The rush for the world’s automakers to convert from internal combustion to electric power has had untold impacts on various parts of the world’s economy. Perhaps among the primary beneficiaries of this mega-trend is lithium giant Albemarle (NYSE:ALB). Batteries need lithium, and those around the world that make batteries need more and more of it to meet the massive demand that’s coming. Albemarle is the clear leader in lithium, and no one is better positioned at the moment to take advantage of the tsunami of demand that’s accruing from consumer demand for EVs.

Confluence of support suggests near-term upside

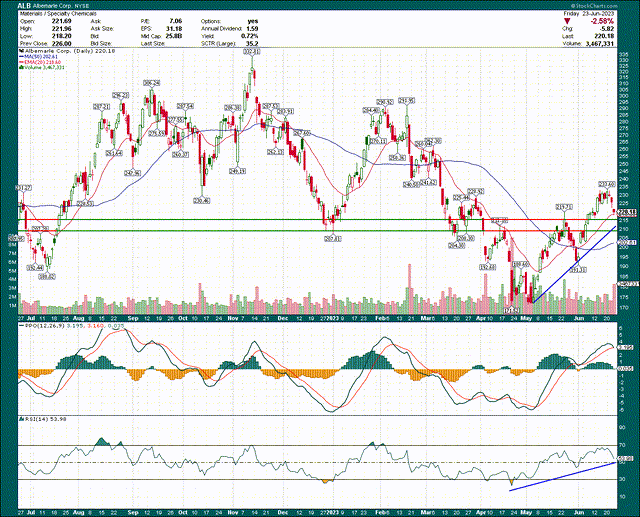

Let’s begin with a look at the price chart, which looks like it has a few options for near-term support. Shares rallied hard out of the April/May double bottom and have since seen some profit taking, but right into what should be robust support levels.

StockCharts

There’s support from potentially four different sources just below current price, which is why I see the odds of support holding here as high. First, the rising 20-day exponential moving average is $218, and it’s well ahead of the 50-day simple moving average, strengthening the odds this is a new uptrend. Second, there’s a trendline from the May bottom that comes into play around $212/$213. Third (and fourth), there are two support levels from prior relative highs and lows at $210 and $215. There is also the rising 50-day SMA at $202, but I don’t think we’ll see the price that low barring some sort of unforeseen news.

The momentum picture is looking good, with both the PPO and 14-day RSI ahead of their respective centerlines, and with modest pullbacks during this profit-taking period. The first upside target here is the cluster of resistance at $240/$245, and after that, ~$290. If you do get long, the final line in the sand from a support perspective would be the 50-day SMA, in my view. If that breaks, this current uptrend will likely have failed.

Fundamentals support higher prices

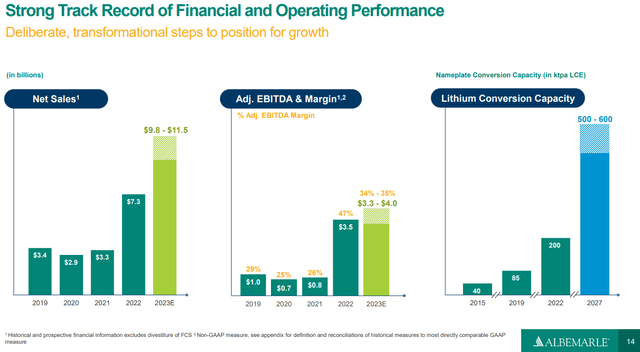

Much of the appeal of Albemarle’s growth story is that it’s already coming to fruition. There’s insatiable demand for lithium from the world’s automakers, and it’s only going to get stronger. Albemarle is in the best position to reap the benefits given its size and scale, and the company continues to invest accordingly.

Company presentation

Sales for this year are expected to be triple that of 2021, and there’s more where that came from as the years move on. The company’s lithium conversion capacity is expected to triple between last year and 2027, as a sign of not only demand, but Albemarle’s ability to satisfy it.

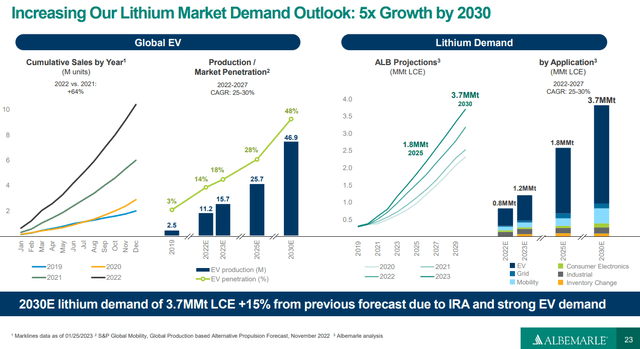

On the subject of demand, we can see the company’s forecasts are for massive growth.

Company presentation

We can see that while other categories of battery usage are growing as well, in the context of growth from autos, they are small enough that they don’t matter much. This is an EV story, and it’s a really good one.

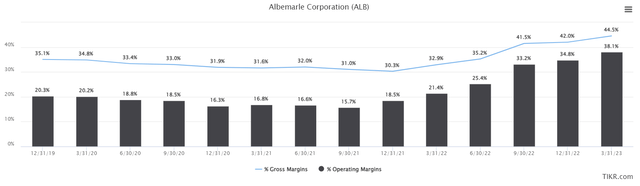

Now, revenue growth is great, but in order to drive the stock price higher, we need to see earnings grow. The good news is that Albemarle’s ability to extract profit out of revenue is getting better and better. Below we have trailing-twelve-months gross and operating profit to illustrate this point.

TIKR

Not only are both of these rising (which is ideal), but the gap between gross and operating profit is closing quickly. What that means is that the company is quickly leveraging down costs as revenue rises. In other words, as revenue rises, it’s spending less and less of that revenue to operate its business, so profits rise both from higher revenue, as well as the fact that more of that revenue is flowing to the bottom line.

That creates a virtuous cycle where higher revenue begets higher gross profits and then higher operating profits. That’s the story here, and if forecasts come to fruition on the top line, we should see better and better numbers on this chart over time.

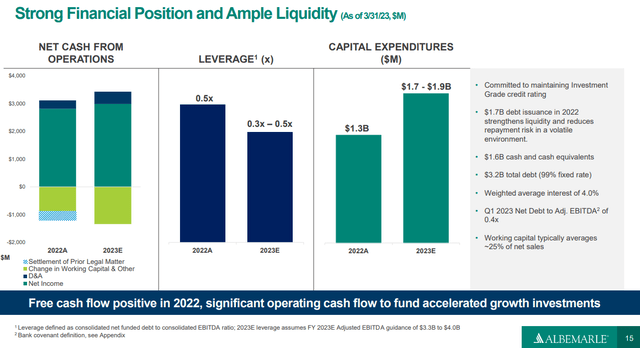

A quick look at the balance sheet is below, and I don’t want to dwell here because it’s not central to the growth story.

Company presentation

However, the point here is that Albemarle is creating cash, has ample room on its balance sheet for additional leverage if needed, and is investing heavily in making sure it can capture the wave of demand that’s already underway. Balance sheet flexibility affords the ability to invest where necessary, and is also part of the margin story given it’s not spending unduly on debt servicing.

Valuation looks great

Albemarle’s valuation reached fever pitch in late 2021 at an eye-watering 66X forward earnings, but has since settled down given earnings are temporarily plateauing.

TIKR

However, at just 12X forward earnings, a clean balance sheet, size and scale advantages over its rivals, and the massive wave of demand for EVs that’s already underway, the downside to the valuation here should be quite limited. Now, it’s completely unreasonable to expect 60X forward earnings, or even 30X for that matter, in my view. However, could we see 20X? Absolutely, but even a reflation back to 16X from 12X would offer up another ~$90 on the share price (~$22 in annual EPS times 4).

The point being that Albemarle has just about everything one could hope for with a potential long position. The chart looks good, as though we are seeing the beginnings of a new uptrend. The company has a massive head start over competitors in one of the hottest sectors of any market. The balance sheet is clean, margins continue to improve, and the valuation looks quite reasonable. I like Albemarle on a short-term basis because of the chart, and on a long-term basis because of the valuation and growth potential. I’m slapping a strong buy on Albemarle for these reasons.

Read the full article here