Background

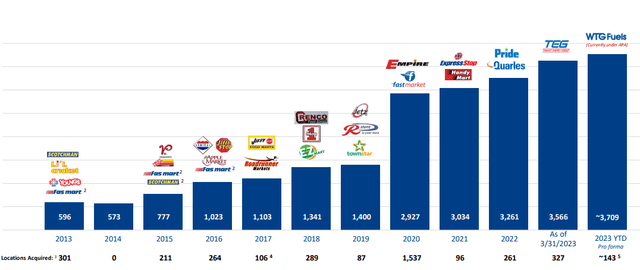

Arko Corp. (NASDAQ:ARKO) is the 6th largest convenience store chain in the US operating over 1,400 stores under more than 20 regional brands with a focus on smaller towns (40% of stores are located in cities with population of less than 20,000 and 20% of stores are located in cities with population between 20,000 – 50,000). It is also a leading wholesale distributor of motor fuel, supplying to about 1,700 independent dealer locations. It had embarked on a debt-fueled acquisition spree, having completed 23 acquisitions since 2013.

Company filings

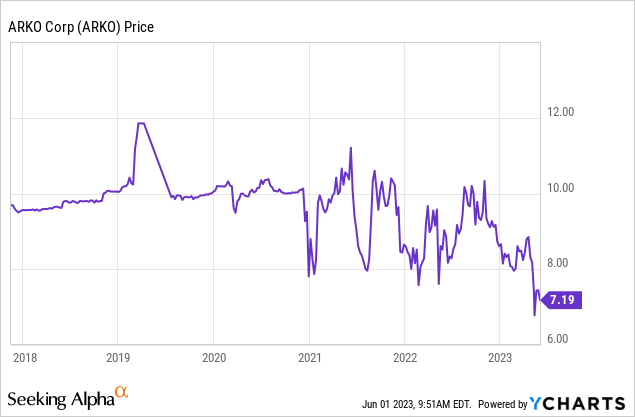

Despite the continued growth through acquisitions, the company has remained an underperformer as it has not been able to drive performance in its acquired brands while debt remains a concern, particularly in a rising interest rate scenario.

It recently tried to acquire Travel Centers of America (TA) at $92 per share, higher than rival BP’s bid of $86 per share. However, TA rejected Arko’s higher bid, citing execution risk and Arko’s sub-investment grade debt rating.

Strong Earnings in Q1

After challenging Q3 and Q4 2022 with falling sales and shrinking margins, the company has been able to turn the tide in Q1 2023. It reported a same-store sales growth (excluding cigarettes) of 7.6% within merchandise segment driven by double-digit growth in key categories such as candy, sweet snacks, salty snacks, and packaged beverages. These categories along with beer and alternative snacks drove 63% of its Q1 same-store sales excluding cigarettes and 43% of its total same-store sales, highlighting consumers’ increase in preference towards high-margin packaged foods segments. Same-store fuel gallons decreased 5.8% YoY, however, fleet fueling segment, which began in July 2022 contributed positively to the growth along with continued acquisitions led to an overall revenue growth of 5.9% YoY in Q1 2023.

Merchandise margins improved 120 bps YoY, driven by growth in higher-margin category products. Fuel margin dropped from 37.5 cents to 35.4 cents as it continue to witness a reset in elevated fuel margins last year as a result of Russia’s invasion of Ukraine. Fuel margin in proprietary cardlock locations remained at 44.5 cents focused on commercial locations and Arko’s focus on further strengthening its position in fleet fueling would further aid in driving higher margins.

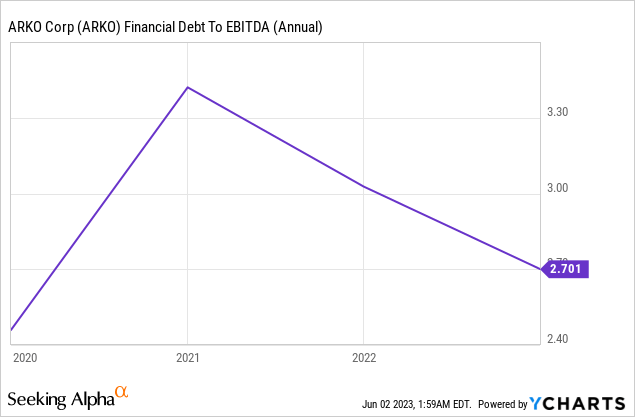

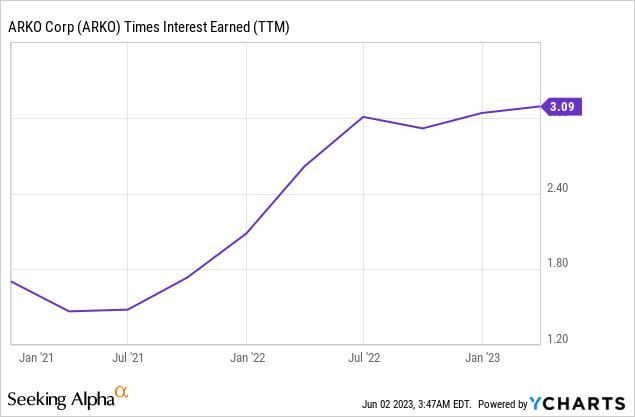

While the company’s debt position has been at the center of the investor’s concern, its strong execution and in-store performance along with strategic acquisition such as fleet fueling cardlock and fuel distribution business of Quarles Petroleum has led to an improvement in its credit ratios with its current Debt/EBITDA at 2.7x. Times interest earned, a measure of interest-paying capability, is also among the highest, demonstrating management’s ability to deliver performance while also managing debt.

Valuation

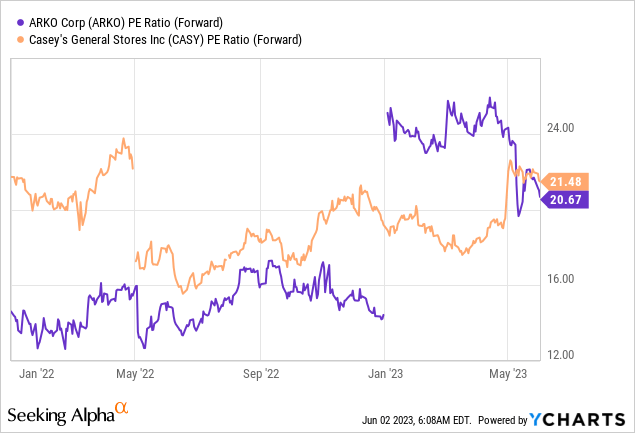

Arko trades at a forward PE ratio of 20.7x in line with its larger peer Casey’s (CASY), despite CASY’s larger scale and outsized margins as a result of earnings drag in Arko’s previous quarters. However, investors offer a premium to the company’s growth-focused business model led by acquisitions which will further boost EPS. It has also announced increasing its original share repurchase program from $50 mn to $100 mn to drive shareholder value, which will boost EPS by another 10% (Assuming share repurchase of $60 mn for the year). We believe, at current prices, the risk-reward is balanced and initiate at Neutral.

Risks to Rating

Risks to rating include 1) gas price volatility which can impact margins significantly as witnessed during Q2 2022 and quarters post that 2) company overpaying for growth and have expensive acquisitions which would further impact execution 3) slowdown in fuel retailing business that would impact revenues and 4) normalizing inflation levels which would lead to a moderation in sales growth.

Conclusion

Arko has led on its acquisition-fueled journey, having grown its EBITDA 20x in the last decade. However, execution remained spotty, and the company had not been able to fully leverage the in-store performance, leading to sub-par organic growth. Debt also remained a concern as the company is rated below investment grade and for any acquisition-led growth, debt management remains a concern for investors. However, it has off late able to improve its credit ratios with improving Debt/EBITDA and interest coverage giving them ample cushion for further acquisitions. However, valuation wise, the company is trading almost in line with its larger peer Casey’s, which could go down once the acquisitions done in this year reach full potential, earnings wise. We believe the risk-reward at current levels is balanced and initiate at Neutral.

Read the full article here