The saddest aspect of life right now is that science gathers knowledge faster than society gathers wisdom. – Isaac Asimov

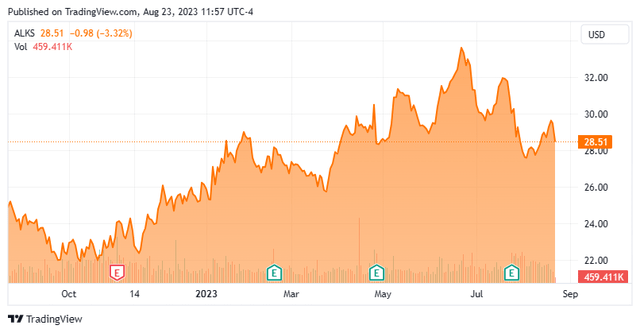

Today, we put Alkermes plc (NASDAQ:ALKS) in the spotlight. The company has had news on many fronts in recent months, including a fight with an activist investor and an upcoming spinoff of its oncology assets. Where will the stock go from here? An analysis follows below.

Seeking Alpha

Company Overview:

Alkermes plc is a specialty and generic drugmaker headquartered in Dublin, Ireland. The company manufactures products to satisfy the unmet medical needs of patients in the fields of neuroscience and oncology. The company’s product line is focused on alcohol dependence, opioid dependence, schizophrenia, and bipolar I disorder. Alkermes also has a pipeline of product candidates in development for neurological disorders and cancer. The shares currently trade just under forty bucks a share and have an approximate market capitalization of $4.9 billion.

The company has three main proprietary products on the market: VIVITROL, ARISTADA, and LYBALVI. The majority of Alkermes’ current sales, however, come from both royalties and manufacturing revenues (primarily from INVEGA and VUMERITY).

Alkermes also has several compounds in its Neuroscience pipeline, the most advanced of which is targeting Schizophrenia or Bipolar I Disorder (pediatric) and is in late-stage development. It also has several oncology-focused drug candidates in its pipeline as well. The most advanced of which is targeting Platinum-Resistant Ovarian Cancer and is in Phase 3 development.

Late last year, the company announced that it was planning to break off its development-stage oncology pipeline into a separate company while retaining its existing commercial-stage neuroscience business. Alkermes hopes to have this completed sometime before the end of 2023. This should lower the company’s R&D costs significantly (which were $100.8 million in the second quarter) when executed. This spinoff Mural Oncology will also require $200 million to $300 million of capital from Alkermes.

There is also something of a soap opera angle to this story. Sarissa Capital Management, an activist investor in the shares since 2021 started to get more aggressive with its holdings of 14 million shares (as of March). The fund manager believes the company’s current CEO is a major impediment to unlocking shareholder value. In May, Sarissa put forth three nominees for new board seats, which Alkermes’ management declined to endorse. Sarissa won a proxy battle against Amarin (AMRN) earlier this year and got a slate of new directors appointed to their board. However, in late June, Sarissa lost its battle to get its nominees on the board at Alkermes.

Second Quarter Results:

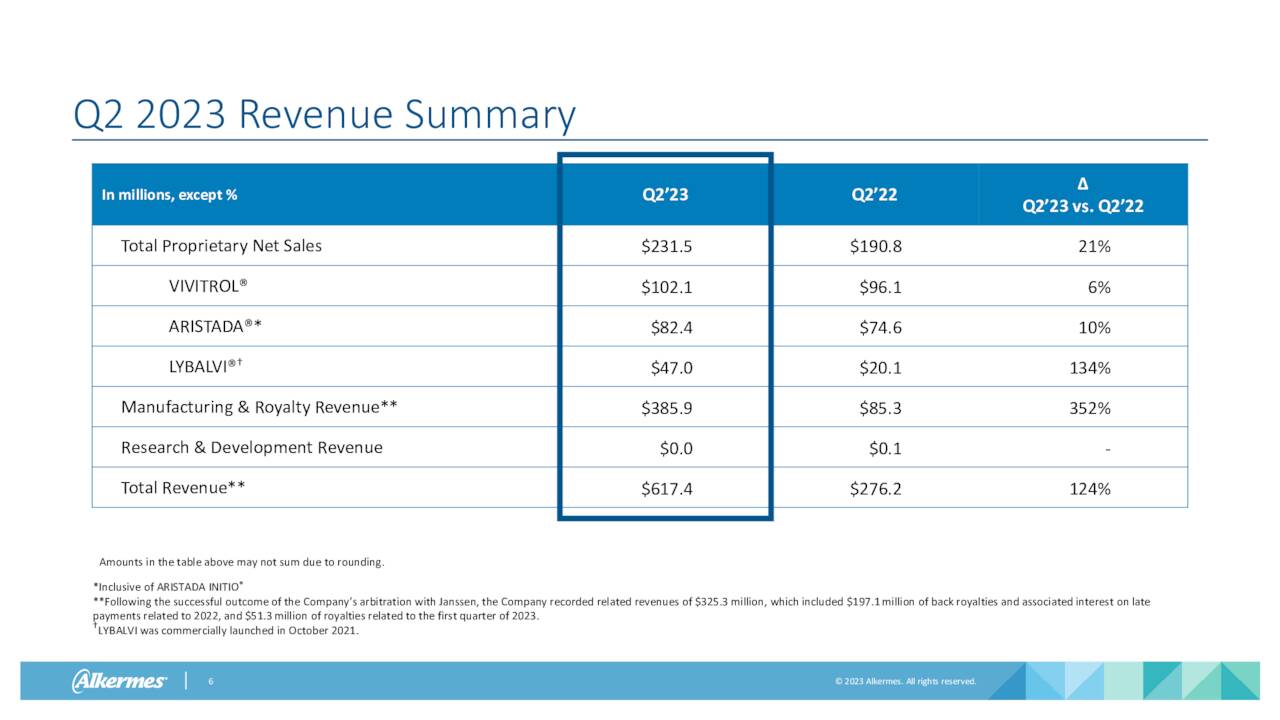

Alkermes reported second quarter numbers on July 26th. The company had non-GAAP profits of 55 cents a share, nearly a dime a share under expectations. This happened even as year-over-year revenues surged by more than 120% on a year-over-year basis to $617.4 million, just under $135 million above the consensus.

July Company Revenues

It is important to note that $248.4 million of these sales were due to back royalties and interest connected to long-acting INVEGA which is the result of a lawsuit against Janssen that Alkermes recently prevailed in. VUMERITY royalties/manufacturing revenues came in at $32.3 million, up from $26.2 million in the same period a year ago.

Alkermes did see revenue growth from all three of its proprietary products, with a big increase from LYBALVI. Sales from this product, used to treat adults with schizophrenia and bipolar I disorder, were up 133% from the same period a year ago and 24% sequentially from 1Q2023.

July Company Overview

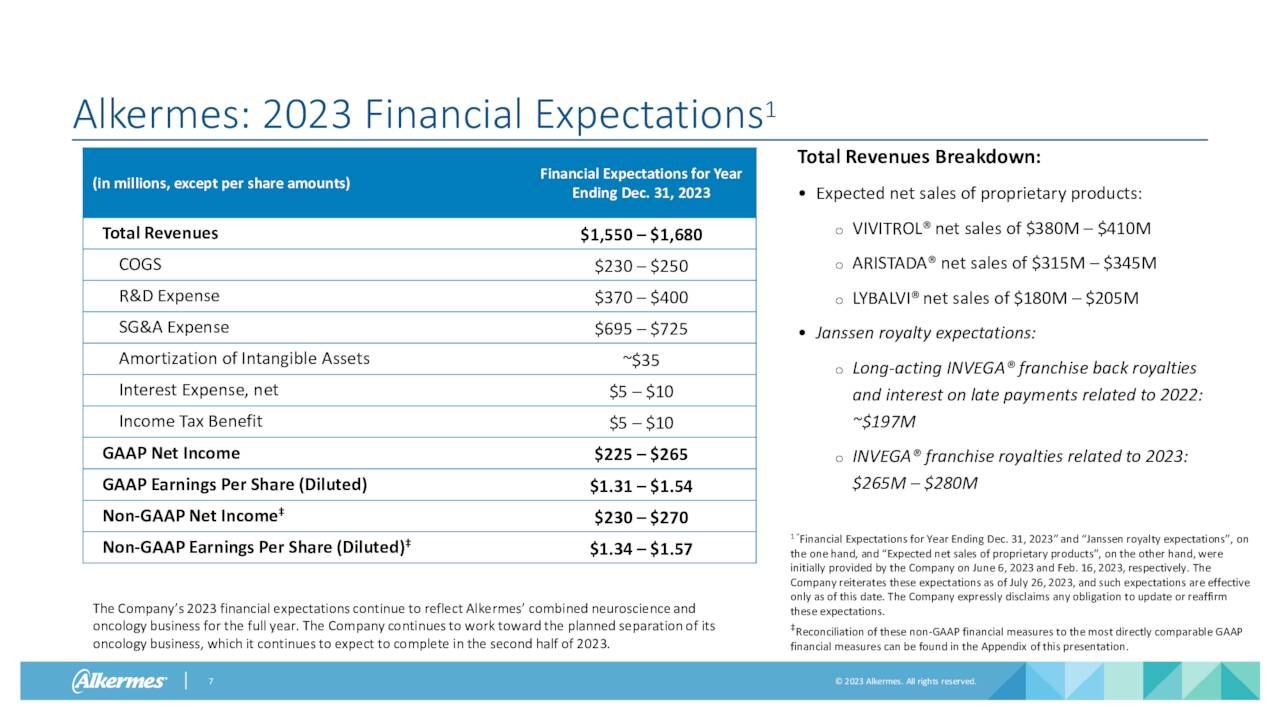

Factoring in the recent litigation win against Janssen, which is a division of Johnson & Johnson (JNJ), management provided the following forward guidance for the rest of FY2023.

July Company Presentation

Analyst Commentary & Balance Sheet:

The analyst community collectively believes the shares are overvalued. Six analyst firms including JPMorgan and Stifel Nicolaus have reissued Hold/Neutral ratings on Alkermes since late April. Four analyst firms, including Jefferies and Goldman Sachs, have maintained Buy/Outperform ratings on the stock. However, price targets proffered by the ‘optimists’ range from $37 to $48 a share.

Approximately four percent of the outstanding float in the shares are currently held short. Three insiders sold just over $2.1 million worth of shares collectively in May and June. It was the only insider activity in the stock so far in 2023. The company ended the second quarter with just over $900 million in cash and marketable securities against total debt of $292 million.

Verdict:

The company made 34 cents a share on $1.11 billion in sales in FY2022. The analyst firm consensus is that earnings shoot up to just over $1.50 a share this year as revenues rise just over 45%. In FY2024, they see sales slipping in the high single digits but profits moving up to just over two bucks a share.

There is a lot of noise around Alkermes at the moment between an upcoming spinoff, the recent settlement around INVEGA, and a board battle that has left a disgruntled activist investor. The stock is selling at a not unreasonable three times forward sales and just over 13 times FY2024’s projected profits.

That said, I am somewhat conflicted on ALKS at the moment. In addition, a new set of fresh data points and management guidance is due out with third quarter results shortly. Therefore, I am withholding any investment recommendation around Alkermes at the moment.

Any fool can know. The point is to understand. – Albert Einstein

Read the full article here