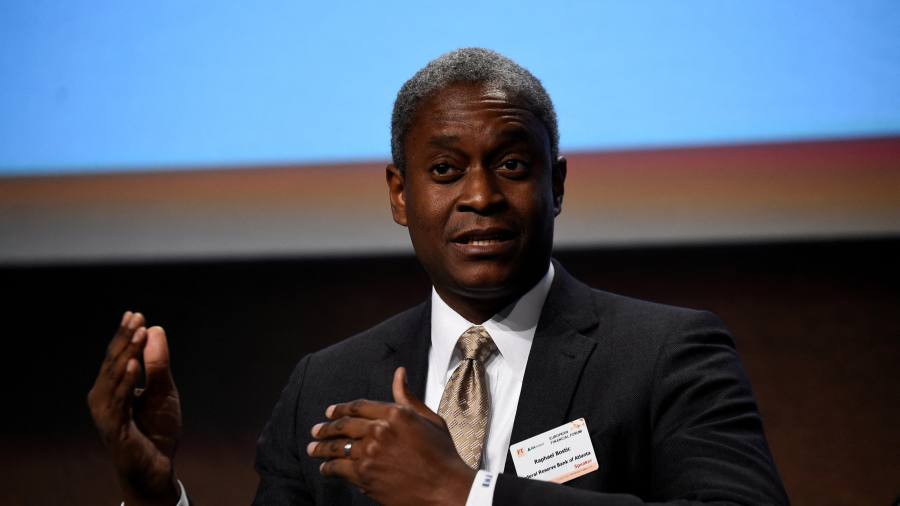

The head of the Federal Reserve Bank of Atlanta disclosed new transactions that violated the US central bank’s trading guidelines, reviving one of the worst scandals to hit the institution.

Raphael Bostic on Thursday revealed transactions involving 19 exchange traded funds made on May 2 of last year, just one day before the Federal Open Market Committee gathered for a two-day policy meeting. At that time, officials were in a so-called blackout period during which public communications were limited and trading prohibited.

Bostic was not a voting member at the gathering, after which the Fed raised its benchmark policy rate by half a percentage point.

The trades, all of which ranged between $1,001 and $50,000, were made on behalf of Bostic and his spouse by a money manager using an account over which they had no discretion. They were disclosed as part of an annual release of all regional presidents’ financial activity.

“As I now understand, transactions in such accounts are not exempt from the reporting requirements and FOMC blackout period trading restrictions,” Bostic said in a statement, adding that the trades occurred “prior to realising that they were subject to blackout restrictions”.

It is not the first time Bostic has come under scrutiny for trading activity linked to his managed accounts. In October, he was found to have “filed materially incomplete annual disclosures during all prior years in office”. On Thursday, he said that all of his and his spouse’s assets had been moved out of the accounts in question last year.

The Fed in 2021 tightened trading rules governing top officials and senior staff after several policymakers were found to have actively bought and sold shares and other investment products at a time when the central bank was forcefully intervening in financial markets at the onset of the coronavirus pandemic.

Two regional Fed presidents subsequently resigned after their transactions came to light in September 2021. Richard Clarida, then the vice-chair also came under scrutiny and stepped down from his term early in January 2022. He was cleared of any wrongdoing.

The new rules prohibit Fed leadership from buying individual shares and other investments and limit transactions to “purchasing diversified investment vehicles, like mutual funds”. Officials also were limited to authorising transactions during narrow windows, including being banned from trading at times of acute market stress.

Bostic on Thursday said the trades had been reported to the Atlanta Fed, ethics officers at the board of governors in Washington, as well as the central bank’s independent inspector general.

The 11 other regional presidents also released their annual financial disclosures but no other violations were identified.

Read the full article here