Overview

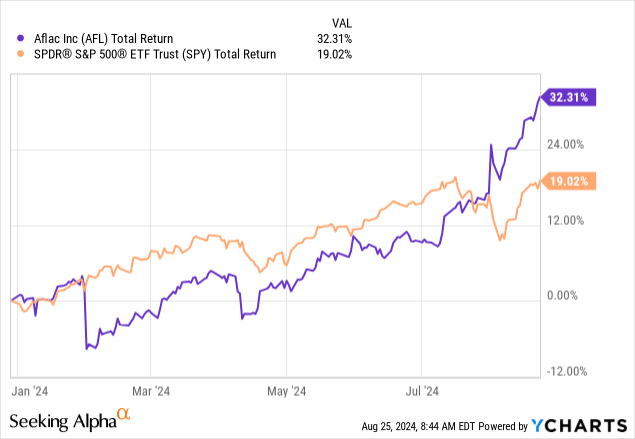

I previously covered Aflac (NYSE:AFL) back in early April, and since then, the performance has been stellar. AFL has provided a total return greater than 27% since my last issued buy rating, outpacing the S&P 500. I strongly believe that AFL will still benefit from a growing amount of cancer cases globally and long-term shareholders will be handsomely rewarded. However, I wanted to reassess and cover the financial strength of AFL and how it has helped the company navigate through all headwinds untouched.

Zooming out to a YTD basis also reinforces AFL’s strength with continued outperformance. Although the price has risen up to new highs, I still believe there can be additional upside captured if their portfolio of investments continues to pull in higher levels of net investment income.

Growth aside, AFL still remains an attractive dividend growth holding for investors that value a source of growing income. The price rise has brought the dividend yield down to about 1.8%. However, the growth rate remains attractive, and the dividend remains well-supported by earnings. Therefore, I am expecting future dividend raises to be strong and aligned with prior increases. The dividend has been increased for over 41 consecutive years and I see no roadblocks stopping AFL from reaching that golden fifty-year milestone of achieving dividend king status.

Additionally, something that I do not see covered often is AFL’s strong portfolio of debt investments. They maintain portfolios exposed to commercial real estate and middle market loans that have helped propel the stock higher. While the structure may not be exactly the same, I find it similar to the structure that business development companies follow. As a result, AFL has been able to capitalize on this higher interest rate environment efficiently. Let’s first start by assessing the most recent earnings report to see how financials have improved over the last quarter.

Financials

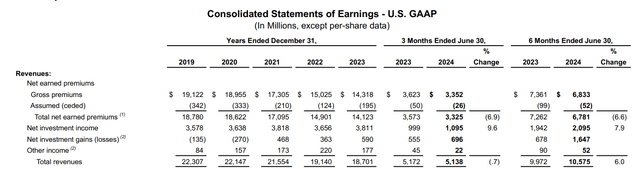

About a month ago, AFL reported their Q2 earnings, and the results were positive. On one end, earnings per share came in at $1.89 and beat expectations by a sizeable $0.29 per share. This was a large increase from the prior year’s total of $1.58 per share, representing a growth in earnings of 15.8%. Additionally, revenue for the quarter was reported at $5.1B, which beat expectations by $830M. However, on a year-over-year basis, the revenue decreased by about 0.6%.

Aflac Japan is the larger segment and brought in about $3.2B for the full year of 2023. In comparison, the Aflac US segment brought in $1.5B for 2023. For the most recent 6 months ending on June 30th, 2024, the Japan segment brought in $1.67B, representing a 4% increase from the year prior. Over the same time frame, the Aflac US segment brought in $739M, representing a smaller 2.5% increase over the year prior. Both of these can be attributed to increased sales volumes and demand.

AFL Q2 Earnings

Total net earned premiums for the last six-month period have decreased down by 6.6%, amounting to $6.7B. This was a decrease from the prior year’s total of $7.2B over the same time frame. However, this was offset by a 7.9% increase in net investment income that was driven by AFL’s strong portfolios of debt investments in middle-market companies and commercial real estate. This was accompanied by net investment gains of $1.6B, which ultimately contributed to total revenues being up over 6% of last year’s total. Total revenues amounted to $10.57B, an increase over the prior $9.97B.

In addition, net earnings ultimately increased by 28.8% for the last six-month period because of the accompanying decrease in benefits and claims. Think of benefits and claims as the expenses that AFL has to incur during the quarter. Total benefits and expenses decreased by 6.2%, amounting to $6.38B, which was a decrease over the prior year’s total of $6.8B.

Liquidity remains strong and helps put AFL in a comfortable position to navigate any potential headwinds or impacts to earnings. For instance, cash and equivalents sit at a total of $6.06B, which represents a large increase over the prior year’s balance of $4.7B. However, long-term debt amounts sit at $7.3B, which can be improved.

AFL currently trades at a forward price to earnings ratio of 11.1x, which undercuts the sector median of 12.3x. Therefore, AFL could still have some upside potential. Year-over-year EBITDA growth has been massive at 22.8% which is accompanied by an EBITDA margin of 33.6%. While future interest rate cuts may slow down the rate of growth, I still believe that this strong performance will result in continued upside. AFL currently has a Quant rating of a strong buy with a score of 4.78. However, I think it’s worth shifting focus to AFL’s portfolio of debt investments since it has helped the business generate elevated levels of income and grow earnings more rapidly.

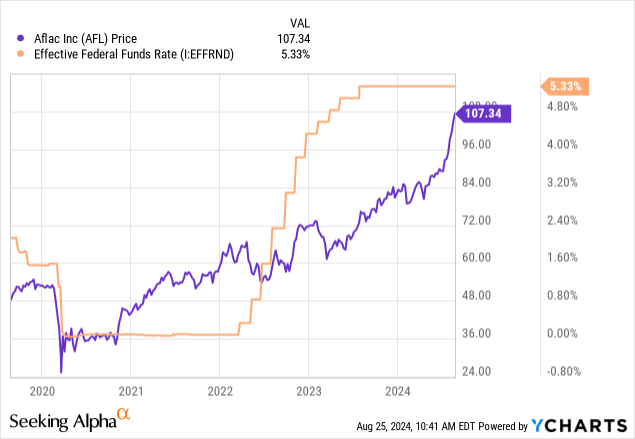

Higher Rates For Longer – Debt Investments

Similar to business development companies, Aflac has been able to generate higher revenues through its diverse portfolio of debt investments. Aflac maintains a portfolio of exposure to middle-market loans and commercial real estate. Starting with the loan portfolio, AFL has been able to efficiently capitalize in the current high interest rate environment due to following a floating rate structure on first-lien senior secured loans. A floating rate structure has been beneficial because as interest rates rise, so do the amount of interest payments received from borrowers. As a result, it’s no coincidence that AFL’s price took off alongside the federal funds rate.

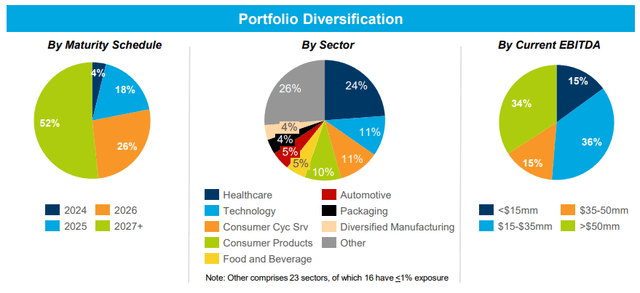

They’ve managed to secure these investments on a senior secured basis as well, which offers a greater sense of security and stability. First-lien senior secured debt sits at the top of the corporate capital structure, which means that it has the highest priority for repayment. This is helpful in cases where borrowers default on their debt and need to liquidate assets because it ensures that AFL recovers some invested principal rather than losing everything.

The loan portfolio also remains highly diversified across many sectors, with a primary focus on healthcare investments accounting for 24%. AFL tens to focus on making investments to companies with an EBITDA range below $50M as it offers a larger window of opportunity for growth. Their loan portfolio has a net book value of about $4.4B with a yield of 11.05% that’s spread across 299 individual issuers.

AFL Investment Details

I do anticipate the income generation from this portfolio of investments to eventually decrease as interest rates get cut. The Fed has indicated that interest rate cuts are ahead and while we do not know how severe or light those cuts will be, we should expect a drop in income here. Lower rates will directly translate to lower net investment income since the portfolio operates on a floating rate basis. I do not expect the Fed to cut rates to near zero levels like they did following the pandemic as there is no need for such a dramatic stimulus at the moment. Inflation rates continually decreased and now sit at the 2.9% mark as of the latest update. Therefore, consumers should see a bit of relief and spending levels may actually increase. Ultimately, a higher for longer interest rate environment would continue to contribute to the success of the loan portfolio.

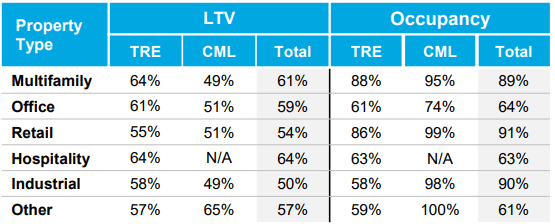

To complement the loan portfolio, AFL also maintains investments in commercial real estate. Total net book value sits at $7.2B with a yield at 7.7%. Similarly to the loan portfolio, AFL’s real estate exposure has been structured on a floating rate senior secured basis and maintains a high level of diversity across property type and geography. The largest property type in their portfolio consists of multifamily properties, accounting for 42%. The portfolio spans across office buildings, retail properties hospitality, and industrials.

With the real estate portfolio, I wanted to consider how interest rate cuts would improve occupancy. Lower interest rates reduce borrowing costs for tenants and could be an incentive for businesses to lease these spaces from AFL. Occupancy levels remain low for office properties, as expected from the shift due to the pandemic. Remote work changed the rates at which office properties were needed so I expect this to be the weakest source of the portfolio.

AFL Investment Details

With only retail and industrial properties the only segments maintaining occupancy levels above 90%, the rest of the portfolio could use some improvements. Lower interest rates could be a positive catalyst as it increases the demand for properties, and it could also create lower financing costs that could be used for renovations and upgrades. Not to mention, unemployment levels have consistently increased over the last twelve months and now sit at 4.3% as a result of companies implementing layoffs to cut down on expenses. Interest rate cuts could improve the employment rate and increase the occupancy of office properties.

Dividend

As of the latest declared quarterly dividend of $0.50 per share, the current dividend yield sits at 1.8%. The dividend remains well-supported with a payout ratio of only 28%. This is extremely impressive for a company that has consecutively increased their dividend payouts for over 41 years in a row. For reference, the sector median dividend payout ratio sits close to 40%. Not only does it remain at a low risk of cuts, but the dividend growth rate has also been extremely impressive.

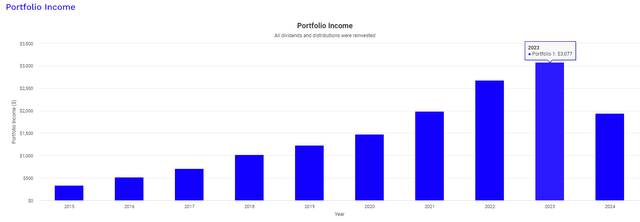

As a dividend investor, it is extremely valuable to have a holding that increases the amount of income they pay you but also does so with stability that eliminates any stress. With AFL, you will not have to worry about any cuts or reductions in income and the growth rate enables a growing yield on cost. For instance, long-term shareholders that have maintained a position in AFL for a decade would now be sitting on a yield on cost that is greater than 6%. This is all supported by a double-digit increase rate of the dividend. The dividend has increased at a CAGR (compound annual growth rate) of 14.77% over the last three-year period. Even zooming out to a span of ten years reveals a dividend CAGR of 10%.

Having a dividend that averages an annual double-digit growth rate is a power income-building tool that can rapidly increase the rate of your passive income growth. In order to visualize this, I ran a backtest of an initial investment of $10,000 at the start of 2015. These results assume that all dividends received were reinvested back into AFL to accumulate more shares. In addition, this graph assumes a fixed monthly contribution of $500 throughout the entire holding period. As we can see below, a combination of these factors leads to a consistent level of income growth represented by the blue bars. Year after year, the amount of dividend income received would have grown.

Portfolio Visualizer

In year 1 of your investment, the annual dividend income received would have totaled $333. Fast forwarding to the full year of 2023, your annual income would have grown to $3,077. This represents a growth greater than 9x your original income amount in year 1. The best part is that the dividends received are classified as qualified. Therefore, AFL offers the most tax-friendly dividends possible, which makes it a great income holding for all account types.

Vulnerability

While the portfolio of debt investments has helped AFL generate higher levels of earnings since rates were hiked to their decade highs, I do believe the time of higher rates is coming to an end. When rates start to get cut, AFL may not be able to continue pulling in the same levels of net investment income. Interest rates will decrease and the portfolio of middle-market loans will no longer be able to pull in higher interest payments from borrowers. Therefore, we may see a dip in income that’s generated from their debt investments and if revenue doesn’t grow. However, impacts here could potentially be offset by positive growth of the commercial real estate portfolio as occupancy levels increase.

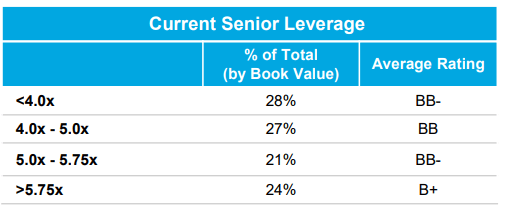

We also have to take into consideration that AFL’s portfolio of debt investments has poor credit ratings. Their debt investments have been exposed to borrowers that are rated below investment grade. We can see that the average credit rating of their borrowers is mostly rated at a BB. For reference, credit ratings of BBB- and below are considered below investment grade. This simply means that these borrowers may not have strong balance sheets with large cash cushions to help them navigate extended headwinds. This increases how vulnerable they are to challenging market conditions and can lead to an increased rate of defaults in a higher interest rate environment.

AFL Investment Details

We have no idea where interest rate cuts will fall yet, but if they are not significant, AFL still remains vulnerable to defaults within its portfolio. Lastly, the commercial real estate portfolio contains office property exposure, which has not been an ideal sub-sector of real estate. As remote work continues to become more globally accepted as a norm, the demand for these properties is seeing a shift. This remains an area of the portfolio that I suspect will see low occupancy levels and not fulfill its full income-earning potential.

Takeaway

In conclusion, I maintain my buy rating on AFL due to the strong underlying portfolio of debt investments that have helped propel the stock to new heights. Their portfolio of investments has brought in higher net investment income that has contributed to accelerated earnings growth. Additionally, the dividend remains well-supported by a very low payout ratio that leaves plenty of room for future growth. The dividend continues to grow at a double-digit rate, which can enable a rapid growth of dividend income when held with a long-term outlook in mind. Therefore, AFL makes for a great dividend growth holding and the total return has the potential of being comprised of both capital appreciation and income.

Read the full article here