Last month, I detailed how the crash in shares of movie theater chain AMC Entertainment (NYSE:AMC) would limit the company’s turnaround potential. With management looking to sell equity to help a very distressed balance sheet, every dollar the stock declined meant less funds coming in. Recently, the company finished off its equity sales program, and the result was even more disappointing than I originally thought. As a result, shareholders are likely to see even more dilution in the coming years than previously projected.

Right before the reverse split took place, AMC shares were trading at $4, which would have meant a price of $40 after the 1 for 10 split went through. With management looking to sell 25 million shares, this meant the outside possibility of a one billion dollar equity raise. The resulting stock drop I covered previously was to around $2.50, which meant with no other fall in shares, the company could raise around $625 million.

AMC has been looking at ways to improve its financial situation in recent years. With the movie business getting hurt tremendously by the coronavirus, the company found its debt pile surging. At the end of Q2, the net debt amount was nearly $4.4 billion, with about two-thirds of that coming due in 2026. Management has reduced the amount of total debt that it owes, but that was primarily as a result of draining the cash balance.

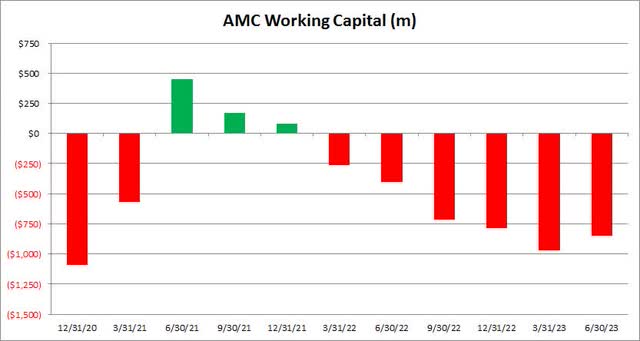

In the near term, however, the bigger issue is probably the working capital balance. This key balance sheet metric is the amount of current assets the company has minus its current liabilities. A negative number here means you have a lot more bills coming due in the next 12 calendar months than you have the ability to pay back. As the chart below shows, working capital has been quite negative for AMC over the past six quarters.

AMC Working Capital (Company Filings)

At the end of Q2, AMC had negative working capital of nearly $850 million. Ignoring the debt pile for a minute, an equity raise of more than half of billion dollars would have certainly helped reduce this balance quite substantially. Unfortunately for shareholders, the company announced last week that it raised just about $325 million from the equity sales program, and this was after increasing the program to 40 million shares.

Excluding any moves in the debt pile made in these last few weeks of Q3, as well as what happens financially during the current quarter, AMC didn’t even raise enough money to reduce its working capital deficit in half. The company would still be more than half a billion dollars in the red here, and that’s despite diluting investors by 60% more than originally planned. As a quick reminder, AMC last got its working capital balance into the green, as shown in the chart above, by roughly tripling its outstanding share count in the first half of 2021.

Before the recent equity sale took place, there were about 158 million shares outstanding. After the deal was completed, that number surges to around 200 million. Don’t forget that the split-adjusted figure was only around 5 million prior to the coronavirus (when looking only at Class A shares), so investors have been diluted tremendously here and the balance sheet is still in horrible shape. The key point here is that investors are likely going to face a lot more dilution moving forward, and it is quite possible another equity raise takes place in the next couple of quarters if the working capital number doesn’t improve significantly.

Given the company needed to sell a lot more shares than previously thought, as well as the much lower amount of funds raised, I am continuing to rate this stock as a sell here. The stock is close to a multi-year low, and there has been a lot of volatility in the name in recent years, so it wouldn’t surprise me if the stock bounces around a bit moving forward. However, it seems that the long term path here is lower, because the financial situation is not improving as quickly as it needs to be. With the stock crashing recently, every additional equity raise moving forward is going to be even more dilutive, as the market cap here is down to around $1.55 billion.

In the end, AMC’s equity raise turned out to be a major disappointment. The stock’s crash around the reverse split caused the net proceeds to be a lot less than hoped for, and this was after management boosted the offering size by 60%. With a working capital balance still deep in the red, and a huge debt pile that needs to be addressed in the coming years, the company is likely to need additional equity sales moving forward, and that could pressure the stock even more in the future.

Read the full article here