Atmus Filtration Technologies (NYSE:ATMU) debuted in the stock market through an IPO on May 22, 2023, and has seen a modest 2% increase in share price in the initial month. Despite the unexciting response from the investment community, the fundamentals of Atmus’ business model strongly suggest a “Buy” rating.

One of Atmus’ primary strengths lies in its media design and manufacturing expertise. The company’s in-house capabilities provide cost advantages and enable fast product development. Atmus has an impressive intellectual property portfolio of over 1,300 patents and an average launch of 400 new products annually. Moreover, Atmus is strategically positioned for growth by leveraging its filtration media technology to cater to near-adjacent markets such as mining and oil & gas. The company’s financial position is strong, evident from its low long-term debt-to-equity ratio of around 6% and its consistent free cash flow history.

Investors looking for a stock with market leadership, robust in-house capabilities, and avenues for expansion should consider Atmus, as it holds the key elements for sustained success.

Business Model

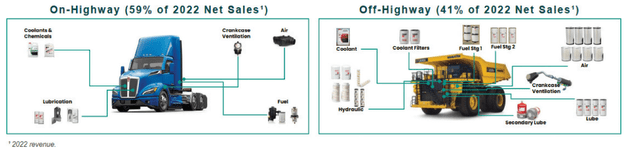

Atmus is a leading supplier in the commercial filtration market, catering primarily to on-highway and off-highway vehicles. The company’s products include fuel, lube, air, crankcase ventilation, hydraulic filters, coolants, and other chemicals that reduce emissions and provide vehicle protection. Their products are valuable to their customers as they give the end-users extended service intervals, reduce maintenance costs, and increase uptime. Atmos’s broad range of products enables one-stop shopping, a key competitive advantage.

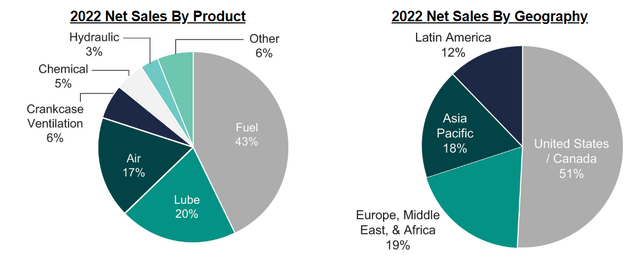

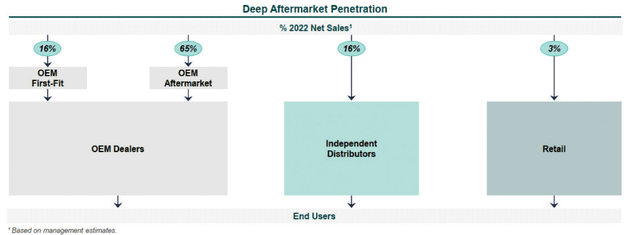

In the fiscal year 2022, the company achieved a sales distribution of 59% for on-highway and 41% for off-highway vehicles. Notably, 84% of Atmus’ sales came from the aftermarket, which provides a hedge against the volatile nature of the truck market. Atmus predominantly sells its products under the Fleetguard brand, with three major customers each contributing over 10% of its sales, Cummins (CMI), PACCAR (PCAR), and the Traton Group (OTCPK:TRATF) revenues of 19%, 16%, and 12% respectively in FY22. The company’s sales are geographically diversified, with the majority coming from the US/Canada (51%), followed by Europe (19%), Asia Pacific (18%), and Latin America (12%).

Company Reports Company Reports

Atmus estimates the filtration product market is large and attractive, with total product sales of approximately $74 billion in 2021. The filtration total addressable market is broken down into Atmus’ core on and off-highway vehicles and equipment at $13 billion, the passenger car market at $17 billion, and the industrial filtration market at $44 billion. Atmus’ strategy is to expand into the industrial filtration market due to the large TAM and 5% annual growth rate. Additionally, the company does not participate in the passenger car market as it has relatively lower margins.

One of Atmus’ core competencies is its in-house design of filter media, which is essential for the filtration process. This vertically integrated approach enables Atmus to adapt quickly to changing standards and contaminants. The media is a vital part of filtration as it removes contaminants while protecting downstream components. With its robust in-house media capabilities, Atmus has the potential for growth by expanding into adjacent markets. For example, since Atmus already has products for mining equipment, it can naturally expand into mining and oil and gas markets by modifying existing products.

Atmus distributes its products through various channels, including OEMs, independent distributors, and retail outlets. After separating from Cummins, it is anticipated that Atmus will focus on expanding its distribution network through independent dealers and retail outlets to gain a larger share in the aftermarket. The company’s products are available at over 45,000 independent aftermarket retail outlets worldwide-Atmus ships products directly to its global channel partners from its 12 distribution centers.

Company Reports

4 Pillars of Growth Strategy

Atmus has outlined four pillars for its growth strategy, aimed at fortifying its position in the market and achieving sustainable business growth.

- Growing Share in First-fit Core Markets: Atmus intends to leverage its strong relationships with OEMs and its global presence to increase its share in first-fit markets. Through technological innovations, new product offerings, and focusing on system modules, Atmus aims to increase its product content per vehicle. The company also supports OEMs transitioning to alternative fuel technologies to build on their relationship further.

- Accelerating Profitable Growth in the Aftermarket: With 84% of its net sales in 2022 coming from the aftermarket business, Atmus views this segment as a significant opportunity for expansion. The company launches an average of 400 new products annually and utilizes analytic tools, including AI and Machine Learning, to identify opportunities for cross-selling and up-selling. Atmus plans to broaden its reach through its multi-channel distribution network.

- Transforming the Supply Chain: Atmus aims to improve customer experience and drive growth by transforming its supply chain. The company plans to increase product availability, optimize its physical footprint, and enhance plant throughput. It also wants to automate processes and optimize its supplier base and spending. This transformation is expected to expand margins through a more efficient cost structure.

- Diversifying Beyond Core Markets: Atmus is looking to expand into industrial filtration markets, which could substantially increase its core TAM. While the company’s core market is growing at approximately 2% annually, the industrial filtration market is growing at about 4%. Atmus will likely rely on bolt-on acquisitions to enter new markets, focusing initially on near-adjacent markets like oil and gas and mining before attempting to penetrate more distant markets such as food & beverage and pharmaceuticals through M&A.

Risks to Buy Rating

Investing in Atmus involves a high degree of risk, especially with a lack of trading history for a new IPO. Potential investors should consider the following risks as they could adversely affect the share price if they materialize.

- Dependence on a few Key Customers: Atmus has a considerable concentration in its customer base, with three customers accounting for a significant portion of its sales. Losing any of these key customers could significantly impact Atmus’ financial and operational performance.

- Disruption Risk: The adoption of electric vehicles and fuel cell electric Vehicles poses a significant risk to Atmus, as these vehicles require less filtration compared to internal combustion engines. If EVs penetrate the market substantially, this could adversely affect Atmus’ product demand. In a slower adoption scenario, filtration product needs may remain relatively stable by 2030, giving Atmus time to diversify into new technologies.

- M&A Risk: Atmus is expected to use M&A as a primary method to enter the industrial filtration market. This approach can be faster, considering Atmus’ comfortable leverage ratio. However, as a standalone company, Atmus lacks a track record in M&A, and the integration and success of these ventures carry uncertainties and risks.

Valuation

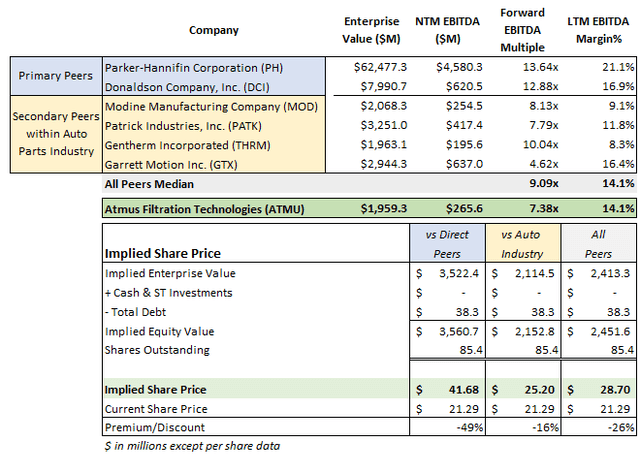

Atmus can be compared against its two direct peers, Donaldson Company (DCI) and Parker-Hannifin (PH). These companies share pivotal characteristics with Atmus, making them ideal comparable companies. Donaldson specializes in producing filtration systems and replacement components on a global scale, while Parker-Hannifin is engaged in the manufacturing and sales of motion control technologies and systems, with one of its business divisions focusing on filtration systems.

Atmus trades at a discount relative to its primary peers with a forward EBITDA multiple of 7.38x vs. 13.26x. Additionally, when comparing Atmus to secondary peers within the auto parts and equipment, it is relatively cheap, albeit less than its direct peers.

Capital IQ

When benchmarked against its primary peers, Atmus’ implied share price is $41.68, 49% higher than its current share price of $21.29. This suggests that Atmus is substantially undervalued compared to its direct peers. Atmus’ implied share price is $25.20 compared to auto industry peers, reflecting a 16% premium to the current share price. Although less pronounced than the direct peer’s comparison, this indicates that Atmus is trading at a discount to the broader auto industry peers.

Final Thoughts

In conclusion, Atmus presents a compelling “buy” investment thesis. Atmus’ strength lies in its diversified product sales and geography, innovative in-house media design, and strong distribution network. Atmus possesses significant growth potential through expansion in its core market and near-adjacent categories, while its strong cash flows and solid balance sheet create opportunities for strategic acquisitions to penetrate the broader industrial filtration market.

Furthermore, Atmus is trading at a discount compared to its peers, despite its substantial aftermarket sales mix, which accounts for over 80% of its revenue. The company’s planned expansion into the industrial filtration sector will gradually bridge this valuation gap compared to direct filtration peers. Considering these factors, Atmus is an attractive investment opportunity with promising upside potential.

Read the full article here