By Breakingviews

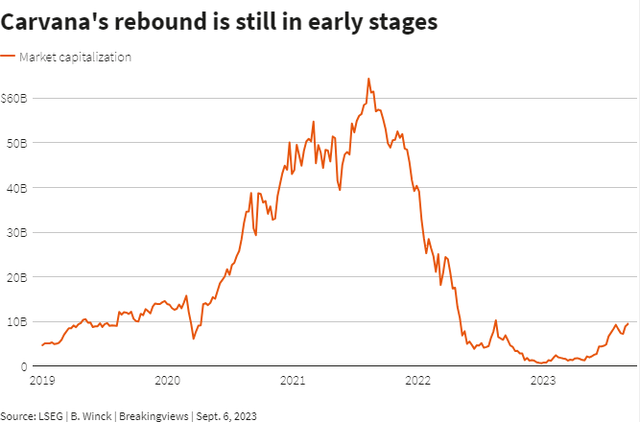

Strikes at Detroit’s automakers could hit the brakes on Carvana’s (CVNA) turnaround. The $10 billion used-vehicle vendor’s share price has increased nearly 10-fold this year as profitability improved.

That’s partly because it’s paying less to acquire old cars to list on its marketplace. An industry-wide shutdown could reverse that trend, threatening a repeat of Covid-19’s disruptions but without the silver linings.

Carmakers Ford Motor (F), General Motors (GM) and Stellantis (STLA) have just one week left to iron out a new contract with their 150,000 unionized employees. The United Auto Workers union voted last month to authorize a strike if a labor agreement isn’t reached by Sept. 14.

That imperils Carvana’s nascent hot streak. In the quarter to June, the company’s gross profit per car sale more than doubled from the year prior, helping boss Ernie Garcia III report positive EBITDA for the first time in nearly two years.

The jump was partly driven by a widening gap between what Carvana pays to scoop up vehicles at wholesale and the price it sells them for at retail. Wholesale prices fell 12% year-over-year in July, vehicle auction firm Manheim said last month.

But Detroit’s Big Three accounted for 43% of new cars sold in the U.S. last year, according to Cox Automotive. If that disappears, even briefly, buyers could be forced to the used market, leading to a scramble that drives wholesale prices up again.

Garcia’s been here before. Early pandemic shutdowns and new car shortages drove buyers to Carvana’s online marketplace, propelling its valuation to over $64 billion at its peak.

Retail sales more than doubled year-over-year in 2021. But wholesale prices also jumped 62% from before the pandemic to their early-2022 highs, halving Carvana’s gross profit per sale over that period.

When demand finally eased, the company was stuck with difficult-to-sell, expensive inventory. Its share price collapsed by 99% between August 2021 and late 2022 as it worked to reshuffle its heavy debt load.

An autoworker strike promises similar pain with little of the lockdown-era gain. Prices are still well above pre-pandemic levels, while higher interest rates make car loans less affordable.

That’s already weighing on Carvana’s retail car sales, which fell 34% year-over-year in the June quarter. It also limits the company’s ability to raise retail prices.

Granted, a walkout probably won’t last as long as the pandemic, and negotiations are gathering pace. But UAW President Shawn Fain sounds ready for a fight. Garcia’s road to a comeback might have just gotten longer.

Context News

Members of the United Auto Workers union voted on Aug. 25 to authorize a strike at General Motors, Ford Motor and Stellantis if a new labor agreement isn’t reached before a Sept. 14 deadline.

The authorization was approved by 97% of members. UAW President Shawn Fain said the union doesn’t plan to extend the deadline. The UAW has made a counter-offer to Ford, after the company’s initial offer fell short of the union’s demands, Reuters reported on Sept. 7.

Carvana on July 19 said that adjusted EBITDA in the second quarter came in at $155 million, marking the first time it has reported a positive margin since the third quarter of 2021.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here