A Quick Take On Advanced Biomed Inc.

Advanced Biomed Inc. (ADVB) has filed to raise $150 million in an IPO of its common stock, according to an S-1 registration statement.

The company has been developing various cancer screening technologies.

ADVB is still at a relatively early stage of product development, but the market for cancer screening and diagnostics in China is large and growing.

Advanced Biomed Overview

Tainan, Taiwan-based Advanced Biomed Inc. was founded to develop a proprietary microfluidic platform to detect, identify, diagnose and stage various types of cancer conditions.

Management is headed by Chief Executive Officer Hung To Pau, Ph.D., who has been with the firm since November 2022 and was previously Chairman of Shanghai Sglcell Biotech Co.

The firm has completed the research and development phases for its immunostaining products and related biochips and has received approval for, submitted registration applications in China for certain products or will shortly do so for other products.

Below is the current status of the company’s product development pipeline:

Company Product Status (SEC)

Advanced Biomed has booked fair market value investment of $12.7 million as of June 30, 2022, from investors including Advance On Ventures, Yimin Jin, Xiaoyuan Luo and Nanzhen Shen.

Advanced Biomed’s Market & Competition

According to a 2022 market research report by Grand View Research, the global cancer diagnostics market was an estimated $95 billion in 2021 and is forecast to reach approximately $160 billion by 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of 5.97% from 2022 to 2030.

Key elements driving this expected growth are technological improvements in diagnostics technologies, an increase in the number of cancer cases worldwide and supportive government initiatives.

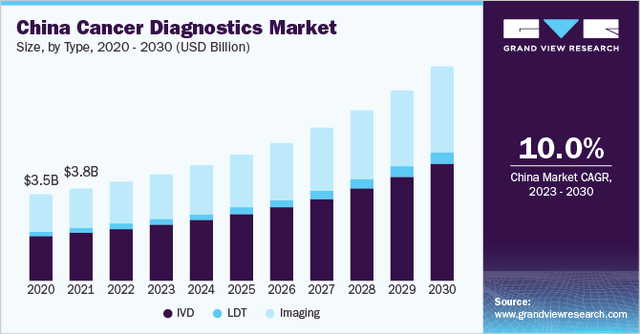

Also, the chart below shows the historical and projected future growth rate of the Chinese cancer diagnostics market:

China Cancer Diagnostics Market (Grand View Research)

Major global vendors that provide or are developing related diagnostic solutions include the following companies:

-

GE HealthCare

-

Abbott

-

F. Hoffmann-La Roche Ltd.

-

Qiagen N.V.

-

BD

-

Siemens Healthcare GmbH

-

Thermo Fisher Scientific

-

Hologic

-

Koninklijke Philips N.V. (Philips)

-

Illumina

Advanced Biomed Inc. Financial Status

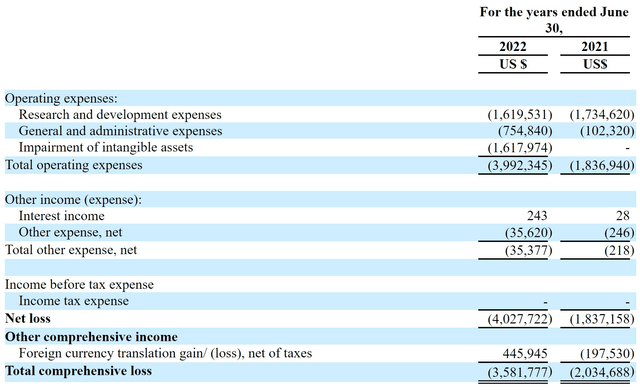

The firm’s recent financial results are typical of a development-stage diagnostics company in that they feature no revenue and substantial R&D and G&A expenses.

Below are the company’s financial results for the past two fiscal years:

Statement Of Operations (SEC)

As of June 30, 2022, the company had $4.8 million in cash and $3.2 million in total liabilities.

Advanced Biomed Inc. IPO Details

Advanced Biomed intends to raise $149.5 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price, although this element may become a feature of the IPO if disclosed in a future filing.

The firm is an ‘emerging growth company’ as defined by the 2012 JOBS Act and has elected to take advantage of reduced public company reporting requirements; prospective shareholders will receive less information for the IPO and in the future as a publicly-held company within the requirements of the Act.

Management says it will use the net proceeds from the IPO as follows:

Approximately 80% for IVD clinical trials, chip design and development, laboratory building, and our planned expansion to the U.S. and European market;

Approximately 10 % for marketing and sales; and

Approximately 10% for general working capital.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said it was ‘not aware of any pending or threatened material legal or administrative proceedings’ against the firm.

The sole listed bookrunner of the IPO is Univest Securities.

Commentary About Advanced Biomed’s IPO

ADVB is seeking U.S. public capital market investment to fund further diagnostic test development and for its general corporate growth requirements.

The market opportunity for providing cancer diagnostics is large and expected to grow at an approximate CAGR of 6% through 2030.

Like other companies with Chinese operations seeking to tap U.S. markets, the firm operates within a WFOE structure or Wholly Foreign Owned Entity. U.S. investors would only have an interest in an offshore firm with interests in operating subsidiaries, some of which may be located in the PRC. Additionally, restrictions on the transfer of funds between subsidiaries within China may exist.

Also, a potentially significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA Act, which requires delisting if the firm’s auditors do not make their working papers available for audit by the PCAOB.

Prospective investors would be well advised to consider the potential implications of specific laws regarding earnings repatriation and changing or unpredictable Chinese regulatory rulings that may affect such companies and U.S. stock listings.

The Chinese government may intervene in the company’s Chinese business operations or industry at any time and without warning and has a recent history of doing so in certain industries.

Additionally, post-IPO communications from the management of smaller Asian companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a generally inadequate approach to keeping shareholders up-to-date about management’s priorities.

Univest Securities is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of 2.8% since their IPO. This is a mid-tier performance for all major underwriters during the period but is subject to Univest’s high volatility IPO history.

ADVB is still at a relatively early stage of product development, but the market for cancer screening and diagnostics in China is large and growing.

When we learn more details about the IPO, I’ll provide an update.

Expected IPO Pricing Date: To be announced.

Read the full article here