A Quick Take On Augmedix

Augmedix (NASDAQ:AUGX) provides medical practitioners with patient care note-taking services.

The firm has announced an investment and collaboration partnership with HCA Healthcare (HCA) to further develop its Go platform.

AUGX has received a strong vote of interest from a major industry player, which, if it pans out, will lead to much higher visibility and demand pull-through for the company elsewhere in the market.

I’m cautiously optimistic for AUGX in the medium term, so my outlook is a Buy at around $4.00 per share.

Augmedix Overview

San Francisco, California-based Augmedix was founded to develop a SaaS-based platform that enables physicians and other care providers to electronically document their patient care activity with improved efficiency.

Management is headed by president and CEO Emmanuel Krakaris, who has been with the firm since 2018 and was previously CEO of Streetline and CFO of Command Audio Corporation.

The firm provides the ability for medical practitioners to use their smartphone to communicate in real-time with its network of medical data specialists who observe the patient interaction (with patient approval) and take/transcribe/update relevant notes for the physician and upload them to the electronic health record system.

Company products include:

-

Augmedix Go

-

Augmedix Live

-

Augmedix Notes

-

Augmedix Prep

AUGX uses its in-house direct sales force to sell its solutions to physician groups and health systems.

Management says its solutions have generated millions of medical notes and related data for clients.

Augmedix’s Market & Competition

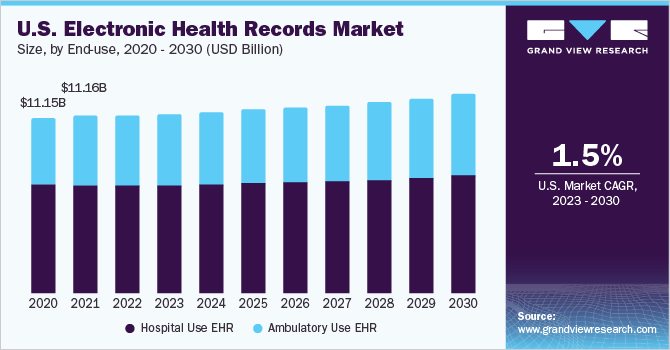

According to a 2021 market research report by Grand View Research, as a proxy for the medical note market, the overall electronic health records [EHR] market was an estimated $28 billion in 2022 and is forecast to reach $38.8 billion by 2030.

This represents a forecast CAGR of 3.7% from 2021 to 2028.

The main drivers for this expected growth are continued government initiatives to increase the adoption of healthcare IT solutions to improve efficiencies and information sharing and analysis within the industry as it transitions to a value-based care model of healthcare delivery.

Also, the chart below shows the historical and projected future growth trajectory of the EHR market through 2030:

U.S. EHR Market (Grand View Research)

Major competitive or other industry participants include:

-

Nuance Communications

-

M-Model

-

IKS Healthcare

-

AQuity

-

Robin Healthcare

-

DeepScribe

Augmedix’s Recent Financial Trends

-

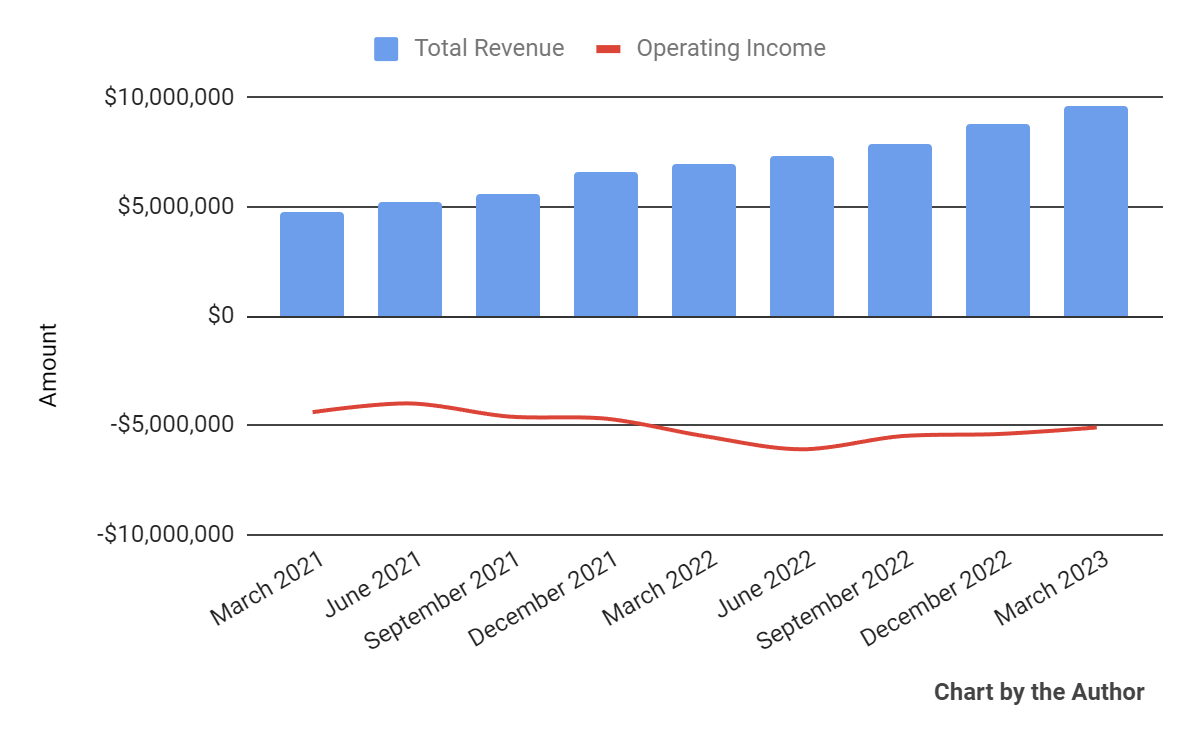

Total revenue by quarter has risen while operating income by quarter has remained negative.

Total Revenue and Operating Income (Seeking Alpha)

-

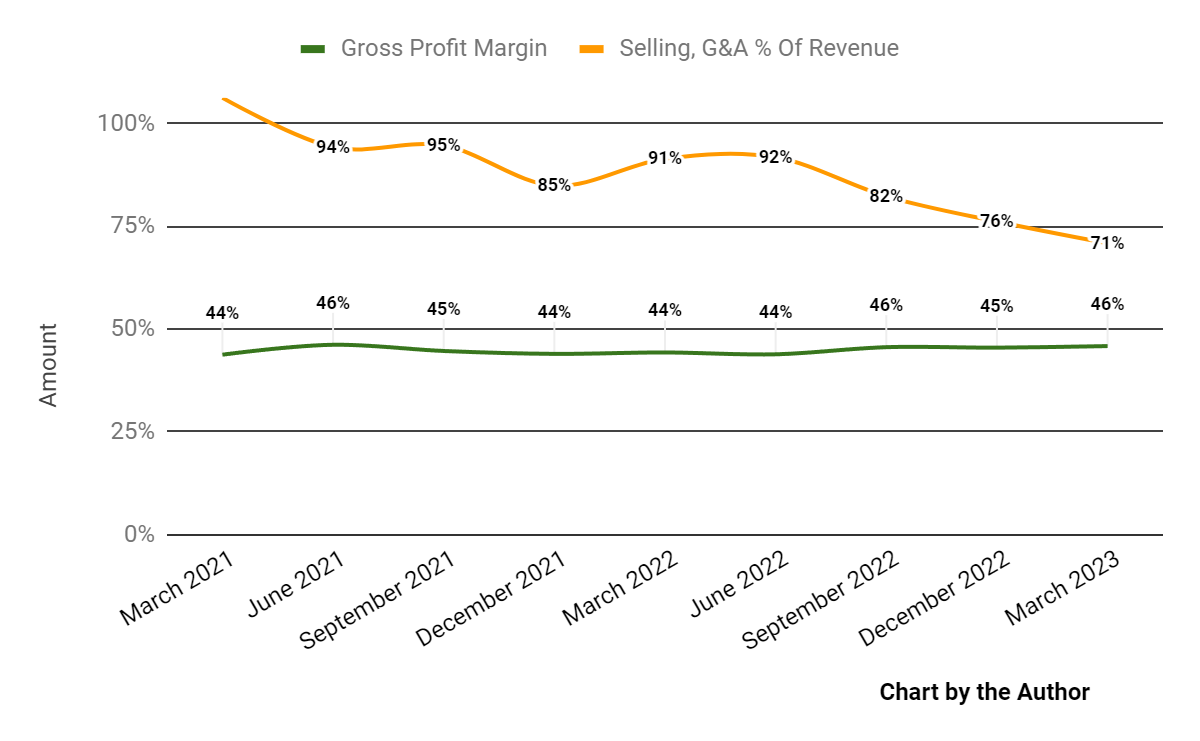

Gross profit margin by quarter has trended slightly higher recently; Selling, G&A expenses as a percentage of total revenue by quarter have fallen markedly in recent quarters.

Gross Profit Margin (Seeking Alpha)

-

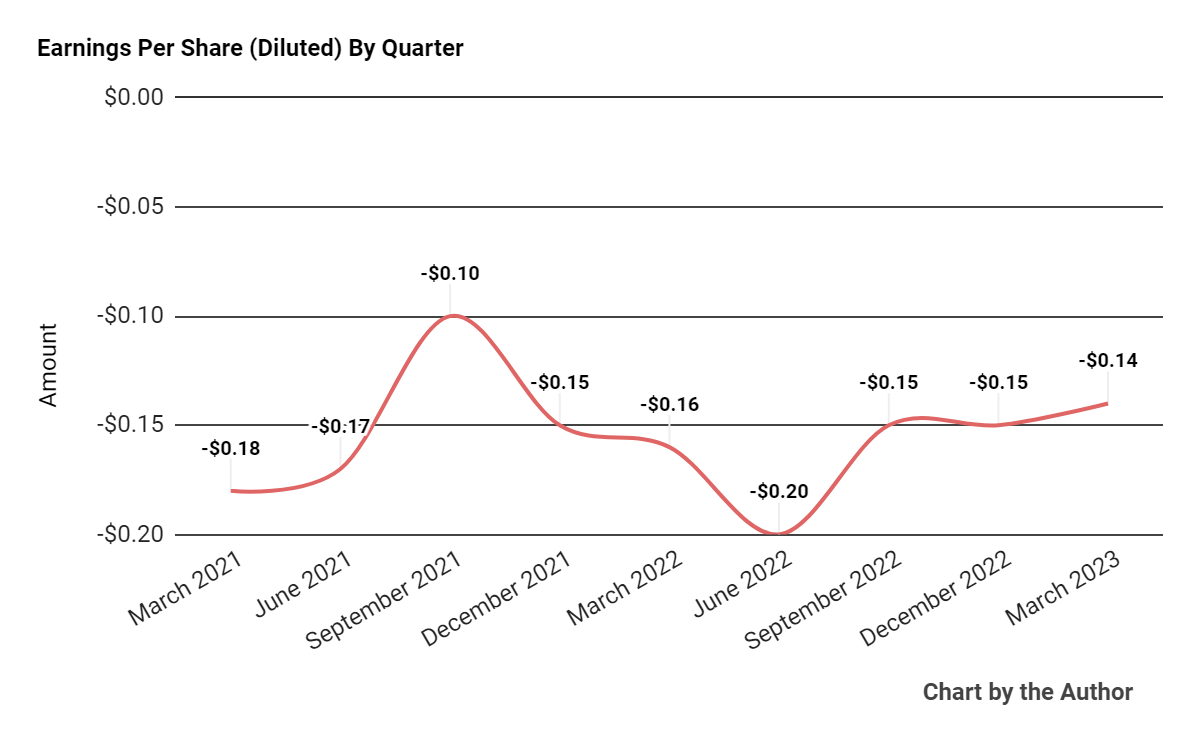

Earnings per share (Diluted) have remained negative, as the chart shows below.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

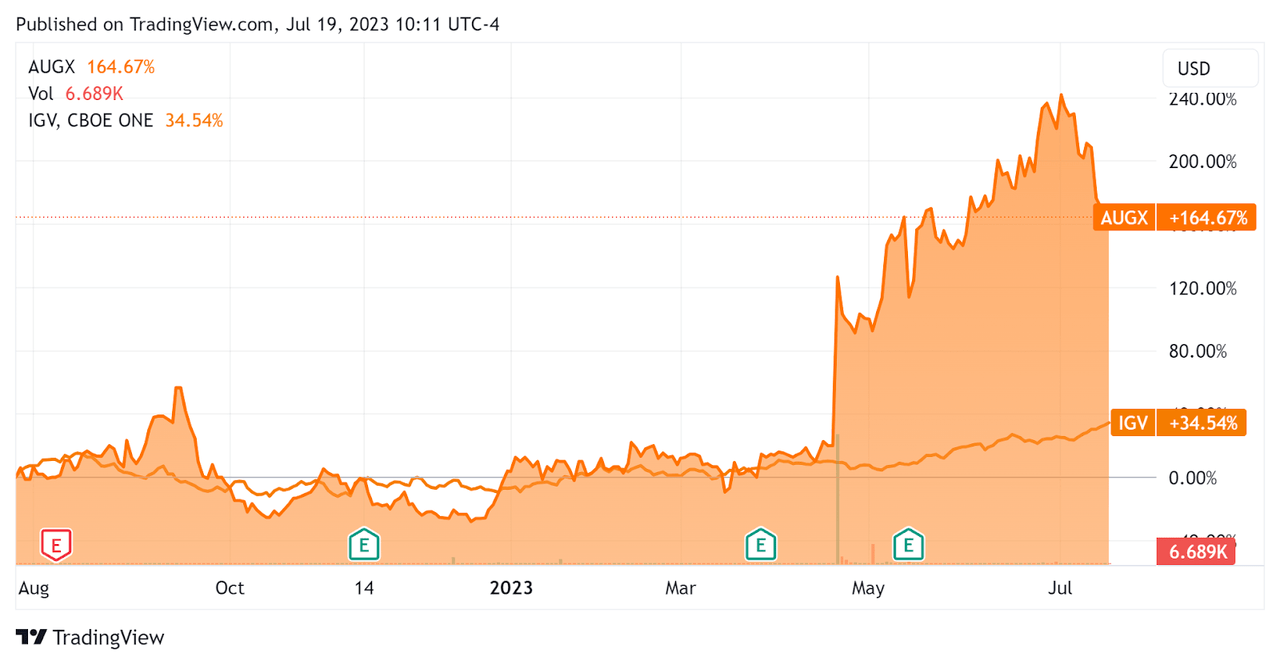

In the past 12 months, AUGX’s stock price has risen 164.67% vs. that of the iShares Expanded Tech-Software Sector ETF’s (IGV) rise of 34.54%, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

AUGX’s stock rise in April 2023 was the result of a recent announcement of an investment and development partnership with HCA Healthcare (HCA) to further develop its ‘AI-powered ambient documentation products for acute care clinicians.’

For the balance sheet, the firm ended the quarter with $19.9 million in cash and equivalents and $20.2 million in total debt, of which $2.5 million was categorized as the current portion due within 12 months.

The new equity investment by HCA and existing investor Redmile Group totaled $12 million, which would add to the firm’s cash and equivalents balance post-Q1.

Over the trailing twelve months, free cash used was $19.9 million, during which capital expenditures were $1.1 million. The company paid $2.2 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For Augmedix

Below is a table of relevant capitalization and valuation figures for the company.

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

5.1 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

4.5 |

|

Revenue Growth Rate |

37.8% |

|

Net Income Margin |

-70.5% |

|

EBITDA % |

-62.5% |

|

Net Debt To Annual EBITDA |

0.0 |

|

Market Capitalization |

$170,120,000 |

|

Enterprise Value |

$172,550,000 |

|

Operating Cash Flow |

-$18,840,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.64 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

AUGX’s most recent Rule of 40 calculation was negative (24.6%) as of Q1 2023’s results, so the firm has performed poorly in this regard, per the table below.

|

Rule of 40 Performance |

Q1 2023 |

|

Revenue Growth % |

37.8% |

|

EBITDA % |

-62.5% |

|

Total |

-24.6% |

(Source – Seeking Alpha)

Commentary On Augmedix

In its last earnings call (Source – Seeking Alpha), covering Q1 2023’s results, management highlighted the recent HCA investment and development collaboration deal as a potential growth catalyst.

Management expects to reach operating cash flow breakeven by the end of 2024, which is laudable but certainly represents a far-off point, subject to a multitude of factors.

The company’s net dollar retention rate was 136%, indicating strong product/market fit and excellent sales & marketing efficiency.

Total revenue for Q1 2023 grew by 37.1% year-over-year and gross profit margin increased by 1.5%.

Selling, G&A expenses as a percentage of revenue dropped 20.6% YoY, a positive signal and operating losses were reduced by 7.3%.

The company’s financial position is only fair, with debt equal to cash but significant free cash burn, giving the firm only one year of runway absent further equity investment or a debt facility.

AUGX’s Rule of 40 performance has been poor, with high operating losses dragging down its results.

Looking ahead, management guided full year 2023 topline revenue growth equal to approximately 35.5% over 2022’s results.

If achieved, this would be a slowing revenue growth rate since AUGX’s 2022 revenue growth was 39.64% year-over-year.

In the earnings call, analysts questioned company leadership about the HCA collaboration. Management responded that it would see increased operating expenses associated with the early testing and development of its Go product.

It is also pursuing a collaboration with HCA in its care center network which is 2,200 centers nationwide, in addition to its 188 acute care hospitals which is the subject of the initial collaboration efforts.

Regarding valuation, in the past twelve months, the firm’s EV/Sales valuation multiple has risen by 2.4x, as the chart from Seeking Alpha shows below.

EV/Sales Multiple History (Seeking Alpha)

The rise in the stock’s price has been driven by a concomitant increase in its valuation multiple.

A potential upside catalyst to the stock could include an announcement of expanding its partnership with HCA to its 2,200 care center network.

However, I put the odds of that occurring quickly as low since HCA will likely wait to see the results of the acute care network testing and rollout to determine if it will expand the partnership.

While the HCA partnership is certainly positive, with a large partner, it can present development risks.

Large partners can skew the roadmap of a product in a way that favors the partner, potentially delaying market adoption by a wider customer base, so Augmedix will need to manage its product development with an eye toward the wider ramifications of any changes.

Still, the company has received a strong vote of interest from a major industry player, which, if it pans out, will lead to much higher visibility and demand pull-through for the company elsewhere in the market.

I’m cautiously optimistic for AUGX in the medium term, so my outlook is a Buy at around $4.00 per share.

Read the full article here