At a Glance

In my previous analysis of GSK (NYSE:GSK), I highlighted the challenges and uncertainties stemming from ongoing legal battles and a somewhat tumultuous market momentum, despite the company’s solid financial health and strong product portfolio. Since then, GSK’s Q3 2023 financials have painted a more optimistic picture, with Arexvy’s exceptional sales performance and a commanding presence in the U.S. retail vaccination market, both surpassing expectations and strengthening the company’s market position. This positive shift, however, doesn’t negate the need for investors to stay vigilant, especially in monitoring GSK’s momentum in relation to broader indices and remaining alert to regulatory developments concerning Arexvy. Management’s confidence, reflected in the commendation of the vaccine’s efficacy, adds a positive note, yet it is imperative to keep a balanced view, considering both the company’s current achievements and potential future challenges.

Q3 Earnings

To begin my analysis, looking at GSK’s most recent earnings report, Q3 2023 demonstrates a robust financial performance. Their Q3 revenue reached approximately $9.939B, reflecting a 10% increase when omitting COVID-19 solutions. This is further accentuated by a substantial 83% surge in total operating profit, amounting to around $2.378B. On the earnings spectrum, adjusted EPS experienced a 17% growth, amounting to roughly 61.5¢. Significantly, GSK has positively adjusted its full-year guidance, projecting a revenue rise of 12-13%, a 13-15% increase in adjusted operating profit, and an adjusted EPS boost of 17-20%. These numbers derive strength from the sales of Arexvy and the uptick in their vaccines and specialty medicines segments.

Financial Health

Turning to GSK’s balance sheet, the combined value of ‘cash and cash equivalents’, ‘liquid investments’, and ‘current equity investments’ equates to approximately $8.15B. The current ratio is below 1, at approximately 0.95, signaling potential liquidity constraints. GSK’s debt profile includes significant short-term borrowings of $5.9B and long-term borrowings of $19.5B, indicating substantial leverage. With a positive net cash from operating activities averaging $725M per month over the last six months, GSK has been bolstering its financial resources. Nonetheless, this retrospective analysis does not guarantee future outcomes. Given the current liquidity and cash flow, the odds of GSK needing additional financing within the next year appear low, barring unforeseen expenditures or strategic financial commitments.

Note: All above values were converted from Pound to USD at a ratio of 1:1.22 (at the time of writing) and are, subsequently, approximate.

Market Sentiment

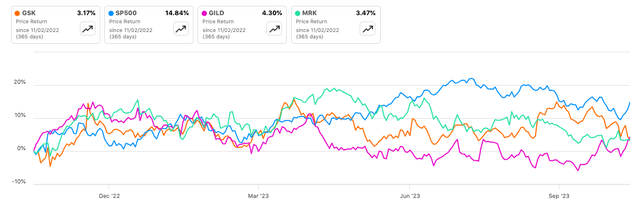

According to Seeking Alpha data, GSK’s market capitalization of $70.12B aligns with its robust financial performance, indicating market confidence. Analyst revenue projections suggest a slight dip in sales in 2023 (-0.95%) but a promising uptick in 2024 (+5.55%) and 2025 (+5.92%). GSK’s stock momentum has underperformed the SP500 over 3, 6, and 9 months, but demonstrated resilience over a year with a +3.35% growth compared to SP500’s +9.90%.

Seeking Alpha

Institutional ownership stands at 13.58%. There are 5,418,425 shares in “New Positions” and 1,888,467 shares in “Sold Out Positions”. Notable institutions include Dodge & Cox, FMR, and Fisher Asset Management. Insider net activity over the past year shows mixed sentiment.

Outpacing Predictions: Arexvy’s Q3 Sales Showstopper

The performance of GSK’s Arexvy – the first approved RSV vaccine for older adults – in Q3 is stellar, marking a successful launch in the U.S. with significant sales figures. The sales for Arexvy were reported at approximately £709M ($865.98M), a figure that outpaced analysts’ expectations which were pegged at £358M. This revenue surge contributed to a 33% increase at CER in GSK’s third-quarter vaccine sales, bolstered further by strong Shingrix (Shingles) vaccine uptake in ex-U.S. markets.

In terms of market penetration, this quarter saw Arexvy capturing two-thirds of the retail vaccination market share. It’s highlighted as an excellent start for Arexvy, being its first full quarter on the market, with sales figures instilling confidence in the vaccine’s potential peak annual performance. The vaccine not only bolstered the company’s bottom line but led to an upward revision in the full-year guidance, reflecting the positive financial impact Arexvy has had on GSK.

Management’s commentary during the recent earnings call mirrors the successful performance depicted in the sales figures. The remarks highlight a high demand and strong commercial positioning, particularly in the U.S., with a significant number of doses being co-administered with flu vaccines. Management also voiced their excitement regarding the launch and expressed confidence in achieving peak sales of more than £3B. They also provided a sales forecast for the full year to be between £0.9B and £1B, anchored on an analogy of flu vaccination seasonality.

Management’s emphasis on a “long runway” for Arexvy in the U.S., the vaccination of more than 1.4 million adults out of the 83 million at-risk, and the ongoing launches in Europe and Canada, along with the approval in Japan, indicate a bullish outlook on Arexvy’s market performance both domestically and internationally. The narrative also underscores a strategic focus on highlighting the vaccine’s 94.6% efficacy in the co-morbid population, which seemingly has resonated well with strong HCP brand recognition.

Juxtaposing these insights with management’s commentary reveals a coherent narrative of strong market performance, strategic commercial positioning, and a buoyant outlook on Arexvy’s future market penetration and revenue generation. This aligns well with management’s optimism and strategic focus shared during the earnings call.

Peer Comparison

GSK’s lower valuation multiples like P/E Non-GAAP (FY1) at 9.30 and EV/EBITDA [FWD] at 7.28 compared to Merck’s (MRK) 16.71 and 12.24, and Gilead’s (GILD) 12.16 and 8.81 respectively, suggest a comparatively conservative valuation. The lower Price/Sales [TTM] ratio of 1.93 for GSK against Merck’s 2.74 and Gilead’s 3.67 may indicate a lesser premium on GSK’s revenue. This conservative valuation could reflect market skepticism towards GSK’s near-term growth prospects, especially given its negative revenue growth forecasts for 2023 post-COVID revenues. Conversely, higher valuation multiples for Merck and Gilead could signal market optimism towards their future earnings, justified by Merck’s solid revenue growth on the steady wings of Keytruda and Gilead’s high profitability margins. These relative valuations underline differing market expectations and investment risk-profiles among these healthcare firms.

My Analysis & Recommendation

The robust financial performance of GSK in Q3 2023, driven notably by the stellar market debut of Arexvy, lays a promising foundation for 2024. The initial market penetration of Arexvy, capturing a significant portion of the retail vaccination market share, coupled with management’s bullish outlook, underscores the potential for revenue augmentation. However, the company’s financial health hints at potential liquidity constraints, despite a low probability of needing additional financing in the near term. The market dynamics reflect a mixed sentiment, with GSK’s stock momentum trailing the SP500, yet the conservative valuation relative to peers like Merck and Gilead could present a less risky profile amidst the competitive landscape.

Investors should closely monitor the ongoing market expansion of Arexvy, especially in international markets, and any regulatory advancements that could further bolster its market position. An eye should also be kept on the company’s ability to manage its debt profile and enhance liquidity, which would be critical in fueling its operational and strategic initiatives.

Strategically, investors could consider a diversified exposure to the healthcare sector, perhaps through ETFs, to mitigate firm-specific risks while capitalizing on the sector’s growth potential. Monitoring GSK’s operational efficiency and the commercial success of its new vaccine could provide indicators for timely investment decisions.

With a confidence score of 65/100, my recommendation shifts towards a “Speculative Buy”. This position reflects the potential upside driven by Arexvy and other vaccine segments, balanced against the financial health concerns and competitive pressures that GSK might face in the near to medium term.

Risks to Thesis

While the financials and promising sales of Arexvy paint an optimistic picture for GSK, there are inherent risks:

- Product Dependency: Heavy reliance on Arexvy could render GSK vulnerable if unforeseen safety issues arise or if competitors introduce superior products.

- Market Saturation: The current rapid uptake of Arexvy might saturate the target demographic faster than anticipated, potentially slowing future sales.

- Regulatory Hurdles: International market expansions can introduce regulatory challenges that might delay or hamper Arexvy’s adoption.

- Competitive Pressure: Rival firms might expedite R&D, producing competing vaccines with better efficacy or pricing, eroding GSK’s market share. For example, Pfizer’s (PFE) RSV vaccine, Abrysvo, FDA-approved just a month after Arexvy, is a major competitor.

- Economic Factors: Global economic downturns could impact the pharmaceutical sector, dampening sales growth.

- Debt Levels: Despite robust cash flows, GSK’s significant net debt of ~$21.5B cannot be overlooked, potentially affecting future investment capacities or dividend payouts.

- Litigation: Persistent U.S. lawsuits regarding GSK’s retired Zantac may result in billions of dollars in settlement costs.

Read the full article here