Intro

We wrote about Aveanna Healthcare Holdings Inc. (NASDAQ:AVAH) before the company’s first-quarter earnings announcement in May of this year where we were looking for a solid Q1 number to keep the year-to-date momentum going. Shares are up close to 17% since our previous commentary. Aveanna actually posted a marginal bottom-line beat in Q1 which aided shares in going on a 3-month rally which finally ended on the 11th of August this year with shares topping out above $1.80 a share. Nevertheless, although Aveanna delivered another bottom-line beat in the second quarter this year, it was definitely the company’s Q2 earnings report that has reciprocated the sustained pattern of lower lows we have since over the past 7 weeks or so.

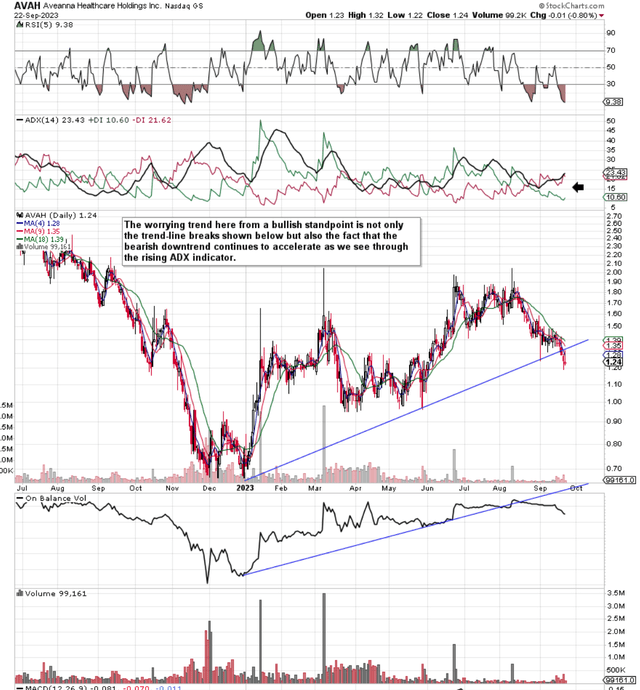

In fact, if we pull up a technical chart of Aveanna, we see that we have multiple bearish trend-line breaks in both the OBV (On balance volume) indicator as well as the share price itself. Suffice it to say, sustained selling here could easily bring the stock’s 2023 lows of under $0.80 a share into play once more. Unfortunately, the market continues to price in the ramifications of a very difficult labor market as we see below.

Aveanna Healthcare Daily Technicals (Stockcharts.com)

Q2 Trends

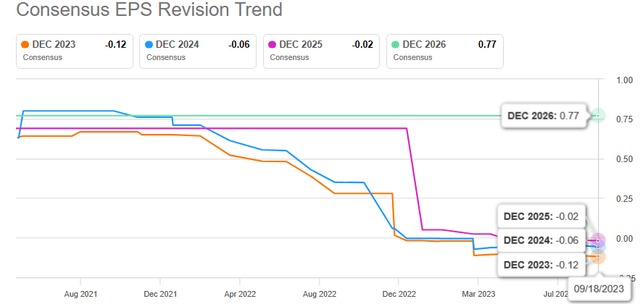

Although Aveanna reported $0.13 per share in GAAP earnings in Q2 which was a convincing bottom-line beat, the company’s sequential earnings momentum does not look like it will continue for the remainder of the year. In fact, the company may have adjusted its full-year guidance for both revenue & adjusted EBITDA to the upside on the recent Q2 earnings call but consensus believes that profitability will remain constrained in Aveanna for some time to come.

Aveanna Consensus EPS Revision Trend (Seeking Alpha)

From an earnings standpoint, Aveanna’s principal tailwind going forward will be inflation both on the labor side as well as the balance sheet side. In essence, the company needs to make enough money on the front end in order to attract home & community care talent on the back end. This though in the present environment is easier said than done as Aveanna is finding out.

The reason is that because demand is sky high at present for labor in this industry, caregivers can be very choosy when picking their employers. Suffice it to say, Aveanna literally has to be willing to pay top-dollar wages in order to retain talent over time and this will most certainly become a bigger financial burden if indeed inflation continues to increase to the upside.

Why do we state this? Well in order to try and stay ahead of the inflation curve, the company has been very busy cementing down rate improvements from managed care payers as well as government institutions in multiple states across the US. Moreover, Aveanna has been busy ramping up its preferred payer volumes in an effort once more to pull in more revenues on the front end. This makes sense as conditions with preferred payers are superior where extra payments (Depending on results & staff hours) also play into the value case here. Bringing in more sales on the front end is obviously one way to tackle inflation.

Then, on the balance sheet, Aveanna’s almost $1.5 billion in debt is principally hedged by means of fixed-rate swaps and interest rate caps. What investors though need to consider here is that these hedging mechanisms will one day come to an end and will cost more funds if indeed interest rates & inflation continue to head northward. Furthermore, when considering the amount of debt Aveanna has on its books compared to its earnings, value investors in particular need to look beyond the company’s current ultra-low sales multiple (Forward sales multiple of 0.13). Interest expense will continue to take a large chunk of the company’s operating profit for some time to come which will obviously adversely affect profitability trends & cash-flow generation.

Conclusion

Therefore to sum up, although Aveanna Healthcare has reported two consecutive quarterly earnings beats in its past two quarters with sales growth of over 6% in the company’s most recent second quarter, recent bearish trendline breaks on the technical chart illustrate that lower lows may be on the cards. Negative equity & negative cash-flow generation resulting in share-price dilution over time demonstrate the tough trading conditions Aveanna continues to find itself in. Let’s see what Q3 brings. We look forward to continued coverage.

Read the full article here