At a Glance

With a focused lens on the clinical side, Immatics N.V. (NASDAQ:IMTX) appears poised for a disruptive entry into the oncology landscape, primarily through its IMA203 TCR-T cell therapy. Safety metrics are encouraging, notably the lack of high-grade CRS or ICANS and confirmed ORRs above 60% in a hard-to-treat patient population. Financially, the firm’s balance sheet is bolstered by partnerships with industry titans like Bristol Myers Squibb and Moderna, effectively mitigating short-term cash concerns. While operating losses persist, a high liquidity position virtually negates immediate financing risk. Combined, these factors signal that Immatics has the resources to fuel its robust pipeline and shows promise for solid returns—pending successful Phase 2 results for IMA203.

Q2 Earnings

To begin my analysis, Immatics’ latest earnings report for Q2 2023 reveals a revenue increase in collaboration agreements to $23.7M from $18.2M YoY. Concurrently, R&D expenses have escalated to $28.9M from $26.7M, and general and administrative expenses increased to $9.9M from $9.2M in 2022. Operating losses stood at $15.2M, showing a slight improvement from the previous year’s $17.6M loss. Critically, the diluted EPS was -$0.34, indicating share dilution.

Financial Health

Turning to Immatics’ balance sheet, liquidity is fortified by $138.2M in cash and $229.9M in other financial assets, totaling $368.1M. The current ratio is approximately 2.9, and the total debt is at $203.3M, implying financial strength. Over the last six months, the company burned through $32.1M in operating activities, resulting in a monthly cash burn of $5.4M. With the recent additions of a $35M equity investment from Bristol Myers Squibb (BMY) and a $120M upfront payment from Moderna (MRNA), the company’s cash runway extends considerably. Past performance aside, these figures suggest a low probability of Immatics needing additional financing in the next twelve months. These are my personal observations, and other analysts might interpret the data differently.

(Note: Figures above were converted from EUR to USD with 1 EUR = 1.059378 USD conversion rate.)

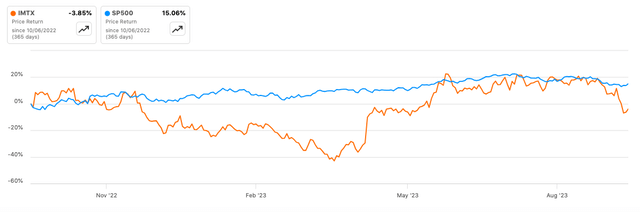

Equity Analysis

According to Seeking Alpha data, Immatics has a market cap of $826.52M, indicating moderate market confidence given its clinical stage. Revenue projections show a YoY decline of -66.69% for 2023 but a slight recovery of +8.72% in 2024, signaling short-term uncertainty yet modest long-term growth. Comparatively, IMTX’s 6-month stock momentum is impressive at +54.97% versus SPY’s +4.96%. The 24-month beta of 0.77 suggests lower volatility compared to the broader market.

Seeking Alpha

Options expiring in Q4 show higher open interests at strike prices around $10 and $12.50, signifying expected volatility and a cautiously bullish sentiment. Short interest stands at 11.11%, suggesting a moderate level of bearish outlook. Ownership is fairly diversified with institutional holdings at 50.99%; new institutional positions account for 6,753,710 shares while 702,161 were sold out.

IMA203 TCR-T Cell Therapy Shows Promise in Safety and Efficacy

The IMA203 TCR-T cell therapy demonstrates not just promising safety but also remarkable efficacy in 11 patients, based on data cut-off on April 4, 2023. The treatment’s manageable tolerability even at high doses (mean 3.67×10^9 TCR-T cells) could be a significant advancement in the context of cancer therapeutics. It’s noteworthy that both the highest dose levels (DL4 and DL5) have been cleared by the Data and Safety Monitoring Board for Phase 2, indicating confidence in the treatment’s safety profile.

The lack of additional dose-limiting toxicities since the initial Phase 1a cohort is especially noteworthy in a therapeutic area fraught with safety concerns. Adverse events like cytokine release syndrome [CRS] were mostly low to moderate, and no patients exhibited high-grade CRS or immune effector cell-associated neurotoxicity syndrome (ICANS), which are often the pitfalls of other cell therapies.

From an efficacy standpoint, the initial and confirmed objective response rates (ORRs) of 64% and 67%, respectively, are promising. These numbers are impressive, especially considering the patient population consisted of individuals who had been heavily pre-treated and had exhausted standard treatment options, thus increasing the clinical relevance of the outcomes.

Considering that patients with varying tumor types responded to the therapy, IMA203 could represent a broad-spectrum option that addresses the challenge of tumor heterogeneity. This universality is further substantiated by the treatment’s efficacy across all levels of PRAME expression—a protein often overexpressed in various malignancies—indicating that this could be a critical therapeutic pathway.

When contextualized within the broader cancer treatment landscape, TCR-T cells like IMA203 may offer a distinct advantage over other cellular therapies, such as CAR-T, because they can potentially target a wider range of antigens, including intracellular ones. This could make IMA203 applicable to solid tumors, an area where CAR-T has faced limitations.

The clinical data for IMA203 suggests that it’s a therapy well worth watching as it moves into Phase 2 trials, not just for its safety profile but also for its potential to be a game-changer in treating a variety of tumor types.

My Analysis & Recommendation

In summary, Immatics presents a compelling narrative that combines fiscal stability, robust clinical data, and strategic collaborations, making it an enticing candidate for investment consideration. While operating losses persist, the company’s strong liquidity position, buoyed by high-profile partnerships with Bristol Myers Squibb and Moderna, virtually negates short-term financing risk. Immatics’ IMA203, a PRAME-targeted TCR-T monotherapy, shows exceptional early promise in both safety and efficacy.

For IMA203, the next update in 4Q 2023 will be crucial in determining its trajectory toward registration-directed trials. Investors should closely monitor Phase 1b cohort data for additional insights into safety and efficacy. Positive results could catalyze the stock, while any signs of dose-limiting toxicities or reduced efficacy in a larger patient pool could serve as a downward pressure point.

As for stock performance, the 24-month beta of 0.77 and the 6-month stock momentum of +54.97% suggest a portfolio diversification opportunity with upside potential. However, given the 11.11% short interest, I’d advise caution; while this could present a short squeeze opportunity, it could also indicate a larger-than-usual bearish sentiment. Furthermore, a keen eye should be kept on the options market for shifts in investor sentiment, which could present strategic entry or exit points.

Given the overall health of the balance sheet, promising clinical data, and strategic partnerships, I recommend a “Buy” for Immatics. This is particularly for investors who are looking for a potentially high-reward biotechnology firm that has skillfully managed the inherent risks of clinical-stage drug development. However, be prepared for possible short-term volatility ahead of the 4Q 2023 clinical update for IMA203. Timing your entry post this data release could offer the best risk-reward scenario, assuming the data remains positive.

Remember, the above analysis reflects my personal interpretation and should not substitute for your own due diligence. Nonetheless, Immatics stands out as a company well-positioned for transformative growth in the oncology space.

Risks to Thesis

While my analysis leans bullish on Immatics, several risks could challenge this view:

-

T-Cell Therapy Development: The landscape for T-cell therapies like IMA203 is competitive and scientifically complex. Failure rates are high, and small changes in trial protocols can lead to significant efficacy or safety changes.

-

Competitive Pressure: Larger biotechs with deep pockets and advanced pipelines in T-cell therapies could outpace Immatics. This market is not a zero-sum game, but the lead matters.

-

Overestimation of Financial Strength: While liquidity appears robust, partnerships can unravel, leading to unexpected financing needs. The monthly cash burn of $5.4M should not be underestimated.

-

Regulatory Risks: The clearance from the Data and Safety Monitoring Board for Phase 2 is encouraging, but the regulatory pathway for T-cell therapies is highly stringent.

-

Market Cap & Sentiment: An $826.52M market cap and 11.11% short interest expose the stock to volatility and speculative trading.

-

Clinical Data: Although IMA203 has shown promise, Phase 1b and Phase 2 trials could reveal unforeseen adverse effects or reduced efficacy.

-

Biases: Confirmation and optimism biases may lead to underestimation of these risks.

Read the full article here