Alamo Group Inc. (NYSE:ALG) has seen a steady rise in the last 12 months as the share price is up over 39%. In this article, we will be taking a close look at why ALG can continue to meet the immense amount of demand the sector and industry are seeing. The strategic investments the company is making right now are paying off very well, and I anticipate that the top and bottom line will continue to grow from here, leading to a buy rating.

Operational Overview

ALG is a global company specializing in the design, manufacturing, distribution, and servicing of equipment dedicated to vegetation management and infrastructure maintenance. The company operates through two distinct segments: Vegetation Management and Industrial Equipment. Within its Vegetation Management Division, ALG provides a range of products, including hydraulically-powered mowers and mowers mounted on various types of equipment, such as tractors and off-road chassis. These solutions cater to the needs of governmental, industrial, and agricultural customers worldwide.

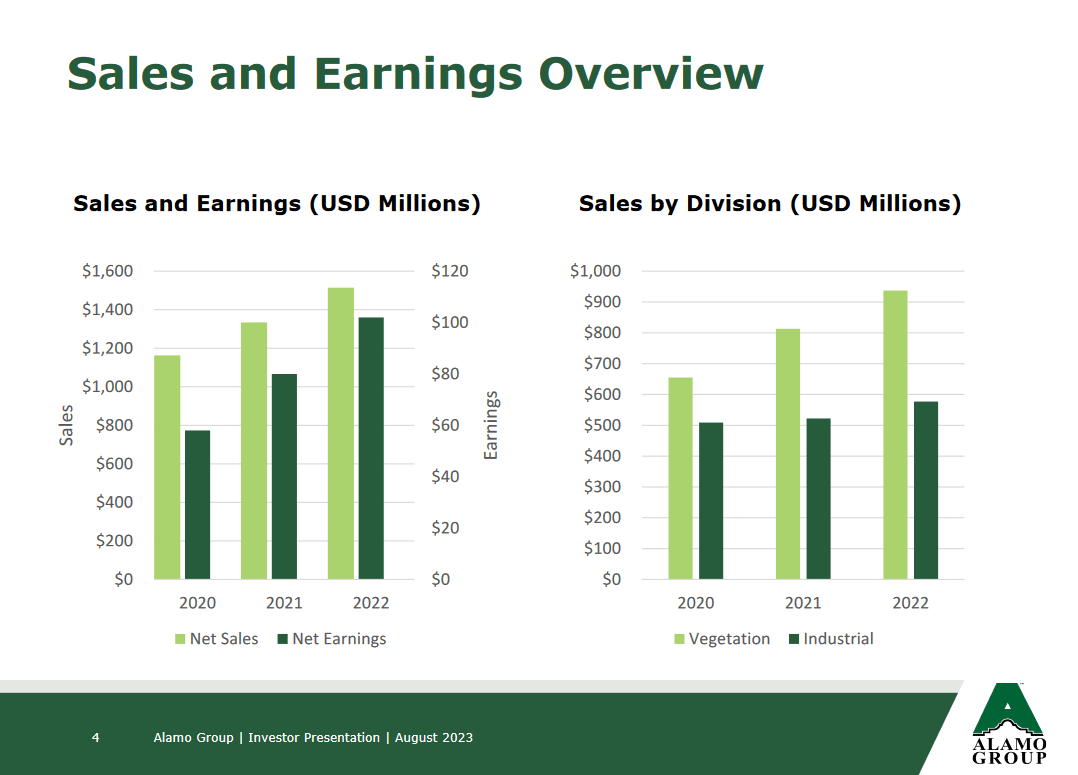

Sales (Investor Presentation)

Over the last couple of years, the sales of the company have been growing quite quickly as the demand the industry is placing on the business is immense. The two segments in the company have however shown quite different results. The vegetation segment has grown immensely over the last 3 years. If the trajectory and speed continue, then I believe it could double in the next 2 years compared to where it was in 2020. With a slightly lower earnings multiple than the sector, I think the market still seems to be quite positive on the upside here and I tend to view it the same.

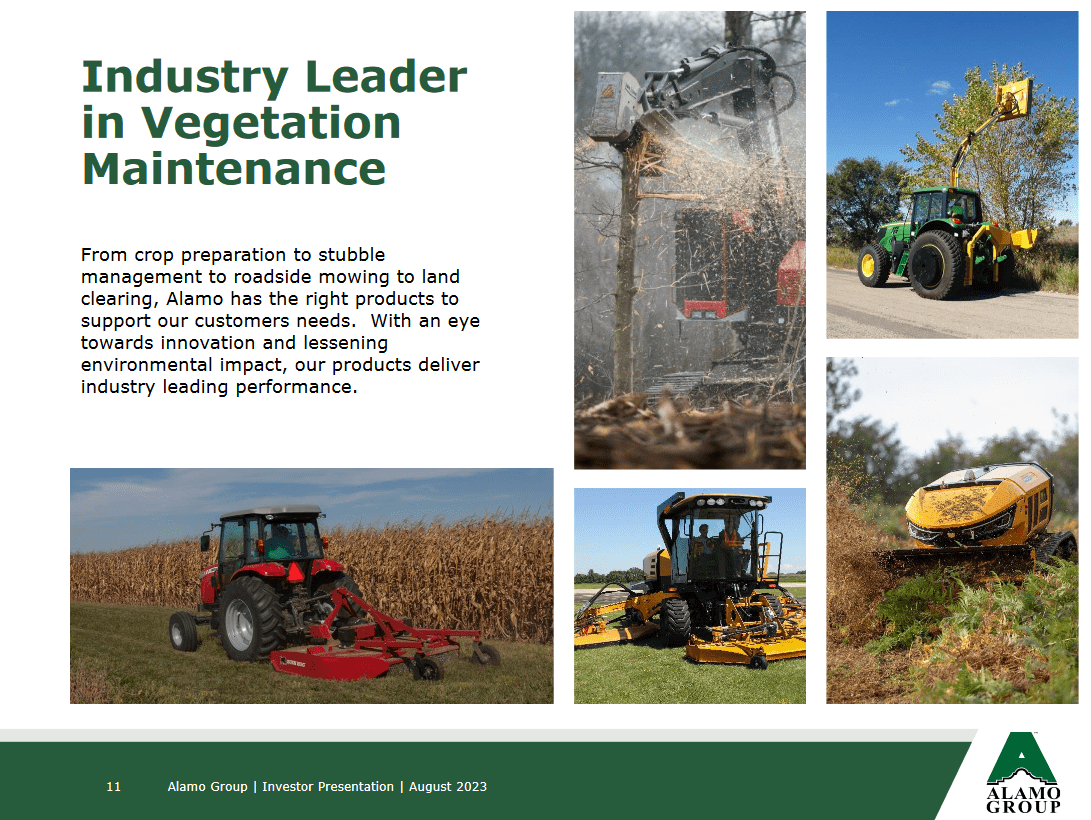

Company Overview (Investor Presentation)

ALG has adeptly reevaluated its backlog, emphasizing the growth potential of the Vegetation Management sector, while simultaneously reducing work in progress. In addition, the company has successfully curtailed its SG&A expenses as a percentage of sales. Furthermore, their strategic shift towards equipment electrification augments their efforts to enhance profit margins. These concerted efforts collectively set the stage for ongoing margin expansion, ensuring a promising outlook for the company’s financial performance. Going into the next decade, I think that the vegetation segment is going to be the main driver of sales growth for ALG. Up until 2029 the market for it is estimated to show a CAGR of over 7% which I believe ALG can capitalize on, and potentially outperform, given the market share they have and the large buildup of backlogs already. Which from the last quarter was nearly $900 million in total.

Technicals

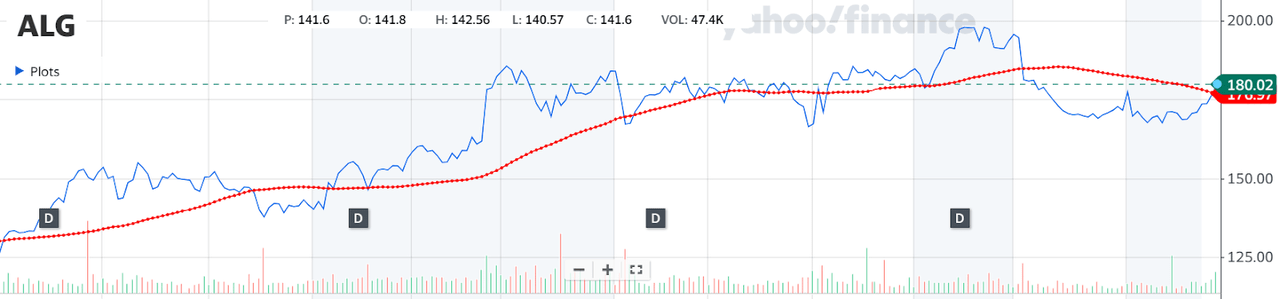

Stock Chart (Yahoo Finance)

Looking at the last 12 months, the share price for ALG has been on a steady rise as we have discussed. Fueling this growth and expansion has in my view been the excellent performance of building robust backlogs of orders and margin retention. The net margins are at 7.76%, a fair bit above the 5-year average of 6.02% the company has had previously. Looking closer at the price chart, we can see that ALG is in a crucial position right now as the moving average and the share price is meeting up. It has bounced previously off it in early July and I think in this case it will as the fundamentals of the business are solid and support the argument that ALG can grow the top and bottom line efficiently over the coming years.

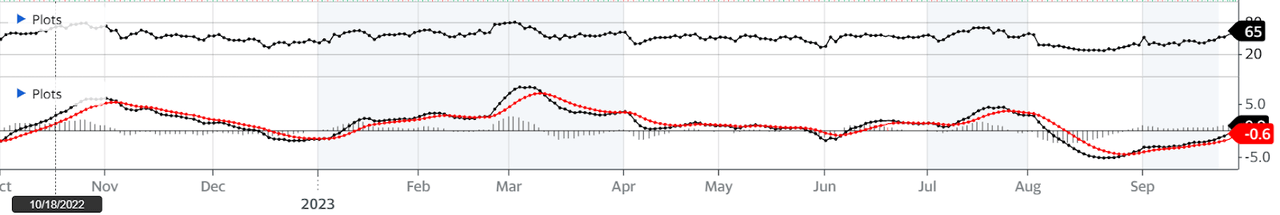

RSI (Yahoo Finance)

Supporting my argument further that the short-term looks very promising is that the MACD is looking to cross very soon, which should send the share price further up and be a bullish signal. Basing investments solely on the technicals is not a very good choice always, but in this case, I am using them as supporting factors for the short-term outlook as ALG continues to post impressive results.

Assessing The Value

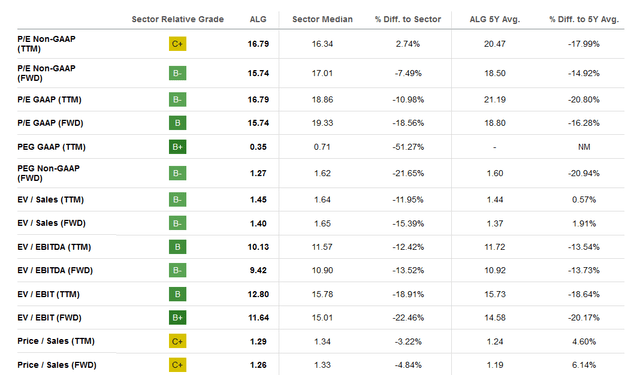

Valuation (Seeking Alpha)

The p/e for ALG has been declining quite steadily over the last couple of quarters and trades at 16.59 currently as the bottom line has been growing steadily. Furthermore, in comparison to the broader sector, it displays a decent discount of roughly 10% based on earnings. With ALG offering a p/e discounted by 10%, it’s within my preferred range of the margin of safety and a crucial factor why ALG could be considered a buy right now.

In comparison to a peer like Trinity Industries (TRN), ALG does display some positives based on the current p/e, with TRN trading higher at 17x. On a FCF basis, I think TRN seems like the better choice given that it has been generating it more consistently and trades at a low p/fcf of under 10, whilst ALG is at over 22. With TRN offering a higher dividend as well, it comes off to me as the better choice of the two.

Risks

Another significant concern for ALG pertains to the prevailing environment of increasing interest rates. The escalation in interest rates has the potential to raise the company’s borrowing expenses, thereby impacting its financial performance. Additionally, it could have repercussions on the ALG network of dealers, which plays a pivotal role in the company’s distribution and sales operations. The elevated interest rates might place constraints on the dealers’ ability to maintain adequate inventory levels, ultimately affecting ALG sales volumes and cash flows. These combined effects pose challenges that ALG needs to navigate in this evolving economic landscape.

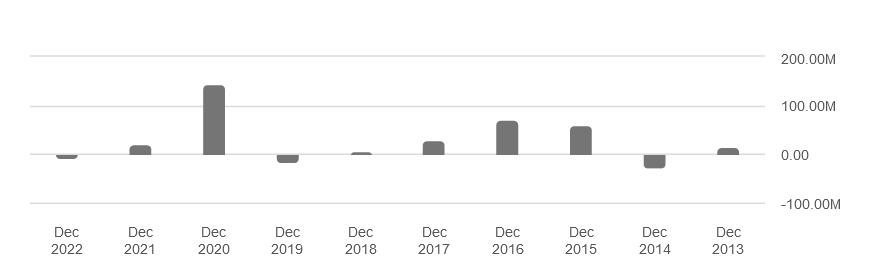

Cash Flows (Seeking Alpha)

Prolonged disruptions in the supply chain may jeopardize the sustainability of the Industrial division’s recent surge in orders. ALG must remain vigilant in monitoring the ominous signs of inflationary pressures that could gradually erode profit margins. The strategies employed by the company to counter inflation, such as implementing price increases and making operational adjustments, might encounter challenges in the face of persistent inflationary forces. This could potentially disrupt the delicate balance of profitability within the organization and necessitate a proactive approach to safeguard its financial health. The coming reports from ALG should be displaying improvements on this front if we are to expect to see the share price appreciate further in value. The market seems to have a lot of faith in the continuation of the business and that ALG can maintain the current growth trajectory, so any unexpected disruption could send the price down.

Last Pointers

The vegetation maintenance and infrastructure maintenance markets are both set to grow steadily over the coming decade and given the number of backlog orders that ALG has built up I think a reasonable bet to capture this growth is by investing in ALG. It offers a decent p/e that’s discounted right now and leaves investors with the potential of immediate upside potential. This concludes with a buy for ALG right now.

Read the full article here