Antero Midstream (NYSE:AM) has been making acquisitions for some time. Several are too small to mention. But the cumulative effect has been to acquire assets below cost enough to boost the free cash flow progress a little faster than the market may be expecting. When this is combined with the progress Antero Resources (AR) is making towards a credit rating upgrade which would lower debt costs, the next dividend increase is getting closer than one would expect as well. It still may take a couple of years. But it looks more doable by the day.

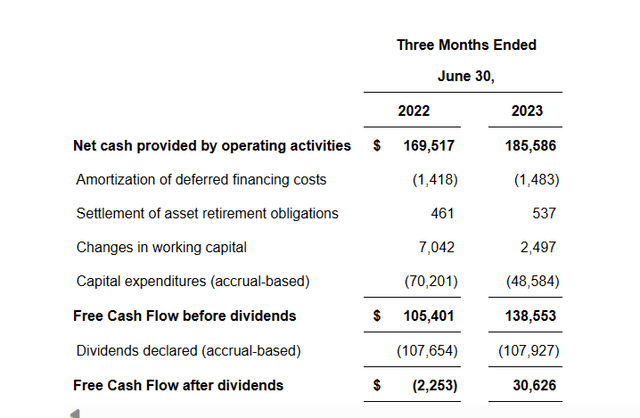

Antero Midstream Calculation Of Free Cash Flow After Dividends (Antero Midstream Second Quarter 2023, Earnings Press Release)

For a long time, there were all kinds of worries about the ability to maintain the dividend because there was not enough free cash flow to pay the dividend. This was in spite of the fact that this company is a financial rock. Therefore, management has always had the alternative of borrowing to pay the dividend so that the capital schedule could be maintained while paying that dividend.

Never mind that it could just as easily be stated that the company borrowed money to expand operations while paying the dividend. That would actually make more financial sense. But Mr. Market sometimes has a habit of worrying over some of the most insignificant issues (and then not letting that issue go).

Now that management is shown to be correct and has been all along about free cash flow, maybe the market can finally price this issue in line with other midstream companies. That would give long time holders of this issue an appreciation bonus not often seen with an income-oriented holding.

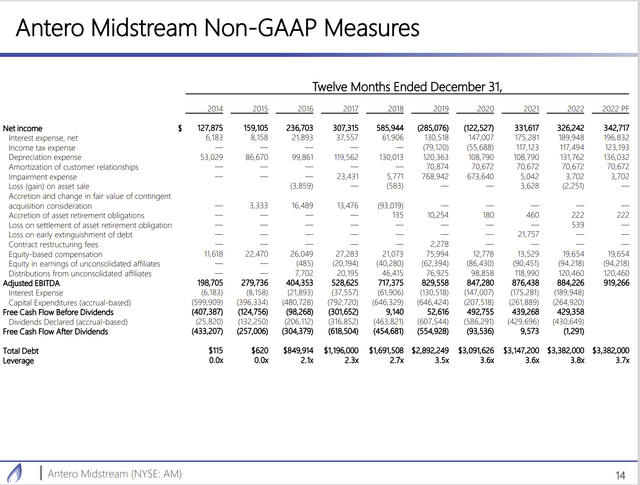

Antero Midstream Leverage Calculation Trend (Antero Midstream Second Quarter 2023, Earnings Conference Call Slides)

Most investors believe that the way to reduce the leverage ratio shown above is to repay debt. That assumption is true as far as it goes. However, growing EBITDA is an excellent way to reduce the debt leverage ratio as well.

As an aside, that leverage ratio is so low for a midstream that management could have “borrowed to pay the dividend” for years to come and the leverage still would not have been an issue. The capital budget was far in excess of what would have been needed. The debt ratio would not have changed materially either each year.

It is not like the company would have needed relatively huge amounts to maintain the dividend. Of course, Mr. Market ignored that minor detail. It got ignored in spite of the fact that companies do this all the time when management can see its way to “earning the dividend” in the future. This is especially true when a company like this one is growing.

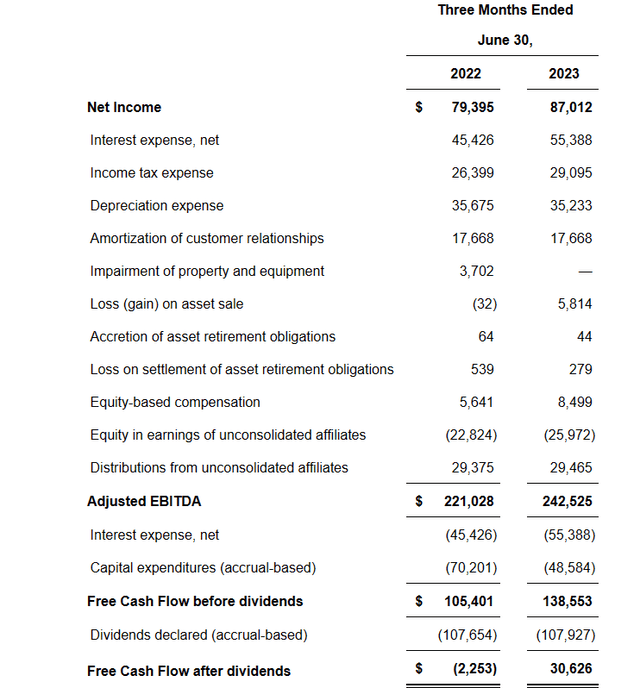

Antero Midstream EBITDA Calculation and how it relates to Free Cash Flow (Antero Midstream Second Quarter 2023, Earnings Press Release)

EBITDA had one of the largest growth spurts in recent memory. That probably means that Antero Midstream is going to have one of the larger cash flow gains in recent memory in the current fiscal year.

Management mentioned in the latest conference call that capital requirements went down while earnings and cash flow increased. The combination of the two led to an increase in EBITDA and hence free cash flow.

What drove the heretofore unexpected increase was the acquisition made that closed last December from Crestwood (CEQP). This acquisition added some assets that could be moved to places that needed those assets. because the pipeline itself was underused.

All of a sudden, the dividend coverage went from market worrying under-coverage to very comfortable. Mr. Market often does not put a whole lot of emphasis on management guidance until the evidence is under his nose. In this case the evidence just got there.

Now forecasts of more free cash flow have some credibility. than they did in the past. The declining capital requirements mean that more volumes in the future will add to cash flow while declining capital requirements also add to cash flow. This is just the kind of cash flow cascade the market wants to see.

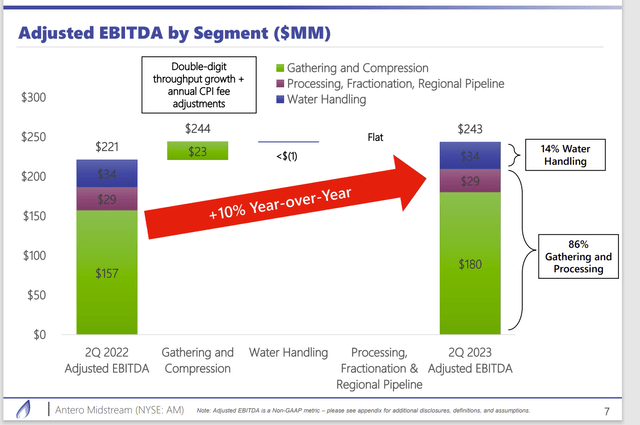

Antero Midstream Profit Center Detailing Of EBITDA Growth (Antero Midstream Second Quarter 2023, Earnings Conference Call Slides)

The growth is coming about because Antero Resources has decided to emphasize the liquids rich acreage served by Antero Midstream. This likely will enable Antero Midstream to grow for years to come regardless of what Antero Resources decides to do.

Antero Resources is going to grow production because of strong well results and other efficiency gains. There is also a corresponding Antero Resources capital reduction due to these gains as well as the market downturn that tends to make service costs soft.

Because of these efficiency gains, Antero Resources now has lower costs per MCF on new production. That influences the decision of “to drill or not drill” to maintain or increase production even though older production is higher cost and largely responsible for reported results.

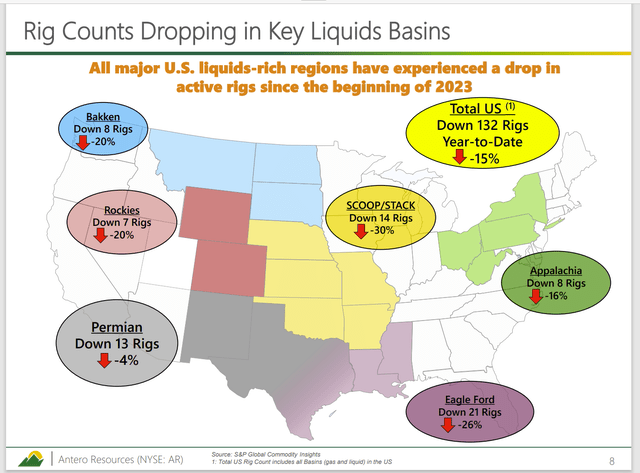

Antero Resources Rig Count Decrease That Will Bring Natural Gas Supply In Line With Demand (Antero Resources Second Quarter 2023, Earnings Conference Call Slides)

The dropping rig count is very bullish for every single product produced by Antero Resources. Management has long stated that they expected liquids pricing to do better in the second half of the fiscal year. While timing can always be “give or take”, the slide above is a definite opinion that all kinds of produced products are going to have a pricing recovery.

Anyone who is worried about the volumes handled by Antero Midstream only needs to take a look at the slide above to realize that any volume drop is going to be very temporary because of the activity decline shown above.

The map does not account for the strip well part of the industry and other high-cost production that normally gets shut-in during times of weak pricing. It will be back when prices recover (and it can come back faster than some expect because all the operator has to do is “turn on the tap”).

Summary

Antero Midstream is on its way to a record year. It is likely to be a record year in a big way, thanks to the acquisition made at the end of the last fiscal year.

The combination of declining capital requirements and increasing EBITDA will have a large effect on the market important free cash flow measure. Already, dividend coverage has moved from “market worrying” to very comfortable. Management has guided to even better numbers to come.

Management wants to see the debt ratio down to 3 before raising the dividend. That will likely happen in a couple of ways. The obvious way is to repay debt while growing EBITDA. But Antero Resources is working on a debt rating upgrade that would likely flow through to Antero Midstream. This would reduce debt refinancing costs and aid the achievement of a lower debt ratio.

Therefore, a dividend increase “down the road” looks like a realistic possibility for the first time in ages. Mr. Market will likely revalue the stock now that the dividend appears to be in no danger. Investors should note though that it would only take one more accretive acquisition like the last one to bring the chances of a dividend increase to the near future.

Read the full article here