A Quick Take On Alithya Group

Alithya Group Inc. (NASDAQ:ALYA) reported its FQ4 2023 financial results on June 8, 2023, producing revenue growth of 13.5% year-over-year.

The firm provides a range of digital technology consulting, strategy and advisory services for companies in Canada and internationally.

Given the macroeconomic challenges its clients are increasingly facing, and the resulting challenging revenue growth environment, my outlook on Alithya Group Inc. in the near term is Neutral [Hold].

Alithya Group Overview

Montreal, Canada-based Alithya Group Inc. was founded in 1992 to provide strategy and digital technology consulting services to companies in Canada, the U.S. and Europe.

The firm is headed by president and CEO Paul Raymond, who joined the firm in 2011 and was previously SVP of Business Engineering at CGI and an officer in the Department of National Defense.

The company’s primary offerings include the following:

-

Strategic consulting

-

Digital transformation

-

Organizational performance

-

Enterprise architecture

-

Application services.

Alithya acquires customers via its direct sales and marketing efforts, and through partners and referrals.

Alithya Group’s Market & Competition

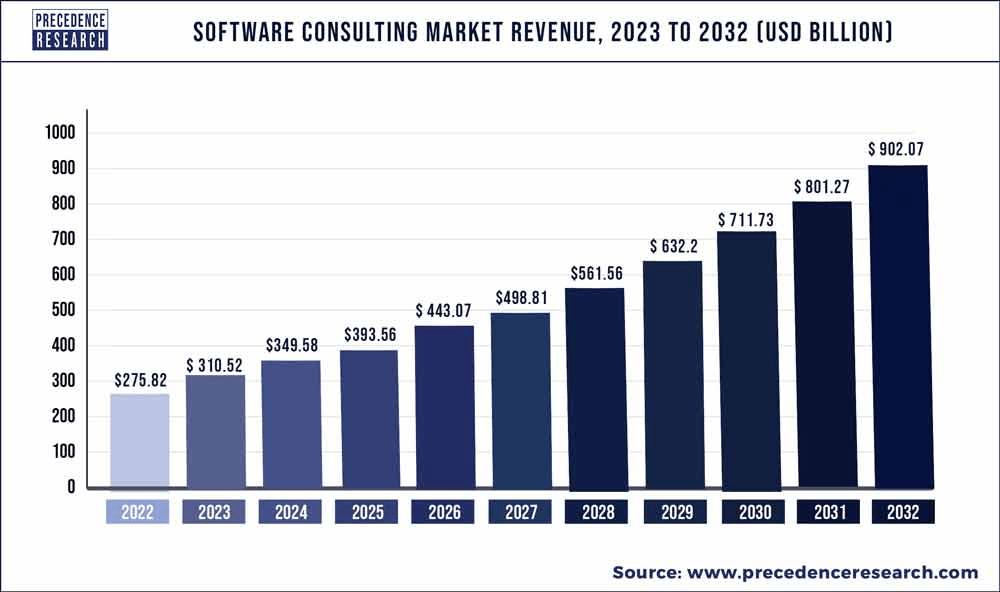

According to a 2023 market research report by Precedence Research, the global market for IT consulting was estimated at $276 billion in 2022 and is forecasted to reach $902 billion by 2032.

This represents a forecast CAGR (Compound Annual Growth Rate) of 12.58% from 2023 to 2032.

The main drivers for this expected growth are an increasing preference for the digitization of business processes across every industry in order to increase efficiency and support revenue growth.

Also, the chart below shows the software consulting market trajectory forecast through 2032:

Software Consulting Market (Precedence Research)

Major competitive or other industry participants include:

-

Accenture

-

Atos SE

-

Capgemini

-

CGI Group

-

Clearfind

-

Cognizant

-

Deloitte Touche Tohmatsu

-

Ernst & Young

-

Infosys

-

International Business Machines Corp.

-

Oracle Corp.

-

PricewaterhouseCoopers

-

Rapport IT

-

SAP SE

-

Others.

Alithya’s Recent Financial Trends

-

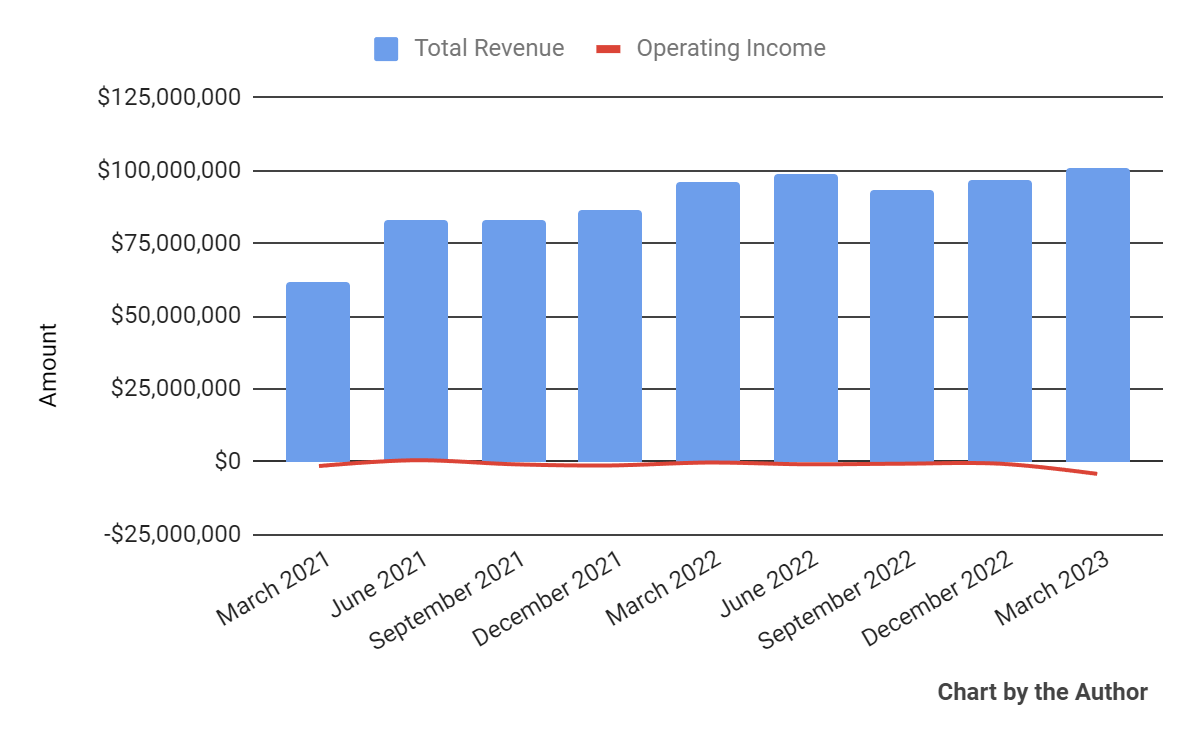

Total revenue by quarter has risen per the following chart; Operating income by quarter has dropped recently:

Total Revenue and Operating Income (Seeking Alpha)

-

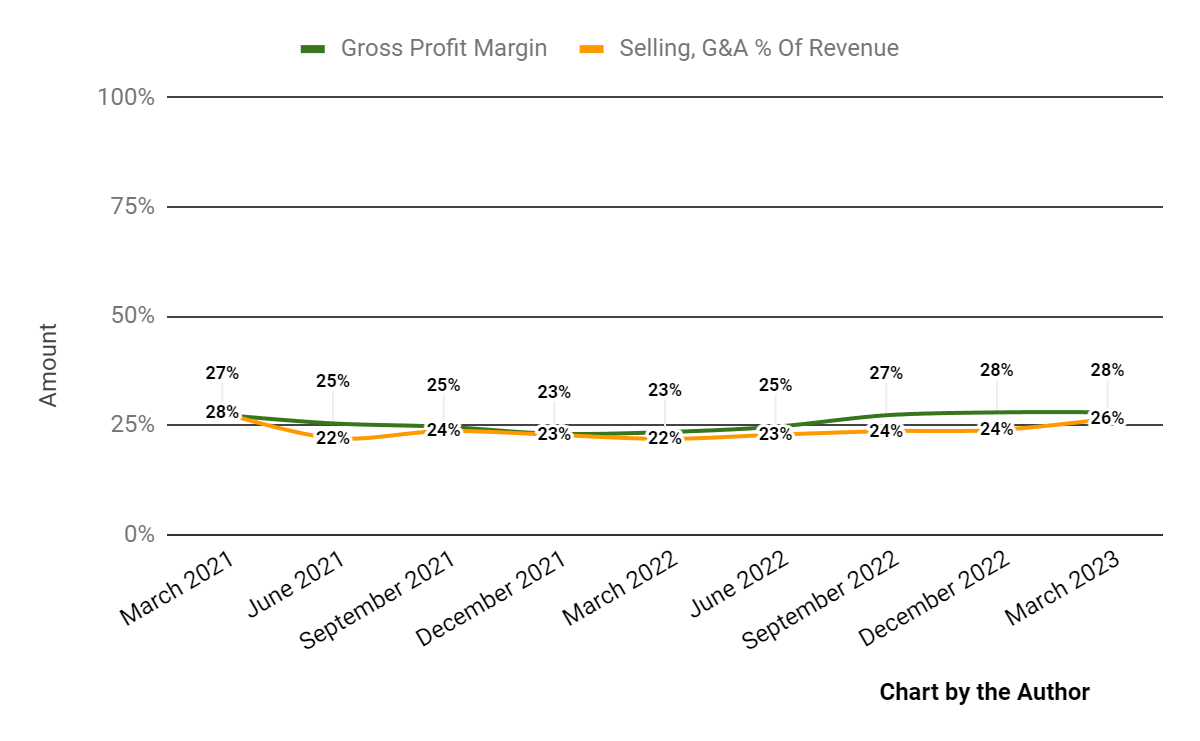

Gross profit margin by quarter has risen recently; Selling, G&A expenses as a percentage of total revenue by quarter have also risen, indicating lower efficiency in generating incremental revenue.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

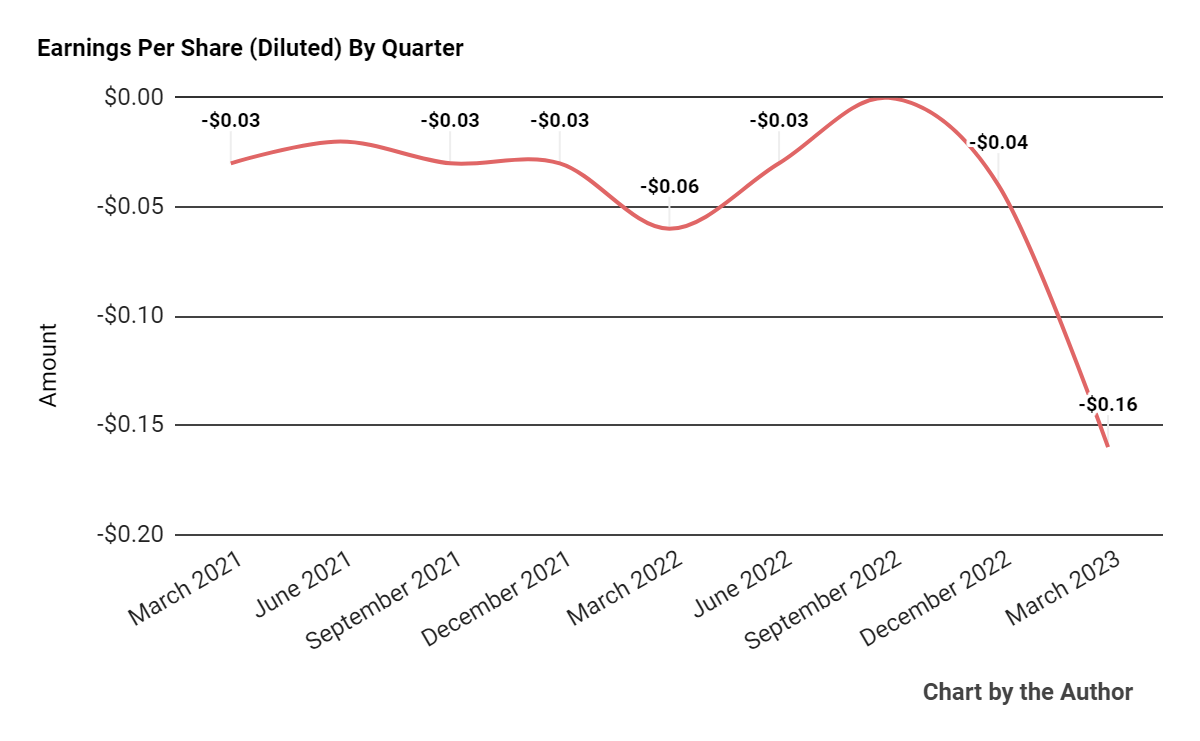

Earnings per share (Diluted) have dropped sharply recently.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

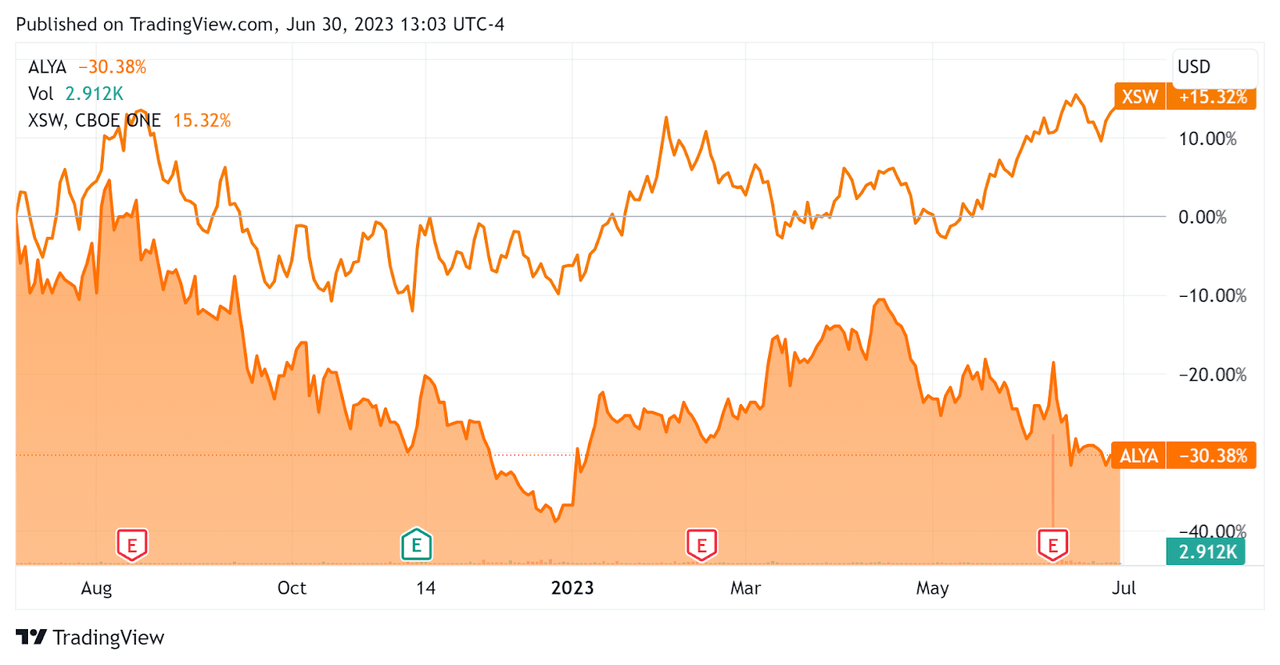

In the past 12 months, ALYA’s stock price has fallen 30.38% vs. that of the SPDR® S&P Software & Services ETF’s (XSW) rise of 15.32%, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $16.7 million in cash and equivalents and $94.1 million in total debt, of which $9.5 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $20.1 million, during which capital expenditures were $1.3 million. The company paid $5.0 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For Alithya

Below is a table of relevant capitalization and valuation figures for the company.

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.6 |

|

Enterprise Value / EBITDA |

19.0 |

|

Price / Sales |

0.4 |

|

Revenue Growth Rate |

19.4% |

|

Net Income Margin |

-5.8% |

|

EBITDA % |

3.4% |

|

Net Debt To Annual EBITDA |

5.2 |

|

Market Capitalization |

$155,860,000 |

|

Enterprise Value |

$248,760,000 |

|

Operating Cash Flow |

$21,370,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.23 |

(Source – Seeking Alpha.)

As a reference, a relevant partial public comparable would be CGI Inc. (GIB); shown below is a comparison of their primary valuation metrics.

|

Metric [TTM] |

CGI |

Alithya Group |

Variance |

|

Enterprise Value / Sales |

2.6 |

0.6 |

-75.2% |

|

Enterprise Value / EBITDA |

14.7 |

19.0 |

29.1% |

|

Revenue Growth Rate |

10.3% |

19.4% |

87.3% |

|

Net Income Margin |

11.2% |

-5.8% |

–% |

|

Operating Cash Flow |

$1,470,000,000 |

$21,370,000 |

-98.5% |

(Source – Seeking Alpha.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

ALYA’s most recent Rule of 40 calculation was 22.8% as of FQ4 2023’s results, so the firm is in need of improvement in this regard, per the table below.

|

Rule of 40 Performance |

FQ4 2023 |

|

Revenue Growth % |

19.4% |

|

EBITDA % |

3.4% |

|

Total |

22.8% |

(Source – Seeking Alpha.)

Commentary On Alithya Group

In its last earnings call (Source – Seeking Alpha), covering FQ4 2023’s results, management highlighted passing half a billion dollars [CAD] in annual revenue run rate and bookings reaching CAD$124 million.

In the U.S., the company is seeing some “software providers getting out of the services business to focus on higher-margin product sales. We see this as a very positive development for us.”

Notably, its subscription-based software offerings now represent 12% of total revenue, compared to 6.7% a year earlier.

Management didn’t disclose any company, customer or employee retention rate metrics; the company is focusing on converting subcontractors to employees as it seeks to reduce effective costs and improve margins.

Total revenue for FQ4 rose 5.0% year-over-year, and gross profit margin increased by 4.5 percentage points.

Selling, G&A expenses as a percentage of revenue grew 4.6 percentage points, indicating reduced revenue generation efficiency.

Operating losses worsened substantially due to one-time, non-cash write-downs.

Looking ahead, management did not provide forward guidance, other than to say it continues to reduce debt and plans to begin seeking growth through acquisition in the future.

The company’s financial position is only moderate, with limited liquidity, material debt but positive free cash flow.

ALYA’s Rule of 40 performance has been only middling.

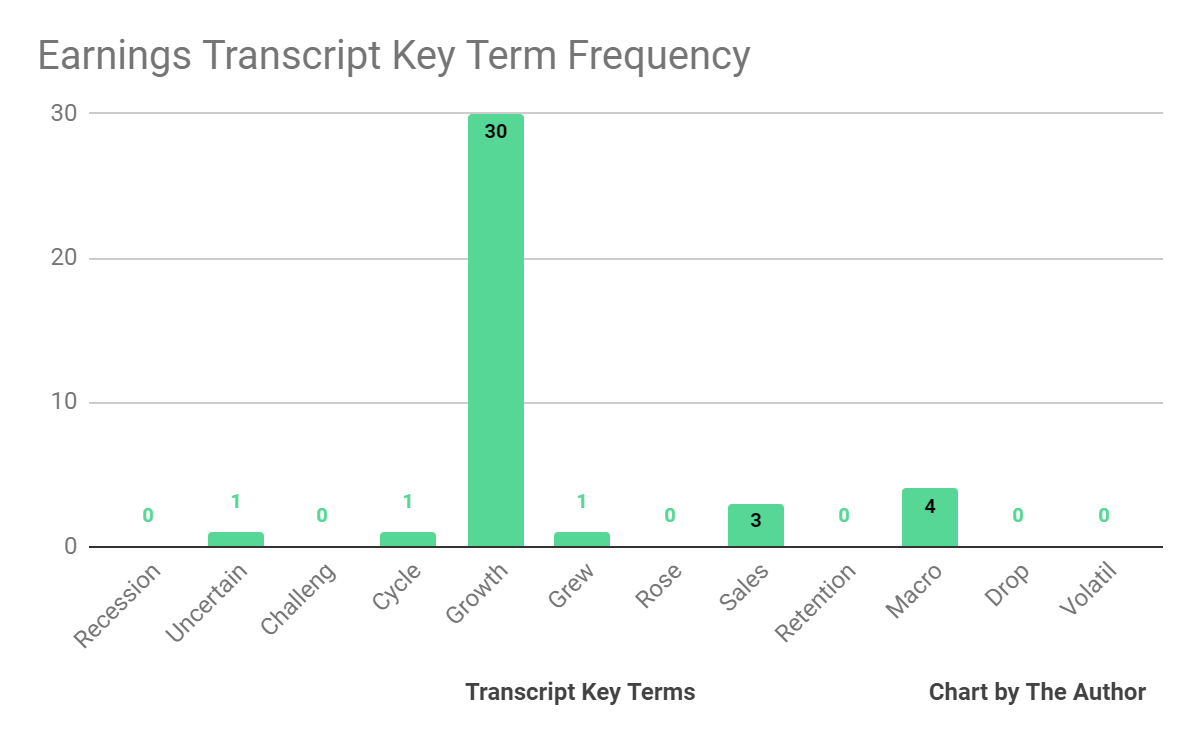

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited “Uncertain” once and “Macro” four times.

The negative terms refer to the firm’s exposure to financial services firms and the growing negative macroeconomic pressures on that sector.

Compared to the Seeking Alpha IT Consulting & Other Services industry average EV/EBITDA multiple of 16.32x, the firm is currently being valued by the market at a multiple of 19.0x, a premium to the industry index.

While the firm posted trailing twelve-month revenue growth of 19.4%, the IT Consulting & Other Services index averaged 16.5% for the same period.

So, the company is being valued higher than the market index as it has grown faster. However, the next twelve months’ growth rate for the index is expected to be only 9.3%.

My expectation is for Alithya to produce slower growth rate as clients reduce their spending via project deferrals and discretionary spend reduction or elimination.

Given the macroeconomic challenges its clients are increasingly facing, and the resulting challenging revenue growth environment, my outlook on ALYA in the near term is Neutral [Hold].

Read the full article here