Avid Bioservices (NASDAQ:CDMO), is a biologics contract development and manufacturing organization that offers full lifecycle capabilities from concept to commercial supply. The company has a strong pipeline of products in various stages of development, including MB-107, ZMapp, BIVV001, and ALXN1210. These products showcase Avid’s expertise in biologics development and manufacturing services and highlight its commitment to providing high-quality services to its clients.

Investing in CDMO stock offers investors an exclusive chance to gain exposure to the biologics sector. Its emphasis on providing top-notch services to its customers has allowed for enduring partnerships with major biotech and pharmaceutical companies. Plus, Avid’s development projects, such as the recently finished double expansions within its mammalian cell operations and the construction of the company’s new cell and gene therapy (CGT) facility, demonstrate its dedication to meeting the rising requirement for its services.

Encouraging Third-Quarter Financials

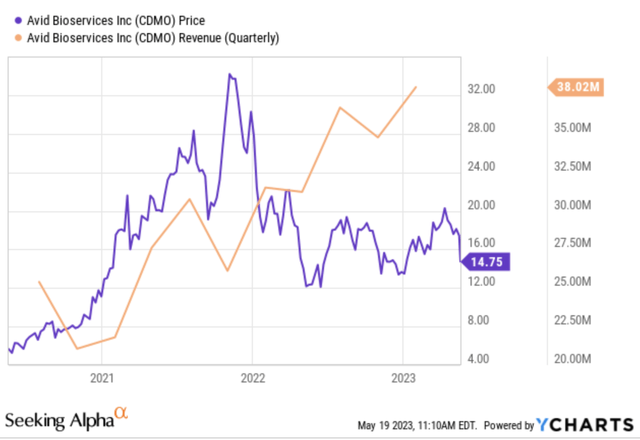

Avid Bioservices reported encouraging financial outcomes for the third quarter and initial nine months of fiscal 2023, reaffirming its revenue projections for the year at between $145 million and $150 million.

Revenues for the third quarter of 2023 amounted to $38.0 million, representing a 21% increase from the same timeframe in 2022. This was primarily driven by increased demand for services, processing development for new clients, and revenue recognition during this period. For the first nine months of the fiscal year, revenues totaled $109.5 million – 24% higher than the previous year. The company’s revenue backlog on January 31, 2023 stood at $176 million—26% higher than one year before—most of which is expected to be accounted for over the following twelve months.

ycharts.com

Gross margin decreased to 26% in Q3 2023 (down from 29%) with an overall decrease of 21% across the year-to-date period (as opposed to 34%). This reduction was largely due to excessive labor, overhead, and depreciation expenses associated with planned Current Good Manufacturing Practice (CGMP) facility expansions.

In terms of Selling, General, and Administrative (SG&A) costs, these rose to $7.1 million (22%) in Q3 2023 and $20.3 million (33%) during the YTD period. These increases were mainly attributed to greater compensation and benefits spending as well as elevated legal, accounting, and professional fees.

The firm posted net income of $0.5 million or $0.01 per basic and diluted share in the third quarter, down from a total of $2.2 million or $0.04 a share for Q3 2022; this decreased again for the full nine month period to $0.9 million or $0.01 per share, compared to the previous year’s $12.1 million ($0.20 and $0.19 per basic and diluted share, respectively). Reductions were largely driven by changes in gross margins together with SG&A hikes.

Despite the fall in net income, Avid Bioservices, remained financially stable with cash and cash equivalents of $60 million as of season end, decreasing from the $126 million it held at April 30, 2022. There is continued high demand for their services as illustrated by the $176 million backlog, prompting a robust fiscal year guidance of between $145 million to $150 million for fiscal 2023.

Services and Collaborations

Avid Bioservices, Inc has several products at different stages of development, including MB-107, a lentiviral gene therapy for X-linked severe combined immunodeficiency (X-SCID), also known as bubble boy disease; ZMapp, a cocktail of three monoclonal antibodies that target Ebola virus glycoprotein and requires CGMP manufacturing of drug substance derived from mammalian cell culture; BIVV001, a recombinant fusion protein designed to extend the half-life of Factor VIII and prevent bleeding episodes in patients with hemophilia A; and ALXN1210, a humanized monoclonal antibody targeting complement protein C5 and inhibiting its cleavage into components responsible for membrane attack complex (MAC) formation and subsequent red blood cell lysis in patients with paroxysmal nocturnal hemoglobinuria (PNH) or atypical hemolytic uremic syndrome (aHUS).

In addition to these products, Avid Bioservices provides viral vector development and manufacturing services for MB-107 and MB-207 for Mustang Bio (MBIO), in collaboration with St. Jude Children’s Research Hospital. It also provides CGMP manufacturing of biopharmaceuticals derived from mammalian cell culture for BIVV001 which was acquired by Sanofi (SNY) (previously developed by Bioverativ Therapeutics), and for ALXN1210 developed by Alexion Pharmaceuticals (ALXN). Each product delivers a specific therapeutic molecule using delivery platforms such as viral vectors, monoclonal antibodies and fusion proteins, enabling it to replace missing or defective genes or proteins, neutralize pathogens or toxins, or modulate immune responses. By providing high-quality services to its clients, Avid Bioservices demonstrates its expertise in biologics development and manufacturing.

Enhanced Mammalian Cell Facilities

Avid Bioservices has successfully completed two enhancements within the company’s mammalian cell facilities. These expansions allow Avid Bioservices to better accommodate both current and future mammalian cell business clients, potentially yielding an additional $100 million in yearly revenue. Moreover, by doubling the company’s overall process development capacity through the expansion of mammalian cell process development, it can support up to an extra $25 million in yearly process development revenue. The inauguration of these enlarged facilities aligns perfectly with the substantial demand Avid Bioservices continues to experience for its mammalian cell services, underscored by significant new business acquisitions and the largest backlog in the company’s history.

This expansion endeavor is anticipated to be advantageous for Avid Bioservices, as it enables the company to boost its capacity to meet the increasing demand for its offerings. As the biotechnology sector continues to expand, so too does the need for biologics development and manufacturing solutions, positioning Avid Bioservices to emerge as a market leader. With these facility enhancements, the company not only augments its revenue potential, but also its ability to support customers in biologics development and production. This expansion initiative showcases Avid Bioservices’ dedication to investing in its capabilities and delivering top-notch services to its clientele. The successful conclusion of these expansion projects attests to the company’s proficiency and its capacity to carry out complex endeavors. In summary, this development is favorable for Avid Bioservices, and the company is well-situated to maintain its growth momentum in the biotechnology field.

Potential Pitfalls

Avid Bioservices has aided in the development of several products with potential dangers. MB-107 and MB-207 use lentiviral vectors to deliver a functional copy of the IL2RG gene, which can result in inflammation, organ failure, and cancer or other diseases. ZMapp uses three monoclonal antibodies that target the Ebola virus glycoprotein but this approach may cause allergic reactions, cytokine release syndrome, and organ damage. BIVV001 utilizes a fusion protein that could lead to immunogenicity and anaphylaxis or thrombosis. Lastly, ALXN1210 employs a humanized monoclonal antibody prone to immunogenicity, allergic reactions, and cytokine release syndrome that is associated with increased infection risk.

Despite the risks associated, those without other options may find that the benefits of using these drugs outweigh the potential harms. It is essential to closely monitor and assess the safety and efficacy of these substances before they are employed clinically. Researchers should also keep exploring new methods of designing and manufacturing biologics while keeping patient welfare in mind.

Avid Bioservices is Hard to Beat

Avid Bioservices, is a competitor in the highly competitive biologics industry with several other companies that offer similar products and services. One key rival of Avid Bioservices is Lonza Group Ltd. (OTCPK:LZAGY), a Switzerland-based biotechnology company that provides contract development and manufacturing services for pharmaceutical and biotechnology industries, including viral vectors, cell therapy, monoclonal antibodies, and recombinant proteins. In comparison to Lonza, Avid has an edge due to its expertise in gene therapy, demonstrated by its involvement in MB-107 and MB-207, which use lentiviral vectors to deliver functional copies of genes to target cells. Additionally, Avid’s knowledge of fusion proteins gives it the upper hand when dealing with Sanofi.

Another company vying for market share against Avid is Catalent, Inc. (CTLT), a U.S.-based biotechnology provider that offers viral vectors, monoclonal antibodies, and recombinant proteins. Here, Avid has a beneficial advantage: experience in the production of biopharmaceuticals derived from mammalian cell culture, exemplified by their participation in ZMapp. Similarly, Avid’s proficiency in the creation of humanized monoclonal antibodies makes them an attractive choice for Alexion Pharmaceuticals Inc., another one of their clients.

Overall, Avid Bioservices boasts a number of advantages over its competition—from its delivery of gene therapy, fusion proteins, and biopharmaceutical drug substances to a commitment to providing quality services for success in such a competitive field.

Conclusion

Avid Bioservices is poised to expand in the coming years evidenced by its involvement with several innovative products at different stages of development demonstrating expertise in biologics-related services. Recent facility expansions and process development capacity illustrate commitment towards providing high-quality services for clients and meeting increased customer demand.

The potential risks associated with these products may be worth taking if the benefits are evident and patients have no other effective treatment options. Avid Bioservices’ dedication to safety and efficacy makes it a reliable partner in clinical trials, further strengthening its well-established reputation in the industry as an attractive long-term investment option. These current trends point out an increasing need for biologics – a defining moment in Avid Bioservices’ journey.

Read the full article here