After completing the reverse stock split, Spire Global (NYSE:SPIR) shares caught my eye. Analyzing the company’s growth over the years, both in terms of financial performance and product, I have good reasons to believe that this company is prime material for an asymmetrical bet. Notably, the gross margin is extremely high, providing a strong foundation for the company to become profitable within the next 2-3 years. Additionally, we are already nearing significant financial milestones, with management showing their capability to meet the goals previously presented to investors.

With a market capitalization of just $122 million, the potential upside is very high when one starts to seriously analyze the results the company could produce in the coming years. Additionally, they maintain a solid financial position, which will further improve as the company begins to generate cash from its core business.

Company Overview

Spire operates a constellation of nanosatellites. They are not optical satellites like those of ICEYE, Maxar, or Capella Space. They are radio occultation satellites, which use radio waves to study the Earth’s atmosphere. This produces data that’s distinct from optical satellites, suited for different and very practical use cases.

Spire Global provides solutions beneficial for various industries:

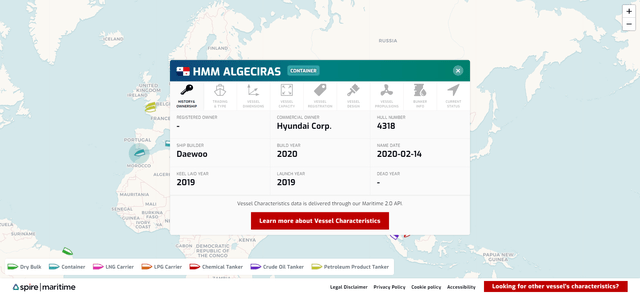

- Maritime Industry – Not only can ships be tracked in terms of location, but also their characteristics, their routes, and operations in the ports;

- Weather – Radio occultation satellites excel in studying temperature, humidity, and other atmospheric variables to make weather forecasts. Studies conducted by the ECMWF, NOAA, and NCAR prove that radio occultation technology can significantly improve the reliability of weather forecasts;

- Aviation – Spire Global’s EURALIO program for the aviation industry provides advanced fleet tracking solutions and aims to introduce new tools. For instance, the company now claims to predict turbulence and even the strength of turbulence;

- Finance – Although the company doesn’t expressly discuss it, this is an almost obvious use case. The vast amount of climate data collected from their satellites is literally alpha-as-a-service when it comes to studying agricultural commodities markets.

Whether it’s assisting an investment bank in trading cocoa futures or preventing a cargo ship from falling victim to Somali pirates, there’s no doubt the company offers a valuable product.

Spire’s Vessel Tracking Tool – Live Demo

SWOT Analysis

Being a nascent and rapidly expanding industry, there are plenty of opportunities but also many uncertainties “orbiting” the world of satellites. This uncertainty is clearly a problem only up to a point: where there’s uncertainty, as always, there’s potential for market asymmetries.

Opportunities and Strengths

Spire’s main strength is that it’s, for now, the only true benchmark for the satellite-to-cloud service tied to radio occultation satellites. There’s no real competition for this specific service, allowing Spire to maintain extremely high margins. The current gross profit margin is around 60-65%, and the company believes it can reach 70% in the coming years.

Another significant advantage is their ability to defend their competitive edge through AI and machine learning algorithms that turn satellite observations into useful and accessible data. This means it wouldn’t merely suffice to create the same satellite constellation to offer the same service.

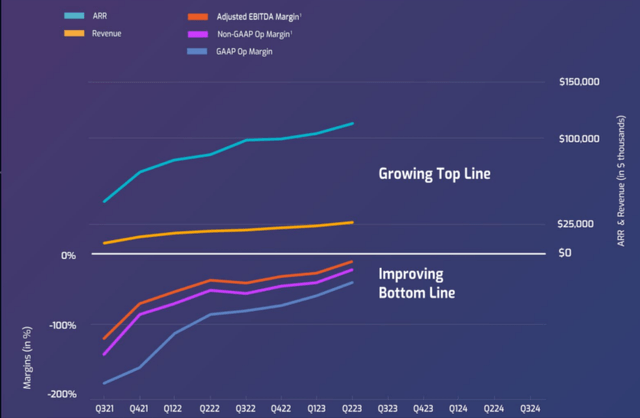

Another essential point to emphasize is that the company’s business model allows it to generate ARR rather than spot sales. On this, there are two important metrics to note from the latest earnings call:

- The annual retention rate is currently over 110%, meaning the added value of existing contract expansions exceeds the churn rate value;

- As of June 30, 2023, the ARR value was $112.8 million.

Spire Global – Q2 2023 Earnings Presentation

Weaknesses and Threats

More than weaknesses and threats in the classic sense of these terms, the main issue for Spire is to make customers perceive the value of their products and the solutions the company is able to offer. Data from radio occultation satellites are harder to interpret compared to simple images, so not all potential customers understand how they might benefit from this product.

The company lives off an “indirect adoption” process, at least when the customer is not directly involved in meteorology. Through APIs, external developers can integrate the data into their platforms – for example, ship tracking data can be integrated into a broader fleet management platform.

Fortunately, demo functionalities have been extended in recent quarters, even live on Spire’s website, focusing heavily on data processing, not just collection. Given that the last quarter ended with 813 customers compared to 692 last year, it seems the decision is paying off commercially.

There remains a significant unknown represented by the TAM (Total Addressable Market). Being the only company that operates this specific service, within the broader framework of the emerging satellite big data sector, it’s very difficult to put a number on Spire’s actual potential. Fortunately, the market capitalization is so low that it doesn’t matter whether the TAM for data from radio occultation satellites is $5 billion or $15 billion. What matters is that there’s plenty of room for the company to grow, both in terms of top-line and bottom-line.

Financial Analysis

When analyzing Spire Global’s financials, it’s essential to bear in mind that the company is still extremely young. Consequently, even if trends are emerging, we’re still in a phase where growth takes precedence over profitability. And considering that the company aims for a gross profit margin of 70% with customers that remain loyal to the service for several years, it’s a perfectly logical approach.

Income Statement

Below are the really important numbers to focus on at the moment (data in $ million, source Seeking Alpha):

|

2019 |

2020 |

2021* |

2022 |

TTM |

|

|

Revenue |

18.5 |

28.5 |

43.4 |

80.3 |

93.5 |

|

COGS |

14.9 |

10.3 |

18.7 |

40.3 |

40.9 |

|

OpEx |

30.7 |

43.6 |

85.9 |

108.5 |

109.7 |

|

EBITDA |

-17 |

-19.9 |

-52.1 |

-50.2 |

-40.2 |

|

Gross profit margin |

19.46% |

63.86% |

56.91% |

49.81% |

56.26% |

|

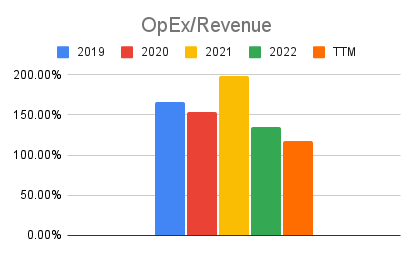

OpEx/Revenue |

165.95% |

152.98% |

197.93% |

135.12% |

117.33% |

|

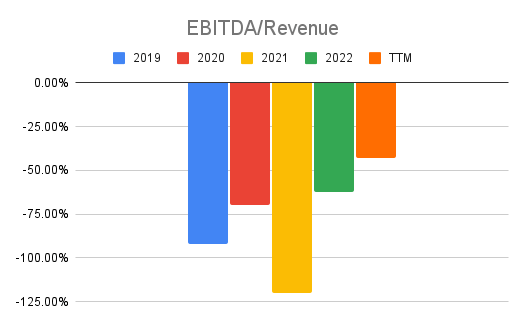

EBITDA/Revenue |

-91.89% |

-69.82% |

-120.05% |

-62.52% |

-42.99% |

*2021 was marked by merger costs to complete the SPAC

Chart created by the author – Data Source: Seeking Alpha

The things to note are:

-

The growth rate remains excellent, even if there’s a delay between the contracted annual recurring revenue and the moment when those contracts effectively turn into revenue. As already mentioned, the contracted ARR is currently $112.8 million, and the company plans to close the year at $132 million;

-

OpEx is stabilizing, growing noticeably less than revenue in recent quarters. The company also undertook a cost-cutting program to approach GAAP EBITDA positive more quickly. The last quarter closed with an OpEx increase of $0.8 million year-on-year, against a revenue increase of $6.1 million;

-

R&D expenses have grown much slower than revenues, especially in the last six quarters.

Chart created by the author – Data Source: Seeking Alpha

That said, it’s very unlikely that the company will achieve GAAP EBITDA positive before 2028. Fortunately, the cash flow situation is much better, with Spire expecting to produce positive cash from operating activities as early as next quarter. Moreover, it aims to become FCF positive in the second or third quarter of 2024, which would be exceptionally good for the company’s valuation.

Debt and Liquidity

Spire closed Q2 2023 with $97.8 million in current assets. With only $40.4 million of current liabilities, of which $21.9 million is unearned revenue, the company has a strong foundation to minimally dilute shareholder ownership before becoming FCF positive. In the last earnings call, it was highlighted that, cautiously and on days when trading volumes and stock performance are good, some of the shares registered last year are sold to ensure a good balance of liquidity sources.

Given that from the end of 2023, the company will also be able to produce cash from its operations, ownership dilution shouldn’t be a concern. The company has still $130 million in credit facilities not in use, and in the last quarter they were able to burn just $3.7 million with as little as $8.3 million coming from financing. Cash burn used to be a concern, but it the last couple of quarters we have really seen the effects of the spending review program. With the company now a lot more focused on profitability, the cash burn has been reduced dramatically.

Downside Risk

The main risks associated with this analysis are four, which I list in order of risk and impact:

- Competitors providing images from optical satellites might decide to diversify their operations and enter the radio occultation satellite market, increasing competition in an as-yet small market segment.

- Spire might not be able to maintain its growth rate over the coming years, which would jeopardize its ability to achieve a positive GAAP net income. A 25-35% annual growth rate, at this time, is essential to make operations profitable by 2025-26.

- Even if there are no direct substitute technologies for radio occultation satellites, their utility could be overshadowed by improvements in the capabilities of optical satellites combined with AI-based predictive algorithms.

- For now, regulations have been favorable to companies managing satellite constellations, but in the future, new rules might arise necessitating greater R&D expenditures and increased COGS. One example is possible anti-debris regulations, but this is the least immediate risk at present.

While these are existing and significant risks, the ones with the most substantial impact – the entry of new competitors and the downsizing of the growth rate – have a low likelihood of occurrence. No competitor in the optic satellites-as-a-service sector is large enough to consider allocating significant resources to enter the radio occultation satellite world, knowing that the capex would be substantial and that it would take years to generate profits. Thus, it’s very likely that the market will remain under Spire’s control and that the company will be able to maintain its growth rate due to the absence of true competitors.

Opinions and Final Conclusions

Spire Global is showing an excellent growth rate, both in revenues and margins. The company is in the final stages of using liquidity sources that dilute shareholder ownership and is about to start generating cash from its operations. The prospect of achieving a positive operating margin and FCF by the end of 2024 is another critical factor for my rating.

There’s a solid foundation to sit tight and let time take its course. With this growth rate, these margins, and this retention rate, it’s just a matter of time. When it becomes possible to use a DCF model to value the stock, I believe Wall Street will begin to focus seriously on Spire.

No significant catalysts are needed, just for the company to continue doing what it’s already doing. So far, the company has performed better than the management’s guidance, and there’s no reason to believe things will change in the future.

For those interested in small caps with great potential in the space sector, I also recommend reading my analysis of Terran Orbital: the prospects are very similar to Spire’s.

Read the full article here