It’s amazing the difference great management can make in the insurance industry, where volumes can be easy to come by, but profits often are elusive. AIG (NYSE:AIG) spent a decade or two as the poster child of poor insurance underwriting, regularly generating combined ratios in excess of 100. While several managers claimed they would fix it, AIG finally started making the right hires several years ago, and the team did exhaustive work re-underwriting the massive portfolio with a focus on maximizing risk-adjusted returns. Their success has created a massively more attractive business with immense future prospects for shareholders, buying at what are truly bargain prices.

AIG Q1 23 Investor Presentation

When an insurance company attains a combined ratio below 100, they are being paid to invest the massive insurance float generated by the written premiums. This can become an absolute compounding machine, as legendary operations such as Berkshire Hathaway and Markel have shown. AIG has long had elite distribution and relationships with most Fortune 100 companies, but it had previously prioritized market share as opposed to underwriting profitability. That ship has sailed, and I couldn’t be more impressed with how effectively management has changed the culture. Mr. Market still seems quite skeptical given the ridiculously cheap valuation the stock trades at, but I’m more bullish on AIG than I’ve been in many years.

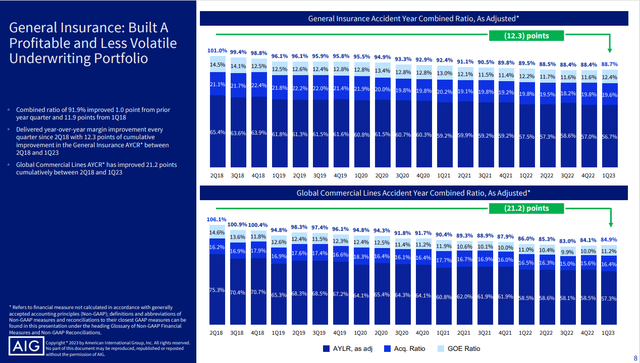

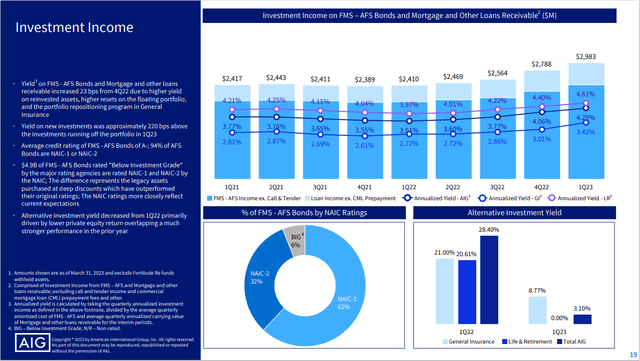

On May 4th, AIG reported outstanding 1st quarter financial results, highlighting the vast improvement this management team has had on the company, and the stock rallied nearly 8% on Friday as a result. Adjusted after-tax income was $1.2B, or $1.63, up 9% YoY. GAAP net income of $23MM, or $.03 per share, were diminished by net realized losses in Life and Retirement largely related to Fortitude Re funds withheld embedded derivative, as a result of capital market movements. Net premiums written in General Insurance grew by 10% on a constant dollar basis, driven by the Commercial business, and underwriting income was $500MM, up 13% YoY and which was a record first quarter. The accident year combined ratio, excluding catastrophes, was 88.7%, 80 basis points less YoY, showing the continued progress in the crucial underwriting metrics. Net investment income on a consolidated basis was $3.1B, as income was $573MM higher from fixed maturities and loans, while alternative investment income was lower by $593MM. The average new money reinvestment rate was 5.35%, which is nearly 220 basis points above sales and maturities. The yield improved to 4.29%, which was up 78 basis points from Q1 22, and up 23 basis points sequentially. Higher yields should continue to provide a nice tailwind to earnings moving forward, which is extremely nice after the last 15 years or so of ZIRP policies. General insurance adjusted pretax income was $1.2B in the quarter, up $37MM YoY.

AIG Q1 23 Investor Presentation

While Commercial insurance has been particularly strong, Personal insurance has been a bit weaker, although still better than under prior management. On April 26th, the company announced that it has finalized an agreement with private equity firm Stone Point, to form Private Client Select Insurance Services (PCS), an independent Managing General Agency (MGA) to serve High Net Worth and Ultra High Net Worth markets. This venture will launch in Q3, and the company expects to bring on additional capital providers in the 2nd half of the year. Management is very bullish on this new structure, saying “it will significantly increase net premium written growth, generate improved loss ratios, and both the expense ratio on an acquisition basis, as well as the general operating expenses will improve.” AIG also sold its Crop Risk Services group to American Financial Group for $240MM, as the company continues to prune its insurance portfolio, to optimize its risk-adjusted returns.

Life and Retirement (Corebridge) (CRBG) also had a good quarter, with premiums and deposits of $10.4B, up 44% YoY, as investors look for safer products. Individual Retirement sales were $4.9B, up 26% YoY. Adjusted pretax income was $886MM in Q1, down $48MM YoY, and the adjusted return on equity for the segment was 10.7%. Blackstone has invested roughly $11B on behalf of Corebridge, with an average gross yield of 6.5% and an average credit rating of A, which should augur well for future earnings. This partnership widens the spectrum of asset classes that Corebridge can invest in, hopefully ascertaining higher long-term returns. Thus far as a public company, Corebridge has paid approximately $450MM of dividends to public shareholders, which is pretty impressive given that the IPO was just last September. The Life and Retirement company announced a $1B buyback program, which should be enormously accretive given the stock price, which trades far below any conservative estimate of intrinsic value. As market conditions allow, AIG will continue selling down its stake in Corebridge, but I would hope they are willing to wait for more favorable pricing. Once Corebridge is totally divested, approximately $300MM of expenses will shift from AIG to Corebridge.

AIG returned approximately $840MM to shareholders in Q1 via $600MM of buybacks and $240MM of dividends. The company ended the quarter with $3.9B of parent company liquidity. AIG’s financial strength is allowing the company to increase the quarterly dividend by 12.5% to $.36 per share starting in Q2. AIG tapped capital markets in March for $750MM of debt to pay down near-term maturities and additional stock buybacks. Shares outstanding were 744.1MM at the end of Q1, down from 826MM a year ago.

AIG’s management is completely focused on achieving a 10%-plus ROCE through a combination of sustained improved underwriting profitability, cost efficiencies, the deconsolidation of Corebridge, and capital management. AIG is shifting away from the conglomerate structure it has operated in for decades, which should lead to a much leaner operation. The goal is for the parent expense structure to only be approximately 1-1.5% of premiums, or $250-$350MM based on today’s levels. AIG sees $500MM of cost reduction at AIG parent, with a cost to achieve of $400MM. The company plans on reducing its common stock outstanding to 600M-650MM shares, while achieving a debt-to-capital leverage ratio at the lower end of 20-25% post-deconsolidation of Corebridge. Thus far in Q2, AIG has repurchased an additional $240MM of common stock. AIG ended Q1 with a leverage ratio of 32.8%, down 1% sequentially despite the new issuance, and excluding AOCI and the Fortitude-embedded derivative, debt leverage was 26.3%.

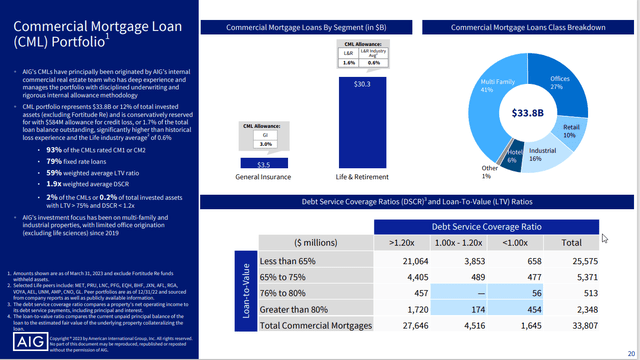

The insurance sector has been battered on concerns regarding commercial real estate, and AIG appears to be in a pretty good position. The company has $33.8B of Commercial Mortgage Loans, of which $30.3B were at Corebridge and $3.5B at GI. About 40% of this exposure is multifamily housing or apartments, and Industrial Property loans are about 16%. U.S. Office is only $5.4B, or 2% of AIG’s invested assets. 94% of office loans are high-quality rated CM1 or CM2, with debt service coverage averaging about 2.1x and weighted average LTVs of 64%. The company retains a CECL allowance against the portfolio of about $330MM, or 3.7% against the office loan portfolio, and $584MM for the total commercial mortgage portfolio or 1.7%. Around 75% of the buildings securing the loans are Class A, or are newer buildings with updated amenities, mostly in the top 5 U.S. metropolitan areas.

AIG Q1 23 Investor Presentation

AIG’s book value per common share ended at $58.87 in the quarter, up 7% sequentially, principally due to higher valuations on the AFS portfolio due to lower long-term interest rates. Adjusted book value per share was $75.87 per share, virtually flat sequentially. AIG’s ROCE has been improving, reaching 8.7%, with GI at 11.6% and 10.7% in Life and Retirement. As the ROCE starts consistently exceeding 10%, AIG should be valued at least at book value, and I expect that book value to show material growth, providing another tailwind for shareholders. Friday’s 8% pop after earnings put the stock at $53.79, but I believe within 18-24 months, we should see $70 per share. Investors are paid 2.7% on the dividend, and buybacks done at current levels are enormously accretive to all relevant metrics. Fear permeates financial stocks currently, but I believe the risks are overblown, and long-term investors in AIG can take advantage of Mr. Market’s pessimistic current outlook.

Read the full article here