We remain hold-rated on Analog Devices, Inc. (NASDAQ:ADI). We expect the analog semiconductor market to underperform the broader semi industry in the back end of the year and expect ADI stock to be an in-line performer with its peer group. The analog market is in a correction as inventory levels remain high, and we’re seeing this reflected as softer demand in all of ADI’s end markets in the near term. We see a less favorable risk-reward profile for ADI in 2H23 as we expect orders to decline further in Q4 2023 and possibly 1H24 due to the macro headwinds.

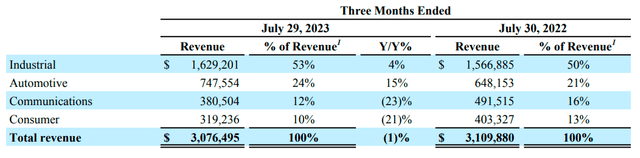

Management is guiding for a 12% sequential decline in revenue for Q4 2023 to $2.7B, trailing consensus of $3.10B, after a 6% QoQ drop this past quarter to $3.08. ADI remains well-positioned for longer-term growth once inventory correction wraps up, but we don’t see any near-term catalyst offsetting the weaker demand environment in 2H23. To better gauge the end demand weakness, the following outlines ADI’s Q3 2023 revenue trend by segment.

ADI 3Q23 press release

Our main near-term concern for ADI is softer demand in its industrial and automotive segments, which account for 53% and 24% of total revenue, respectively. We think the industrial and auto markets will be the last leg of the semi correction in the post-pandemic environment. We’re seeing weak auto data points in the near term impacting ADI as well as Texas Instruments (TXN), ON Semiconductor (ON), and Monolithic Power Systems, Inc (MPWR), among others. Hence, we see lackluster end demand weighing on ADI’s top-line growth in 2H23.

Additionally, we think ADI is at risk of further gross margin contraction due to lower fab utilization as customers work through high inventory levels. The company reported a gross margin of 63.8% in Q3 2023, down 190 bps, and non-GAAP gross margin contracting 150 bps to 72.2%. We expect gross margins to continue to contract next quarter. We recommend investors stay on the sidelines as, consistent with management’s outlook on the Q3 earnings call, we expect the correction to last a few more quarters and impact sales.

Priced in weakness but no near-term catalyst

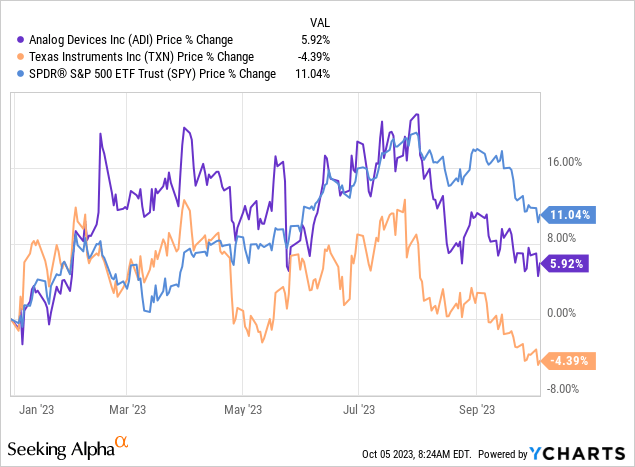

We think the weakness has been priced into the stock and the outlook for Q4 2023, which is partially why we’re not sell-rated on the stock. The stock is up roughly 6% YTD, underperforming the S&P 500 (SP500) and the broader semi-peer group, with the exception of TXN. The stock is down 9% over the past six months, underperforming the S&P 500 by 13%. We maintain our hold rating rather than upgrading on priced in weakness, as we see more downside risk in the near term. ADI’s two other end markets, Communications and Consumer, account for 12% and 10% of total sales, respectively, and are also forecasted to see muted end demand due to the weaker spending environment.

The following graph outlines ADI’s stock performance YTD.

YCharts

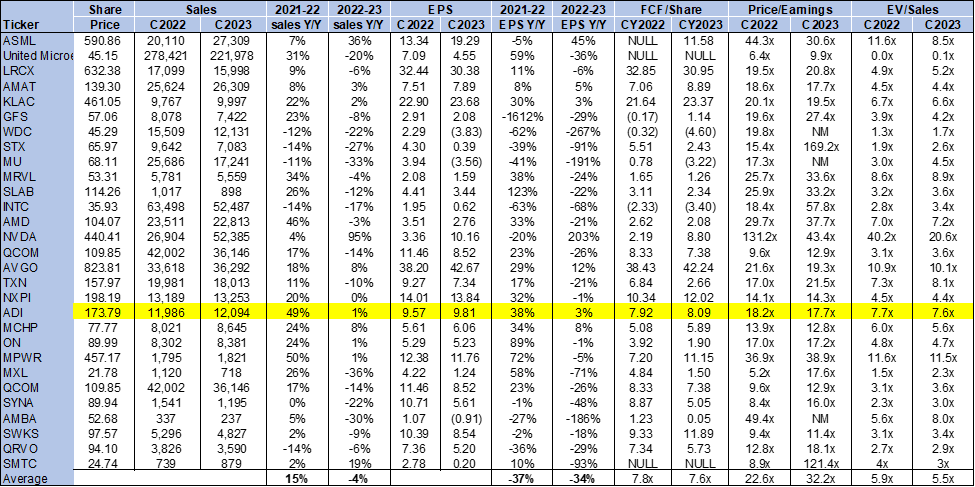

Valuation

Analog Devices, Inc. is trading above the peer group average on an EV/Sales metric at 7.6x C2023 versus the peer group average of 5.5x. On a P/E basis, the stock is trading at 17.7x C2023 EPS $9.81 compared to the peer group average of 32.2x. We don’t see attractive entry points into the stock at current levels and see a higher risk profile for ADI in the back end of the year and possibly 1H24.

The following chart outlines ADI’s valuation against the peer group average.

TSP

Word on Wall Street

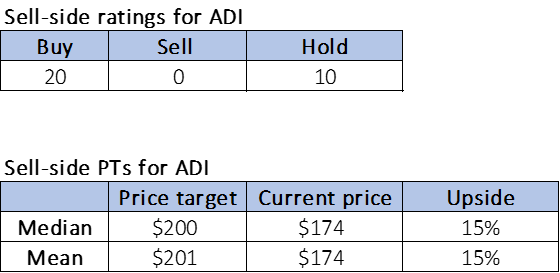

Wall Street is bullish on the stock. Of the 30 analysts covering the stock, 20 are buy-rated, and the remaining are hold-rated. We attribute Wall Street’s bullish sentiment on the stock to ADI’s longer-term growth potential, especially with positive activity on the A.I. and data center front. Our bearish sentiment pertains to the near-term outlook; we don’t see ADI stock working in the near-term as management forecasts softer demand in all its end markets.

The stock is currently priced at $174 per share. The median sell-side price target is $200, while the mean is $201 for a potential 15% upside.

The following charts outline ADI’s sell-side ratings and price-targets.

TSP

What to do with the stock

We continue to be hold-rated on Analog Devices, Inc. The stock has priced in most of the negatives from the macro weakness, but we see no catalysts offsetting the softer end demand in 2H23. We expect inventory correction cycles to continue weighing on demand in all ADI’s end markets and pressuring top-line growth. Simultaneously, we expect margin contraction to continue due to lower fab utilization. We recommend investors stay on the sidelines, as we believe Analog Devices, Inc. will underperform in 2H23 and possibly 1H24.

Read the full article here