Arch Resources, Inc. (NYSE:ARCH) a leading producer of metallurgical coal, demonstrated robust operational momentum in Q1 2023 despite softening coal prices. The company trades at a market cap of around $2.28 billion and an enterprise value of $2.233 billion because it has a net cash position.

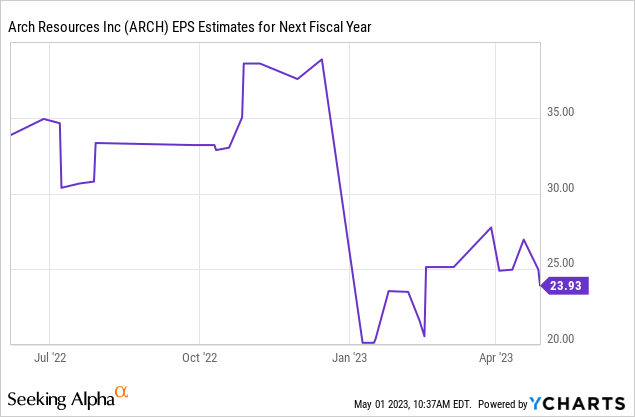

Analyst estimates for earnings for next year have adjusted slightly downwards since my last article (reflecting the lower trending coal prices) and are now at $24 per share down from $25.

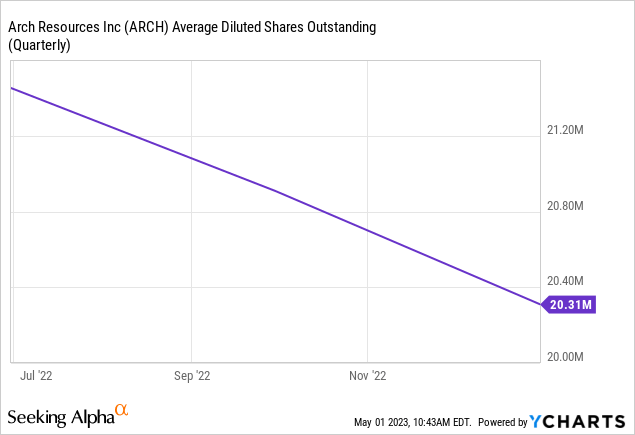

The diluted share count continued to decrease:

Management also continued chipping away at its complicated capital structure. They went over the execution and plans on the latest call again (emphasis added by me):

While the basic share count increased more than one million shares in the quarter due primarily to the warrant exercises, there was not a similar increase in fully diluted shares. And in fact, we actually reduced the fully diluted count over the course of Q1 by 300,000 shares through the convertible repurchase and share buybacks. We now have just over 450,000 warrants that remain outstanding and given their terms would expect those to be exercised in the next couple of quarters.

Going forward to the extent we have additional warrants exercised on a gross basis, we will use the cash proceeds to reduce dilution just as we did in the first quarter. While the exercise of the remaining warrants will increase the basic share count, there should be no change in the fully diluted count. And as we continue to execute on the second 50% of the capital return program, we would expect both the basic and the fully diluted share count to continue to decline over time.

Finally, while we have repurchased all the convertible bonds, the caps call that we purchased at the time of the issuance remains outstanding. The caps call is not factored into our reported fully diluted share count or otherwise recorded in our financial statements, but the intrinsic value of the cap call remains approximately $62 million, representing more than 520,000 shares at yesterday’s closing share price.

I’ve come to think of removing the overhang of warrants and convertibles as quite important. Increasingly, institutions aren’t interested to own any coal exposure. The future shareholder bases for Arch are increasingly individuals, family offices, hedge funds, quants, etc. Except for some hedge funds, these aren’t the best equipped to do many complex financial models involving a lot of securities. They can do it, of course, but it may not have the best returns on headaches.

I’d love for Arch just to hit the share count as hard as they can, but there is some sense in being tactical about returning capital to shareholders.

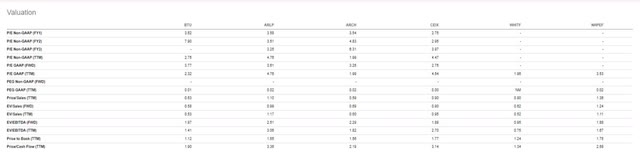

I periodically review the valuations of various coal producers with similar market capitalizations using data from Seeking Alpha. These companies are primarily focused on either metallurgical or thermal coal production.

Among these companies, Arch no longer stands out as undervalued across several metrics. In my opinion, critical multiples such as P/Es, EV/EBITDA, and others generally point to Arch trading at the higher end of the range. Having said that Arch is guiding towards increasing production for next year and it has a lot of 2023 production locked up by customers. It seems to me that coal companies’ future cash flows are almost universally overly discounted even when we assume an upcoming recession is likely (something that’s mostly a matter of time in my opinion).

Valuation coal companies (Seekingalpha.com)

One thing that’s really important to me is that Arch management is aware of the value it is creating by aggressively returning cash to shareholders and plans to continue on this path:

As we have stated repeatedly, we believe our capital return program has proven to be tremendously effective in driving shareholder value and do the capital allocation model is appropriate, durable and well aligned with shareholder interests and preferences. As a result, we fully expect this program to remain the centerpiece of our value proposition for the foreseeable future.

At the same time, the phrase “foreseeable future” implies there could be a future where it is not the centerpiece of the value proposition. That seems unlikely because it would require much higher multiples before I’d understand not pursuing buybacks aggressively.

This time around, Arch offered some interesting color on coal price dynamics.

It is early March, the price of High-Vol A coking coal loaded in a vessel on the U.S. East Coast has declined about 25% from $328 to $247 per metric ton. While that is a significant pullback clearly, it is important to point out here that Arch’s low cost mines still generate a healthy cash margin, even today at stepped down prices, which illustrates again the value of being in the lowest quartile of the cost curve.

But particularly interesting about pullback and seaborne coking coal prices, is that we continue to see many constructive indicators in the marketplace. For instance, global steel prices continue to trade at levels around 50% above their November loans. Moreover, the vast majority of the blast furnace capacity idled in Europe last year in the face of weak steel demand around 25 million tons by our count has now restarted and lead times for new orders of finished steel are twice what they were just a few months-ago.

The company sounds a little bit more optimistic than on the prior call. At the same time the World Bank put out a report that’s fairly bearish coal for 2023/2024 but does expect it to remain above 2015-2019 levels. U.S. natural gas actually recovered a little bit since the April lows as well. Arch explains this in a way that I’ve found highly plausible for quite a while now:

At the same time, coking coal supplies remain constraint after years of underinvestment and the situation has been exacerbated by increasing regulatory pressures in all jurisdictions. This combination of circumstances is particularly evident in Australia, where coking coal exports declined by more than nine million tons in 2022, versus the already depressed low of 2021 and a follow an incremental 15% on a year-over-year basis during the first two-months of 2023.

…Finally, Russia, the other large supplier in the seaborne coking coal market, remains a significant question mark in the face of continuing hostilities in Ukraine, which in turn has created various challenges to move in these products due to credit considerations and logistics.

While most of the Russian volume continues to find a home in global markets, we believe that mounting cost pressures and increasingly difficult business climate, and heavy discounts for the product could make it difficult to maintain this dynamic indefinitely…

To my knowledge, Russian product is mainly finding its way to India at a $15-$20 discount rates to general market prices. At the same time, these sales are generated at substantially higher costs than they would under normal conditions. Just think about the additional transport costs and the difficulties of finding transportation and insurance. Without Russia finding buyers outside of Europe, coal prices would likely look very different. What I believe the company is getting at is that at lower coal prices some of the Russian demand may be taken off-market. Very high coal prices have more or less cushioned Russian producers from the effect of the increased cost structure. I can see how this would stabilize coal prices a bit more quickly than would normally happen in recessionary circumstances. Especially as Russia is effectively in the same boat regarding its oil and gas production. Notably, gas is a direct competitor for coal.

The prospects aren’t immediately exciting for Arch. However, we should put this in the context of a recession being widely anticipated (which means it will be partly priced in). With prices, analyst estimates have come down a lot from ~$35 to ~$24. But Arch is trading at $119 per share with a net cash position. I think things are still looking quite ok. Once the next recession is dealt with and we’re looking beyond, the outlook may improve and traders may get back on the bandwagon.

Over the past 12 months, Arch Resources, Inc. paid around ~$21 in dividends. It generated a 27% shareholder yield (which includes buybacks). If it does half that over the next year, that’s still quite attractive and quickly de-risks the investment. I own a basket of these out-of-favor names. Arch Resources, Inc. is currently not my favorite. I like Peabody Energy Corporation (BTU) a little bit better for now. I also need to update my views on Whitehaven Coal Limited (OTCPK:WHITF) because I suspect it is relatively attractive as well. Having said that, I do own them all.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here