Investment Thesis

Adobe has the strongest growth and balance sheet in its recent history due to its strong product offering and emerging trends in AI (Artificial Intelligence). However, this landscape’s competition is ever-evolving, with changes coming fast. Its relentless fast growth could be moderating in the coming quarters due to both economic slowdown and competition. Its price valuation seems fair right now.

Company Overview

Adobe (NASDAQ:ADBE), founded in 1982 with headquarter in San Jose, CA, is one of the largest software company in the world that specializes in graphic and video design. The company offers three business segments, Digital Media, Digital Experience, and Publishing and Advertising.

Strength

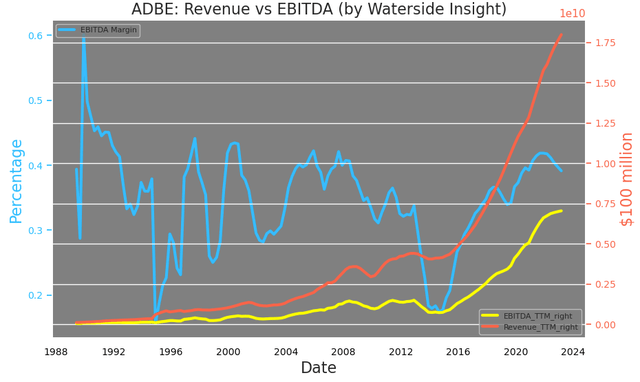

Adobe has seen strong growth in both the top line and bottom line. The company’s revenue growth has almost been exponential since 2015, and its earnings have kept up with the pace as well. Its EBITDA margin is at its higher-end range historically, up from 10% to the current 40% since 2015.

Adobe: Revenue vs EBITDA (Calculated and Charted by Waterside Insight with data from company)

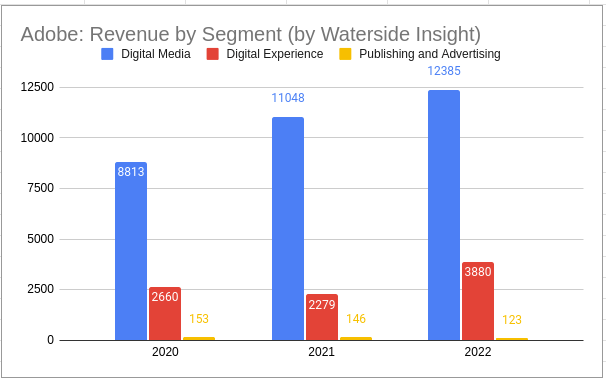

By its reportable segment, Adobe’s revenue has 75.8% from Digital Media as of 2022. It is also the segment that has posted consistent growth in the past three years.

Adobe: Revenue by Segment (Charted by Waterside Insight with data from company)

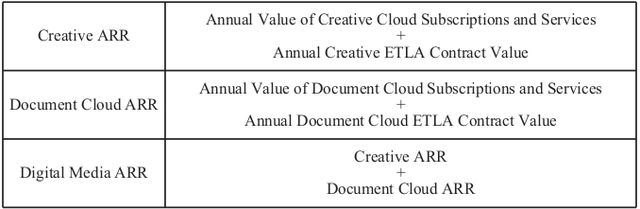

Within the Digital Media segment, the company defines its Annual Recurring Revenue as a key performance metric in the following:

Adobe ARR Definition (Company 2022 10K)

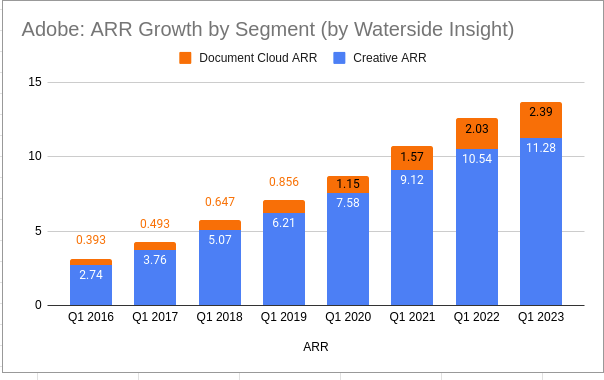

They are made up of subscription and contractual value. By composition, its Creative segment, which offers “desktop tools, mobile apps, and cloud-based services for designing, creating and publishing rich contents and immersive 3D experience”, made up 87.5% of the total ARR. While the Document Cloud, which has Acrobat Sign as part of its product offering, is only 12.5%. The importance of the ARR for Adobe is that 94% of its revenue comes from subscriptions. The growth of each segment is strong. The pace of its Document Cloud and Creative segment combined, called Total Digital Media, is almost doubling every three to four years. The company cautions investors to see ARR as a performance metric that is separate from its accounting measurement of revenue and deferred revenue. But if stacking them up for comparison, one will find that Total Digitam Media ARR of Q1 is about 75.95% of its Q1 annual revenue on a TTM basis. That is almost the entire Digital Media segment (a slight difference from the previous 75.8% was due to being calculated on a TTM basis up to Q1). This is because the company basically doesn’t allow users to continue, after a brief trial, without paying the subscription fees. So there are two ways to see this ARR. One is it is a strong component of the total revenue and it is recurring. Another is because its services most likely have to be accessed through subscription, so this ARR figure provides less anchoring effect, if you will, to the total revenue. In other words, it is hard to use ARR to gauge clients’ “inertia” should there is a slowdown occur, as there is no substantial non-subscription portion of revenue to compare with. Its target customers are mostly photographers, video editors, graphic designers and game developers, communicators and content creators, marketers, and knowledge workers. Each type of customer could have its own demand and spending cycles that drive the decision of whether to continue the subscription.

Adobe: ARR Growth by Segment (Charted by Waterside Insight with data from company)

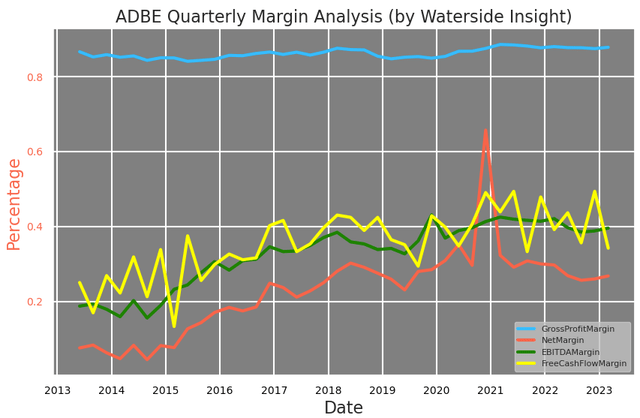

Certainly, so far, the company has had healthy margins in all main categories in the past few years. The trends are stable to tilting upward, except for its net margin is ever so slightly weaker. Although, in contrast with its relentless revenue growth, the margin growth has plateaued in the past three or four years.

Adobe: Quarterly Margin (Calculated and Charted by Waterside Insight with data from company)

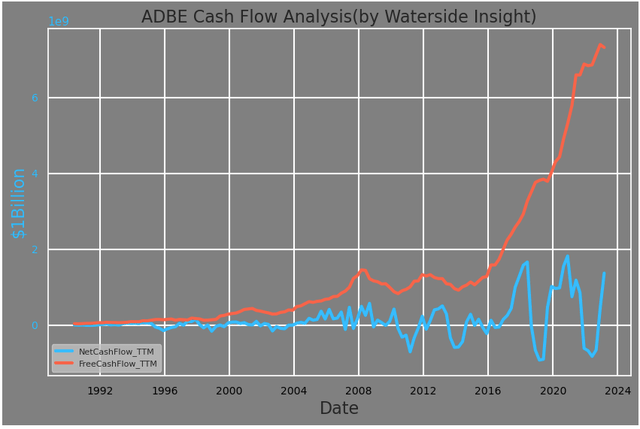

Its cash flow also has been strong, with free cash flow reaching its highest level on a TTM basis while net cash flow fluctuates. Breaking down its net cash flow, it shows that the largest pull lower came from its periodical financing activities. Most of them were stock repurchases and paying down debt. It spent around $3 billion, $3.9 billion, and $6.5 billion for repurchases of common stock from ’20-’22, which accounted for almost 90% of the final net cash flow from financing activities. It paid down $3.1 billion of debt and re-issued $3.1 billion in 2022, with no new debt issuance in the past two years. Overall, the company is in a strong position cash-flow-wise.

Adobe: Cash Flow Analysis (Calculated and Charted by Waterside Insight with data from company)

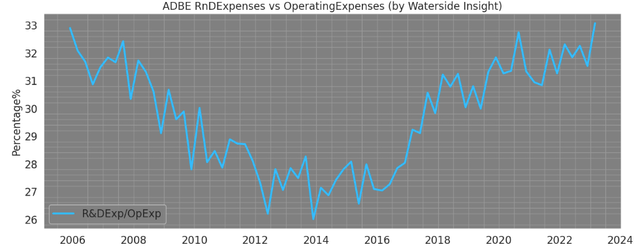

A lot of buzz about Adobe lately is for the incorporation of AI into its product offering, such as in its Adobe Stock and Behance services, app creation capabilities, and enterprise and team collaboration tools within its Digital Media segment. Its launching of Firefly initiatives combines generative AI with its underlying graphic prowess to allow users to “experiment, imagine, and make an infinite range of creations”. The company has indeed ramped up its research effort since 2014. Its research and development expenses have gone up to over 33% of its total operating expense for the first time since 2006.

Adobe: R&D vs Operating Expenses (Calculated and Charted by Waterside Insight with data from company)

Weakness/Risks

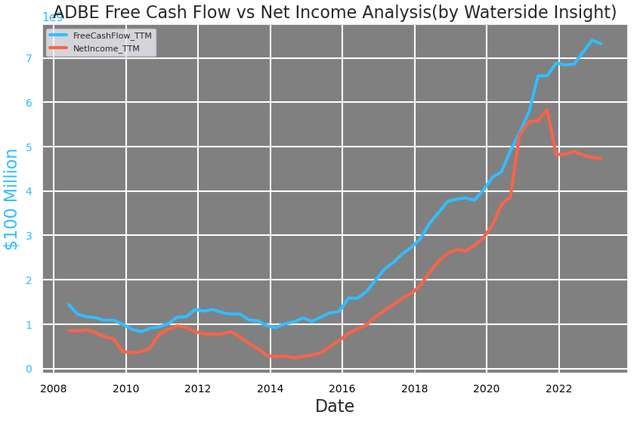

In comparison with its free cash flow, Adobe’s net income has deviated from the upward momentum since 2021. The slowdown in net income is in direct connection with its cost of revenue, which has incidentally risen faster than its revenue lately. It is still at a much higher level since the period before 2016.

Adobe: Free Cash Flow vs Net Income (Calculated and Charted by Waterside Insight with data from company)

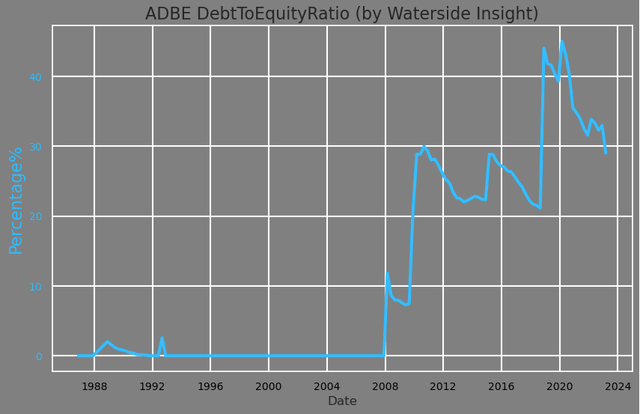

The company’s debt-to-equity ratio has decreased by a lot since its peak of around 45%, but is still at a higher level historically. At the current level of 30%, it is still above the average before the pandemic. When facing a higher interest rate environment, the company could better use its cash flow to reduce leverage and strengthen its balance sheet.

Adobe: Debt To Equity Ratio (Calculated and Charted by Waterside Insight with data from company)

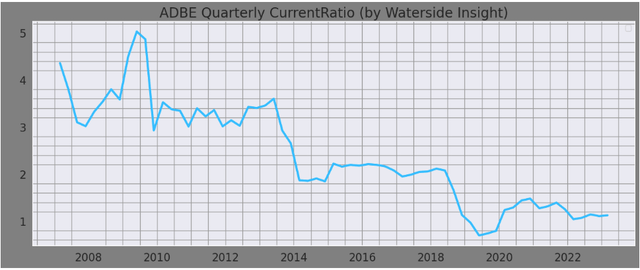

In contrast with its strong cash flow, Adobe’s current ratio is quite low at 1.12x. The company is recently in a buyout deal of $20 billion for the cloud-based designer platform Figma. Although there might be a regulatory hurdle, it will no doubt put more liquidity constraint on its book should it goes through.

Adobe: Current Ratio (Calculated and Charted by Waterside Insight with data from company)

Adobe’s long-term growth ultimately will align with the growth cycle of its targeted customers and the competitive landscape that is ever-fast-evolving in the image/video + generative AI space. But Adobe’s product offering isn’t entirely unique, and some of them are in uncharted ethical and social territory as well. There are competition and threats coming from all angles. For example, face recognition and artificial image mash-up have been under attack for privacy invasion and fakes. In today’s Google (GOOG) I/O event, Google’s CEO unveils a product called Magic Editor that is coming online later this year. This product feels and works to some degree like what Photoshop can do but is aided by AI. These are just some of the examples of why Adobe is facing stiff competition with the competition changing fast. Photo, image, video, and immersive experience are areas that many large and niche players are currently aggressively pursuing.

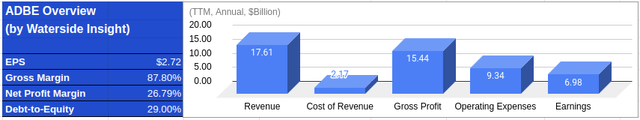

Financial Overview

Adobe: Financial Overview (Calculated and Charted by Waterside Insight with data from company)

Valuation

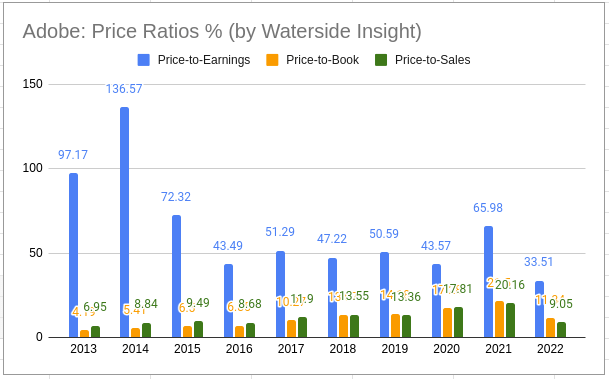

From most of the important price ratios, Adobe doesn’t appear to be overpriced after last year’s price slump. Its price-to-earnings ratio has come down to 33.51x, which is the lowest in the past ten years, while its price-to-book and price-to-sales are about at the average of this period.

Adobe: Price Ratios (Calculated and Charted by Waterside Insight with data from company)

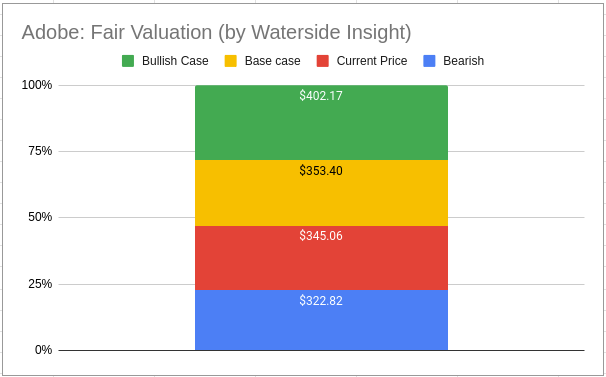

By combining all the analysis above, we use our proprietary models to assess the fair value of Adobe from projecting its growth ten years forward. In our bullish case, we priced in an economic slowdown in the tech sector in the near term, but continuous technological innovation ahead brings both advanced application and competition that creates a more volatile cash flow stream for the company; it was priced at $402.17. In our bearish case, Adobe faces more competition and regulatory hurdle that stifles more ways to apply its products; it was priced at $322.82. In our base case, the company will be devoting more effort to its research which might keep its margin flat-ish but will drive its long-term growth; it is priced at $353.40. The current price is almost right at the ally of our base case.

Adobe: Fair Valuation (Calculated and Charted by Waterside Insight with data from company)

Conclusion

Adobe has had impressive strong growth since 2014-’15 continuously. The product offerings of its main strength in photos, images, and videos are right at the center of AI innovation. It is facing both challenges and opportunities ahead. Although we don’t think its annual recurring revenue has as high an implication for its near-term growth as the number itself indicates, we do believe Adobe has the long-term advantage to sustain its growth to be renewed from time to time. But the competition, especially now coming from the large AI firms such as Google and other niche start-ups, will continue to erode some of the product margins for the company. The current price is about right for the stock. We recommend a hold.

Read the full article here