Americold Realty Trust, Inc. (NYSE:COLD) is a REIT that invests in temperature-controlled logistics properties and provides related value-added services that are essential to the global cold supply chain. Due to efforts to improve its profitability by pushing through pricing increases while better integrating its assets, efforts that have significantly improved its margins of late and should continue to do so going forward, Americold Realty’s outlook is now quite bright. After a period of subdued dividend growth, Americold Realty is now in a position where it could push through substantial payout increases over the coming years. Shares of COLD have shot higher of late as investors are beginning to take note.

The REIT has economic interests in 240+ temperature-controlled warehouses across the globe including ~195 in North America, ~25 in Europe, ~20 in the Asia-Pacific region, and a couple in South America (the vast majority of these are owned and operated by the REIT though a small portion are managed by third parties) along with minority interests in various joint-ventures that primarily concern temperature-controlled warehouses in Brazil (along with a few properties across Chile and Dubai).

Americold Realty is an interesting income growth idea given its niche operational focus on assets that are crucial to supporting global food supply chains. Products that need cold supply chains include meats, fruits, vegetables, prepackaged frozen foods, certain medical products, and various other products, though agricultural and food products are huge here in terms of volume.

Operational Overview

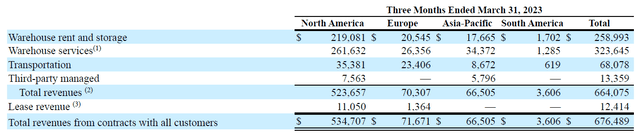

When looking at Americold Realty’s revenue breakdown, the REIT is about much more than simply leasing out warehouses and the significance of its value-added services shouldn’t be overlooked. In the first quarter of 2023, ‘warehouse services’ and ‘transportation’ activities generated roughly 58% of its total GAAP revenues. The firm’s warehouse services are numerous and cover a whole range of activities that involve ensuring its clients’ products are kept cool, stored properly, and can move with ease across the cold supply chain. Americold Realty uses both its in-house and third-party trucking operations to enable its customer base to utilize temperature-controlled transportation services. This approach means that each new warehouse Americold Realty adds to its portfolio can spawn several new revenue streams that are “sticky” given the essential nature of these services for agricultural companies, retailers, consumer staples firms, and other entities.

Americold Realty does a tremendous job finding ways to use new and existing temperature-controlled warehouses to create new revenue streams by providing value-added services supporting the cold supply chain. (Americold Realty Trust Inc – 10-Q SEC Filing Covering The First Quarter Of 2023)

Financial Overview

While Americold Realty’s GAAP revenues declined by 4% year-over-year in the first quarter of 2023 to reach $676 million, its net operating income shot higher by almost 19% to reach $188 million. Declines in sales at its transportation and third-party managed segments were partially offset by revenue increases at its ‘Global Warehouse’ operations (warehouse rent and storage plus warehouse services activities), though most importantly, Americold Realty’s cost structure improvement strategies are starting to really pay off in a big way.

Its Global Warehouse segment-level margin grew from 27.0% in the first quarter of 2022 to 29.4% in the first quarter of 2023. On a same-store basis, looking at just the “stabilized” assets that Americold Realty has owned for a significant period of time, its Global Warehouse operations saw its segment-level margin rise from 28.1% to 31.6% during this period. These margin improvements are being driven by a few factors including pricing increases, rental rate escalations, greater economic utilization of its asset base, incremental revenues generated via organic growth developments that expand the capacity of its existing asset base, and other factors.

Growth in its company-wide net operating income was primarily driven by profitability improvements at its Global Warehouse operation. Margin expansion was more than enough to offset a marginal year-over-year decline at its Global Warehouse unit, which posted 20% year-over-year net operating income growth in the first quarter of 2023. Please note that Americold Realty’s Global Warehouse unit represents the source of over 90% of its company-wide net operating income, and that this asset’s performance is a key driver of the REIT’s cash flow performance.

Americold Realty’s adjusted funds from operations (‘AFFO’), a non-GAAP metric, rose to $0.29 per share in the first quarter of 2023 versus $0.26 in the same period last year (a 12% year-over-year increase). Profitability improvements at its Global Warehouse unit was key to drive its AFFO higher, and this story has legs.

Dividend Growth Story Could Pick Up Soon

Looking ahead, Americold Realty’s recent Project Orion initiative aims to keep the momentum going in the right direction by further improving the profitability of its Global Warehouse operations. Future margin expansion would provide the REIT’s cash flows with a substantial tailwind as it concerns future cash flow and ultimately dividend growth potential. Americold Realty’s 2022 Annual Report describes the initiative as such (lightly edited):

In February 2023, we announced our transformation program “Project Orion” designed to drive future growth and achieve our long-term strategic objectives, through investment in our technology systems and business processes across our global platform. The project includes the implementation of a new, best-in-class, cloud-based enterprise resource planning (“ERP”) software system. Since going public in 2018, we have acquired over 100 facilities, or approximately 40% of our total warehouse facility network. Project Orion will enable us to better integrate many of these recent acquisitions and position us well for the integration of future acquisitions…

The activities associated with Project Orion are expected to be substantially complete within three years. We estimate the aggregate investment in Project Orion to be approximately $100 million, which includes $50 million capital investment into our Company along with another $50 million of one-time implementation and integration expenses. We will continue to evaluate our overall project for additional opportunities and benefits, which could result in the identification and implementation of additional actions associated with Project Orion and incremental costs and benefits.

Americold Realty’s growth trajectory involves growing its asset base via acquisitions (which need to be effectively integrated into its company-wide operations to spawn new revenue streams and margin expansion opportunities), expanding its existing asset base via organic growth endeavors (including storage and onloading/offloading capacity, for example), pushing through rental rate increases and benefiting from rent escalators, ensuring high economic utilization of its assets, and leaning on its Project Orion initiative to effectively integrate those operations into its global portfolio.

The REIT only recently launched its Project Orion initiative, so we have yet to see the kind of margin expansion upside this effort will yield. In the recent past, pricing increases have helped significantly improve the profitability of Americold Realty’s golden goose, its warehouses. Looking ahead, significant improvements in the economic utilization rates of its assets represent another major potential cash flow growth driver. For instance, Americold Realty’s Global Warehouse unit had an economic occupancy rate of 69.8% in the first quarter of 2022 which rose to 73.6% in the first quarter of 2023. There is ample room for the REIT to ensure its existing asset base is being better utilized, and if its Project Orion initiative is successful, these assets should churn out substantially more cash flows.

Americold Realty aims to generate $1.16-$1.26 in AFFO per share in 2023 versus $1.11 in AFFO per share in 2022, which represents 9% annual growth at the midpoint. Shares of COLD pay out a quarterly dividend of $0.22 or $0.88 on an annual basis and to be fair, its payout growth has been flat to marginal in recent years. However, the company’s AFFO per share is starting to grow robustly and that could enable management to push through significantly larger payout increases going forward. A key part of my thesis is that profitability improvements and greater economic utilization rates at its Global Warehouse unit drives material cash flow growth at Americold Realty over the coming years, which in turn enables the REIT to resume increasing its payout by a significant amount.

In the event Americold Realty generates $1.21 in AFFO per share in 2023 (the midpoint of guidance), its payout ratio (dividend per share divided by AFFO per share) would stand at 73%, below the 80% threshold that’s considered healthy for the REIT industry. Should its AFFO per share growth trajectory continue in earnest in 2024+, something that I view as likely, Americold Realty’s income growth story should become a lot more promising.

This past June, the REIT announced a partnership with the railroad operator Canadian Pacific Kansas City Ltd (CP) that aims to locate temperature-controlled warehouses along the Canadian Pacific Kansas City’s network. Americold Realty’s cash flow growth runway should benefit from these new growth opportunities (starting with a new warehouse in Kansas City, Missouri) which in turn should further enhance its dividend growth story.

Downside Risks

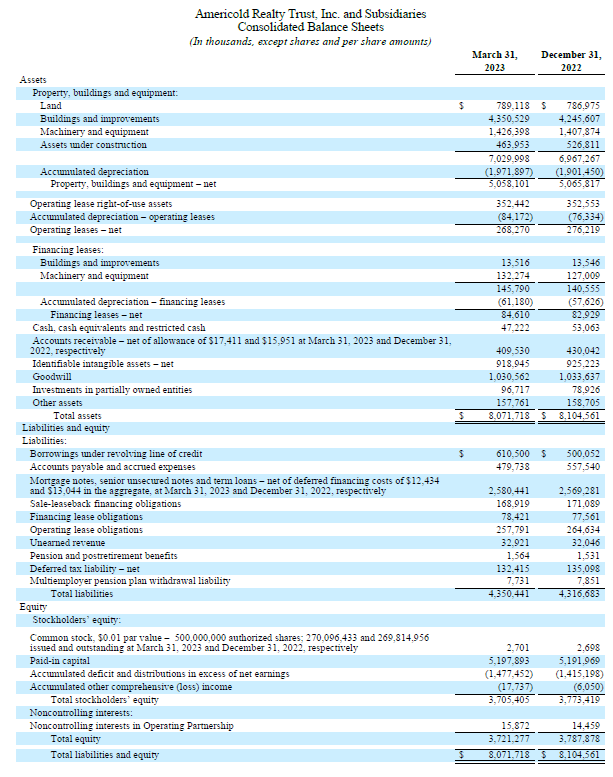

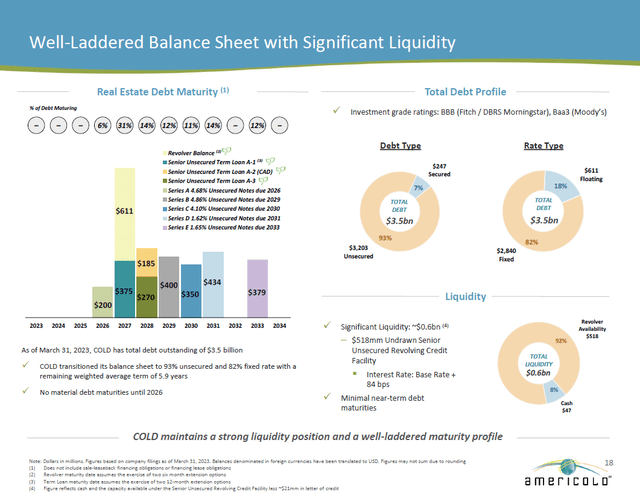

Investors should be aware that there are downside risks to consider here, such as Americold Realty’s large net debt load and dependence on capital markets. At the end of March 2023, Americold Realty had $3.4 billion in total debt-like liabilities on the books which consisted of $3.2 billion in short- and long-term debt along with $0.2 billion in sale-leaseback financing obligations and financing lease obligations, which was offset by a negligible amount of cash on hand. Rolling over that burden in the current interest rate environment will put upward pressure on the REIT’s cash interest expenses. Its need to refinance that debt highlights how important it is that Americold Realty retains access to debt markets at reasonable rates.

Americold Realty has a large debt load. (Americold Realty Trust Inc – First Quarter of 2023 Earnings Press Release)

However, on a positive note its debt maturity schedule is well-staggered as you can see in the upcoming graphic down below. Furthermore, Americold Realty has an investment grade credit rating (BBB/Baa3) with ample remaining borrowing capacity on its revolving credit lines (~$0.6 billion in total access to liquidity when considering its available borrowing capacity on those facilities plus its cash on hand).

Americold Realty has an investment grade credit rating, ample access to liquidity, and a staggered debt maturity schedule which should enable the REIT to stay on top of its various financial obligations going forward. (Americold Realty Trust Inc – Summer 2023 IR Presentation)

In my view, the REIT should be able to continue funding its acquisitions (it spent $69 million in cash on acquisitions in the first quarter) while managing its other financing needs such as rolling over its debt, funding its dividend, and investing in organic growth endeavors (it spent $18 million on its capital expenditures while generating $41 million in net operating cash flow in the first quarter of 2023). Please keep in mind that Americold Realty’s total payout obligations stood at $60 million in the first quarter of this year, payouts that were funded in large part by the REIT’s balance sheet. Maintaining access to debt and equity markets is an essential part of Americold Realty’s business model and ability to keep making good on its payout obligations.

Concluding Thoughts

Shares of COLD have been on a strong upward trend of late and could retest highs seen in April 2021 (when shares closed above $40) within the coming months, especially if management continues to showcase how Americold Realty’s margins are going to improve materially via the Project Orion initiative. I like Americold Realty as an income growth idea because its payout growth story is about to resume after management held the REIT’s payout flat over the past couple of years, in part due to headwinds arising from the COVID-19 pandemic, and investors are beginning to take note. With shares of COLD on a nice upward trend, that makes tapping equity markets an easier task as it concerns raising funds to meet Americold Realty’s financing needs. Shares of COLD yield ~2.7% as of this writing.

Read the full article here