Assertio Holdings (NASDAQ:ASRT) stands at a pivotal juncture in its history. A mere 3.5 years ago, Assertio’s portfolio was heavily reliant on ZIPSOR and CAMBIA, but today, these once-dominant assets constitute only a fraction of the company’s net product sales. Furthermore, the company deliberately exited the opioid business, marked by the discontinuation of OXAYDO and notable progress in opioid litigation. This transformation underscores a remarkable shift in Assertio’s business model, achieved through a series of strategic acquisitions and the reduction of debt by an impressive $195M. Looking back, one can find multiple occasions where the company executed strategic decisions with a forward-thinking approach to ensure financial discipline and fortify its position in the market. While the FDA’s approval of a generic indomethacin product poses a new challenge for Assertio, the company remains steadfast and resolute. Drawing from its history of successfully navigating similar situations, combined with a focused market access strategy.

I believe Assertio is poised to weather this storm and defend its market position. As a result, I consider ASRT to be trading at a significant discount for its current performance and should be on a watch list for one of the Compounding Healthcare portfolios.

I intend to provide to brief background on Assertio Holdings and their latest performance. Then, I will recap some of their recent updates and growth prospects. Next, I will discuss the ticker’s valuation and risks. Finally, I decided what Compounding Healthcare portfolio ASRT is destined to find a home in and the trading opportunities offered.

Background on Assertio

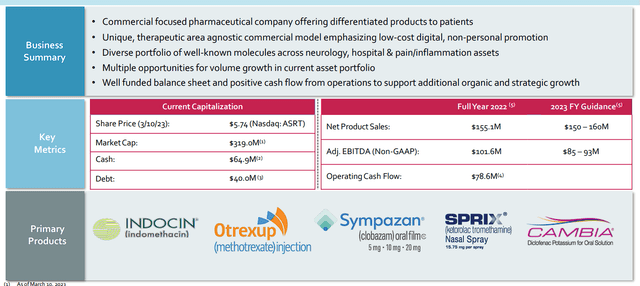

Assertio Holdings’ strength lies in inflammatory conditions, neurology, and rheumatology, addressing critical medical needs with a comprehensive array of solutions. Among their crown jewels is INDOCIN, a cornerstone treatment for rheumatoid arthritis, ankylosing spondylitis, and other types of arthritis. The portfolio extends to encompass solutions for Lennox-Gestalt Syndrome-related seizures, migraines, and pain relief, creating a mosaic of care that empowers patients across diverse therapeutic areas.

Assertio Holdings Overview (Assertio Holdings)

The company has relied on mergers and acquisitions to build its portfolio of products and improve its finances. Since the merger with Zyla Life Sciences in May 2020, Assertio Holdings has demonstrated remarkable agility and strategic prowess in the pharmaceutical sector. The Zyla merger enriched the company’s product portfolio with the addition of Indocin, Sprix, and Oxaydo. Assertio’s seamless integration of Zyla’s assets in Q3 of 2020 underlines their operational skillset. Additionally, the company streamlined its portfolio with the cessation of SoluMatrix and the termination of related license agreements. In addition, the company acquired Otrexup from Antares Pharma to bolster its portfolio, as well as bring in Sympazan from Aquestive Therapeutics (AQST).

Recent Performance

Assertio’s Q2 performance paints a picture of a robust product portfolio. Assertio’s objectives of core growth, cash flow, and portfolio broadening were evident in their Q2 results. A pivotal factor contributing to this success was Assertio’s cost-effective digital non-personal sales model to push their products. As a result, the company reported its net product sales surged to an impressive $40.1M, up 13% year-over-year. Notably, their gross margin experienced a significant improvement, reaching an impressive 88.1%. This uptick is primarily attributed to the strategic shift towards higher-margin products. As a result, Assertio reported adjusted EBITDA hitting $24.8M compared to $22.9M in Q2 of last year. Furthermore, Assertio made $18.6M in cash flow and finished Q2 with $70.2M total in cash and cash equivalents.

On the downside, In light of recent developments regarding the approval of a generic indomethacin suppository (INDOCIN) by the FDA, Assertio has chosen to withdraw its 2023 financial outlook.

Discounted Valuation

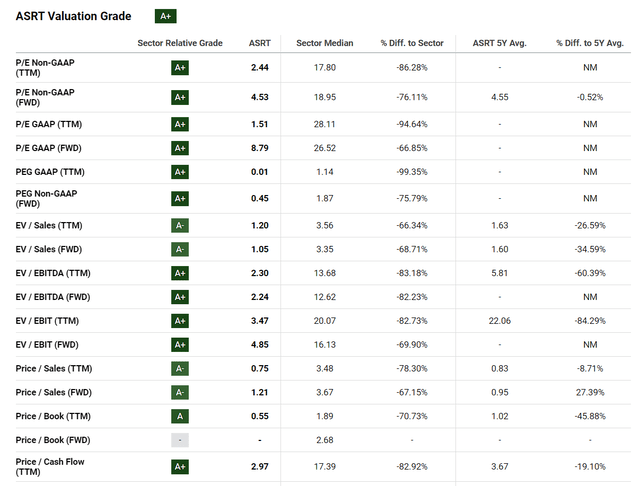

Estimating ASRT’s value is a delicate alchemy, however, it is clear that the ticker is undervalued for recent performance. Looking at ASRT’s valuation grades below, we can see almost A+ grades with most metrics being between -60% to roughly -95% of the sector’s median. Indeed, one cannot solely rely on valuation metrics because one must consider growth prospects and the long-term outlook for the company.

ASRT Valuation Grades (Seeking Alpha)

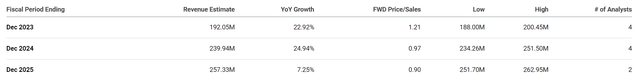

Well, the Street appears to believe that ASRT will be reporting solid growth over the next couple of years and will ultimately report over $250M in revenue for 2025, which would be less than 1x forward price-to-sales.

ASRT Analyst Revenue Estimates (Seeking Alpha)

It is important to note that the industry’s average price-to-sales is roughly 4x-5x, so trading under a 1x price-to-sales is considered a deep discount. If ASRT was to be priced in line with its peers with 2025’s revenue estimate, it should be trading around $11 per share in a couple of years. Considering the ticker is trading around $2.50 per share, we can say ASRT is trading at a significant discount.

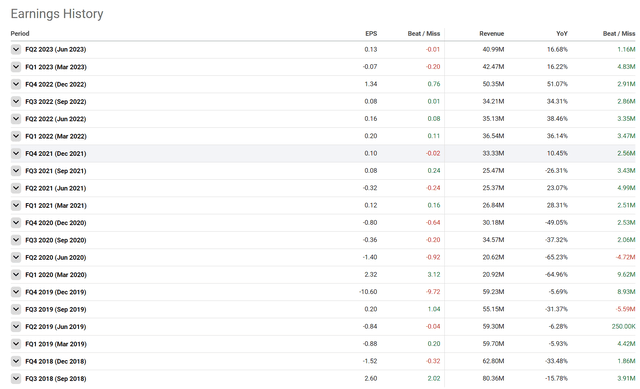

Typically, I have to write a disclaimer here about how the small-cap healthcare company is probably going to have to perform some form of dilutive financing in the coming years, and the valuations will be watered down. In ASRT’s case, the company is pulling in a positive EPS and is expected to report some growth.

ASRT Analyst EPS Estimates (Seeking Alpha)

Therefore, I think it is possible that the company’s expected revenue and EPS growth will justify a much higher valuation.

Certainly, we don’t know if the company will hit those projections, however, the company’s performance would really have to miss the mark for it to come short of the Street’s expectation and its internal goals. However, the company could still miss by a wide margin, and yet, the ticker would probably still be undervalued when matched to a multitude of metrics.

Again, I would understand a ticker trading a significant discount if the company is losing market share to generics and revenue is fading. However, Assertio has the growth prospects to offset the negative sentiment associated with the deteriorating revenue from 2018.

ASRT Earnings History (Seeking Alpha)

However, I must point out that Assertio has revealed some signs of a potential turnaround over the past year. Yet, the share price is just above its 2021-lows, so, there is a divergence between the fundamental outlook and the ticker’s performance.

Looking For Growth

In order to revive some bullish sentiment for ASRT, we need to discuss the company’s growth strategy. Recently, Assertio has been dedicated to external growth and portfolio expansion. Right now, Assertio has to seek out new assets to address the reduction in income from Indocin and offset anticipated revenue declines in ZIPSOR and CAMBIA attributable to the loss of exclusivity.

Thankfully, Assertio has an efficient non-personal sales model, combining digital channels and virtual sales representatives, Assertio delivers targeted messages to healthcare providers and consumers efficiently. This should improve their reach while limiting costs and trying to drive growth from Otrexup and Sympazan.

The big growth lever is probably the acquisition of Spectrum Therapeutics. This deal marks a watershed moment in Assertio’s trajectory thanks to ROLVEDON reporting a staggering 34% quarterly growth, which should bolster company earnings in 2024. Holding just 2% of the market share, ROLVEDON presents promising growth prospects. The acquisition further diversifies ASRT’s portfolio, creating a synergistic powerhouse poised for sustained growth.

Spectrum’s integration, along with the potential upside from Assertio’s existing FDA-approved drugs, positions ASRT as a potential turnaround candidate with notable growth prospects.

Downside Risks

Primary downside risks revolve around potential challenges in integrating Spectrum and revenue loss due to competition as certain drugs lose exclusivity.

Yes, Assertio has to deal with the generic indomethacin suppository being approved, which forced the company to withdraw its 2023 financial outlook. In addition, the company only has $70.2M in cash and cash equivalents at the end of Q2, so they don’t exactly have a war chest to deploy to absorb great-than-expected losses or to be used to acquire additional assets if the Spectrum deal doesn’t yield fruit.

Indeed, I would like to be optimistic about the company’s future and the trajectory of its earnings potential. However, I am sticking to a cautiously optimistic, with a “prove it” stance at the moment.

As a result, I am giving ASRT a conviction level of 2 out of 5.

Finding A Portfolio

The question is… which one? Is Assertio a speculative ticker for the “Bio Boom” portfolio? Is Assertio considered a growth stock deserving a spot in the “Bioreactor” growth portfolio?

In general, I think Assertio is poised for growth and the company has a track record of pivoting and decreasing the dependence on a select few drugs in their portfolio. In addition, their commitment to diversification is crucial to surviving in the pharma industry, where patent expirations and market dynamics can have an acute impact on the company’s performance and survivability. I believe these points make ASRT less of a speculative ticker, however, the chart’s technical rating and some potential unknowns lead me to place ASRT in the “Bio Boom” portfolio watchlist for the time being.

However, the company has a heftier balance sheet, and they are better positioned for future growth efforts. Therefore, I will consider moving ASRT to the “Bioreactor” growth portfolio if they are able to hit the Street’s 2024 estimates of pulling in ~$240M in sales and recording a $0.46 EPS. At that point, I believe we should have a stronger conviction about the company’s growth trajectory and long-term outlook.

My Plan

In the midst of the company’s unpredictability, glimmers of positivity emerge. ASRT has recently surprised with better-than-expected results over the past year, indicating a more stable financial position than previously perceived. Moreover, the company’s current valuation aligns with anticipated revenue declines rather than growth. When I look at ASRT, I see an opportunity to take advantage of the discounted valuation that was provided by the market hyper-focusing on the deteriorating revenues despite the company making several moves to pivot.

For me, I see the undervalued, the technically oversold opportunity, and the turnaround opportunity, all of these being a result of selling pressure going too far and in effect “priced in” most downside risk. I see a near-perfect setup for a speculative trade opportunity that could turn into a long-term investment.

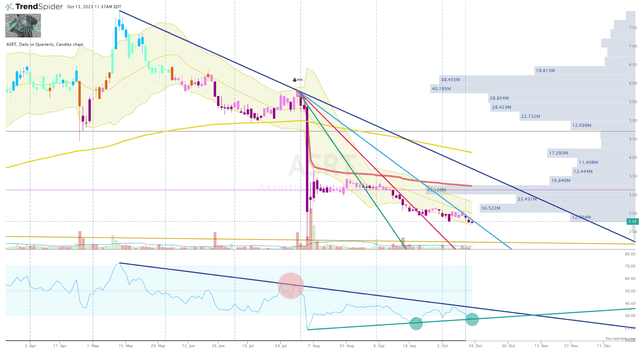

In order to take advantage of these opportunities, I am going to wait for ASRT to show a high probably reversal setup on the Daily Chart. Despite the potential for the company to continue to report better-than-expected earnings, I am not going to fight algorithms that have had a chokehold on ASRT since the company’s Q2 earnings report back in August.

ASRT Daily Chart (Trendspider)

At the moment, I can only find a few hints of a potential reversal setup, but nothing I am willing to step in front of. It appears the company’s decision to withdraw its 2023 guidance has most prospective buyers waiting for the coast to be clear before stepping in. I plan on following a similar game plan… wait for the sellers to fade and find an opportunity to start a minuscule position in ASRT.

If the company is able to beat expectations and prove their recent deals are able to offset the generic indomethacin encroachment, we could see the market start to reverse course on ASRT. Thus, providing an opening to book profit and quickly move the position to a “house money” position, or possibly accumulate more at a discounted valuation.

Read the full article here