Ares Capital (NASDAQ:ARCC) is a leading business development company or BDC. Its market cap of $10.5B gives it a significant scale and firepower advantage against its smaller peers. The company focuses on “high-quality borrowers” in the middle-market space. Its strategies encompass a myriad of debt and equity structures, providing investors with a blend of income and potential capital appreciation benefits.

Ares Capital is scheduled to report its third-quarter or FQ3 earnings release on October 24. I expect it to be a highly-anticipated release, given the significant developments in the market as long-term yields surged.

Accordingly, the 10Y Treasury yield (US10Y) reached 5% this week as investors prepare for the “bear steepening” phase. As such, the worries of a hard landing have intensified, which could cause significant pain for BDCs, given their exposure to relatively less fundamentally strong companies.

Despite that, the recent bank earnings indicated that their management has turned increasingly optimistic that the US economy could avert a broad-based recession, given its resilience. Despite that, the sharp increase in long-term yields has also caught the attention of market bears once more, as they assessed it could lead to a recession next.

Keen investors should recall that Ares Capital management highlighted the company didn’t anticipate an “imminent recession” at its second-quarter earnings conference. As such, investors should scrutinize management’s updated commentary to ascertain material changes to the company’s economic outlook.

Notwithstanding that caution, my base case remains that the market has likely priced it in even if we could have a recession. Also, a higher-for-longer Fed is expected to benefit Ares Capital’s core EPS, given the exposure of its floating-rate debt portfolio. Still, such tailwinds must be balanced against the specter of potentially higher default risks emanating from a credit crunch attributed to a hard landing. In other words, we can only go so high in rates before something breaks and the dominoes collapse.

While it does sound spooky, at least in theory, the reality is that ARCC’s price action has remained robust. Makes sense? Since the market is forward-looking, ARCC should be one of the first stocks to be hit significantly if the market anticipates a debilitating hard landing. However, ARCC has outperformed the S&P 500 (SPX) (SPY) since my July 2023 update on a total return basis.

Notably, ARCC has remained well above its October 2022 lows, when Bloomberg Economics issued its “100% recession call over the next twelve months” in mid-October 2022, which has failed to pan out. As such, I urge investors not to be unduly worried about the financial media’s narrative. Instead, they should pay close attention to the market action for deeper insights.

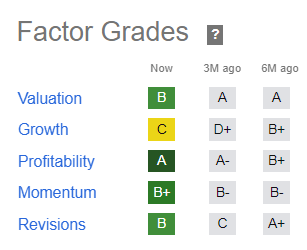

ARCC Quant Grades (Seeking Alpha)

Furthermore, ARCC remains attractively valued (“B” valuation grade) as compared to its financial sector (XLF) peers. While I expect earnings growth normalization headwinds next year as the tailwinds from the Fed’s rapid rate hikes wear off, it’s still a profitability behemoth (“A” profitability grade). Therefore, I haven’t gleaned any red flags in ARCC suggesting we need to be extra cautious.

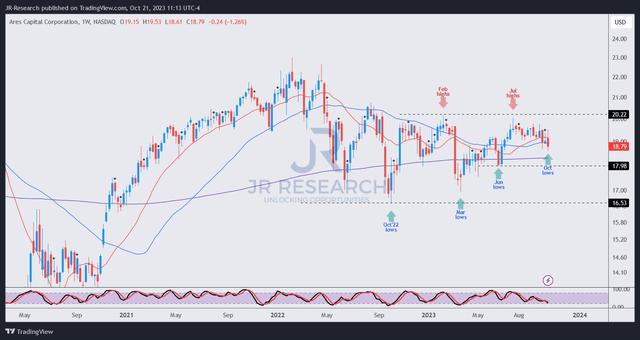

ARCC price chart (weekly) (TradingView)

As seen above, ARCC’s price action remains well above its October 2022 lows ($16.5 level), suggesting market participants have remained confident that the worst is likely over.

While ARCC has met resistance again at the $20 level, I expect it to remain supported above its June 2023 lows ($18 level). Coupled with a robust forward dividend yield of 10.3% at the current levels, income investors aren’t expected to turn to high-yield cash, given the attractive spread. Also, solid portfolio yields underpinned by high floating rates should continue to support its dividends.

With that in mind, I urge investors to carefully assess the media’s pessimistic narrative. While we should never throw caution to the wind, ARCC’s buying sentiments suggest that things aren’t as bad as they seem. Therefore, I’m confident about maintaining my bullish thesis as we head into Ares Capital’s Q3 earnings.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here