Thesis

In my analysis, I delve into the performance and growth potential of AZZ Inc. (NYSE:AZZ), a global leader in hot-dip galvanizing and coil coating solutions. Despite some impressive growth in its key divisions, AZZ recently missed analyst expectations for its Q1 fiscal year 2024, with an EPS of $1.14, falling short by $0.03, and revenues of $390.87M, missing the target by $4.11M. The company’s ability to counteract recent disruptions, coupled with promising strategies for customer engagement and efficiency, paints a fairly bullish picture; however, I argue that rising costs, high debt levels, and underperformance relative to the S&P 500 (SP500) suggest caution.

Company Overview

AZZ Inc., is an industry stalwart offering top-tier hot-dip galvanizing and coil coating solutions with a presence spanning across key markets like the United States, Canada, Brazil, China, the Netherlands, Poland, Singapore, and India.

This company is structured around two major segments – AZZ Metal Coatings and AZZ Precoat Metals. Its metal coating services range from hot-dip galvanizing to powder coating, anodizing, and plating, targeting steel fabrication and other associated industries. The clientele of this segment is quite broad, covering entities from various sectors such as electrical and telecommunications, bridge and highway, petrochemical, as well as original equipment manufacturers.

On the other hand, the AZZ Precoat Metals segment offers significant value-add services mainly to steel and aluminum coil businesses. The segment is majorly catering to sectors such as construction, appliance, heating, ventilation, and air conditioning (HVAC), container, transportation, among others.

AZZ Inc.’s Bullish Q1 2024 Earnings Highlights

Coming out of the gate in fiscal 2024 with an unmistakable spring in their step is AZZ Inc., posting first-quarter results that initially paint a fairly bullish picture. What we’re looking at is a sizeable 16.2% sequential uptick in sales to the tune of $391 million. Making another significant move was their Metal Coatings division, which outdid itself with a record-breaking $169 million in sales.

In an equally impressive performance, the Precoat Metals division chalked up sales of $222 million, a hearty sequential climb of 18.7%. Yet, there’s a bit of a cloud here, with a minor drop compared to the same period in 2023, but it’s essentially an echo of supply chain disruptions, and, perhaps, a one-time event at that.

The robust theme continued on the profitability front, too. AZZ reported adjusted earnings per share of $1.14, a slight but positive jump from $1.10 last year. EBITDA posted a vigorous $85.4 million, up a staggering 62.6% from the previous year, accounting for a wholesome 21.8% of sales. It’s worth a tip of the hat to higher seasonal sales and past production initiatives, which helped the adjusted EBITDA margin sequentially soar by 480 basis points.

But, not all was sunshine and roses. AZZ did grapple with disruptions due to an overflow of customer-owned inventories in recent quarters. The good news? Those issues got a first-quarter fix, setting Precoat on a path to comfortably meet margin targets. Even as demand took a bit of a hit in HVAC, transportation, and some construction markets, AZZ kept their cool, pushing for a shift to greener pre-painted solutions – a strategy they’re banking on to keep their full-year projections on track.

In terms of strategic focus, AZZ is setting their sights on enhancing their supply chain solutions and fostering stronger long-term ties with blue chip customers. What’s off the table for the year, however, are acquisitions, as they double down on reducing debt.

There’s also considerable progress with their Digital Galvanizing System (DGS) technology to report. It’s been a seven-year marathon to digitize operations for optimal productivity, efficiency, and energy conservation. This home-grown technology also builds stronger customer bonds by doing away with paper-based processes and revving up service quality and speed. Additionally, their CoilZone application is providing similar boosts in productivity and customer engagement.

Expectations

AZZ stock is currently covered by two Wall Street analysts who have an average “Buy” rating on the shares, with a healthy upside target that is +30% over its current stock price.

Seeking Alpha

Performance

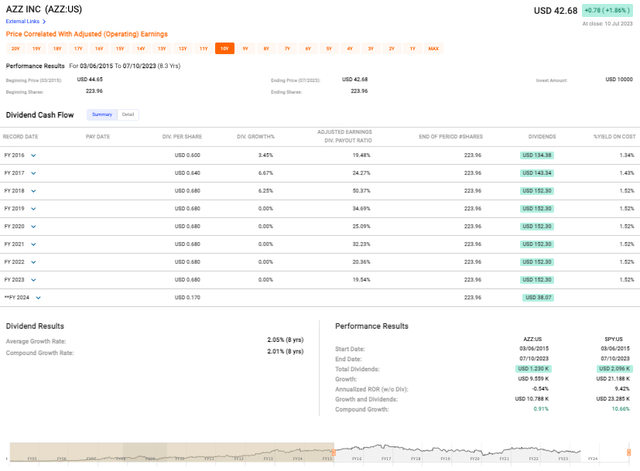

Taking a look at AZZ Inc’s historical performance (see data below) over the last eight or so years, the data reveals at the time of my analysis that the share price has experienced a minor decline, starting at $44.65 in 2015 and ending at $42.68 in 2023. It’s a relatively small decrease over an extended period, but it still reflects negatively on AZZ’s capital growth.

Fast Graphs

Over the medium-term (8.3 years), dividends’ average growth rate averaged 2.05% while their compound growth rate came in slightly lower at 2.01% – both rates provide investors with a modest but sustainable income stream for long-term investing strategies. Unfortunately, we saw a dramatic reduction of dividends for FY 2024, dropping all the way down to $0.17 per share.

The comparison with S&P 500 Index paints an interesting picture because the S&P has outperformed AZZ in terms of both growth and dividends. The annualized ROR for AZZ stands at -0.54% without considering dividends, whereas the S&P has yielded a handsome 9.42% over the same period. Including dividends, AZZ’s compound growth remains modest at 0.91%, while the S&P towers at 10.66%. Clearly, the broader market has fared better during this period.

Valuation

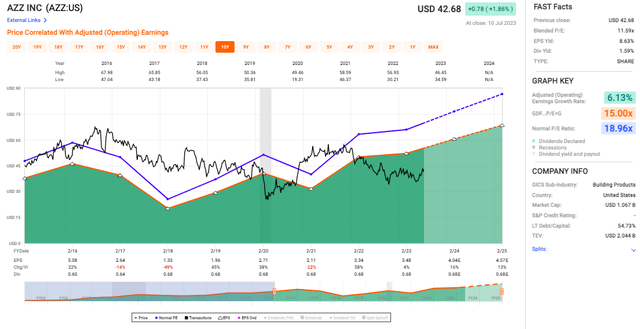

Firstly, AZZ is currently trading at a Blended P/E of 11.59x, significantly lower than the industry norm of 18.96x (see chart below). This underpricing could suggest that the market undervalues the company, potentially providing an attractive entry point for investors.

Fast Graphs

Regarding growth, AZZ’s Adjusted Operating Earnings Growth Rate is 6.13%, indicating steady but moderate growth. While this is by no means spectacular, it isn’t a red flag either; but, considering the inflation and economic growth expectations, we should be wary if this growth rate is not keeping pace with broader market trends.

In the aforementioned dividend department, AZZ has a decent yield of 1.59%. This is not particularly high compared to some other dividend-paying stocks, but it is also not negligible. Essentially, it’s an additional income stream for investors and a sign that the company’s management believes in returning value to shareholders. The EPS yield of 8.63% is also healthy and shows that the firm’s earnings are relatively robust relative to its stock price.

Risk & Headwinds

Let’s begin by exploring the issue of the narrowing financial margins. Although there has been an expansion in gross profit, the dimensions of this profitability paint a more complex picture. Notably, we’ve seen a decline in the gross and adjusted EBITDA margins compared to the previous fiscal year, a rather unwelcome trend.

Diving deeper, it’s clear that the contraction in these margins is largely fueled by heightened labor and commodity costs, a macroeconomic factor that is presently impacting many businesses. Should these cost elements continue on their upward trajectory, we could expect to see an even more significant squeeze on the company’s profitability. This rising cost structure, in a marketplace where pricing power might be limited, puts the company in a precarious position where each incremental dollar of revenue is yielding less net income.

Moving onto the matter of earnings per share (EPS), we see a tale of muted growth. The adjusted diluted EPS displayed a modest uptick of 3.6% year over year. While growth is always a positive sign, the rate at which it is growing is cause for concern. The expansion in EPS is slower than the corresponding growth in sales and net income. This disparity reveals the effect of the preferred convertible shares being converted, diluting the earnings power for existing common shareholders.

Switching gears to focus on the company’s interest expenses, we witness a significantly worrying trend. These expenses have surged alarmingly from $7.5 million to a staggering $28.7 million. The prime drivers of this leap appear to be acquisition-linked borrowings and a more costly interest rate environment. If interest rates continue their upward climb, we could see a dent in future earnings, thereby potentially affecting the overall financial health of the company.

Finally, the company has charted a growth trajectory through investments in new projects. For example, a new coil coating facility in Washington, Missouri has been earmarked. These investments, although carrying the potential to spur future growth, are not without their risks. They necessitate significant capital outlays and could be subject to execution risk or market demand fluctuations.

Final Takeaway

Given the steady performance, global presence, solid Q1 2024 earnings, and future growth potential of AZZ Inc., I would rate the stock as a “Hold.” While the recent improvements in earnings and company’s strategic initiatives are encouraging, the long-term underperformance relative to the S&P 500, high debt levels, increasing interest expenses, and potential risks related to new investments cast a cloud of uncertainty, I believe it would be prudent to wait for further signs of sustainable growth and resolution of the mentioned headwinds before upgrading to a “Buy” rating.

Read the full article here