Staples come in 5th.

iShares.com

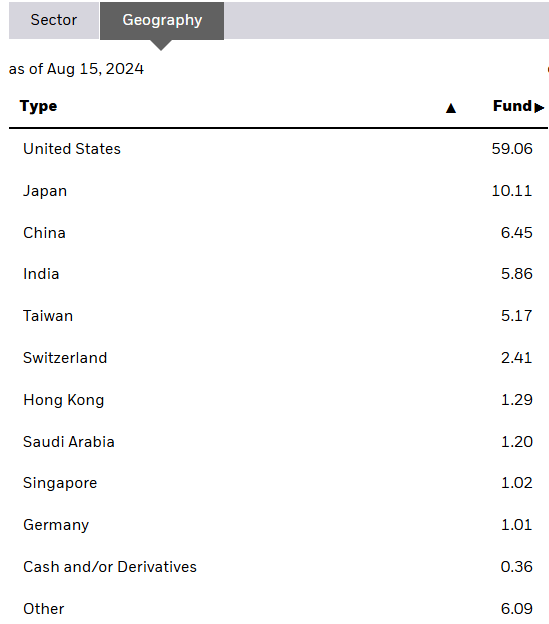

As to the Geography end of things, given that the fund provides global stock exposure, the US dominated at nearly 60%. Japan is a distant second, followed by China and India. As the US goes, so too will ACWV, but the fund certainly is more diversified than just a core S&P 500 fund which is all US, and a third Tech.

iShares.com

Peer Comparison

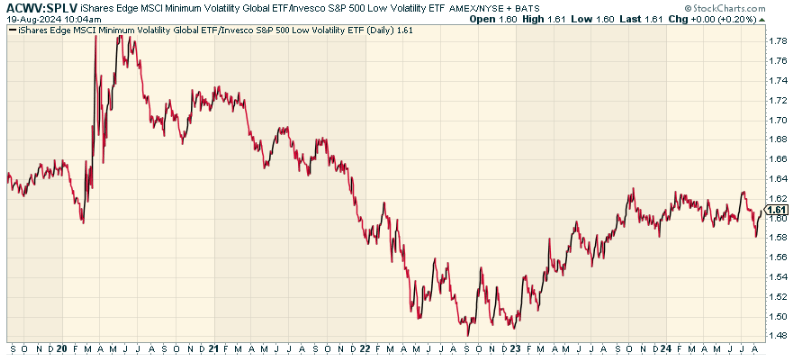

Although ACWV is not the only minimum volatility ETF, it is unique (among other factors) in its global investment approach and the methodological construction of the underlying index. One fund worth comparing this against (which is US only) is the Invesco S&P 500 Low Volatility ETF (SPLV). This is also trying to provide a portfolio of lower volatility stocks. When we look at the price ratio of ACWV to SPLV, we find that ACWV has been a bit range-bound for a year. It’s been a US stock, though, so I actually find the fact that ACWV has kept pace somewhat encouraging, given the additive effects of having exposure to stocks outside America.

StockCharts.com

Pros and Cons

The positive side here is that the low-volatility bias of the fund and its global diversification and sector balance could be quite beneficial. This is not just from a risk-adjusted return perspective, but also in terms of the cycle of volatility we might be about to enter. The portfolio looks far more robust than most large-cap US averages here, and I think the mix of investments and diversification is top-notch.

But there are trade-offs to be had here, too. ACWV may not be great at avoiding the occasional big downturn based on a minimum volatility approach. Low volatility strategies are designed to perform well by protecting against downside risk, not necessarily by maximizing upside. Currency and country risks also apply, given that the stock exposure outside the US isn’t hedged to forex fluctuations, which could throw off total return expectations in the long run.

Conclusion

For very defensive global stock investors looking for international exposure, ACWV might be an interesting opportunity. By selecting those stocks that historically have tended to have lower past volatility, the fund offers the potential for better stability that investors might want when markets cycle. I like the fund and think it’s one worth considering overall.

Get 50% Off The Lead-Lag Report

Get 50% Off The Lead-Lag Report

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a limited time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.

Read the full article here