AMC Entertainment (NYSE:AMC) has a pathway to deleveraging as attendance continues to recover, but it needs to avoid any bumps in the road.

Company Profile

AMC owns and operates movie theatres throughout the United States and Europe. The company generates revenue through ticket sales, food and beverage sales, and advertising. The company licenses films from distributors owned by movie production companies, while exhibition costs are based on a share of admissions revenue. The company also offers a monthly subscription service that allows guests to see up to three movies per week.

At the end of June, AMC operated 906 theatres with 10,120 screens. It had 184 IMAX screens in the U.S. and 33 in international markets, while it had 158 Dolby Cinema screens in the U.S. and 7 in international markets. It also had 48 dine-in theatres in the U.S. with 667 screens, and it had 375 U.S. theatres that offered alcohol. In international markets, it had 3 dine-in theatres and offered alcohol in 230 locations.

AMC also owns 23.4 million units of Hycroft Mining Holding (HYMC), a gold and silver development company.

Opportunities and Risks

The pandemic hit AMC’s business as hard as any company, with the theatre operator seeing revenue fall -77% in 2020 to $1.24 billion. While the company’s revenues have rebounded, they nonetheless still remain well below the nearly $5.5 billion the company was generating pre-pandemic, with revenues of just $3.9 billion in 2022.

AMC is very reliant on the movie industry and what Hollywood sends to the big screen. The better the movie slate, the better AMC typically does. Thus, an improved movie slate is one of the biggest opportunities for the company, as blockbuster movies drive people to the theatre. On that front, the company could feel some pressure down the road from the Hollywood writers’ strike, which would slow some production and could push back some releases.

In the near term, though, the company is looking to ride Taylor Swift mania, as the singer’s movie about her Eras Concert tour has already sold $100 million in advance global tickets before it opens this Friday. For its part, AMC is showing the movie in 4,000 movies theatres in North America, and the company has announced that pre-sales for the movie broke the company’s record for most single-day advanced ticket sales with $26 million. Concert-related movies could prove to be a driver, as next month Beyonce will have her own movie hit theatres at the end of November.

Now since the pandemic, the movie industry has changed somewhat with the advent of so many streaming services vying for eyeballs, with the likes of Disney Plus, Max, Paramount, Peacock, and others looking to challenge Netflix (NFLX). There is a risk that movie attendance doesn’t get back to pre-pandemic levels because of this. However, it does seem like movie companies have realized that bringing big budget movies directly to their streaming services and skipping theatres economically is not the best move and that TV shows more than movies draw in and keep subscribers.

Outside of a better Hollywood movie slate and increased attendance, driving premium ticket sales through the likes of IMAX and Dolby Cinema is another opportunity for the firm. These formats have higher ticket prices and AMC is looking to continue to expand its IMAX and Dolby Cinema offerings both in the U.S. and abroad. The company also has its own private label large screens that it operates in some markets that are more price sensitive.

Continuing to upgrade its theatres with things such as stadium seating, as well as with dine-in theatres is another opportunity. Better experiences tend to bring in move moviegoers, while dine-in theatres and theatres that serve alcohol have more revenue opportunities. Food and beverage sales are also very high margin.

Adding additional new, state of the art theatres is another opportunity. The company will also go out and acquire existing theatres as well. In addition, the company can also benefit from closing underperforming theatres as well.

One the biggest risks AMC faces is its debt load. The company has always carried a fair amount of debt, but that only increased during the pandemic as it struggled to stay in business as admission fell off a cliff. With debt higher and revenue still not back to pre-pandemic levels, leverage remains an issue. The company had $4.8 billion in debt against $435.3 million in cash and equivalents on its balance sheet. It also had another $4.6 billion in operating lease liabilities as well. Adjusted EBITDA over the past 12 months is $223.3 million, so leverage is nearly 20x not including its operating lease liabilities.

AMC also is burning cash, with operating cash flow of -$203.3 million through the first six months of the year. Free cash flow was -$299.3 million.

Discussing the company’s outlook of its Q2 earnings call, CFO Sean Goodman said:

“With the post-pandemic record-breaking second quarter behind us, our recovery to date is clear. However, we’re not yet ready to declare victory. The box office remains around 16% below pre-pandemic levels. And there’s some downside risks with the ongoing screenwriters’ and actors’ strikes. And with our fixed cost structure and relatively high debt-servicing costs, these are exacerbated by interest rate increases over the last 17 months, we continue to burn cash on the bottom line. Based on what we know today, we’re optimistic about the remainder of the year and we believe that the 2023 box office could exceed 2022 by more than 20%. However, if the strikes are prolonged or if our ability to access the capital markets is constrained, then our ongoing recovery glide path and our ability to continue to take the necessary actions to strengthen our balance sheet and to ensure a full and sustained recovery may be in jeopardy.”

That is a pretty balanced statement by the CFO, and demonstrates both its opportunities as well as the risks it faces.

Valuation

AMC currently trades around 27x the 2023 consensus EBITDA of $409 million and nearly 21x the 2024 consensus of $528.3 million.

From an EBITDAR perceptive, it trades at about 9x 2023 EBITDAR and 8.2x 2024 EBITDAR.

The company is not projected to generate positive new income any time soon.

The company is projected to grow revenue nearly 18% in 2023 to $4.65 billion, and 3% in 2024 to $4.78 billion.

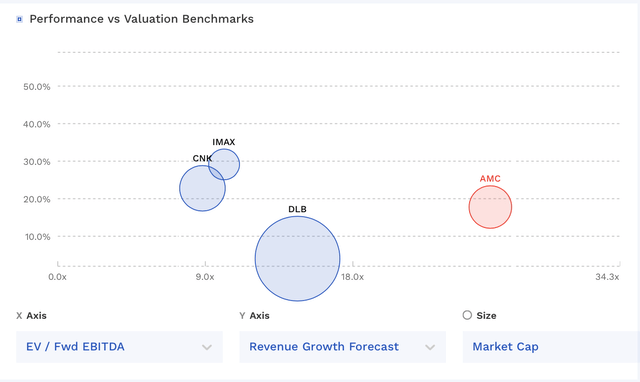

AMC currently trades at a premium to other movie theatre related companies.

AMC Valuation Vs Peers (FinBox)

Conclusion

AMC has a pretty big debt problem that it needs to overcome. Leverage is astronomical and the company continues to burn cash. If the business was debt and rent free, it would be in pretty decent shape and be an interesting box office recovery story. However, interest and rent expenses are just eating up all the company’s cash generating abilities at the moment. AMC did raise $325.5 million with an equity offering recently, but that still makes a pretty small dent into its debt load.

AMC is hoping to see attendance back to pre-pandemic levels by 2025, with more large format screens boosting revenue above prior levels. Even with higher interest expense, the company should still be able to get to about $500 million in operating cash flow if revenue gets back to those pre-Covid levels. Then you can start to see a deleveraging story start to develop.

At this point, I’m a bit conflicted on the stock. I can see the pathway to AMC becoming a deleveraging story, but there could be bumps along the way as well, especially given future macro uncertainty. As such, I want to continue to watch from the sidelines for now before a clearer macro picture develops given the debt risks associated with the name.

Read the full article here