Investment thesis

Our current investment thesis is:

- American Eagle Outfitters (NYSE:AEO) continues to struggle with current economic conditions, facing slow growth.

- Cost inflation is beginning to subside but is being offset by greater discounting and promotional activities.

- We continued to be concerned by AEO’s margins, especially given the most recent decline. Margin improvement in retail is incredibly difficult due to the high level of competition.

Company description

American Eagle Outfitters, Inc. is a specialty retailer that offers clothing, accessories, and personal care products under the American Eagle and Aerie brand names in the United States, and several other countries.

Prior thesis

We first covered AEO in March and assigned a hold rating. The factors driving our rating are:

- AEO is facing economic headwinds, which we believed would slow demand and potentially contract margins.

- We were concerned with the slowing interest in the American Eagle brand but bullish on Aerie and improving digital expansion.

- From a financial perspective, we thought growth was passable but margins were poor.

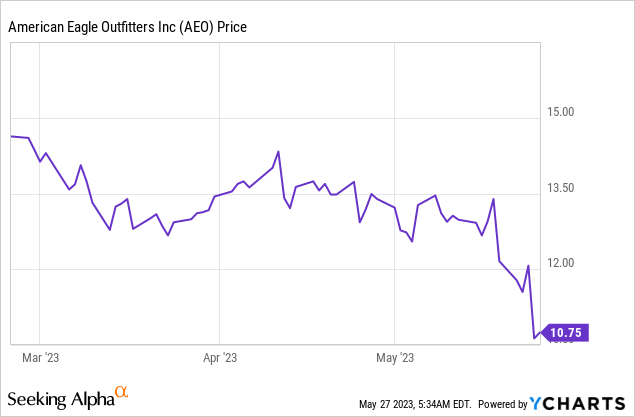

AEO stock price

Following its Q1 earnings release, AEO experienced a sharp decline in share price, with investors continuing to be bearish.

American Eagle Outfitters Q1’23 results

Overall, AEO’s Q1 results were in line with what we expected, although we were disappointed given the surprisingly robust performance by AEO’s peers.

AEO achieved total a net revenue of $1.1bn, which is up 2% compared to Q1-22 but down 27% from Q4-22 (Holiday period). Aerie achieved 12% Y/Y, whereas AE declined 2% Y/Y.

AEO’s growth rate implies resilience during current economic conditions, however, on a like-for-like basis, the company is declining. Of Aerie’s 12% growth, this is only 2% on a comp basis. AE on the other hand declined 4% on a comp basis. Management is seemingly happy with this result, but we are concerned that the cost to achieve this is value destructive.

Before exploring this further, it is worth briefly explaining the revenue growth. In the first quarter, AEO opened 7 stores, 4 of which are AE locations, 2 Aerie, and 1 Todd Snyder (while closing 2 AE locations). This is quite the expansion given current conditions and has clearly had a noticeable offsetting impact on sales. We question whether it is not worth investing further in Aerie locations, as this could support the online growth as it allows consumers to conveniently try-before-you-buy. The brand continues to gain interest and perform well in consumer engagement.

Gross profit increased 6% Y/Y with margins improving 1.4ppts to 38.2%. This is also significantly up from Q4-22 when the company achieved 34%. Margin improvement has been driven by declining transportation costs, with inflationary pressures beginning to ease, especially given the reopening of China. We suspected as much in our prior analysis, and believe there is scope for further improvement in the upcoming quarters. The real gain could come in the next 12-24 months, however, as we believe AEO is engaging in aggressive discounting. Management has acknowledged this and it is clear to see on their websites, but importantly, there was a pressure to shift inventory which had rapidly accumulated. For this reason, it is possible that once demand conditions improve and inventory levels normalize, margin improvement should occur.

Touching further on inventory, Management has touted the rapid decline Y/Y. We believe this to be slightly deceiving as compared to Q4-22, inventory continues to rise (+7%). For this reason, we are concerned that the potential continued easing of inflation will be offset by further discounting to come. To illustrate this, inventory turnover has declined further from 5.7x in Q4 to 5x in Q1.

Moving onto operating costs, we see the primary reason for our disappointment and potentially that of the markets too. S&A spending has increased 5% Y/Y and declined 11% from Q4. Management has increased advertising spend as a means of supporting revenue levels, contributing to a softening of margins. Also, we have seen higher corporate compensation which has compounded the impact. The net impact of this is a decline in OPM from 4% in Q1-22 and 4.9% in Q4-22 to 2.3%. We are not a fan of non-GAAP disclosures, but it is worth highlighting that on an adjusted basis (reflecting one-off and other related charges) AEO achieved 4.1% v. 5.4% (Q4) and 4% (Q1).

The positives are that Aerie’s OPM is improving, which has the scope to support improvement as its growth exceeds AE.

| Period | American Eagle | Aerie |

| Q1-23 | 16% | 15.8% |

| Q4-22 | 16% | 12.2% |

| Q1-22 | 15.2% | 13.4% |

| Q4-21 | 17.5% | 5.3% |

Many criticize the US’ policy of quarterly reports as it has the risk of encouraging Management to think short-term. Our view is that AEO’s current performance is a reflection of this. In many industries, margin is a boomerang, it will come straight back with time. Retail is not such an industry. It is cutthroat and highly competitive. For this reason, AEO could face issues with rebuilding its OPM once we see a normalization of the impact of heavy discounting and inventory accumulation.

Although the comparison is not perfect, Gap (GPS) saw a 12.4% increase in share price following its Q1 results. Gap’s sales performance was in line with AEO, if not worse.

“Comparable sales fell 3% for Gap to match the consensus expectation. Store sales were down 4% during the quarter and online sales fell off 9% from last year’s level”.

Its GPM improvement was also comparable.

“Gross margin was 37.2% of sales vs. 34.6% consensus. Merchandise margin during the quarter was up 610 basis points due to lower air freight expense and improved promotional activity in the quarter”.

However, unlike AEO, the company saw a significant improvement in OPM. This is not to say that AEO could have been more efficient but had there been a greater focus on margin protection or even improvement, investors may not have responded in such a manner.

To conclude our view of Q1 is overarchingly in line with what we expected, but we are disappointed in the level of margins traded-off for underwhelming growth. We would have much preferred a decline in sales but margin improvement.

Outlook

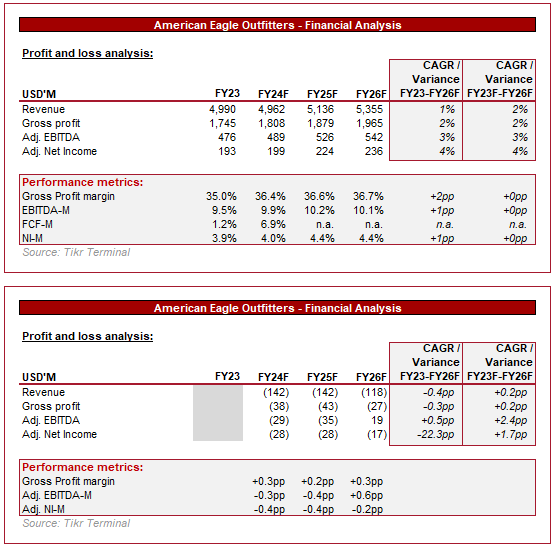

Outlook (Tikr Terminal)

Presented above is an updated view of analysts’ estimates of the next 5 years for AEO, as well as a delta table vs. what we presented in March.

FY24 forecasts have been noticeably re-rated downward, reflecting a change in expectations around margin evolution.

Management is forecasting continued margin contraction, as well as flat to down sales. Based on Q1 results, this looks expected and we would lean toward the bottom end of these forecasts.

Interestingly, analysts are expecting margin difficulties will continue into FY26 relative to their initial view, which suggests they see margin improvement being as difficult as we do.

AEO stock valuation

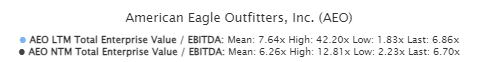

AEO valuation (Tikr Terminal)

AEO is currently trading at 7x its NTM/LTM EBITDA multiple, which is a c.1x contraction relative to the last time we covered this stock.

We have updated our DCF valuation, with the following assumption being changed / maintained:

- MAINTAINED – Revenue growth of 2-4%, driven by Aerie. Management remained focused on growth. We are comfortable that customer engagement remains strong and Aerie continues to develop well. AE remains robust.

- DOWNGRADE – EBITDA margin improvement to 11%. We have reduced this by 1% reflecting the risk of a sustained decline in margins.

- DOWNGRADE – FCF conversion improving to 4%. In line with EBITDA-M, we have reduced this assumption by 1%.

- MAINTAINED – An exit multiple of 8x and a perpetual growth rate of 2%

- MAINTAINED – A discount rate of 10%.

Based on this, we imply an upside of 3%, which is exactly the upside we assigned in March.

This a reflection of why margin dilution is so damaging to mature businesses, and why a slowdown in growth is so damaging to growth businesses. When the expected future cash flows of a business change, investors must adjust their valuation and reflect that in their buying/selling behaviors.

Final thoughts

Although we have not discussed the fact in detail, we remain positive about the company’s social media presence and focus on remaining culturally relevant. Our prior paper highlighted our key concerns, which were around the financial performance of the business. We continue to be concerned. Margins are slipping for what we feel is a bad deal. The growth trade-off is unattractive, especially in the current economic conditions.

In our prior paper we stated, “Until we see improving financials or a further decline in share price (all else equal), we consider the company a hold”. What we find is that the financials have not improved but the share price has declined. Unfortunately, the decline in share price looks proportionately in line with its decline in performance. For this reason, we maintain our hold rating.

Read the full article here