Thesis

For a long time, AWS has been the growth engine for Amazon.com, Inc. (NASDAQ:AMZN). During the pandemic, its e-commerce business showed strong results as the consumer landscape changed rapidly. As a result, AMZN stock hit all-time highs. But now we are in a much different environment. E-commerce has slowed significantly amid high inflation and large rate hikes by the Fed. AWS growth has also slowed considerably as companies scale back their cloud spending amid an uncertain macro-environment. Lastly, the newest AI trend has taken the world by storm in just a few months and Amazon needs to be quick to adopt such technologies if it doesn’t want to fall behind competitors like Google (GOOG) (GOOGL) and Microsoft (MSFT). In Andy Jassy’s most recent annual letter, there are promising signals that Amazon is committed on improving profitability and also making investments in the right areas. Its most recent earnings were also quite strong. However, I believe it is insufficient to quell the fears of a prolonged cloud spending slowdown. In addition, there are uncertainties to Amazon’s AI adoption. The stock is currently valued quite low compared to historic figures but growth is also near all-time lows. Therefore, I believe Amazon is currently a Hold as it is near fairly valued.

Annual Letter Highlights

In Andy Jassy’s annual letter, he stated that Amazon has been analyzing its own business in the past months in order to create better efficiencies and redistribute resources to proper areas. Amazon has also cut funding to some investments that it deemed to have little long-term potential. An example given was that it had stopped pursuit of some physical stores like Bookstores and 4 Star Stores. In addition, it has also adjusted some programs in order to provide better returns. Lastly, as a result of reprioritizing resource allocation, 27,000 corporate positions were eliminated. I believe this is a positive signal as it seems that Amazon is focusing on how to streamline its business and ultimately shareholders will benefit from its reorganization efforts.

Another good direction highlighted in the letter is the company’s efforts to improve fulfillment costs and the speed of delivery. During the pandemic, enormous expansion was needed to handle the demand and in the past months, it has been working to scrutinize processes in fulfillment and transport. It is then also redesigning these processes to try to elevate productivity and reduce costs. An example that the company provided is the transition to a regionalized network. Amazon used to have a national network that wasn’t very efficient as it had to ship across the country more often. Today, Amazon is focusing on creating regional fulfillment centres that can operate largely in a self-sufficient manner meaning there is less need to ship across the country and thus saving both time and cost. In addition, the company is using machine learning to better predict consumer needs and estimate the inventory needed at the regional centres. In my view, with this effort, Amazon is creating value both for customers and shareholders. This will continue to shorten delivery times and cut costs that can be passed on to customers. I believe building these relationships will benefit shareholders in the long run.

The letter also addressed the challenges that AWS is facing in the short term. With the uncertain macro-environment, customers are cautious on spending and that is impacting AWS growth. However, Amazon is focused on building strong long-term relationships, and so it is not trying to push AWS sales on to customers. In my view, even though this is going to harm AWS growth in the near term, it would be better for the company in the long term if it focuses on the needs of customers rather than trying to force sales. I believe this a good strategy that’s in the best interest of both customers and shareholders.

The last highlight that I will discuss is Amazon’s investment into Large Language Models and Generative AI. Amazon has already been using machine learning for many years and now generative AI could cause an acceleration in the adoption of machine learning. Amazon is trying democratize this technology by offering the “most price-performant” machine learning chips Trainium and Inferentia so that companies of all sizes will be able to afford to train and run LLMs. In addition, AWS’s CodeWhisperer is able to provide code suggestions in real-time which can boost developer productivity. I believe Amazon is in the right direction in terms of its AI development. However, as I will discuss later, there are many uncertainties hanging over the company’s AWS AI efforts that can potentially cause concern.

Q1 Earnings

Amazon reported earnings that beat sales estimates but the stock dropped as cloud uncertainties linger. As CNBC reports, the stock initially rallied in after-hours trading but later fell as executives delivered a lacklustre outlook for cloud in the short run. A revenue figure of $127.4 billion beat Refinitiv survey estimate of $124.5 billion. AWS also beat expectations as $21.3 billion of revenue was reported vs. a $21.22 billion expectation from StreetAccount. Do note that even with a revenue beat, Amazon still only has single-digit sales growth currently.

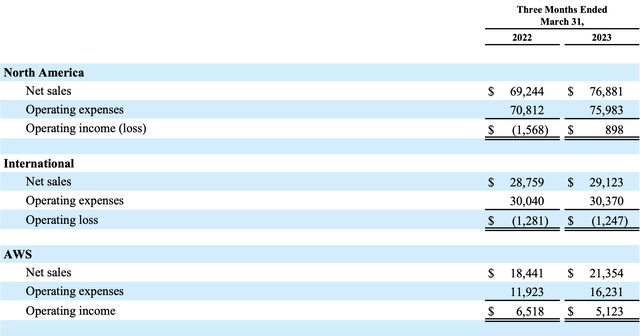

Amazon 2023 Q1 Earnings

In its most recent earnings report, net sales were reported to be up 9% YOY for the quarter from $116.4 billion to $127.4 billion. If the impact of unfavourable foreign exchange rates is excluded, then net sales were up 11% YOY. For North America, sales were up 11% YOY, International sales were up 1% YOY, and AWS sales were up 16% YOY. Excluding foreign exchange impacts, international sales were up 9% YOY. Operating income is up from $3.7 billion in Q1’22 to $4.8 billion while there was $3.2 billion in net income versus a $3.8 billion loss in Q1’22. Lastly, operating cash flow was up 38% YOY for the TTM period as it increased from $39.3 billion to $54.3 billion. From my analysis, Amazon’s earnings showed resilience and stability amid economic uncertainty.

Amazon 2023 Q1 Earnings

When comparing the above sales figures with the previous year’s growth rates, results become a mixed bag. In North America, YOY net sales growth in Q1’22 was only 8% vs Q1’23’s 11%, showing growth starting to reaccelerate. International sales had a YOY net sales decline of 6% in Q1’22 compared to Q1’23’s increase of 1%, showing a stabilization of the international business. However, AWS results could be concerning as YOY net sales growth has dropped from 37% in Q1’22 to only 16%. In my view, this is concerning as the company’s top growth driver for many years is showing a massive growth contraction.

For Q2 guidance, Amazon provided satisfactory figures as the company expects net sales to be between $127 billion and $133 billion. That equates to 5-10% growth YOY and included 30bps of unfavourable foreign exchange rate impacts. In addition, operating income guidance came in at $2-5.5 billion vs Q2’22’s $3.3 billion. In my view, guidance had quite a large range but overall showed that Amazon should continue to show stability in a late cycle economy.

As a whole, Q1 earnings were decent from Amazon. Its total revenue and AWS revenue beat estimates and showed growth. However, when compared to last year’s figures, AWS showed concerning growth deceleration. In my view, AWS is a key storyline that may continue to weigh on Amazon stock in the short run.

AI Adoption

On May 15th, Bloomberg reported that Amazon is trying to add a ChatGPT-style search to its online store. They reported that there were job postings on Amazon’s page that were related to an AI search. One posting was hiring for a Senior Software Development Engineer and in the posting also revealed that the company was trying to incorporate an interactive conversational experience to its search. It was reported that this would potentially be able to help answer questions, compare products and even give suggestions to customers. I believe this a good first step to incorporating AI into the e-commerce business in an attempt to enhance the user experience and could add value in the long run.

In addition, also on May 15th, CNBC reported that Amazon is also using AI to speed up deliveries. Amazon is trying to minimize the delivery distance. The company’s VP of Customer Fulfilment and Global Ops Services for North America and Europe Stefano Perego said that AI could help with mapping and planning routes including using factors like weather to determine routes. Even more importantly, AI could be used to determine where to place inventory. As discussed in the Annual Letter section earlier, AI machine learning can improve regionalized fulfillment centres by estimating and predicting consumer needs. In fact it’s reported that currently already 76%+ of products are shipped to customers from a fulfillment centre in their region. I believe as AI adoption continues, delivery times can continue to shorten and costs can continue to be cut benefitting both customers and Amazon in the long-run.

The source of Amazon’s AI uncertainty is from its AWS unit, however, and that makes it even more concerning. On May 24th, Bloomberg reported that many were seeing Amazon’s ChatGPT answer to be ‘incomplete.’ AWS unveiled the AI tech approximately 6 weeks ago but many are still not allowed to test it yet, causing people to be concerned that the AI tools are actually not yet complete. It was reported that some employees and customers are expressing that Amazon has been surprisingly vague on generative AI. In addition, previous AWS product launches usually had many testimonials but this time it only offered one, which is Coda. Even more concerning is that Coda’s CEO Shishir Mehrotra, who tested the AI tools, said that it was “incomplete.” He further said that the tools were “all fairly early” and that “they’re building on and repackaging services that they already offer.” It is reported that many people are speculating that Amazon was forced to release these tools in an attempt to avoid being seen as falling behind Google and Microsoft in the AI race. Amazon denies this speculation with AWS VP of Product Matt Wood having expressed that the AI tools are new, not rushed, and are completed. In addition, it was reported that some executives at AWS customer companies said that LLM access may be granted by June. In my view, it seems as though AWS is scrambling to keep up in AI adoption and it is trying to release premature tools in order to show that it is adopting AI quickly. I believe this shows that Amazon has a potential lack of confidence in its AI development and this is concerning as AI is becoming the largest tech trend currently. In my view, this AI uncertainty could pressure Amazon’s stock as people question its AI strategy.

Valuation

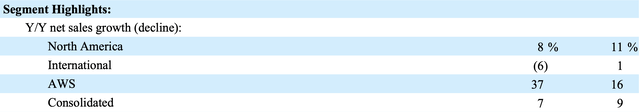

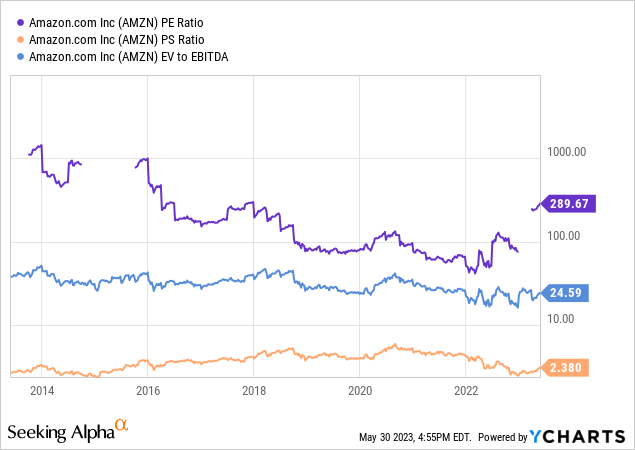

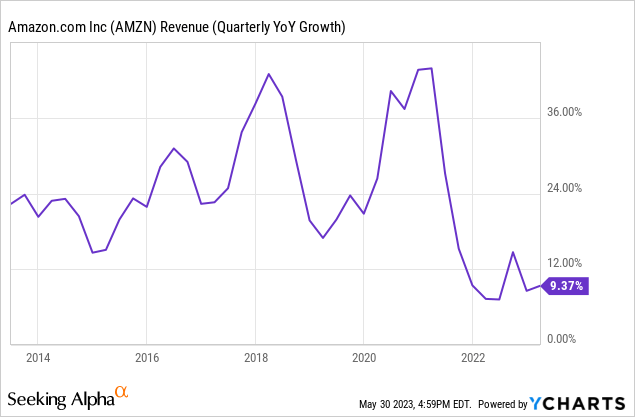

Amazon is currently valued with a P/E of around 290, a P/S of 2.38, and an EV/EBITDA of 24.59. Even though a P/E of 290 seems quite high, it is actually not even near the all-time high valuation for Amazon. The P/S ratio is actually near multi-year lows and EV/EBITDA is also below a long-term average. However, as shown below, Amazon’s quarterly YOY revenue growth is also much lower than levels seen in the past 10 years. Therefore, I believe that Amazon’s stock is currently fairly valued. From my analysis, its current low growth is being compensated by the relative low valuation compared to historic levels. Therefore, I initiate Amazon with a Hold rating with a price target of $125.

Risks

The largest risk to my Hold thesis would be the rapid expansion of Amazon in international markets, particularly emerging markets like India. In the Annual Letter, it was stated that Amazon is making investments in India, Brazil, Mexico, Australia, European countries, the Middle East, and Africa. While they acknowledge that it will take time to scale the businesses, they are already on a good trajectory. They also acknowledge that there may be infrastructure deficiencies in some emerging markets but will continue to work with partners to deliver for customers. In particular, on May 17th, Reuters reported that their cloud unit is investing $13 billion in India by 2030. This is a doubling down of investment in India as they see growing demand in one of Asia’s fastest growing economies. It is reported that this investment will be used to build cloud infrastructure and support 100,000+ jobs annually. Do note that they already have 2 data centres in India already, in Mumbai and Hyderabad. As reported, the public cloud services market could reach $13 billion in 2026 in India, meaning a 23.1% CAGR from 2021 through 2026. In my view, if Amazon could reaccelerate growth by expanding in emerging markets, then its stock could easily become a buy. Particularly, if it is able to reaccelerate AWS growth to higher levels that were seen in the past decade, Amazon’s valuation could expand significantly. Therefore, rapid AWS expansion in emerging markets is the greatest risk to my Hold thesis. However, investment in these markets takes time and the return will also take time to realize, and so in the short term this risk is only moderate.

Conclusion

In its annual letter, I believe Amazon is showing that it is taking steps in the right direction in both reorganizing processes and also in making investments. In its Q1 earnings release, in my view, Amazon is showing its resilience in a tough macro-environment. However, as we look at AWS growth, Amazon’s prospects may become concerning. AWS, Amazon’s growth driver for many years, is showing sluggish growth and that could put a lid on AMZN stock. In addition, Amazon’s AWS AI adoption uncertainty further clouds its growth prospects. In my view, even though the valuation is relatively low compared to historic figures, the low revenue growth, AWS’s sluggish growth, and AI uncertainty justify a lower valuation than prior years. Therefore, I initiate with a Hold rating and price target of $125 as stated above.

Read the full article here