Investment Thesis

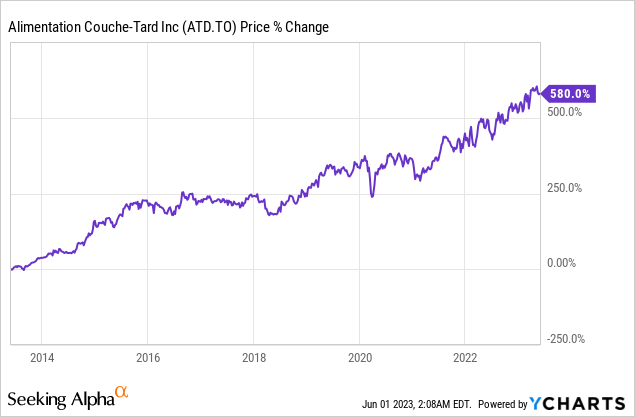

Alimentation Couche-Tard (TSX:ATD:CA) is a lesser-known compounder that performed extremely well in the past decade, with shares up 580% during the period. Despite trading near its historical high, I believe the company is still one of the best SWAN (sleep well at night) stocks to own currently.

The company operates in a massive and resilient industry that provides ample room for expansion. The ongoing industry consolidation also provides further growth opportunities. The company is capitalizing on this through multiple acquisitions, which should accelerate its growth and presence moving forward. While the share price has risen significantly, the current valuation remains very reasonable at just mid-teens PE. Considering this and the strong fundamentals, I believe the company should have more room to run.

A Massive And Resilient Industry

Alimentation Couche-Tard is a global c-store (convenience store) operator with notable brands such as Circle-K, Couche-Tard, and Ingo. The company currently has 14,000 stores in 28 countries across the globe, making it one of the leaders in the industry. While the company has grown meaningfully in the past decade, its market opportunity remains huge.

C-store is a surprisingly massive market. According to Grand View Research, the global TAM (total addressable market) of C-stores is forecasted to grow from $2.23 trillion in 2022 to $3.12 trillion in 2028, representing a CAGR (compounded annual growth rate) of 5.6%. According to Statista, the US alone accounts for roughly $663.5 billion of the market with fuel and inside sales contributing 61.1% and 38.9% respectively.

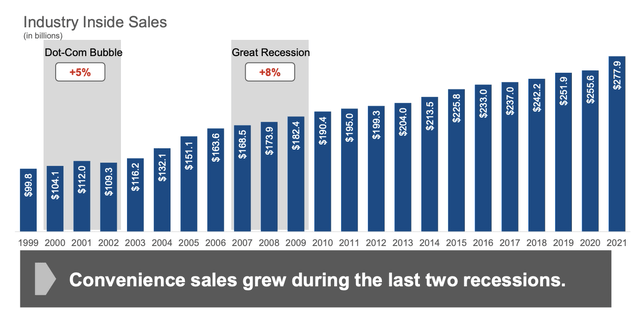

The industry is also highly resilient, as most inside sales are contributed by cigarettes, snacks, and beverages, which are all very sticky products. From the chart below, you can see that inside sales have been growing steadily despite facing the dot-com bubble and the great financial crisis. Fuel sales are also generally very consistent as it is non-discretionary.

Alimentation Couche-Tard

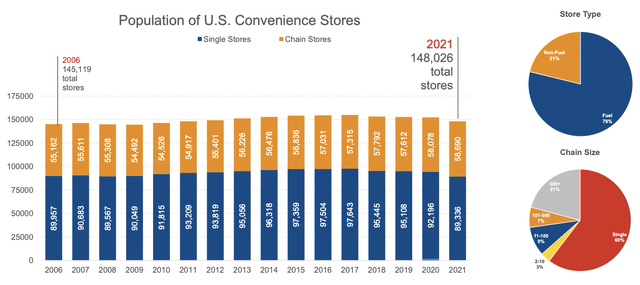

Growing Through Acquisitions

Besides organic market expansion, the C-store industry also presents huge growth opportunities through ongoing consolidation. The industry is currently very fragmented, especially in the US where 60% of stores are single stores, as shown in the chart below. Despite the size of Alimentation Couche-Tard, its market share in the US is still standing at just 5%. The market share of current leader Seven & i Holdings (OTCPK:SVNDY) is also only at 8.5%, which leaves substantial room for expansion through consolidation.

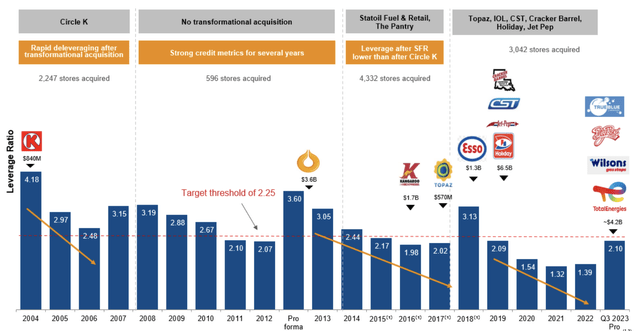

In order to capture these growth opportunities, the company has been going through an acquisition spree lately. In the past few months, it spent roughly $4.2 billion to acquire multiple stores from 4 companies, which include Big Red Stores, Mapco Express, True Blue Car Wash, and Total Energies.

Alimentation Couche-Tard

Through the Big Red Stores and Mapco Express deal, the company will add a total of 157 US fuel and retail sites to its portfolio, which will subsequently be rebranded into Circle-K post transaction. True Blue Carwash currently owns 65 car washes with nearly 170,000 fast-pass subscription members, which should help the company further expand its car wash network. Most of the acquired car washes are also near a Circle-K, which should provide solid synergies.

The €3.1 billion acquisition of some of Total Energies’ retail assets is a huge growth driver in my opinion. Total Energies owns 2,193 stores in Europe, with roughly half in Germany and the rest spreading across the Netherlands, Belgium, and Luxembourg. 975 sites also include car wash operations. The deal allows the company to grow its store count by 15% and expand into 4 new countries, which significantly increases its presence in Europe.

After the recent deals, the company’s leverage ratio is still only at 2.1x, which is below its target of 2.25x and offers ample financial flexibility for more acquisitions. I believe these acquisitions strengthen the company’s growth prospects and we will likely see more of them coming in the future.

Alimentation Couche-Tard’s Leverage Ratio (Alimentation Couche-Tard)

Modest Valuation

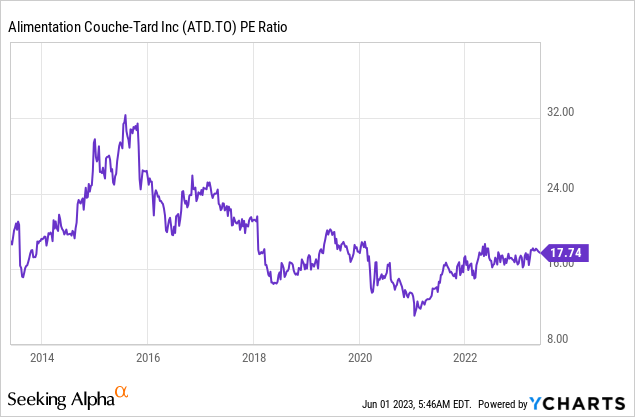

Despite the ongoing increase in share price, Alimentation Couche-Tard’s valuation is still pretty compelling in my opinion. As shown in the first chart below, the company is currently trading at a PE ratio of 17.7x, which is near the lower end of its historical range.

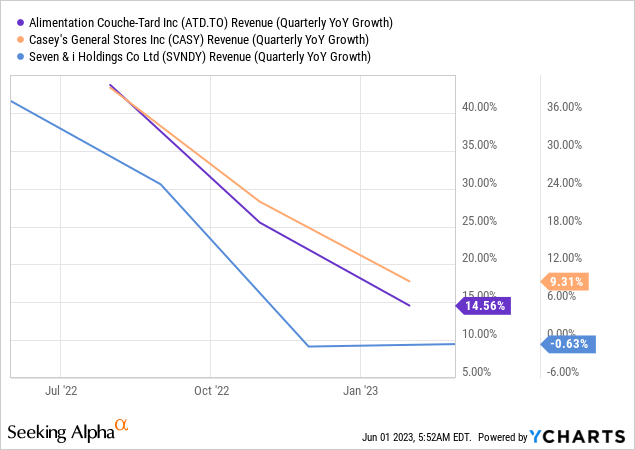

The current multiple is also slightly lower than other C-store companies such as 7-Eleven and Casey’s General Stores (CASY), which have a PE ratio of 18x and 18.8x respectively. I believe the current multiple is a bit compressed when considering its revenue growth. From the second chart below, you can see that the company’s growth of 14.6% in the recent quarter is meaningfully higher than peers’ 9.3% and negative 0.6%. Considering the backdrop, I believe the company deserves a higher multiple which should translate to further upside.

Investors Takeaway

Overall, I believe Alimentation Couche-Tard should continue to perform well in the long run. Its TAM is massive and the market’s fragmented nature also presents further growth opportunities through acquisitions.

The increasing adoption of EVs is a potential concern as it may reduce the foot traffic of gas stations. However, I am not too concerned at the moment as the company is already implementing EV chargers in some of its sites in Europe. During the pilots, the company also saw that the longer charging time often leads to higher in-store traffic, which should be beneficial for inside sales. Considering its solid fundamentals and modest valuation, there should still be ample upside potential and I rate the company as a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here