Summary

Last week the Mexican airport regulator surprised the market with a unilateral change to the formula by which Grupo Aeroportuario del Sureste (NYSE:ASR) charges for regulated services i.e., passenger and airline fees. The stock sold down sharply on the news, at one point off 26% to US$177.

In my view, there are several key drivers at stake that can determine the future value of the stock.

Valuation Damage: The biggest impact is on valuation, what discount does the market apply to a company that regulators/governments can simply change the rules?

Cash Flow at Risk: How much earnings is at risk and are there any mitigation? Media reports anywhere from 15% to 8% cut to tariffs, but does this mean lower capex as well?

I conducted three scenario analyses on the potential impact to ASR’s valuation that ultimately points to an oversold stock with significant earnings protection. This prompts me to rate the stock a BUY under the circumstances.

For more depth on the Mexican Airport business model please refer to my article. Mexican Airports: I Prefer ASR Over OMAB And PAC.

Pre-Tariff Change Estimates and Valuation

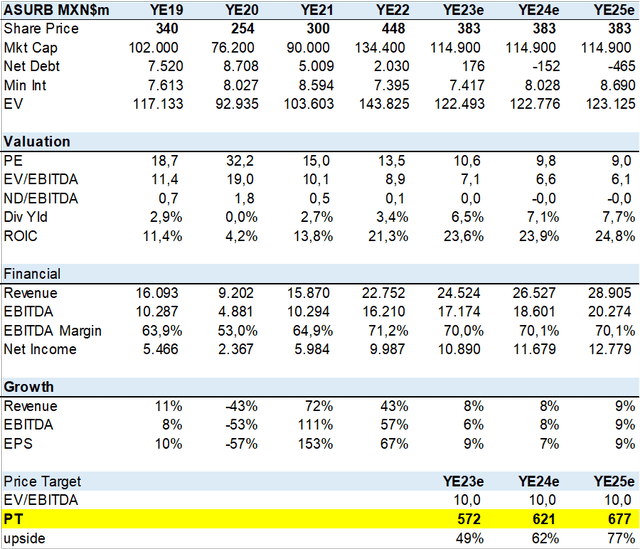

Below are my estimates and valuation prior to the upcoming change to tariffs. One key factor to ASR is the lack of debt and operating diversification. Apart from the Mexico operations its Puerto Rico and Colombia assets contribute about 25% to EBITDA. ASR enters this crisis in a stronger position than its peers.

ASR Financial and Valuation Summary (Created by author with data from ASR)

Three Scenarios

In order to gain some sort of idea as to the potential impact of the tariff cuts I conducted three sensitivity analyses.

1. At how much would tariffs need to decline for today’s stock price to be considered fair?

2. What if rates decline 8%?

3. What if ASR is allowed to extend its concession contract for another 50 years but acquires the abandoned Mexico City airports debt (40% or US$1.9bn)?

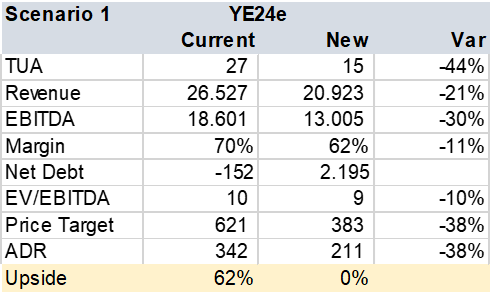

Scenario 1: What is priced in

The first thought I had was how much do tariffs must fall for the current share price to be considered fair. This way, I have an initial idea if the worst is priced in.

However, the first step in this analysis is to assume that the market would cut ASR’s target multiple. The business model is at greater risk from future government intervention. Higher risk, lower valuation. I used a 10x EV/EBITDA multiple for the airports that I now reduce to 9x for ASR to incorporate this greater risk. The saving grace for ASR is that it derives less than 45% of revenue and EBITDA from regulated fees. The remainder comes from commercial revenue and its Puerto Rico and Colombia operations.

Then I calculated that regulated tariffs would need to be cut 44% for the current price to be fair on YE24 estimates at 9x EV/EBITDA. This seems very unlikely in my view

ASR Tariff Impact Priced In (Created by author with data from ASR)

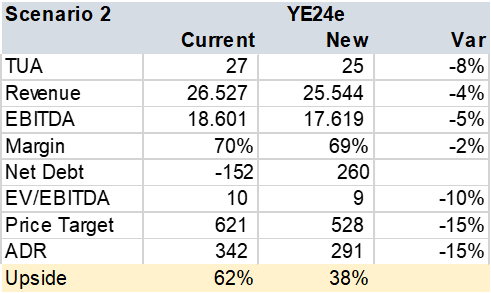

Scenario 2: An 8% tariff cut

In the second scenario, I assumed an 8% tariff cut, a number the government would likely be able to promote in its populist rhetoric but not devastating to company operations. Under this scenario I keep the 9x EV/EBITDA target multiple and only cut regulated tariffs. ASR would see a 5% reduction in EBITDA given its higher commercial revenue mix. More importantly, this level of tariff cut points to a 38% upside potential from current levels. A Buy opportunity.

ASR 8% Tariff Cut Impact (Created by author with data from ASR)

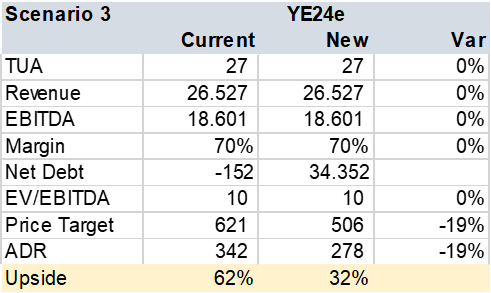

Scenario 3: Adding US$1.9bn in debt

This third scenario requires a bit more speculation. According to some media sources, the government would like to offload the debt accumulated from the cancelled New Mexico City airport, about US$4.8bn. The logic is to exchange this debt for the renewal of the three airport concessions for another 50 years.

Under this scenario, I assume ASR takes about US$1.9bn in debt, in line with GAP but more than OMA given ASR’s greater absolute EBITDA. In this case, I believe the market would not cut fair multiple valuations given the benefits of a renewal. Under this scenario, ASR shares have a 32% upside potential in line with an 8% tariff decrease and represent a BUY opportunity.

ASR Debt Transfer Impact (Created by author with data from ASR)

Conclusion

ASR’s price decline seems to have decoupled from fundamentals even factoring in a sizable real tariff cut or debt transfer. The surprise government action, while not wanted, has created an interesting risk-reward situation in ASR’s stock that I would buy into.

Read the full article here