Last week, our favorite Dutch insurer Aegon (NYSE:AEG) released its H1 results. As a reminder, the company provides pensions, life insurance, and asset management services with roots dating back more than 175 years. Aegon focuses its operation on three core markets (the US, where it is known as Transamerica, the Netherlands, and the United Kingdom) and three growth markets, continuing to optimize its portfolio. Last month, Aegon announced an increase of the Brazilian MAG Joint Venture equity stake from 54.9% to 59.2%, while in India, the company exited its insurance division to Bandhan Financial Holdings. In Q3, the Brazil JV will require a capital increase so that we might have a lower increase in the Solvency II Ratio evolution.

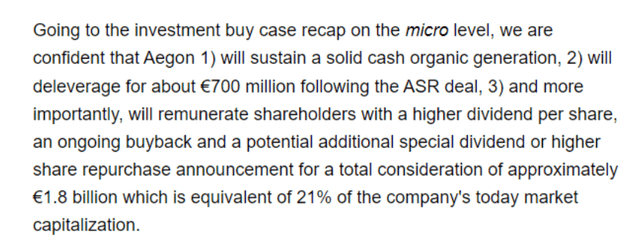

Despite that, our buy rating was supported by Aegon 1) A.S.R. transaction a “Deal To Benefit All,” 2) limited exposure to CS’s AT1 bonds (Rating Upgrade), and 3) higher shareholder remuneration thanks to a sustainable and growing dividend per share combined by an ongoing buyback.

Aegon H1 recap

Source: Aegon Q2 results presentation

Cross-checking Wall Street analyst consensus, the company had a mixed performance. There was a slight miss in the Solvency Ratio and a beat in the operating capital generation. The former was down by a seven basis points while the latter by 10% compared to expectations.

Aside from our investment case recap (Fig 1), there are additional positive takeaways to report and include in our analysis:

- Starting with our buy rating due to higher shareholders’ remuneration, we positively report that in Q3, Aegon started its buyback plan;

- The operating capital generation reached €620 million in H1 with a positive Q2 at €328 million. The solid results were positively favored by the US and lowered new business strain. Post A.S.R transaction, these results confirmed Aegon’s resiliency with OCG estimates of at least €280 million per quarter (very much in line with our analysis). The company delivered an operating result and net profit of €818 and minus €199 million, respectively. In detail, Aegon impaired its Netherlands business for €110 million and announced US changes and a previous earn-out for €574 million;

- Our EU insurance coverage often emphasizes the evolution of the solvency ratio. Aegon reached 202% and missed expectations. However, this was due to a negative one-off and a capital injection into the Asset Management business (already incorporated in our CMD estimates). The Solvency II ratio exceeds the EIPOA minimum regulatory requirements of 160%. Therefore, there are no changes in our forward guidance that align with the management indication (Solvency II ratio at >200%). In addition, Aegon FCF is supportive, and more important, cash at holding was beyond consensus estimates and still in the upper guidance end (Fig 2). In numbers, Aegon’s Cash Capital decreased to €1.3 billion and was due to shareholders’ distribution;

- Key to note is the continuous effort in de-risking non-core assets. The company unclosed the Universal Life with Secondary Guarantees reinsurance transaction. In numbers, this will have relief of $225 million in capital and again is a supportive sign in Aegon’s business transformation. Looking at the company comments, we reported the CEO’s words: “Transamerica will continue to reduce its exposure to Financial Assets and to improve the level and predictability of capital generation.” He also explained how “the reinsurance transaction on 14,000 universal life policies with secondary guarantees generated USD 225 million of capital”.

Mare Past Analysis

Fig 1

Aegon cash at holding evolution

Fig 2

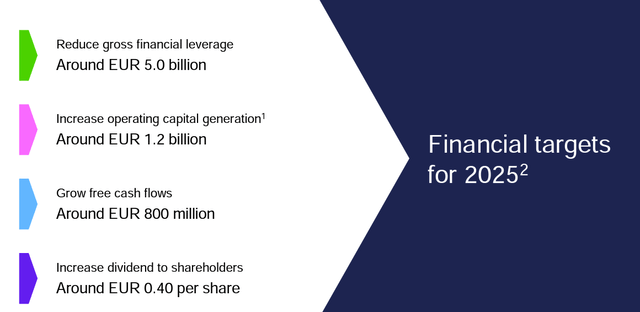

Aegon 2025 target

Fig 3

Conclusion and Valuation

Following Aegon Capital Market Day, there were no changes in the company’s guidance (Fig 3). However, we positively view the operating capital generation development and the US de-risk activities, unlocking $225 million of additional capital. Buy-back (once again) started, and there is further M&A optionality to unlock value. Our estimates align with the company’s estimated 2025 DPS at €0.4 per share, estimating a total dividend payment of 251 and 286 million in 2024 and 2025, respectively. According to our internal estimates, Aegon FCF generation will cover its sustainable DPS. For this reason, with a minimum operating capital generation of at least €280 million per quarter, we derived an EPS of €0.8. Continuing to value Aegon with a price-earnings of 8x with a discount to large EU insurer peers of almost 20%, we derive a target price of €5.7 and $6.1 in ADR. Allianz (OTCPK:ALIZF), AXA (OTCQX:AXAHF), Zurich (OTCQX:ZURVY), and Generali (OTCPK:ARZGF) are trading at a 10x P/E. Our risk section is included here; additional downside risks are deterioration in fixed income portfolio (especially in Govies), higher competition, and regulatory changes in key markets.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here