You just have to get bargains one way or another. Stocks in “free fall” are usually great places to look for bargains. Turnarounds that the market does not yet notice provide another good shopping experience. AT&T Inc. (NYSE:T) has a long list of past shortcomings that the market is more than willing to hold against the company.

Now the market is in “bear” mode, Mr. Market is very likely to take all those past shortcomings out on the stock price. The fears that the stock price will just “fall apart” and investors would lose a lot of money are reaching a high point. But the debt market disagrees enough that this is still a darn good contrarian opportunity. So all that negative opinion is just fine with me.

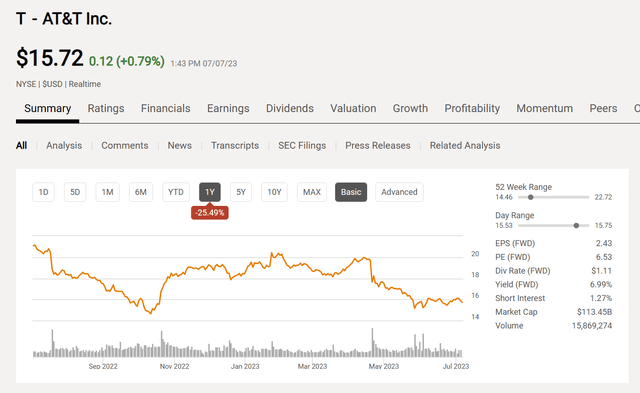

AT&T Inc. Stock Price History And Key Valuation Measures (Seeking Alpha Website July 7, 2023)

It looks as though “the ball began rolling downhill” with the first quarter earnings report. The fact that management had more or less projected the first quarter really did not sway Mr. Market at all. Mr. Market is in a really grouchy mode and “wants what he wants when he wants it.” No excuses allowed, as the chart above shows.

Then came an announcement that second quarter adds would likely be below expectations. Never mind that such fluctuations happen all the time. Mr. Market is now holding the management responsible for paying a lot of bills in the first quarter (after a large fourth quarter) while expecting the “miss” on adds to continue well into the future. Trust Mr. Market to head overboard as usual.

This, of course, is followed by all kinds of opinions about the debt load being an issue and the dividend being in danger along with more scary scenarios than a horror movie. It does not help, of course, if you are already in at $20 or more and all of this wonderful news comes out. The pressure to get out before the turnaround is complete can become overwhelming. Yet even when ideas appear to not be working out, large investors like John Templeton and Peter Lynch would get out at the optimal time. Seldom did they sell on bad news because they thought it was so bad there would be no recovery.

Contrarian investing is psychologically hard when the experts you might normally rely upon are screaming “dividend cut,” “increasing interest rates,” and “debt management issues” (or worse).

But this is also why I keep nearly every position in my portfolio to 2% or less. In this fashion, the portfolio dividends coming in will most likely make up for my unforced errors. However, as long as I chose decently, then the right selections should provide a decent return even with a few unforced errors. More importantly, a 2% loss does not make me anxious to “run for the exits.” It allows for a calm evaluation of the future when that inevitably bad quarter or bad news sends the stock price lower even (it turns out) when a few quarters from now it will not have been the notice of more bad news.

AT&T Inc. is one of those positions. The reason is that I looked at the company and current management. They appear to be making good turnaround progress for a large company.

I particularly like that the market basically skipped the first quarter presentation and went straight to the cash flow picture. Mr. Market then had a “heart attack” over that without listening either to management guidance or to the first quarter management explanation (after the first quarter guidance was given ahead of time). The fact that management was consistent, and the results pretty much were as forecast was no solace to the market. Hence, all the scary scenarios that leave an investor feeling like they are standing in front of a runaway train.

Luckily for investors, most trains run out of fuel when it comes to the marketplace and Mr. Market’s attitude changes. Looking for stocks that will in the future find favor with the market is a very tough proposition. But for those with the nerves to do it (even if the learning process is expensive), the results are usually above average. Contrarian investing in low expectation stocks is the one thing that has been shown time and again to work. AT&T is just the kind of stock that all those research projects had in mind.

First Quarter Results

Management actually demonstrated some solid progress in the first quarter.

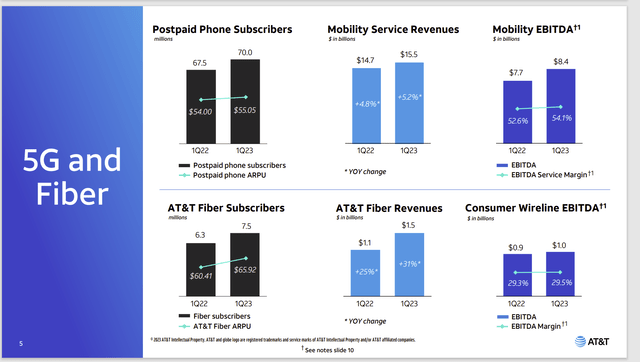

AT&T First Quarter Progress By Business Segment (AT&T First Quarter 2023, Earnings Conference Call Slides)

Management showed solid business progress by segment in the first quarter. This is the part that the stock market really did not pay attention to. Sometimes Mr. Market throws out “the baby with the bathwater.” But then investors get an opportunity to either consider adding to their current position cheaply or consider investing in the first place.

Now, management did announce, lower than the market expects, second quarter adds. But that happens. If a course correction is needed, then investors should expect management to adjust things to get them back on track. Stuff happens and when it does happen, it is usually not fatal.

As long as the progress shown above persists (which is of course a risk), this business will grow eventually enough to make the debt levels acceptable to the market and raise that dividend.

On the other hand, Mr. Market paid attention to:

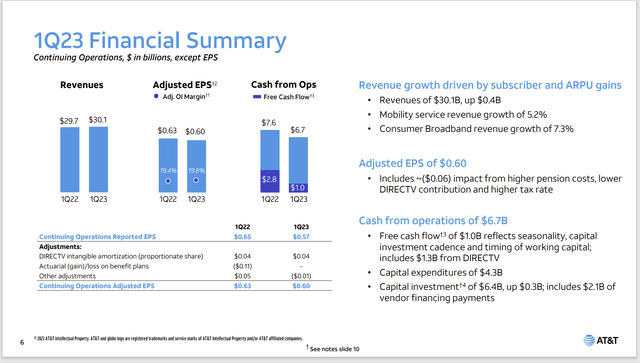

AT&T Inc. First Quarter Financial Result Comparison (AT&T Inc. First Quarter 2023, Earnings Conference Call Slides)

Specifically, Mr. Market hated every last dollar of that free cash flow fall. Management had previously guided to lower cash flow because they had a big fourth quarter and those bills from that quarter get paid in the first quarter. Mr. Market did not care one bit as shown by the stock price action.

Yet, since the first quarter is a seasonally light quarter, the second quarter’s cash flow is bound to improve. More importantly, a shortfall of subscribers adds is unlikely to blunt the coming improvement over the first quarter significantly.

Mr. Market is likely to be downright giddy at the fourth quarter cash flow (when we get there). Management is trying to tell shareholders that they collect the cash or report the income first, and then pay the bills in the first quarter from all that cash or income. Then just maybe, Mr. Market will realize that future cash flows will be more important in the second half of the fiscal year than in the first half for the foreseeable future. No guarantees, though, when it comes to Mr. Market.

Key Takeaways

A down market often first leads the market to punish “everyone and anyone.” A past that is less than stellar, as is the case with AT&T, will likely lead the market to put the stock in the doghouse sooner or later. But the “doghouse” stock price level is usually a buying opportunity for an investor that realizes that new management has no intention of revisiting the past.

In short, “there is a new sheriff in town” that intends to do a better job. Large companies often have a staying power that small companies do not have. Now management can waste that “staying power” (making that an investment risk). But the depth of management in a large company makes that a rare event.

In the meantime, investors are being paid more than 6% in dividends to wait for the market to come around to their point of view. That is nearly the roughly 8% total return that investors report for a long-term annual gain. That means that the stock in the future only has to rise 2% to match the average investor return.

That is just the kind of position that I like to be in. I am like everyone else in that had I known the bear market would take “forever” and drag this stock along with it; well then, sure, I would have waited. Who would not?

However, most of the really good investors I have followed over the years like John Templeton have always preached to buy bargains. None of them ever talk about finding the bottom. Those same investors preach about having a strategy if the story changes and knowing when the change is material enough to change the strategy. I personally believe the original story is intact. Clearly that nearly 7% yield is telling you the stock is a bargain. For me, that is all I need to know.

Now I may let the current downturn run its course. But for those who have not already gotten in (unlike me), this is probably the time to consider. For those who want to consider adding to their position (which I may do with my dividends), then this is probably the time for that consideration.

AT&T has gone off the rails before. But management appears to have clearly “gotten the memo.” For those who can be on board with that idea, then this may be a decent contrarian idea as it really has been since the divestment to what is now Warner Bros. Discovery (WBD).

Yes, AT&T Inc. stock is down since then. But no, not enough time has passed to really evaluate what management is doing. I am a firm believer in giving management one business cycle (which is usually five to seven years). I fully intend to follow that course unless I see a reason to change.

Good managements often make the starting price plus inflation and then some. Really good managements make a large “then some.” How this one turns out remains to be seen. But right now, things look pretty good.

Read the full article here