The BABA Investment Thesis Is Not For The Faint Hearted

We previously covered Alibaba Group Holding Limited (NYSE:BABA) in March 2023, discussing the management’s decision to split up Jack Ma’s empire into six smaller bite-size autonomous parts. The restructuring announcement had been timely then, pointing to China’s ambitious GDP target of 5% in 2023, on top of the supposed relaxation of regulatory crackdowns.

Nonetheless, investors who decided to dip their toes need to be aware of the developing restructuring story, on top of the uncertain macroeconomic outlook and the volatile geopolitical situation.

For now, it appears that BABA is still caught in the cross fire, with its valuations remaining sluggish at NTM EV/ Revenues of 1.62x and NTM P/E of 11.05x, compared to its 5Y mean of 4.43x and 20.63x, or 3Y pre-pandemic mean of 8.25x and 28.43x, respectively.

Based on its NTM P/E and the market analysts’ FY2025 adj EPS projection of $9.45, we are also looking at a long-term price target of $104.42, suggesting minimal upside potential from current levels.

We suppose this cadence means two things.

One, the BABA stock’s prospects may always be affected by the volatile geopolitical risk, no matter the results of the renewed audit in July 2023. Two, anyone hoping for a turnabout in its valuations may need to be very patient indeed.

This is due to the ever widening scope of trade ban between the US and China, with the latest drastically impacting Micron (MU) and the export control on chip-making metals: gallium and germanium.

While market analysts have hypothesized that the RMB 7.12B or the equivalent of $985M fine on Ant Group may signal the end of Beijing’s crackdown, we are less certain if the Chinese stock market and BABA may eventually regain the international investors’ confidence moving forward.

The US government appears ready to further intensify its restriction on future Chinese-based investments as well, targeting “private US equity and venture capital investment in highly strategic technological sectors.” This is on top of the drastic decline in US investment from $35B in Q1’21 to ~$400M in Q1’23, suggesting a great shift in market sentiments away from China.

Beijing’s latest interim rules for generative AI does not appear encouraging as well, with state scrutiny likely being a constant moving forward:

Adhere to the core values of socialism, and must not generate incitement to subvert state power, overthrow the socialist system, endanger national security and interests, damage national image, incite secession. (Cyberspace Administration of China)

With BABA also launching multiple generative AI services, thanks to its in-house research institute DAMO Academy, it remains to be seen if there may be any regulatory backlash moving forward, as seen with OpenAI in the US and the EU. In addition, the newly restructured company will also need to vie with SenseTime Group (OTCPK:SNTMF) and Baidu (BIDU) in the rapidly changing AI landscape.

While past performance may not be indicative of future results, BABA may remain a battleground stock after all.

Then again, the stock continues to trade very attractively at these compressed levels, with an impressive book value of $56.24 per share (+2.8% QoQ/ inline YoY). This is thanks to its robust balance sheet at $76.36B (+1.4% QoQ/ +6.3% YoY) and sustained share repurchases to its current shares outstanding of 2.61B (-60M YoY) by the latest quarter.

Combined with the fresh start and improved fundraising capability from the ongoing restructuring, BABA appears to be extremely well capitalized for its future endeavours indeed.

So, Is BABA Stock A Buy, Sell, or Hold?

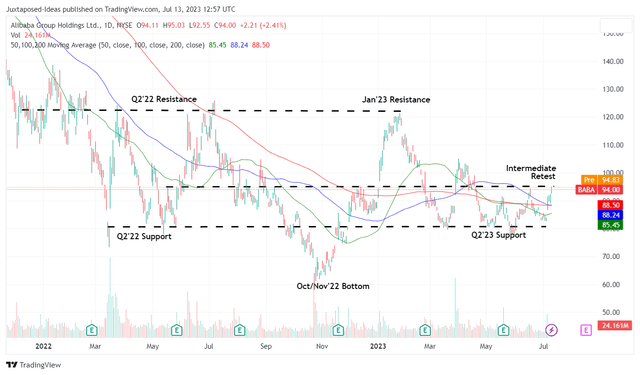

BABA 2Y Stock Price

TradingView

For now, anyone hoping for a quick return to BABA’s previous stock prices of nearly $300 may be sorely disappointed, especially with the uncertain reopening cadence in China.

Therefore, we reckon the stock may be more suitable for quick trades between $80s and $95s momentarily, otherwise known as the swing trade pattern, prior to the stock’s speculative recovery if the geopolitical risks are lifted, potentially from 2025 onwards once the US presidential election is concluded.

Naturally, it is also unknown if these headwinds may be fully resolved or further intensified moving forward. This cadence suggests the BABA stock’s highly speculative nature, compared to its more stable US counterparts, such as Amazon (AMZN) trading at NTM EV/ Revenues of 2.54x/ NTM P/E of 77.63x, Alphabet (GOOG) at 4.67x/ 22.27x, and Microsoft (MSFT) at 10.90x/ 32.54x, respectively.

As a result of its mixed prospects, we continue to rate the BABA stock as a Hold (Neutral) here.

Then again, anyone who continues to hold to BABA through the volatility thus far, probably have strong hands, implying their willingness to wait out the storm. With most of the geopolitical headwind and ADR risk already baked in, it appears that the current Q2’23 levels may also provide a long-term floor for anyone looking to trade.

Assuming that BABA is able to revert to a more geopolitically neutral forward P/E valuations of 20x, we may see its long-term price target rise to $189, implying a nearly doubled upside potential from current levels. It goes without saying that this speculative investing strategy is not for the faint hearted, with this great upside coming with great risks.

Read the full article here