Avantax (NASDAQ:AVTA) expects revenue growth in 2023, and recently enacted aggressive actions to enhance the current valuation, including a Dutch tender offer and a stock repurchase program. In my view, the company has sufficient cash to hire new financial professionals, and further sale of assets could make AVTA even more attractive. Besides, I would expect more attention from investors as recurrent revenue keeps increasing. There are risks from a decline in the stock market and underperformance of investments proposed to clients, however, the current stock price appears too low.

Avantax

Incorporated in Delaware, Avantax, which was previously named Blucora, Inc., offers tax-focused wealth management services and platforms. Clients are usually consumers, small business owners, tax professionals, and certified public accounting firms. The company runs one reportable segment.

Source: Corporate Website

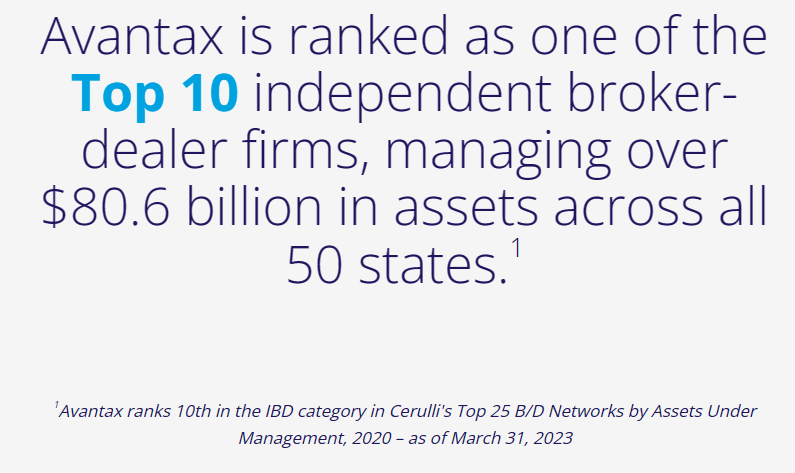

Avantax ranks 10th in the IBD category in Cerulli’s Top 25 B/D Networks by Assets Under Management. Considering such type of figures, I believe that we can expect a significant amount of fees from advisory, wealth management, and brokerage fees.

Source: Corporate Website

Avantax Expects Further Sales Growth And EBITDA Margin Growth

Avantax, Inc. offers integrated tax-focused wealth management services and platforms, assisting individuals, small business owners, tax professional firms, financial professionals, and CPA firms.

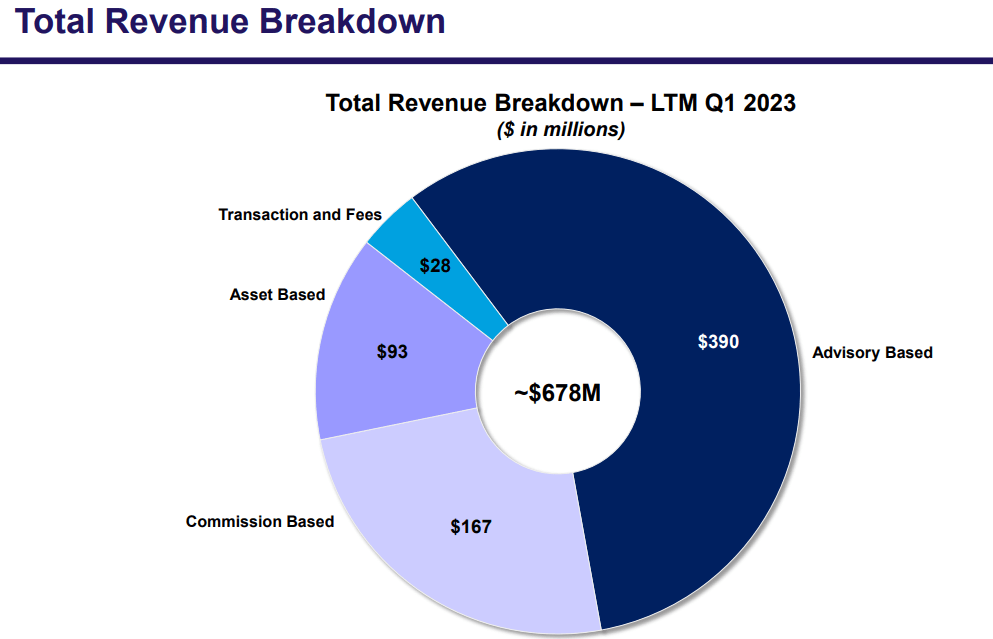

Source: Presentation To Investors

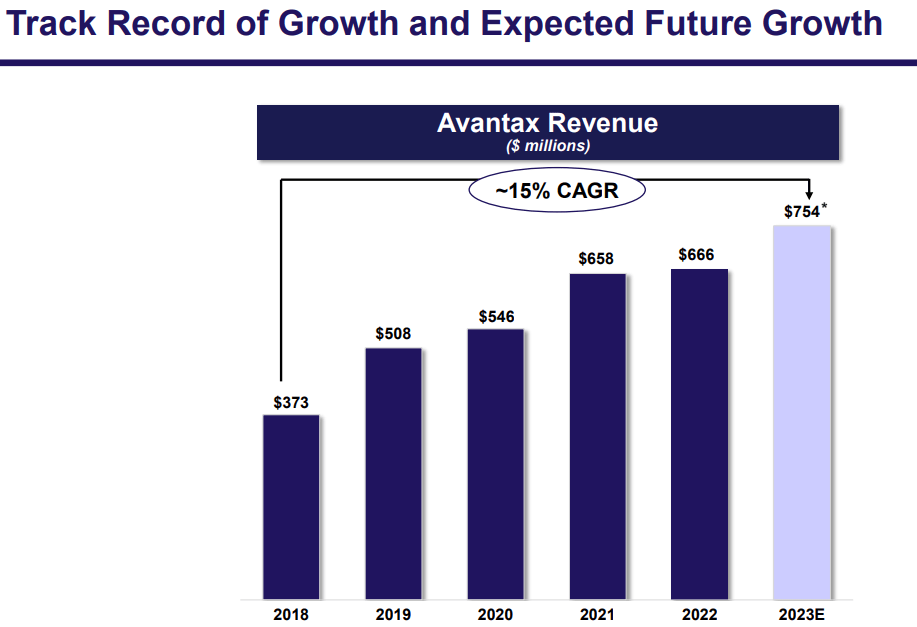

I believe that only taking into account the track record growth and expected future growth of Avantax is sufficient reason to conduct research about the stock. From 2018 to 2023, the company noted revenue growth of close to 15% CAGR.

Source: Presentation To Investors

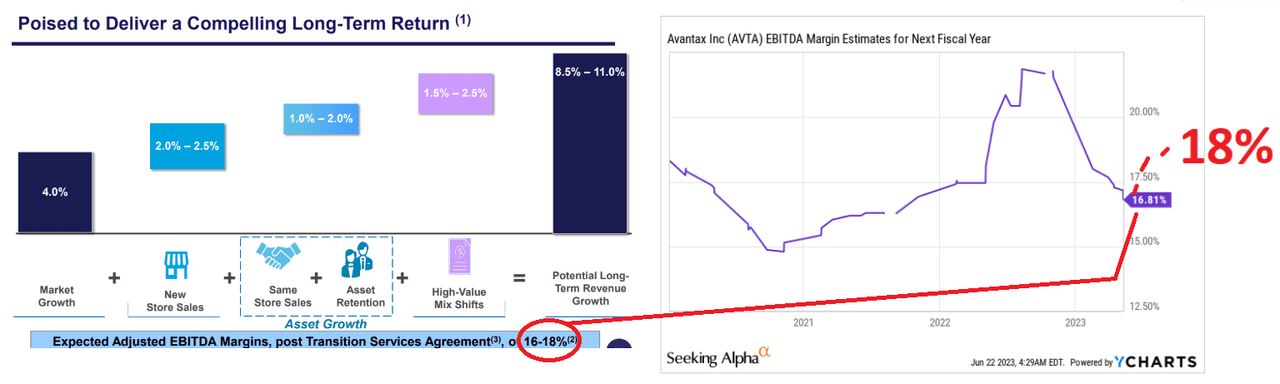

Besides, Avantax noted that market growth combined with new store sales, asset retention, and high-value mix shifts could bring significant potential long-term growth. The company also expects to deliver EBITDA margin of around 16% to 18%. Considering the recent decline in EBITDA margins from 21% in 2022 to around 16% in 2023, an increase to 18% may bring demand for the stock and stock price appreciation.

Source: Presentation To Investors

Market Expectations And Guidance

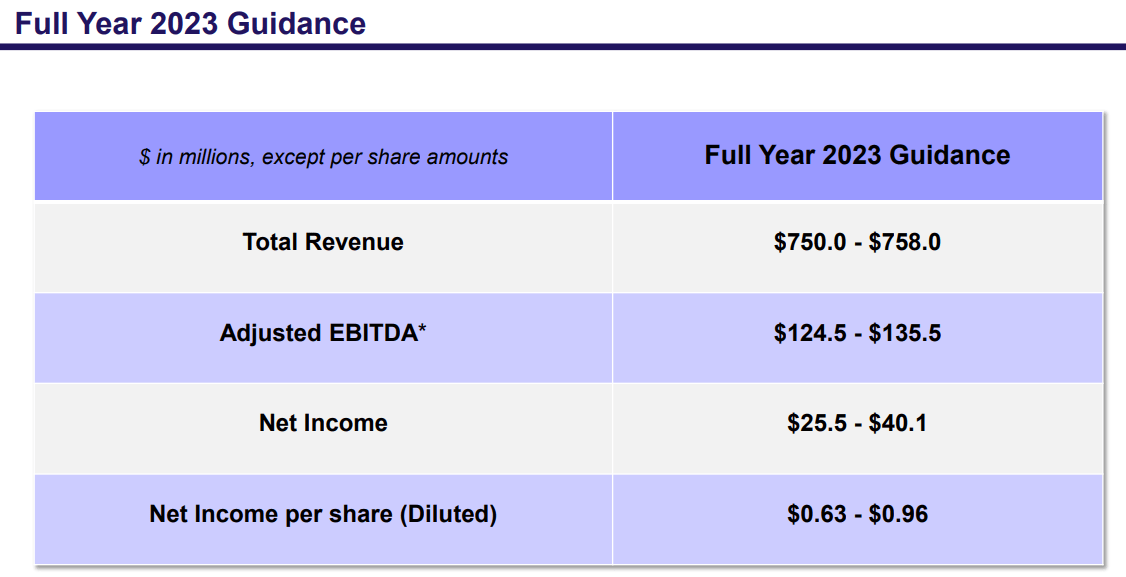

The company reported 2023 guidance close to $750-$758 million, adjusted EBITDA of about $124.5-$135.5 million, and net income of $25.5-$40.4 million. Considering the current macroeconomic environment, I believe that the numbers are quite optimistic. There are many analysts out there expecting a detrimental economic scenario in 2023. However, management expects positive 2023 net income.

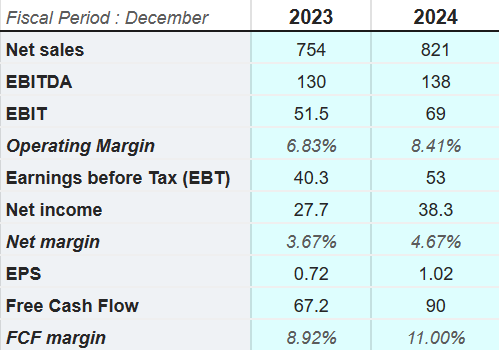

Source: Presentation To Investors

Other analysts also reported 2024 net sales close to $821 million, 2024 EBITDA close to $138 million, 2024 EBIT of $69 million, and operating margin close to 8.41%. Besides, analysts are also expecting 2024 net income of about $38.3 million, with an EPS of $1.02 per share and 2024 FCF of $90 million. I believe that the expectations of these market participants are beneficial as the company expects operating margin growth, net income growth, and FCF margin growth.

Source: Marketscreener.com

The Last Balance Sheet Included Decreases In Cash And Assets

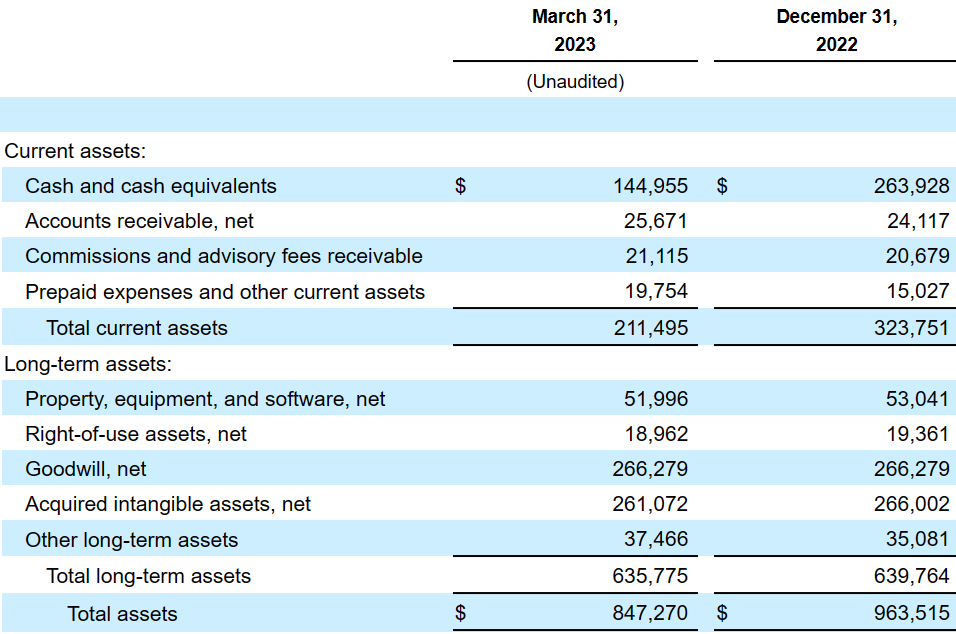

With regards to the balance sheet, I believe that the last quarterly report was not that beneficial. The company reported less cash in hand, less current assets, a decline in property and equipment, and less total assets. It is also worth noting that the total amount of liabilities increased, so the asset/liability ratio did not improve. In my view, the new balance sheet may be part of the reason to explain the decline in the stock price in Q1 2023.

Source: SA

More in particular, the company reported cash worth $144 million, with accounts receivable of $25 million, commissions and advisory fees receivable worth $21 million, and prepaid expenses and other current assets close to $19 million. Total current assets stood at $211 million.

Also, with property, equipment, and software worth $51 million, right-of-use assets of $18 million, goodwill of $266 million, and acquired intangible assets of $261 million, total assets were equal to $847 million. The asset/liability ratio stood at close to 2x, so I believe that the balance sheet does look stable. With that, I hope that the management would successfully stop the decrease in assets that we saw in 2023.

Source: 10-Q

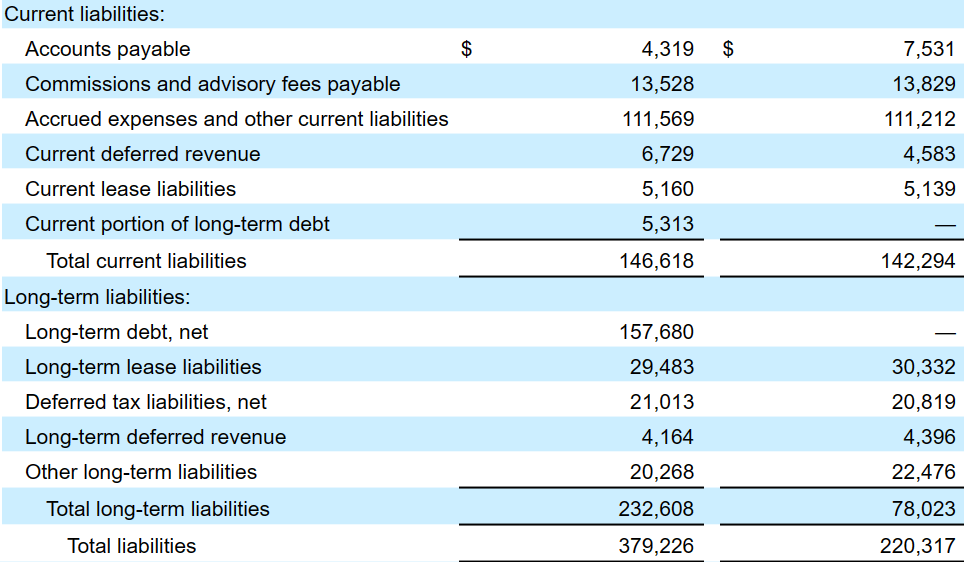

With regards to the list of liabilities, the company noted accounts payable worth $4 million, commissions and advisory fees payable of $13 million, and accrued expenses and other current liabilities of close to $111 million. Long-term debt stands at about $157 million, with long-term lease liabilities of $29 million, deferred tax liabilities of about $21 million, and total liabilities of $379 million.

Source: 10-Q

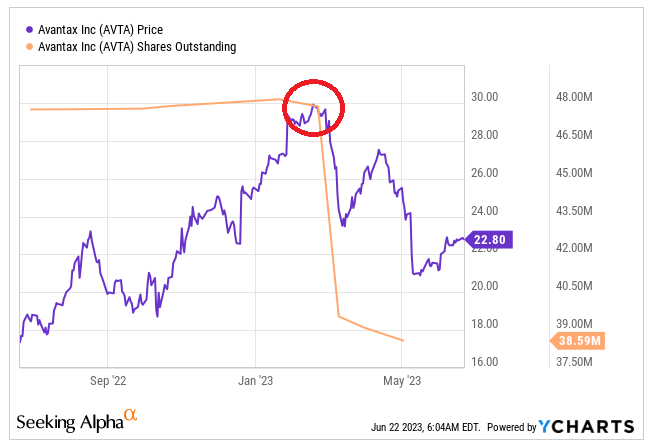

The company executed a Dutch Auction tender offer to acquire close to 8.3 million shares at close to $30 per share. I believe that the reduction in cash may be explained by this transaction.

On January 27, 2023, we commenced a modified “Dutch Auction” tender offer to purchase shares of our common stock for an aggregate purchase price of up to $250.0 million at a price per share not less than $27.00 and not greater than $31.00. Upon the conclusion of the Tender Offer, we repurchased and subsequently retired approximately 8.3 million shares of our common stock at the purchase price of $30.00 per share, for aggregate cash consideration of $250.0 million. Source: 10-Q

In theory, a reduction in the share count may lead to higher stock valuation. It was noted in the case of Avantax as seen in the stock price below. Right after the reduction in the share count from around 48 million to close to 38 million, the stock price declined from near $30 per share to around $20-$23 per share.

Source: YCharts

My Cash Flow Model And The Conclusions Of Engine Capital

In my view, Avantax will most likely continue to receive attention from clients as the strategy implemented appears to be different from that offered by competitors. In my view, further information about how the company helps wealthy individuals pay a bit less taxes may bring the attention of investors. In sum, under my DCF model, the strategy would be successful.

Our growth strategy begins with our purpose to enable clients to achieve their goals by providing holistic financial services through a uniquely tax-focused lens. Historically, the wealth management industry has largely failed to focus on the impacts of taxes, or only executed tax-advantaged strategies for the wealthiest segment of clients, ignoring the tax ramifications for a broad range of clients. We seek to execute holistic, long-term tax minimization strategies for our clients’ tax situations, while expanding access to those strategies to a broader group. Source: 10-Q

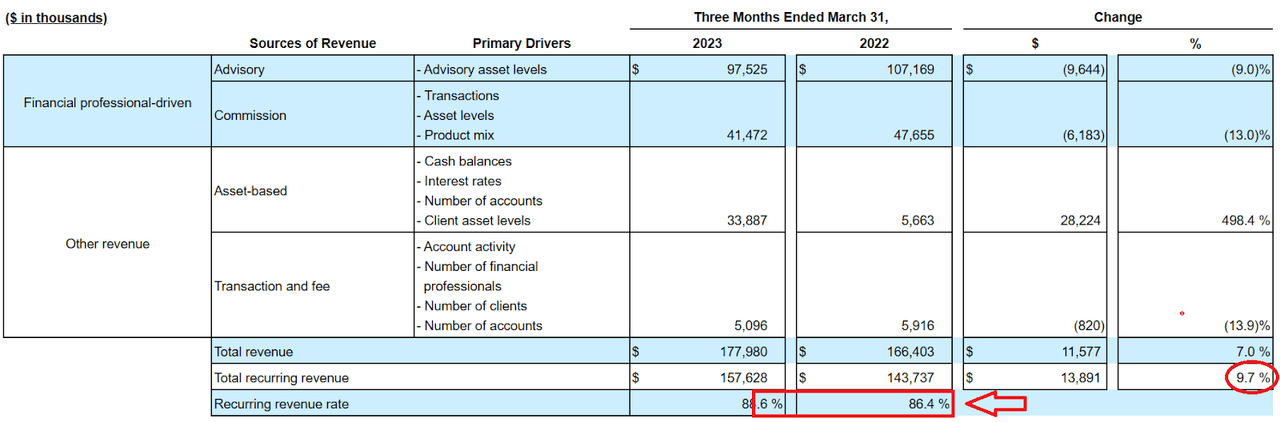

I also assumed that the total amount of recurrent revenue would continue to trend higher as we saw in the most recent quarter. The quarterly recurring revenue increased by close to 9.7%. In my view, market participants will most likely appreciate recurring revenue as it is easier to predict, and may have a beneficial impact on the stock valuation.

Recurring revenue consists of advisory fees, trailing commissions, fees from cash sweep programs, and certain transaction and fee revenue, all as described further under the headings “Advisory revenue,” “Commission revenue,” “Asset-based revenue,” and “Transaction and fee revenue,” respectively. Source: 10-Q

Source: 10-Q

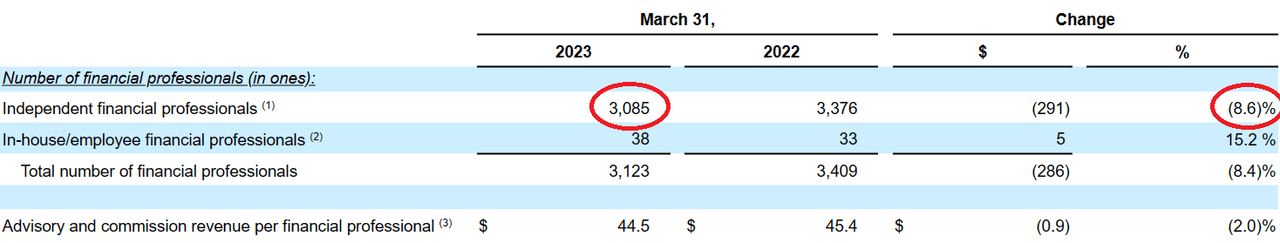

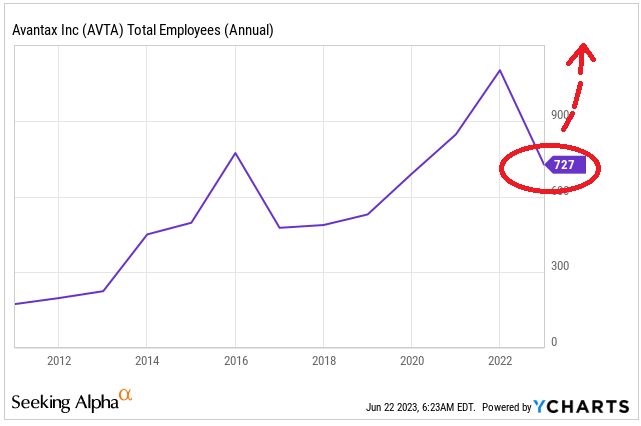

In the last quarter, Avantax reported a decline of close to 8.6% in the total number of independent professionals. I assumed that the company will, in the future, successfully retain more independent financial professionals. It is worth mentioning that the number of employees, according to YCharts, increased from less than 300 in 2014 to more than 900. Considering the cash in hand of $144 million, in my view, management could hire more in the coming years. As a result, more employees may offer more financial recommendations, and more clients may be contacted, which may be a catalyst for future net sales growth.

Source: 10-Q Source: YCharts

In addition, in my view, further sale of assets may bring cash in hand, which may enhance the valuation of Avantax. Selling small divisions to repurchase stock appears more intelligent than selling the whole company. Minority investors may not be able to receive stock returns if the company is sold entirely at the current stock price of $20-$22 or lower. If the company tries to sell itself, and there are no bidders, the stock price may decline, and a transaction could be executed at a cheap price.

On October 31, 2022, we entered into the Purchase Agreement with the Buyer to sell our former tax software business for an aggregate purchase price of $720.0 million in cash, subject to customary purchase price adjustments set forth in the Purchase Agreement. The TaxAct Sale subsequently closed on December 19, 2022. This divestiture was considered part of our strategic shift to become a pure-play wealth management company and was determined to meet discontinued operations accounting criteria under ASC 205. Source: 10-Q

Finally, I think that sufficient communications about the current efforts to enhance the stock price and the valuation of the stock could bring interest from investors. As a result, demand for the stock may lead to lower stock volatility and lower cost of capital, which may enhance the fair price. I really do not think that the solution is a sale of the company, because the company is making a lot of actions to reward shareholders. We have to be patient.

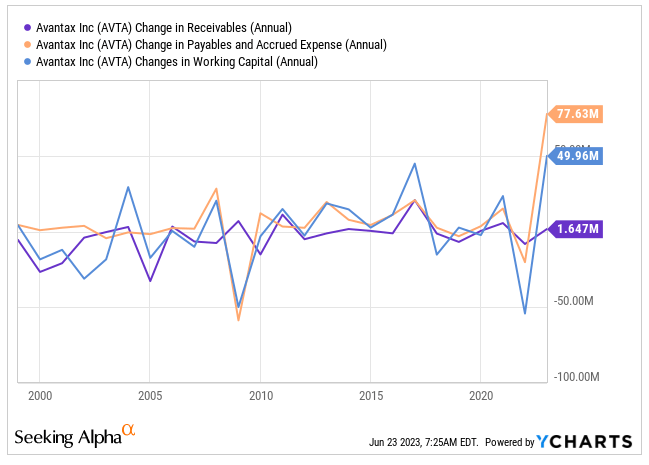

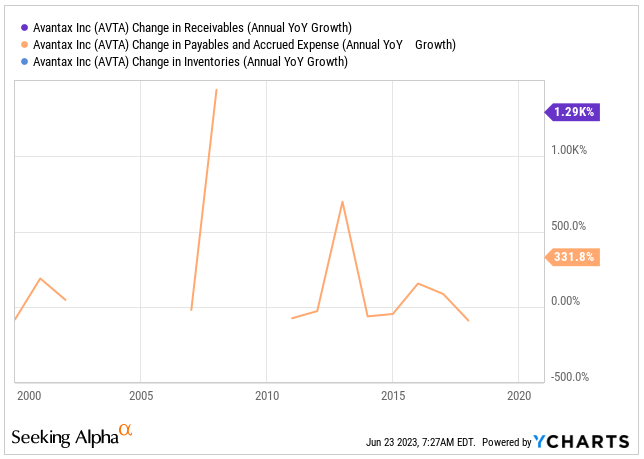

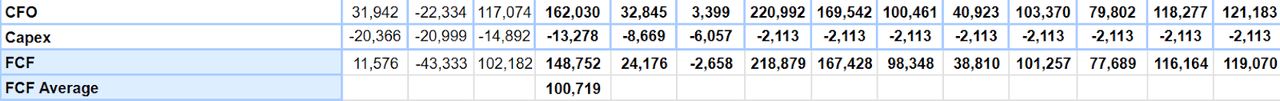

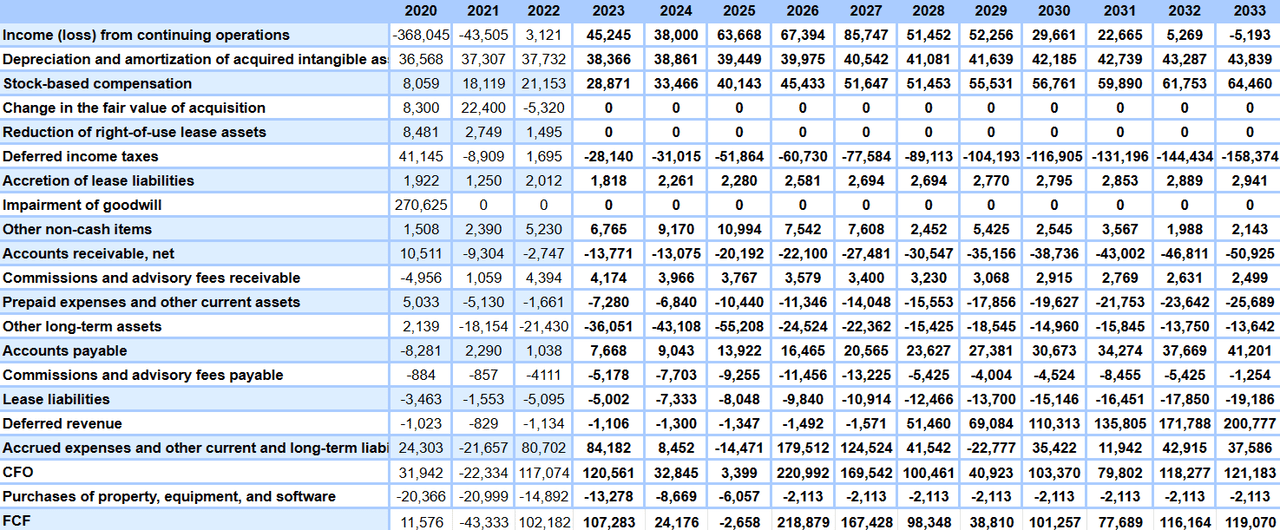

For the assessment of future free cash flow, I assumed declining changes in accounts receivables, growing changes in accounts payable, and growing D&A. I believe that my figures are close to the figures observed in the past, and they are overall conservative.

Source: YCharts Source: YCharts

For the net income growth and FCF growth, I observed that the wealth management platform market is expected to grow at close to 12.85% from now to 2030. In my view, Avantax is a small competitor, so we could expect a bit larger growth than other large competitors. Expecting larger growth than the market would make sense.

The market is anticipated to acquire a valuation of approximately USD 7.55 Billion by the end of 2030. The reports further predict the market to flourish at a robust CAGR of over 12.85% during the assessment timeframe. Source: Wealth Management Platform Market is Projected to Hit USD

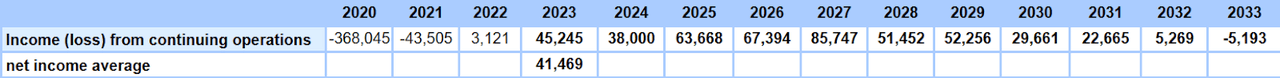

I also included a net income average of close to $41 million between 2023 and 2033, with approximately stable FCF, and FCF average of close to $100 million. Note that I also assumed a decline in capital expenditures like other financial advisors. Capex would range from approximately $13 million to $2 million.

Source: My DCF Model Source: My DCF Model

My financial model included 2033 income from continuing operations close to -$6 million, with depreciation and amortization of acquired intangible assets of $43 million, 2033 stock-based compensation worth $64 million, and 2033 changes in deferred income taxes of -$159 million.

My financial model also included 2033 accretion of lease liabilities worth $2 million, changes in accounts receivable of -$51 million, commissions and advisory fees receivable worth $2 million, and prepaid expenses and other current assets of -$26 million. Besides, I assumed 2033 accounts payable of about $41 million, commissions and advisory fees payable close to -$2 million, changes in lease liabilities of -$20 million, and changes in deferred revenue worth $200 million. Finally, I obtained 2033 CFO of $121 million.

Source: My DCF Model

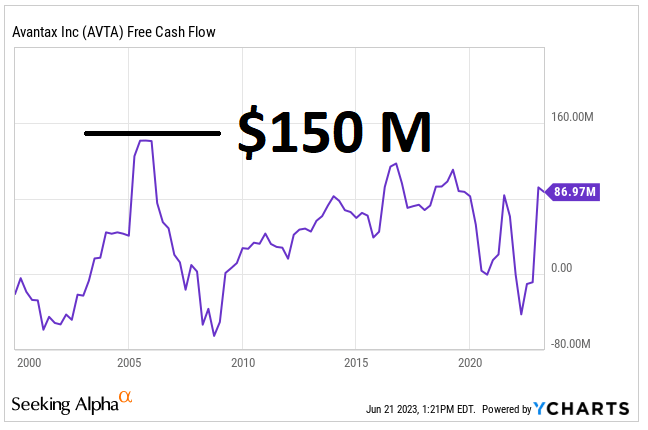

In the past, Avantax reported FCF close to $150 million and about $44 million. My numbers include a maximum FCF of $218 million and a minimum of $38 million. I believe that my numbers are conservative.

Source: YCharts

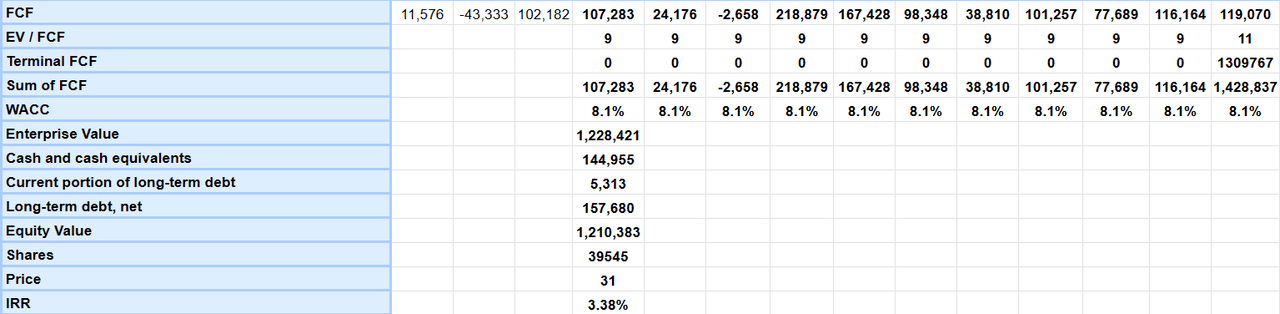

With an EV/FCF ratio of 9x and a WACC of 8.1%, the implied enterprise value would be close to $1.228 billion. If we also add cash and cash equivalents of $144 million, and subtract the current portion of long-term debt of about $5 million and long-term debt of $157 million, the equity value would be close to $1.210 billion. In sum, the fair price would be $30 per share.

Source: My DCF Model

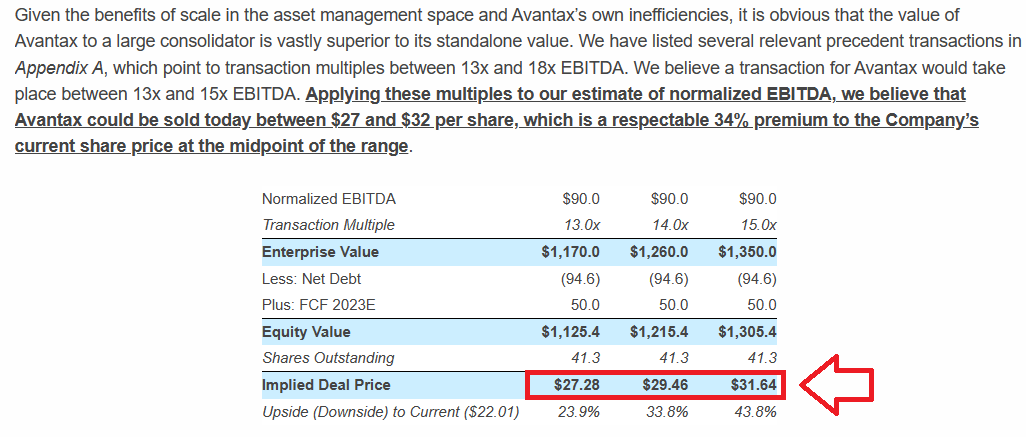

My DCF model implied a fair price close to $31 per share, which is close to the fair price obtained by another investor, Engine Capital. It obtained a fair valuation close to $27-$31 per share through a financial model based on transaction multiples. With a transaction multiple close to 15x, the implied equity would be close to $1.3 billion, and the implied deal price would be $31 per share. The activist investor believes that a sale of Avantax would be very interesting considering the benefits of obtaining economies of scale in the asset management space.

Source: Engine Capital Issues Letter to the Board of Directors of Avantax

I invite readers to have a look at the letter delivered by Engine Capital, which includes smart recommendations about the future steps of Avantax. The activist believes that Avantax would do good by executing a transaction with a large firm. According to Engine Capital, Avantax cannot really compete with large firms, and the industry is in a process of consolidation.

Avantax derives its profit from two different sources – the services it renders to its financial advisors and the cash sweep. The Company has limited control over the profit coming from the cash sweep as well as the profit sharing with its financial advisors. Therefore, when benchmarking Avantax’s margins to its peers, we believe it is important to isolate the revenue and profit from the service side of the business, excluding the cash sweep as well as the payments to its financial advisors. Source: Engine Capital Issues Letter to the Board of Directors of Avantax Regarding the Urgent Need to Explore Strategic Alternatives | Business Wire

Avantax is simply subscale and cannot compete on equal footing with larger firms. Since size matters in the asset management space, Avantax is worth considerably more to a large consolidator than as a standalone entity. Source: Engine Capital Issues Letter to the Board of Directors of Avantax Regarding the Urgent Need to Explore Strategic Alternatives | Business Wire

In my view, Avantax is a buy. If the activities finally push the company to sale for $27-$32, we would make dollars. On the contrary, if the company does not sell itself, I believe that organic growth and further hiring of employees could also bring the stock price up.

Risks

I believe that a decline in the stock market is one of the largest risks for Avantax. If clients perceive that their investments with Avantax do not offer decent results, they may close their accounts. As a result, fees from advisory would lower, net sales may decrease, and the FCF margins would decline because of lower economies of scale. In this regard, management offered the following explanation.

Client service and performance are important factors in the success of our business. Strong client service and product performance help increase client retention and generate sales of products and services. A decline or perceived decline in performance, on an absolute or relative basis, could cause a decline in sales of mutual funds and other investment products, an increase in redemptions, and the termination of asset management relationships. Such actions may reduce our aggregate amount of advisory assets and reduce management fees. Source: 10-k

I also think that a lower number of financial professionals would most likely lower the fees obtained from mutual funds and other partners. Besides, if many finance professionals perceive that Avantax does not offer what they need, or it offers low quality products, the image of Avantax would deteriorate, which may bring lower free cash flow than expected.

We derive a large portion of our revenues from commissions and fees generated by our financial professionals, including our in-house financial professionals. Our ability to attract and retain productive independent contractor and in-house financial professionals has contributed significantly to our growth and success. If we fail to attract new financial professionals or to retain and motivate our financial professionals, our business may suffer. Source: 10-k

Finally, in my view, if Avantax decides to sell itself, and there are no sufficient bidders, the Board of Directors may decide to sell the company for a lower price than the current market price. If there is no deal, rumors may have a detrimental impact on the business model. Good employees may decide to work for other competitors, which may lower future performance.

Conclusion

Avantax continues to deliver beneficial guidance, repurchases its own stock, and acquires a significant number of shares from the market. In my view, if the EBITDA margin trends higher as expected, more independent financial professionals join the firm, and performance delivered to clients is attractive, future free cash flow would trend higher. I also think that selling certain assets to repurchase stock is a better idea than putting the company for sale. Clearly, the company is quite undervalued, but we have to be patient. Management appears to be taking the right actions.

Read the full article here