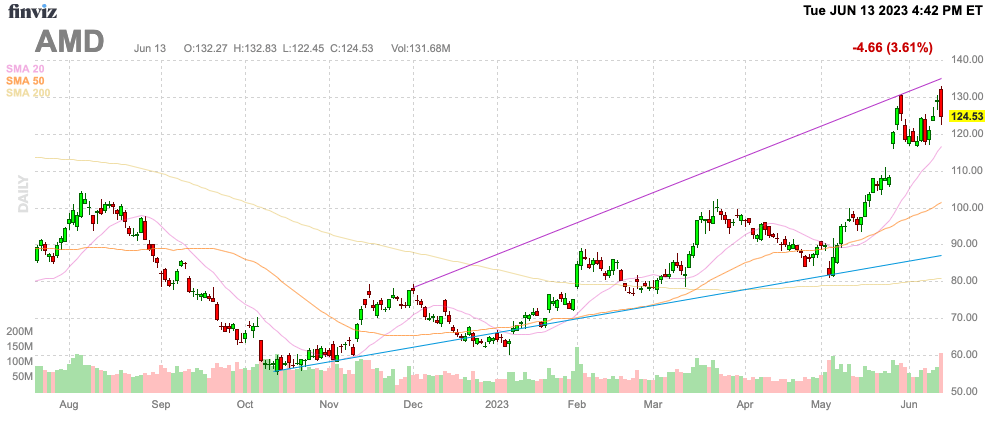

The excitement over AI chips had Advanced Micro Devices, Inc. (NASDAQ:AMD) trading back to $130 heading into the Data Center and AI event on June 13. The stock swooned following the event, with the chip company not announcing any surprise new chips or partnerships to accelerate the shift to AI. Regardless, my investment thesis remains ultra Bullish on AMD stock, which is now trading $40 below all-time highs in late 2021 while Nvidia Corporation (NVDA) stock is already far above those levels.

Source: Finviz

More Than Hype

AMD fell after the AI presentation due to the event not necessarily matching the hype leading up to the event. The chip company provided some general details regarding the new AI chips heading to the market, but the management team didn’t provide any boosts to the financials to attract more investors to push the stock higher.

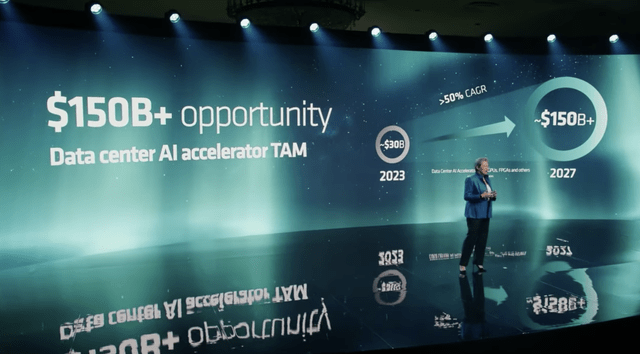

What matters is that AMD has the Data Center chips to play in the surging demand for AI. The company forecasts the Data Center total addressable market (“TAM”) hitting $150 billion by 2027, up from $30 billion now, for massive 50% annualized growth for the next 5 years.

Source: AMD Data Center & AI presentation

AMD had previously presented a $300 billion total TAM opportunity over the next 5 years with only $125 billion assigned to Data Center. The one big revenue boost at the AI event was the suggestion this TAM jumps to $150 billion now in 2027.

What concerns investors the most is this analysis of the swing in CPU demand with the implementation of AI chips. The product requires a huge shift to spending on GPUs (highlighted by Nvidia numbers) while not necessarily using additional CPUs in the process.

MI300 Monster

As SemiAnalysis highlights, AMD is the only other company with a track record of delivering a chip for high performance computing. Intel Corporation (INTC) is nowhere to be found in the discussion with failed AI hardware acquisitions and no GPU coming to market to compete with the Nvidia GPUs. The news leaves the MI300 from AMD as the only competitor to Nvidia in a GPU chip where the company is estimated at charging 5x the production cost.

At the AI event, CEO Lisa Su talked prominently about the new MI300 chips. The MI300A (CPU+GPU) is sampling to customers now with the MI300X (GPU only) sampling in Q3. Both chips will see production ramps in Q4 with the following configurations:

- MI300A – 6 XCDs (Up To 228 CUs), 3 CCDs (Up To 24 Zen 4 Cores), 8 HBM3 Stacks (128 GB)

- MI300X – 8 XCDs (Up To 304 CUs), 0 CCDs (Up To 0 Zen 4 Cores), 8 HBM3 Stacks (192 GB).

The market really wanted to see far more details from AMD on the production ramp in Q4 to provide an indication if the chip company could grab material market share from Nvidia. The GPU company just announced a forecast for record sales in FQ2, with a revenue estimate $4 billion above the analyst estimates for the quarter.

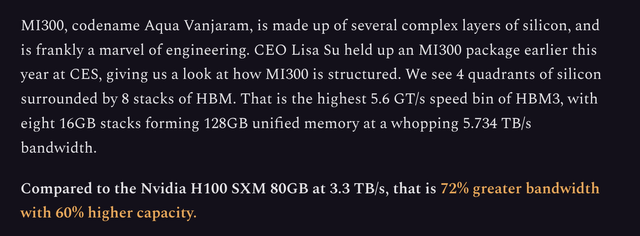

AMD again quoted that the MI300 offers an 8x boost in AI performance and a 5x AI performance boost per watt over the current Instinct MI250. Since this chip hasn’t gained a lot of traction with the HPC crowd, what ultimately matters is the comparison to the H100 from Nvidia garnering all of the current AI chip sales.

As SemiAnalysis highlights again, the MI300 is a marvel of engineering offering a massive 72% greater bandwidth than the H100 with a 60% higher capacity.

Source: SemiAnalysis

The MI300X is expected to be the real volume mover with all GPUs to maximize performance in AI. Considering the excessive costs of Nvidia chips, AMD should provide a TCO advantage over Nvidia similar to how the company starting gaining share against Intel in the CPU market.

The stock is down due to the lack of any material boost to expectations in the short term. AMD didn’t really launch any new AI chips, nor did the company provide any details on any sales move from a potential partnership with Microsoft (MSFT) on AI chips.

In essence, AMD has a potential monster AI lineup, but the chip hasn’t been launched yet, and the success of Nvidia while utilizing Intel CPUs blocks AMD from that market for now. The company faces the ultimate risk of not participating in a segment that could drive a large majority of Data Center growth over the next 5+ years.

As discussed in prior research, AMD has a path to a $5+ EPS in the next few years. A hit product in the AI arena will provide substantial upside to these estimates considering the huge revenue jump at Nvidia.

Takeaway

The key investor takeaway is that Advanced Micro Devices, Inc. likely pauses over the next few weeks or months until the company provides anything more substantive regarding AI chip sales. The catalyst could be 2H guidance following the Q2 earnings report in late July or it could be another event for the launch of the MI300. The key is that investors don’t know when the AI hype will return to the stock, but AMD is highly likely to see a large bump in the year ahead due to the huge potential of the MI300 AI chip line up.

Read the full article here