The latest earnings results of Anheuser-Busch InBev (BUD) indicate that the boycott against the lineup of its beers such as Bud Light is not over yet. The company has already lost its dominant spot in the beer market in the United States and its overall sales in North America have been on a steady decline for several months in a row.

The good news though is that sales in all the other regions in which Anheuser-Busch is present are exceeding expectations and make it possible for the company to mitigate reputational risks which it faces in the United States. This has already helped to prevent further depreciation of Anheuser-Busch’s shares, and while investors are thinking about what’s going to happen next with the company, this article highlights the major developments that could help understand in which direction the share price could go in the following months.

The Story So Far

Since the publication of my latest article on Anheuser-Busch in June, the company’s stock barely moved in either direction and there are reasons to believe that the shares will remain where they are in the foreseeable future. This is due to the fact that sales of the company’s flagship beer Bud Light in the United States continue to decline due to the ongoing boycott.

Despite Anheuser-Busch’s efforts to overcome the boycott by changing its marketing strategy, the latest reports indicate that the company so far has been unsuccessful. Even though Anheuser-Busch continues to own the biggest share of the beer market in the United States due to a large portfolio of various brands, the company’s overall sales in the region were nevertheless down 11% Y/Y. At the same time, the company’s Bud Light beer saw a 26.4% decline in sales and lost its position as the top-selling beer that it held for the last two decades to Modelo Especial.

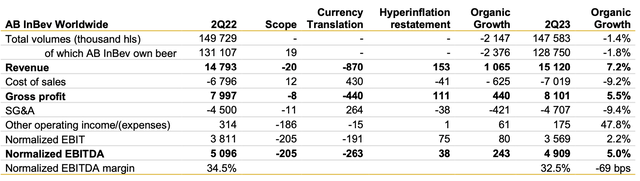

What’s more, is that the latest data shows that Anheuser-Busch’s overall volumes in Q2 declined by 1.4% to 147.6 million hectolitres mainly due to the poor performance in the United States where revenues contracted by 10.5% Y/Y during the period. At the same time, thanks to the increase in sales in Canada, the sales in the North American region were slightly better and declined only by 9% Y/Y to $3.95 billion in Q2. Going forward, it’s hard to see how Anheuser-Busch will be able to significantly improve its performance in one of its biggest markets anytime soon given the reputational damage that its brand received in recent months while its efforts to improve the situation have failed so far.

Anheuser-Busch’s Q2 Earnings Results (Anheuser-Busch)

What’s Next?

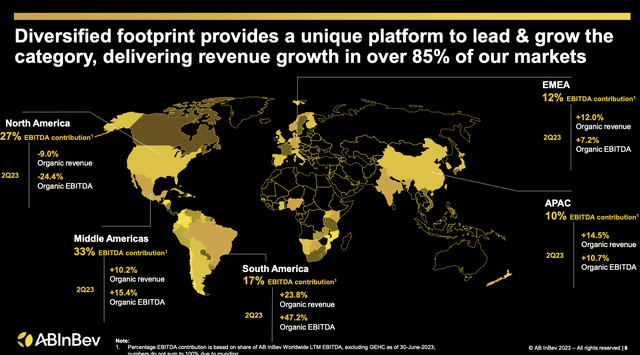

The good news for Anheuser-Busch is that the United States is not the only game in town. As a global company with hundreds of various brands in its portfolio, Anheuser-Busch was able to offset its weak performance in the United States by growing sales in other markets.

The latest earnings results for Q2 showed that the company’s overall revenues increased by 7.2% Y/Y to $15.12 billion. At the same time, the gross profit stood at $8.1 billion while the EPS of $0.72 was above the estimates of $0.69.

Anheuser-Busch’s Q2 Earnings Results (Anheuser-Busch)

Such an improvement in sales shows that despite the overall decline in volumes, Anheuser-Busch was able to perform better than expected thanks to the price increases in other markets. What’s more is that after such a performance, the company reiterated its bullish outlook and still expects a 4% to 8% EBITDA growth in 2023. Such growth is likely to be achieved by the further improvement of the company’s position in regions such as the Middle Americas and South America, where organic revenues and profits continued to grow at an aggressive rate and were able to mitigate the poor performance in North America.

Anheuser-Busch’s Q2 Earnings Results (Anheuser-Busch)

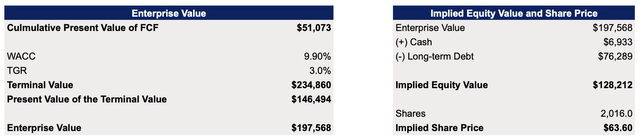

Considering all of this, the main question now should be whether it makes sense to acquire Anheuser-Busch shares at the current price, which has stabilized in recent weeks. Back in June, I already made a DCF model which showed that the company’s fair value is $65.28 per share. However, back then I’ve also noted that if sales in North America deteriorate as a result of a boycott, then the upside could be lower than previously expected.

Since we already have new numbers out, I’ve decided to update my model and revise the top-line assumptions, which are now mostly in-line with the street new estimates and indicate a slightly lower growth in the following years than previously assumed. All the other assumptions in the updated model remain the same since the boycott didn’t have that big of an impact on them.

Anheuser-Busch’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The updated model shows that the fair value of Anheuser-Busch is $63.60 per share, which is slightly below the previous calculations but still represents an upside of ~11% from the current levels.

Anheuser-Busch’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The Bottom Line

From a valuation standpoint, Anheuser-Busch is a buy as its shares are undervalued after the latest depreciation that was caused by the boycott of its products in the United States. The latest successful earnings results showed that the company also has the ability to mitigate reputational risks thanks to its presence in different regions across the globe which are able to outweigh the effects of the boycott.

Despite this, I decided not to open a long position in the company as there’s a possibility that the share price would continue to be affected by negative headlines, which would kill any momentum and would make the stock stuck in limbo. That’s why it’s not worth it to be exposed to such a scenario even for a ~11% upside given that there are better growth opportunities that the market currently offers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here