Stay informed with free updates

Simply sign up to the US economy myFT Digest — delivered directly to your inbox.

An “investment surge” in artificial intelligence has helped the US avoid a sharp slowdown but risks stoking inflation, the IMF’s chief economist has warned, as the fund upgraded its outlook for the world’s largest economy.

The IMF on Tuesday delivered more optimistic forecasts for both global growth and the US economy despite bleak predictions earlier this year that Donald Trump’s trade war risked plunging the world into a “significant slowdown”.

As finance officials gather in Washington for the IMF’s annual meetings, the fund lifted its 2025 global growth projection by 0.2 percentage points compared to its last estimate in July, predicting world GDP will rise by 3.2 per cent this year, only slightly shy of 2024’s 3.3 per cent figure. Global growth is forecast to be 3.1 per cent in 2026.

The US would expand by 2 per cent this year and 2.1 per cent in 2026, the fund said. That marks a slowdown from 2.8 per cent in 2024 but it is by far the strongest growth rate for any of the G7 leading economies and a slight upgrade from July’s forecast. In April, the fund had said US growth would slow to 1.8 per cent this year.

IMF economist Pierre-Olivier Gourinchas said a big reason for the surprising strength of the US economy was “a very significant AI-related, tech-related investment surge” that was helping to ease financial conditions and creating wealth gains for US shoppers.

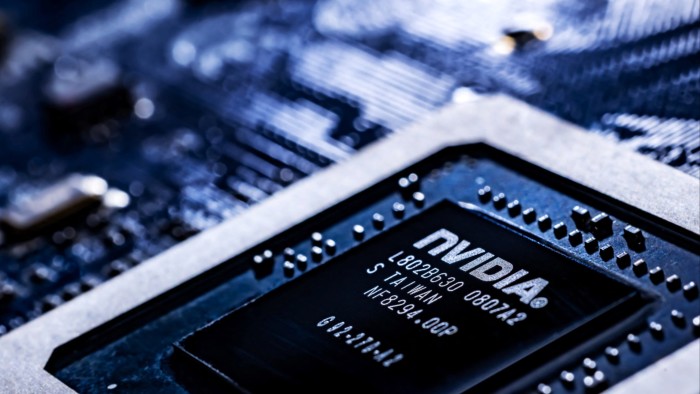

Tech stocks — including Nvidia, Broadcom and Oracle — have surged this year, carrying US equity markets to a series of record highs despite simmering concerns about when some companies will see a return on their vast outlays on AI.

The rally has also led to warnings that global stock markets are at risk of a sudden correction if market sentiment about potential productivity gains from AI turns.

“We are not yet at the levels of the surge investment that we saw in the dotcom boom, we’re not yet at the level of stretched valuations in equity markets,” Gourinchas said. “But we’re maybe half, or two-thirds of the way there.”

Comparing the boom with the dotcom bubble, consumers “feel richer because equities are high”, Gourinchas said. “They get valuation gains, so consumption is high, investment is high. But the economy is not really producing more yet; it’s promises about the future. So that creates demand pressures.”

The IMF is more optimistic about the prospects for the US economy than the OECD, which said last month that US growth would slow this year to 1.8 per cent.

Gourinchas added that he expected the boom to limit the US Federal Reserve’s capacity to cut borrowing costs.

While he forecast further three-quarter point cuts by the Fed this year and next, he said that progress towards the central bank’s 2 per cent inflation goal had been “delayed or stopped” over the past year.

Increasing clarity on trade deals would lead to “more pass-through” of inflation to US consumers, he warned, with importers no longer willing to swallow so much of the cost of tariffs.

The recent trade tensions between the US and China after Beijing imposed sweeping export controls on rare earths and critical minerals had “got us very concerned”, Gourinchas said, adding that it showed a lot of things were in “flux”.

But the IMF acknowledged that the US president’s tariffs had so far had a “limited impact” on global economic activity and prices, with quarterly annualised growth rates of around 3.5 per cent in the first half of the year.

The muted impact reflects in part the fact that the tariff shock had proven to be smaller than initially expected in the wake of Trump’s “liberation day” announcements in April, while households and businesses had brought forward spending in anticipation of higher tariffs.

Healthy profit margins provided an additional buffer as the trade war unfolded, while a depreciation of the US dollar had eased financial conditions for many countries around the world.

The UK is on track for growth of 1.3 per cent in 2025, the second quickest pace in the G7 after the US, and 1.3 per cent in 2026, according to the fund’s latest projections.

China’s economy will expand by 4.8 per cent in 2025 and 4.2 per cent in 2026, unchanged from its July forecast.

Additional reporting by George Steer in New York

Read the full article here